Author: Zhu Yulong

In Great Wall Motors’ multi-brand strategy, the Haval brand has previously taken a relatively small action. Overall, Great Wall Motors’ brand strategy was roughly as follows: the Ora brand focused on pure electric attempts, the WEY brand pursued hybrid vehicles, while the Haval brand pursued the route of making profits from fuel vehicles. However, this time, Great Wall Motors has started to rethink the strategies of competitors, taking a step ahead of BYD and following Geely, Haval has also officially transformed into a new energy brand. Great Wall Motors’ new energy strategy has been fully launched and it is expected that by 2025, new energy vehicles will account for 80% of Great Wall Motors’ sales, while by 2030, the Haval brand will officially stop selling fuel vehicles.

There are core issues here:

-

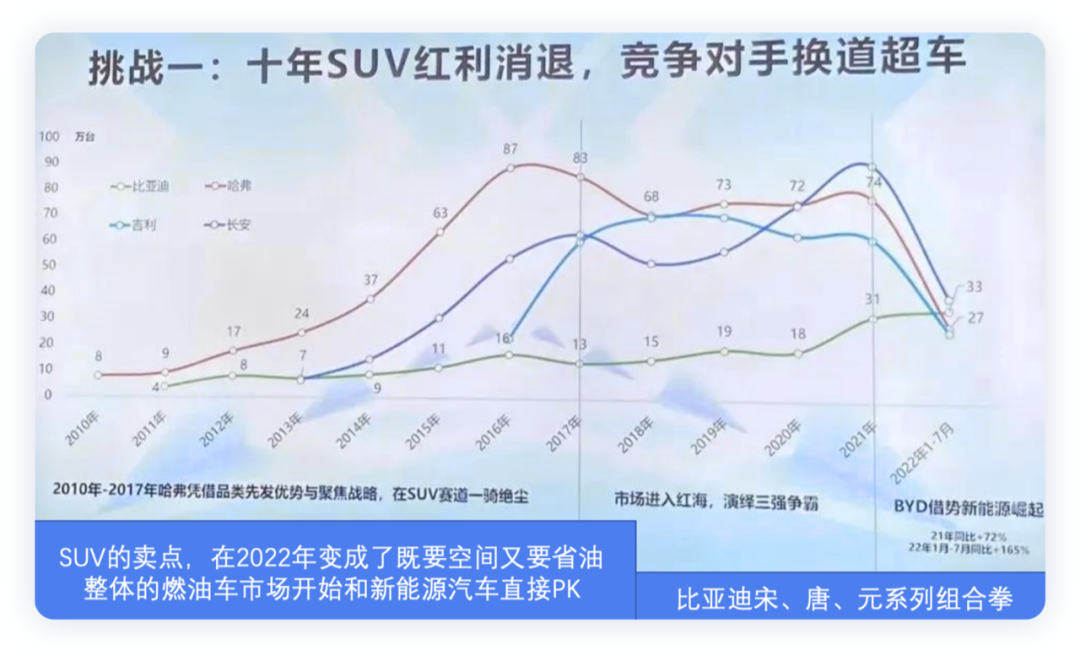

The sudden rise in oil prices (external constraint) actually ended the SUV’s dividend period. The logic of self-owned brands making profits from fuel cars has changed.

-

Pure electric vehicle brands are adopting a strategy of targeting segmented markets, but as the penetration rate of new energy increases, competition is becoming increasingly fierce.

Therefore, the core issue is still how to continue to develop fuel cars. Haval’s approach is to develop HEV and PHEV fuel cars, such as the Haval H6 super hybrid DHT model:

-

H6 DHT hybrid model priced at 149,800 yuan

-

H6 DHT-PHEV plug-in hybrid model with a pure electric range of 55km, pre-sale price of 168,800 yuan; and a pre-sale price of 176,800 yuan for a long-range model with a range of 110km.

