Author: Jaz

Going public, merging, and building cars – these three keywords represent the epitome of autonomous driving development in the past two years.

According to incomplete data collected by Automotive Industry News, only in 2020, there were 28 major financing cases in the autonomous driving industry, with total funding exceeding $8 billion.

After 2020, autonomous driving companies have entered the “post-commercial era” and are pushing the commercialization of autonomous driving to new heights – building cars.

So who’s building cars?

- In January 2020, Cruise released the unmanned vehicle, Origin;

- In December 2020, ZOOX produced Boz, a two-way self-driving vehicle;

- In September 2021, Deepway launched the intelligent new energy heavy-duty truck, DeepXing·Xingtu;

- In April 2022, Xingxing Technology and multiple automobile enterprises released the all-electric box-type lorry, Apebot I;

- In July 2022, Baidu Apollo released its first unmanned vehicle, RT 6…

Recently, Pony.ai also announced the establishment of a joint venture with Sany Heavy Industry to focus on the research and development of L4 level autonomous driving heavy truck products.

Whether it’s building Robotaxis or Robotrucks, the autonomous driving car building phenomenon is no longer a novelty in the post-commercial era.

The “car building phenomenon” also means that autonomous driving companies are reaching a certain consensus:

In order to achieve the unmanned, large-scale and commercialization of autonomous driving, in addition to the safe and reliable technology, product landing is more crucial than ever.

The Two Paths of Autonomous Driving

Although car building is the trend of the autonomous driving industry, different types of autonomous driving companies have different ideas on how to achieve commercial closed loops. Not all autonomous driving companies will directly build cars.

Currently, there are two paths in the autonomous driving industry:

One is directly building cars to achieve software and hardware integration. The other is to build autonomous driving kits and cooperate with car companies.

Building cars requires extremely high requirements for funds and industrial chain collaboration, and moves more slowly. However, building autonomous driving kits can simplify the process and has less financial pressure, which is why many autonomous driving companies still do not build cars.

Waymo once launched a small two-seat prototype vehicle. However, due to high production costs, they did not continue their self-driving car building plan, and instead turned to ordering car models from car companies and modifying them themselves.

This means that selling autonomous driving kits may become one of Waymo’s main businesses.

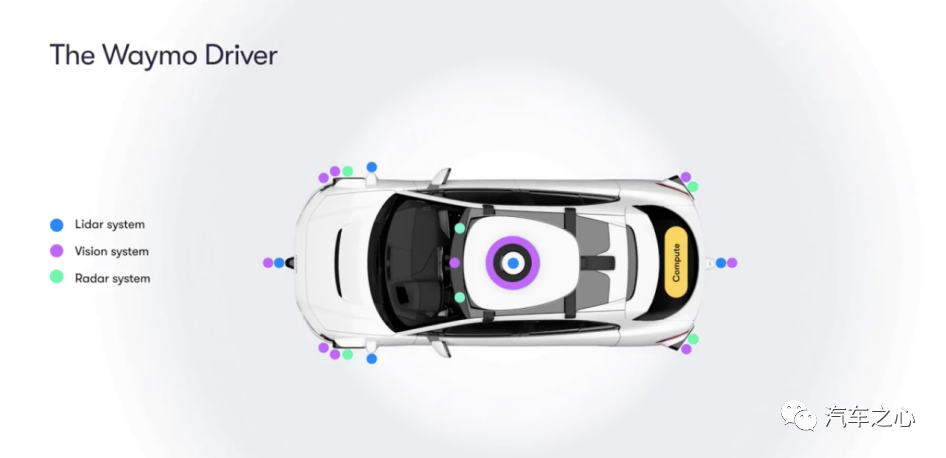

“Lidar King” pioneer Waymo had launched its fifth generation self-driving suite in 2020, with a total of 40 sensors equipped on each vehicle, including 29 cameras, 6 millimeter-wave radars, and 5 lidars.

“Lidar King” pioneer Waymo had launched its fifth generation self-driving suite in 2020, with a total of 40 sensors equipped on each vehicle, including 29 cameras, 6 millimeter-wave radars, and 5 lidars.

The self-driving suite, a hardware and software solution created by autonomous driving companies to decouple cars from autonomous driving technology, includes all the related hardware and software components, such as sensors, computing platforms, data storage, network equipment, human-machine interaction, cooling systems, and structural components.

A few years ago, when autonomous driving was leaving the laboratory, there was a “big flowerpot” on top of the car, and the trunk was stuffed with computing devices and wiring.

