Author: French Fry Fish

The direction of industry giants reflects the direction of the industry.

And this year will be the year of popularization of hybrid city SUV, because the big player, Haval, has already turned the bow towards new energy on this track.

Tonight, Haval released its new energy strategy, new logo, and the third generation of H6 Super Hybrid DHT twins at the Water Cube.

The new car is divided into two categories: hybrid HEV and plug-in hybrid PHEV, with three models:

- DHT, official guide price of 149,800 yuan;

- DHT-PHEV 55km version, pre-sale price of 168,800 yuan after comprehensive subsidies;

- DHT-PHEV 110km version, pre-sale price of 176,800 yuan after comprehensive subsidies.

Why hybrid? Why cut into hybrid at this time point? How is Haval’s hybrid?

For these questions, in an exclusive interview last week, Haval’s CEO Li Xiaorui and CTO Lu Wenbin gave their answers.

Facing Challenges, It’s Time to Change

Why hybrid?

“Because the market is changing,” Li Xiaorui’s answer seems particularly candid.

“The strongest performance in the SUV market so far this year is undoubtedly these new energy products.”

Li Xiaorui agrees with the advantages of new energy products. In fact, the objective market data can also reflect this point. From the beginning of 2021 to now, there is a window of time when new energy rapidly exploded, and the proportion of new energy products in the overall market sales has become increasingly important.

And Haval understands the taste of this window of time better than anyone else, because they were the biggest beneficiaries of the last window of time.

In 2010, Haval began to focus on SUVs, hitting the market demand for SUVs just right. Therefore, in the next seven or eight years, Haval SUV sales opened the “unmatched” mode. Even in recent years, when facing competition from other domestic brands, Haval still remains the leader in this field.

A great leader may not be the most sensitive to changes in the wind direction, but they are certainly the most accurate in their judgments.

Therefore, in the current wave of new forces, Haval has made its judgment.

As for why this particular timing, Li Xiaorui also gave his judgment, “consumers’ minds are changing.”

On the one hand, looking at the overall purchasing decision trend, the penetration rate of HEV hybrid models and NEV new energy vehicles was only 1% in 2018, but as of the first half of this year, the penetration rate of these two parts has reached 28.4%. In the SUV market, where nothing much has changed, “one of the three” new energy vehicle models are devouring the market share of pure gasoline vehicle models.

On the other hand, in the past, many people bought new energy vehicles due to policies such as license plate restrictions, numbering restrictions, and driving restrictions, but this situation has also undergone significant changes this year. In some non-“double-limit” cities, such as Foshan, the penetration rate of new energy has reached 32% in the first half of this year. From a certain perspective, this can be said to be the victory of new energy vehicle product strength. Buying new energy vehicles has become a spontaneously accepted behavior by consumers.

Facing the challenge, the overall market trend and consumer mentality have also become the will of Haval’s transformation. This will is projected into reality by tonight’s release of the H6 “HEV + PHEV” hybrid twin stars.

Hope in the eyes of Hope

Dialectical materialism tells us that challenges and opportunities are natural companions.

In Haval’s eyes, all opportunities come from data.

First, let’s take a look at the sales ranking of each HEV hybrid from January to July this year. One characteristic of HEV is that the two Toyotas together accounted for 90% of HEV sales in the first half of this year, and the market share was basically monopolized by joint venture manufacturers.

Meanwhile, let’s take a look at the sales ranking of PHEVs equipped with plug-in hybrid systems during the same period. Bydom, Ideals, and Chery QQ took 73% of the sales. Unfortunately, Haval did not achieve a high rank on either list. For pessimists, this would be despairing, whereas optimists see hope everywhere.

Meanwhile, let’s take a look at the sales ranking of PHEVs equipped with plug-in hybrid systems during the same period. Bydom, Ideals, and Chery QQ took 73% of the sales. Unfortunately, Haval did not achieve a high rank on either list. For pessimists, this would be despairing, whereas optimists see hope everywhere.

Clearly, Haval, with 3.8 million loyal H6 customers to its name, is optimistic. In the HEV market monitored by joint ventures, Haval sees enormous potential for independent brands in this small niche. In the PHEV market, the two incumbents represent a chance for the top players and Haval can take advantage of this potential opening.

Li Xiaorui summed it up: “The biggest opportunity for Haval is that there is no real pattern in these two markets yet.”