Looking at the amount of insurance policies purchased for new cars from January to July:

-

The sales volume of Latte DHT and Latte DHT PHEV were 7,548 units and 298 units respectively.

-

The sales volume of Mocha DHT PHEV was 1,409 units.

-

The sales volume of Macchiato DHT and Macchiato DHT PHEV were 1897 units and 2176 units respectively.

Haval’s brand transformation

In 2022, the automotive sales environment has changed and the Haval H6 is facing tremendous pressure. The cumulative sales volume from January to July was 147,870 units, a year-on-year decrease of 30.7%. From January to July this year, the total sales volume of SUVs in China was 4.77 million units, with 3.59 million units being fuel vehicles. Compared with the sales volume of fuel vehicles in 2021, there was a decrease of 1.3 million units. As domestic self-owned brands are faster in phasing out fuel vehicles, the proportion of domestic self-owned brands is 29.9%. However, in the new energy vehicle market, domestic self-owned brands account for 82.3%.Actually, looking back to 2018, the market penetration rate of HEV (hybrid electric vehicle) and NEV (new energy vehicle) in the SUV market was only 1%. In the first half of 2022, the electrification market penetration rate has reached 28.4%, with BEV (battery electric vehicle) growing at 155.1%, PHEV (plug-in hybrid electric vehicle) growing at 216.8% (domestically accounting for about 70%), and HEV growing at 130.8% (primarily by Japanese companies). The overall market size of Chinese SUVs remains at around 9 million vehicles, with the market share of fuel SUVs dropping to 71.6%.

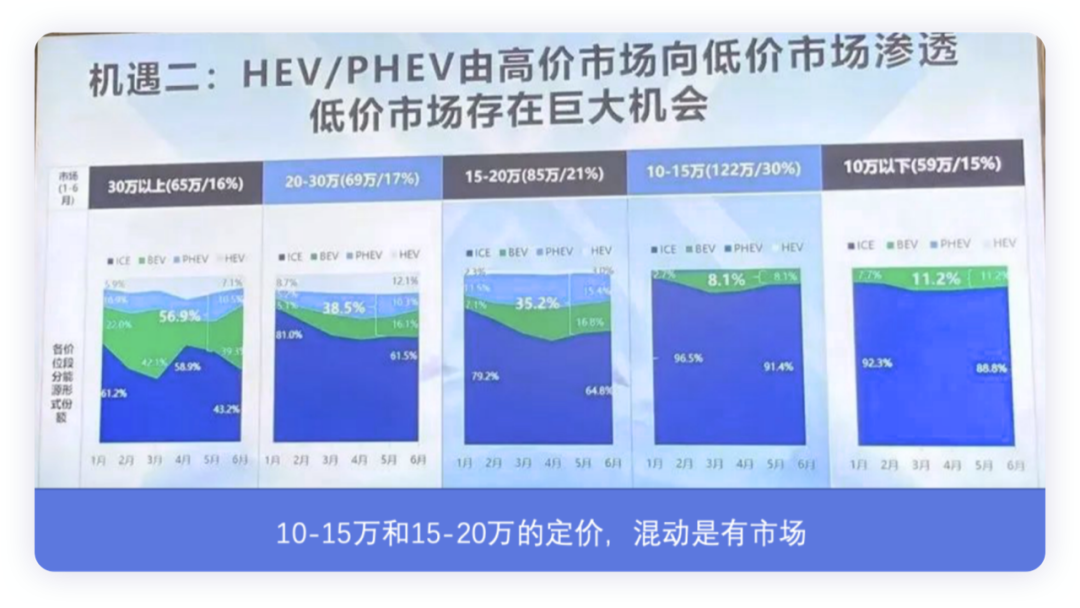

Looking at the first half of 2022, PHEV and HEV models have penetrated the SUV market at various price points:

-

In the price range above 300,000 yuan, with HEV+PHEV having a monthly penetration rate of 7.1%+10.5%=17.6%, pure BEVs are approaching ICE (internal combustion engine) at 43.2%, boasting 39.3% market share.