Now, these companies specializing in self-driving suites have become “more flexible, smarter and cheaper.”

-

In December 2021, Pony.ai released DeepRoute-Driver 2.0, its level 4 autonomous driving solution for front-loading vehicles, equipped with 5 solid-state lidars and 8 high-dynamic-range cameras.

-

In January 2022, Xiaoma Zhixing released its sixth generation self-driving sensor suite, with a total of 23 sensors, including 7 lidars, 5 millimeter-wave radars, and 11 cameras.

-

In May 2022, QCraft released its fourth generation mass-produced level 4 autonomous driving solution, the DBQ V4, with cost as low as RMB 10,000. It is equipped with 5 semi-solid state lidars mounted on the roof, 4 blind spot lidars around the vehicle, 6 millimeter-wave radars, and 12 cameras.

-

In June 2022, WeRide introduced its fifth-generation sensor suite, WeRideSS 5.0, with 7 solid-state lidars and 12 cameras, which are divided into 6 perception modules installed at different locations of the car using integration, modularization, and detached design.

Up to now, there have been three significant characteristics in the iteration of self-driving suites: higher integration, more suitable for mass production, and better cost-effectiveness.

An autonomous driving practitioner stated that partners throughout the industry chain can generally provide products that are designed specifically for level 4 scenarios, meet vehicular applications and standards, and have clear timelines.

As the industry enters the right track, the cost is expected to decrease by 20% per year and decrease in ten years by an order of magnitude.

Although the iteration speed of self-driving suites is being updated every “year” or even “half a year,” ambitious autonomous driving companies are still not satisfied, and the industry has seen new voices coming forth.”Instrumenting sensor kits, technical units, and software onto existing vehicles is no longer in line with the goal of the next stage of autonomous driving – safety and quality will be limited, and costs will remain high. To achieve large-scale commercialization with a better experience and lower costs, combining AI technology and vehicle engineering is crucial.”

“The greatest challenge facing the autonomous driving industry is not software development, but whether hardware can be reliably delivered on time. These voices all point to the same problem – for autonomous driving to achieve technological large-scale production, the vehicle platform needs innovation and the hardware and software systems need deeper integration.”

“In other words, the carrier of autonomous driving needs to start from a blank sheet of paper – the creation of cars.”

After deciding whether or not to create vehicles, self-driving companies will face a second choice – what kind of vehicle to produce. The “old” self-driving heavyweights, represented by Baidu Apollo, General Motors Cruise, and Amazon Zoox, are keenly interested in creating Robotaxis. The “newcomers” in the autonomous driving industry, such as Pony.ai, Plus.ai, and DeepWay, prefer to create Robotrucks.

“I personally believe that this wave of L4 companies has been influenced by Waymo, which has always emphasized Robotaxis,” said the CEO of a self-driving company.

Although the starting point of this viewpoint is based on a positive outlook on the autonomous truck market, it precisely reflects the substantial differences between Robotaxis and Robotrucks in terms of operations, technology requirements, and prospects.

In terms of operation, the Robotaxi ride-hailing market has a lot of potential for growth. According to the “China Internet Development Statistics Report” as of December 2021, China’s ride-hailing user base reached 450 million.

In the face of a vast ride-hailing market, a Robotaxi’s entry will have enormous room for growth, but the problem remains severe. Due to the high proportion of private cars in the ride-hailing market and the low number of operating vehicles, scaling up self-operating vehicles will bring extremely high costs.

Compared to Robotaxis, Robotrucks have reduced costs. Currently, the truck market consists primarily of operating vehicles, making it easier to achieve large-scale autonomous driving transformations. However, trucks are still only a subcategory of the logistics transportation system, and the market is relatively small.

In terms of technology requirements, Robotaxis are more stringent than trucks. Because passenger cars travel on public roads and will also participate in complex road scenes such as urban slums and mountain roads while maintaining passenger safety, the degree of difficulty in designing car bodies and autonomous driving technology is far more challenging, and the policy restrictions will be stricter.And besides public roads, the scenario that trucks face also includes enclosed areas within campuses; this means that the requirements for technology are reduced in enclosed scenarios, and at the same time commercialization of automated driving trucks in this scenario can be achieved first.

However, the difference in the shapes of trucks and passenger cars makes it difficult for companies that manufacture automated driving trucks to enter the field of passenger cars.

Taking unmanned cars designed for passenger cars and trucks as an example:

- Robotaxi requires a larger passenger space, involving more and more difficult parts to be redesigned for unmanned use;

- Robotruck has only the front part of the car used for passenger space, and the rest is dedicated to the transportation of goods. Therefore, the difficulty of designing unmanned cars for it is slightly smaller.

