Author: Zhu Yulong

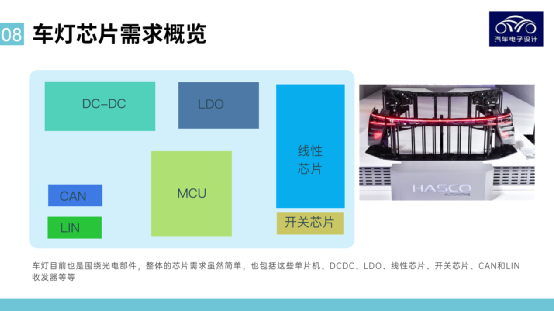

Yesterday, my friend Shu Yi shared some photos of the semiconductor forum in the group chat. The photos were a summary of a Shanghai automotive lighting company’s chips, as shown in the figure below. From entry-level models to luxury models, both front and rear lights have a doubled number of chips.

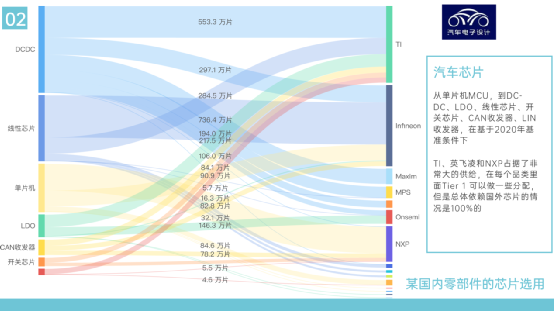

As this automotive lighting company is backed by an automotive group, its business is very good, and it also includes various chip requirements for automotive lighting. From microcontrollers(MCU) to DC-DC, LDO, linear chips, switch chips, CAN transceivers, and LIN transceivers, under the benchmark conditions of 2020, TI, Infineon, and NXP occupy a large supply. Tier 1 in each category can allocate some chips, but the overall dependence on foreign chips is 100% (in 2020).

Note: As the shortage of automotive chips in 2021, people began to rethink this situation.

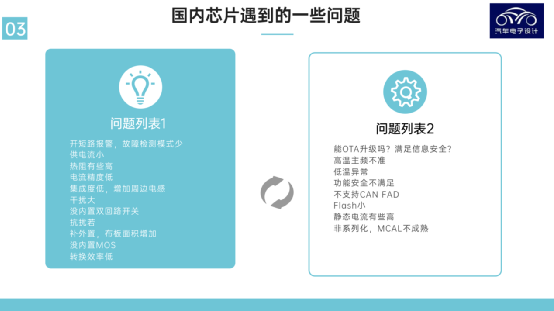

However, the reality is that there are some typical engineering application problems with domestically produced automotive chips that need a lot of time to gradually replace if domestically produced automotive chips want to support the development of the automotive industry.

Overview of Domestic Chip Demand

Domestic chips mainly include these chips, mainly shown in this display:

-

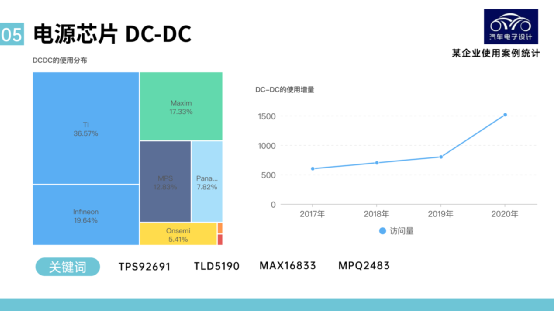

DCDC 15.16 million pieces in 2020, with a large incremental demand for automotive lighting.

-

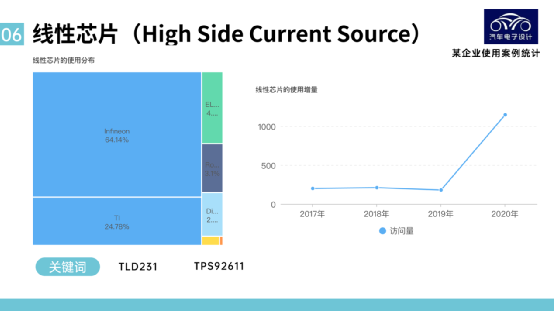

Linear chips, 11.47 million pieces in 2020, mainly for HSD current sources.