-

In the price range between 200,000 and 300,000 yuan, with HEV+PHEV at 12.1%+10.3%=22.4% and pure BEVs at 16.1%.

-

In the price range between 150,000 and 200,000 yuan, with HEV+PHEV at 3%+15.4%=18.4% and pure BEVs at 16.8%.

-

In the price range between 100,000 and 150,000 yuan, relying mainly on pure electric and internal combustion engines.

-

Below 100,000 yuan, also relying primarily on pure electric and internal combustion engines.

Domestic independent brand SUVs have concentrated in the price range of 100,000 to 200,000 yuan, with a distribution of 52%. Despite the high fuel prices, HEV/PHEVs will have significant potential in this market given the increasing number of products.

Profitability and Scale Effect

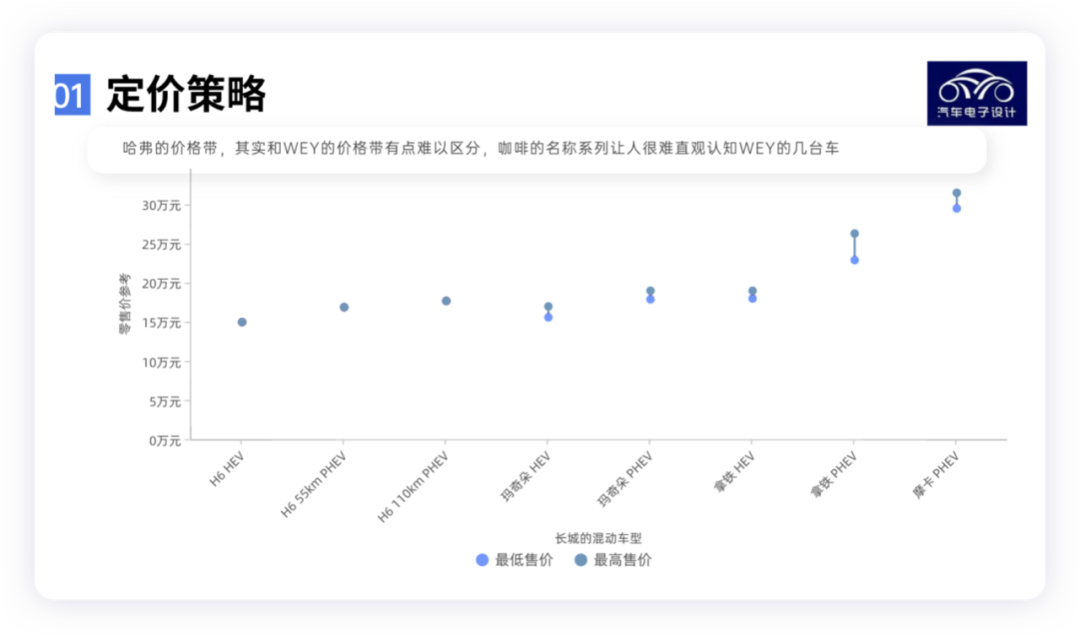

In terms of choosing the hybrid technology route and engineering development, Great Wall Motors released the Lemon Hybrid DHT platform at the end of 2020.From a pricing perspective, due to the Euler’s integral and the total amount of new energy vehicles, Great Wall chooses to maintain a suitable price positioning for DHT, which actually raises the price without harming fuel vehicles. The Wei Pai “Latte” hybrid model has a price range of 180,000-270,000 yuan, and the lowest prices for “Latte”, “Mocha”, and “Machiato” are 155,800 yuan. Haval H6S and Chitu’s HEV hybrid configuration are about 15% higher than fuel cars, testing the market’s reaction. BYD directly uses the tactic of making PHEV lose license plates and directly using lower prices + extensive models. BYD’s new energy sales of the Song model surpasses 120,000 units, exceeding the 108,000 units of the Haval H6 in the same class.