An automated driving practitioner commented:

“Although Robotruck is also involved in car manufacturing, it is done in a relatively lighter manner. The ultimate goal of truck manufacturing is to remove the driver’s cabin and leave only a chassis supporting a container. The core differentiation point in the end is still the ability of automated driving and the optimisation of hardware and software.”

Overall, Robotaxi requires heavy investment, high requirements for automated driving technology, and has a broader market outlook. Robotruck is relatively “small and beautiful”, with faster commercial progression and lower technical difficulty compared to Robotaxi.

This also explains why “major players” are enthusiastic about Robotaxi unmanned vehicles, while “new stars” prefer Robotruck.

Currently, the most outstanding autonomous driving manufacturers in Robotaxi manufacturing are Cruise, Zoox, and Baibu.

Cruise and Zoox released their cars in a batch in 2020. After being acquired by General Motors, Cruise collaborated with General Motors and Honda to produce the Orgin prototype car. According to then CEO Dan Ammann, the cost of Origin will be reduced to half of that of ordinary electric SUV in the future.

After 7 years of research, Zoox also released a pure electric unmanned car that can be driven in both directions in 2020.

In July this year, Baidu Apollo released the sixth generation unmanned car RT6, breaking through the dilemma of domestic Robotaxi mostly being modification cars, and also reducing the price to less than 250,000 yuan while adopting forward design.

Currently, these three autonomous vehicles are heading towards mass production, but the large-scale production of these unmanned cars is expected to happen no earlier than 2024.

The fighting is still spreading.

Cruise, Zoox are facing fierce competition in the U.S. market with the entry of Tesla into the Robotaxi market.

Baidu must also consider the competition from Didi’s car manufacturing business.According to Autohome, in April last year, Didi began planning to build cars. Recently, Didi has been offering salaries twice as high as the average for traditional car companies to hire talent. It is also rumored that Didi will work with Guoji Zhijun to renovate the factory in Ganzhou, Jiangxi for car production.

If Robotaxi’s car manufacturing is a multidimensional process involving operation, policy, and technology, Robotruck’s manufacturing is more focused on increasing production speed during this period.

Here, we have summarized the current layout of the new power heavy-duty truck companies in car manufacturing:

-

In September 2021, Deepway released the first concept car, Deepway Xingtu I. Autohome learned that the white body of the car has been produced and expects to be delivered in 2023.

-

In April 2022, Xingxing Technology released the Apebot I, an L4-level automated driving pure electric box-type heavy-duty truck logistics vehicle.

-

In June 2022, the hydrogen fuel heavy truck company Hydron, co-founded by Chen Mo, co-founder of TuSimple, entered the car manufacturing field.

-

In July 2022, Xiaoma Zhixing and Sany Heavy Industries established a joint venture and will begin mass production of autonomous trucks within the year.

-

In August 2022, Weidu Technology, a startup of new energy heavy trucks, completed its angel round of financing and is now developing a new L4-level automated driving new energy heavy truck for both China and the USA.

Regardless of Robotaxi or Robotruck, there’s fierce competition in this manufacturing.

It is worth noting that many autonomous driving companies are cross-laid out.

Autonomous driving companies such as Baidu, Didi, Xiaoma Zhixing, and Wenyan Zhixing have laid out both Robotaxi and Robotruck.

Especially, Wenyan Zhixing has laid out five product matrices, including autonomous driving minibuses, robotic freight cars, robotic street sweepers, advanced driving solutions, and WeRide One universal autonomous driving platform.

It is expected that the future commercial competition of autonomous driving will intersect each other, which will bring new opportunities while facing fierce competition.

A necessary “cooperation battle” in car manufacturing

Now, Robotaxi wants to become the self-driving version of Didi, seizing the self-driving ride-hailing car market. Meanwhile, Robotruck wants to become the “Wei Xiaoli” of the truck industry, not only focusing on technology but also producing physical vehicles.However, overall, there is still a lack of cooperation between data and the industrial chain in the autonomous driving industry.

One major reason why Tesla can calmly enter the Robotaxi market is that Tesla owners provide a large amount of data to optimize autonomous driving technology.

In addition, autonomous driving companies, which are rooted in technology, still lack the familiarity with vehicle production compared to traditional automakers.

All of these limitations mean that, to achieve commercialization of autonomous driving, manufacturing is just the first step, and support is also needed from technology and scenarios.