-

MCU 8.38 million pieces, which do not have particularly stringent requirements in terms of model and mainly perform basic logic, diagnostic processing, and communication.

-

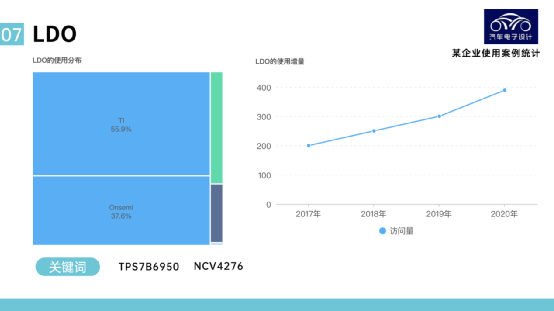

LDO 3.89 million pieces, mainly used to provide logic power.

-

CAN transceivers 2.67 million pieces, 1.43 million pieces for switches and 1.01 million pieces for LIN.

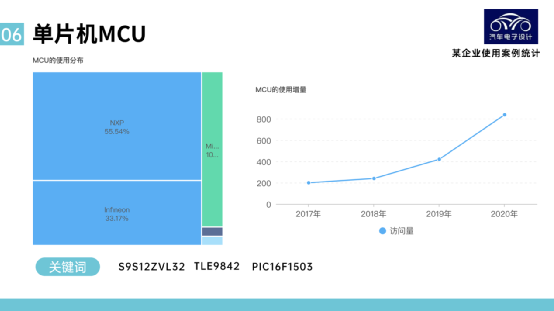

Next, I will focus on some sorting of MCU demands:

MCU Chip DemandFrom a quantity perspective, the use of MCUs in car headlights is increasing, mainly from two companies, NXP and Infineon. First, let’s take a look at the S9S12ZVL32. The S12ZVL platform is a mixed-signal MCU product line of the S12 MagniV, providing a low-cost, highly integrated solution for space-restricted car LIN nodes (8-128K flash memory). The S12ZVL integrates the S12Z kernel with a 12V to 5V LDO and LIN physical layer transceiver.

Note: single-component LDOs and LINs are really hard to see, as they are physically integrated.

Secondly, the TLE9842, the TLE984x product line integrates an Arm® Cortex®-M0 microcontroller core with a relay driver, a high-side switch, a LIN transceiver, and a power system.

Therefore, integration is the ultimate test in the car MCU field, assessing your comprehensive capabilities.

DCDC chips, there’s no denying that these are the most commonly used in car headlights, mainly following the load.

Linear chips, mainly high-side current sources, are also widely used in current products. Specific details will be discussed separately later.

LDOs, on the other hand, were used more frequently in earlier solutions and are now more of a supporting role since they can be integrated around MCUs.

Other issues such as CAN, LIN transceivers, and switches will not be discussed in detail as they are not critical for the future.

Challenges of Chip Localization

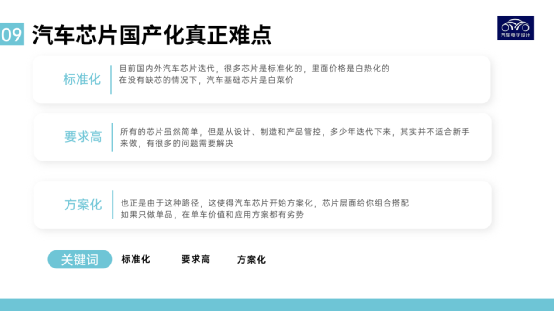

I think the series of issues above are not the real challenges, as the business model of car chips is changing.

(1) It is difficult to replicate standard products.We have seen disappearances in the automotive industry, such as CAN, LIN and LDO. They are either low in price or everyone can do it. If you do it, the value of a single bicycle is low.

(2) Large Integration of MCU

In the future, automotive electronics will integrate countless small components together in a limited space. This tests the comprehensive ability. In fact, except for SOC, there are not many margins, which is done around the solution.

(3) High Requirements

As mentioned earlier, there are many engineering and quality requirements, and it depends on how you meet them.

The iteration of automotive chips has been going on for so many years. Currently, we are making efforts in cabin SOC and intelligent driving SOC. Then, a bunch of companies are entering the automotive MCU to break the deadlock, because the chip demand for automotive electronics itself, according to the application field, is relatively complex.

Conclusion: Based on the material provided by Shuyi, I will write some thoughts and opinions for your reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.