From a technical architecture perspective, the Lemon hybrid DHT is a highly integrated hybrid architecture. Both HEV and PHEV are overpowered with the P4 electric four-wheel drive. From a fuel-saving perspective, the two gears of DHT are equivalent to DM-i, but the power performance on high-speed working conditions is better. Therefore, the fundamental problem is still the pricing strategy, which did not make HEV and PHEV work hard to replace fuel vehicles. I think the problem is:

- China currently does not have a good high-magnification HEV battery

- The development of PHEV batteries using lithium iron phosphate was too late

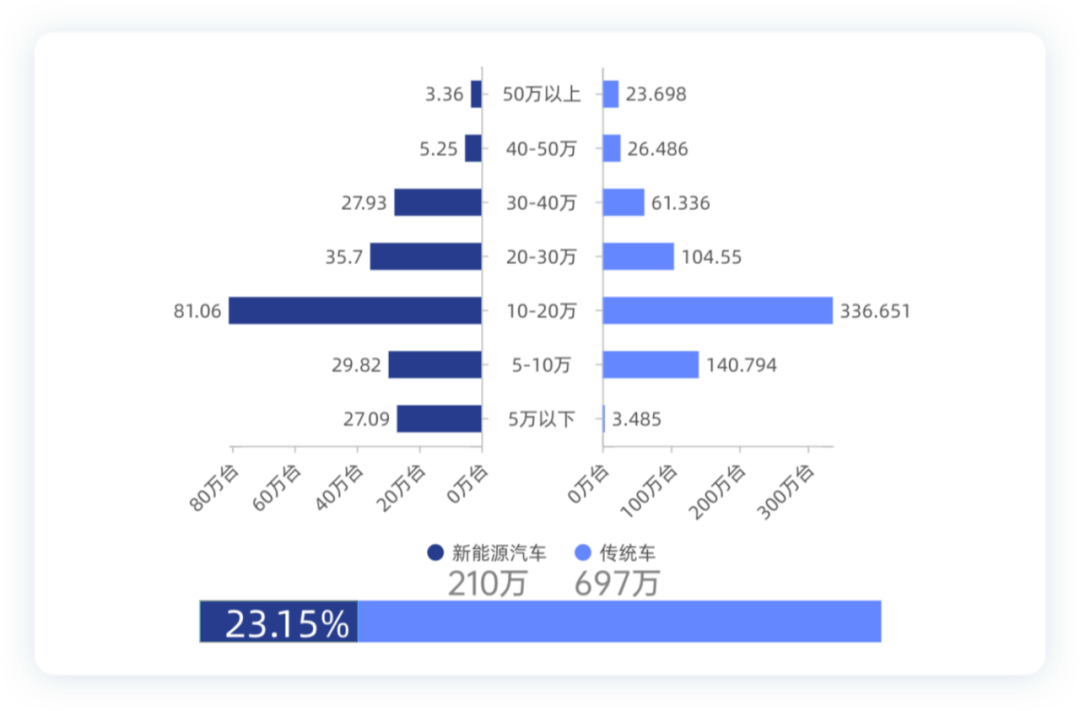

Under the constraints of the epidemic and fuel costs, Great Wall did not calculate well the tax exemption for PHEV, and they were not particularly determined to switch from fuel cars to HEV/PHEV until the cost of the battery affected the Euler low-cost car. Then, when the sales ratio of new energy vehicles to traditional fuel vehicles in the 100,000-200,000 yuan price range was 81 to 336, it was a bit confused, which is normal.

In summary, Great Wall was still very concerned about the sales of fuel vehicles in its hybrid strategy before, and did not push hard. Therefore, once it is determined to follow this path by 2025, the road will be relatively broad. Geely also truly understood this spirit and then vigorously promoted it. Be willing to give up, otherwise there will be nothing to give up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.