Where to manufacture? How to manufacture? And where to sell? These are the three questions that autonomous driving companies must consider when making cars.

Where to manufacture?

Automakers possess a mature vehicle platform, advanced production and manufacturing, quality control systems, and a complete brand and sales channel.

How to manufacture?

Autonomous driving companies possess mature data processing capabilities, precise algorithm optimization capabilities, as well as accumulated experience in autonomous driving technology hardware and software, enhancing their ability to manage the fleet and improve safety levels.

Where to sell?

Different business scenarios can improve the efficiency and generalization ability of autonomous driving technology, making them the best platform for exploring future commercial development paths.

Nowadays, autonomous driving companies are also choosing the best partners for car manufacturing, initiating a “cooperation war” to maximize advantages.

To this end, many autonomous driving companies use the term “triple alliance” to describe their cooperative relationship.

Han Xu, founder and CEO of Wenyuan Zhixing, has said that “only with a high degree of integration between autonomous driving technology and productization and commercialization can technology be applied and used.”

In 2021, Wenyuan Zhixing, in partnership with Jiangling Motors and ZTO Express, released the L4 autonomous driving light commercial vehicle WeRide Robovan, entering the Chinese intra-city freight market with autonomous driving technology provided by Wenyuan, vehicles provided by Jiangling Motors, and scenarios, demand and network provided by ZTO Express.

This model continues at Wenyuan Zhixing, as the fully unmanned Robosweeper fleet that launched in Nansha District, Guangzhou in April 2022 was jointly created by Wenyuan Zhixing, Yutong Group, and the local government.

In addition, there are many other triple alliance projects, such as Guangqi, Ruiqi Travel, and Pony.AI/Wenyuan Zhixing; Geely, Cao Cao, and Yuanrongqi; SAIC, Xiangdao Travel, and Momenta; FAW/Dongfeng/Changan, T3 Travel, and Zhihangzhe, and so on.

The prevalence of such triple alliance models means that it has become a consensus among autonomous driving companies.As Qi Chen CEO Jiang Hua once said, “This combination will become more and more common in the commercialization of autonomous driving.”

However, the “Iron Triangle” cooperation model is not just about signing contracts and reaching agreements.

In the current trend of cooperation, deep interest binding has become the key to measuring the stability of the triangle model.

For example, Wellav Auto has created a joint venture company with Sany Heavy Truck to build a high-end autonomous driving heavy truck brand, and with China Outright Logistics to carry out container transportation business using L4-level autonomous driving trucks.

Each side has a clear division of labor. Wellav Auto calls this set of tactics the “Golden Triangle”:

-

The heavy truck manufacturer has the technological accumulation of whole vehicle development and manufacturing;

-

The logistics company has the accumulation of logistics transportation experience and customer base;

-

Wellav Auto has the core autonomous driving technology and is the key to empowering logistics and future production and manufacturing of heavy trucks.

There are even more extreme cases where logistic companies and technology companies are integrated – DeepWay is an autonomous driving freight company jointly incubated by Baidu and Lianqiao in the field of industrial Internet logistics, which demonstrates the “Iron Triangle.”

DeepWay is responsible for the research and development and manufacturing of vehicles, Baidu provides it with underlying autonomous driving technology, and Lianqiao provides it with smart logistics application scenarios, forming a “vehicle-technology-scenario” closed loop.

From the current trend, autonomous driving companies can only accelerate the commercialization of autonomous driving by establishing close cooperation with vehicle manufacturers and scenario parties to achieve commercial closed loops.

The “Iron Triangle” road of autonomous driving companies is not uncommon.

Take mobile phones as an example. When Google tried to make mobile phones, it only made a system to adapt to all mobile phones, requiring all mobile phones on the market to be tested one by one for compatibility.

However, Apple gained an advantage in software development by choosing to make phones that are compatible with their own hardware.

Jobs once used the phrase “people who are truly serious about software should make their own hardware” to show Apple’s determination to make a good iPhone.

This statement can now be applied to most autonomous driving companies.

Making an intelligent car is far more complex than making a mobile phone, and it is even more impossible to make a package of autonomous driving that can be adapted to all types of cars.

Therefore, bringing together the strengths of all parties from the beginning to define the hardware will actually promote better software development, and improve the mass production capacity and operational efficiency of the autonomous driving industry.In the context where building cars and “Golden Triangle” have become a major trend among autonomous driving companies, we may say that after the car manufacturing stage, the moment to test the stability and expansion power of the triangle model is approaching.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.