Moreover, based on the same confidence, Haval notes the sales gap in the 100,000-200,000 yuan hybrid SUV price range. According to market statistics, in the first half of this year, this price range was dominated by gasoline and pure electric vehicles, with gasoline vehicles fluctuating around a 90% share and pure electric vehicles hovering around 10%. The proportion of HEVs and PHEVs is negligible.

As a result, despite the naturally higher costs of hybrid technology compared to gasoline vehicles, there are currently fewer hybrids on the market. For this reason, “for optimists like Haval, a gap means a big chance.”

Since hybrids that incorporate electric motors can avoid the engine’s inefficient regions, they offer several advantages, such as better fuel efficiency and improved drivability. “We believe that HEVs and PHEVs will inevitably infiltrate the 100,000 – 200,000 Yuan market gradually,” says Li Xiaorui, due to the current advantages of hybrid products. This is the main reason for Haval to enter the new energy SUV market in the 100,000-200,000 yuan price range. They want to participate in a niche market with the greatest chance of expansion in the future.

And the widely acclaimed H6 from Haval is exactly the aerodynamic sharp blade they chose.

Robust DHT Technology

Compared to Haval’s entry into new energy vehicles and the motivation behind the introduction of hybrid products, I’m not so curious about the product strength of Haval H6 hybrid models.

After all, this is not a new hybrid solution that suddenly appeared out of nowhere, it was mostly used in high-end products under Great Wall, and the launch of the H6 hybrid twins this time is, in my opinion, the decentralization of Great Wall’s Citroen hybrid technology.

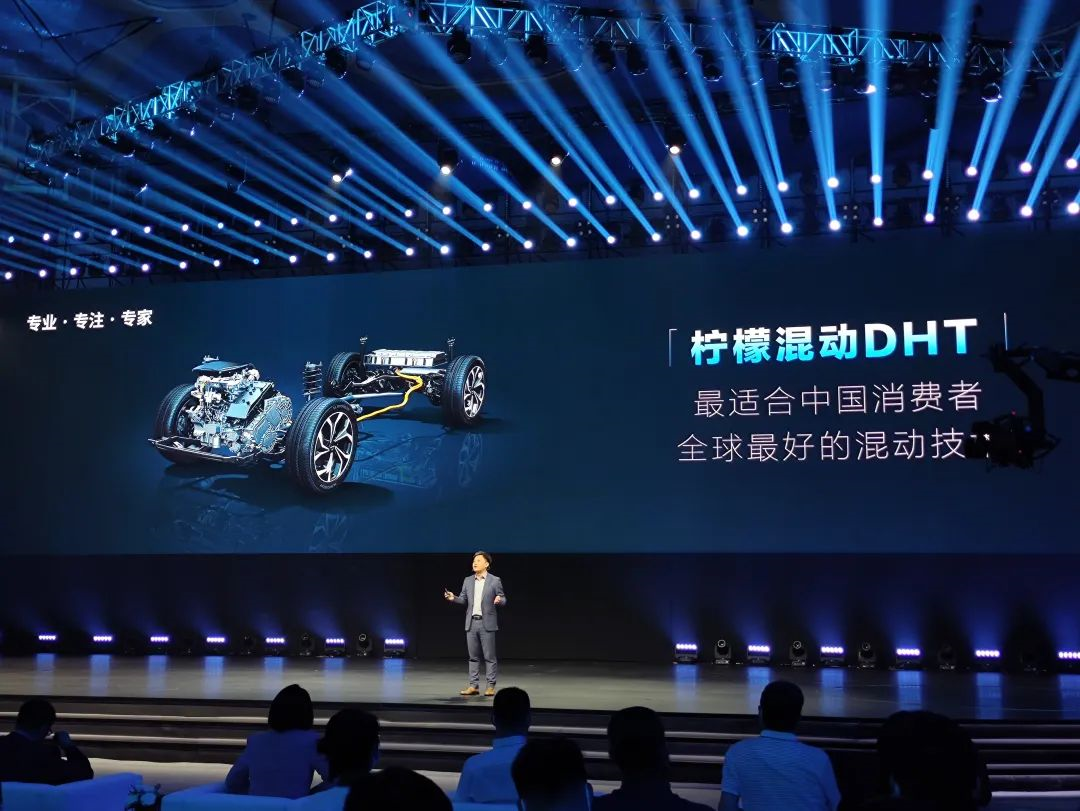

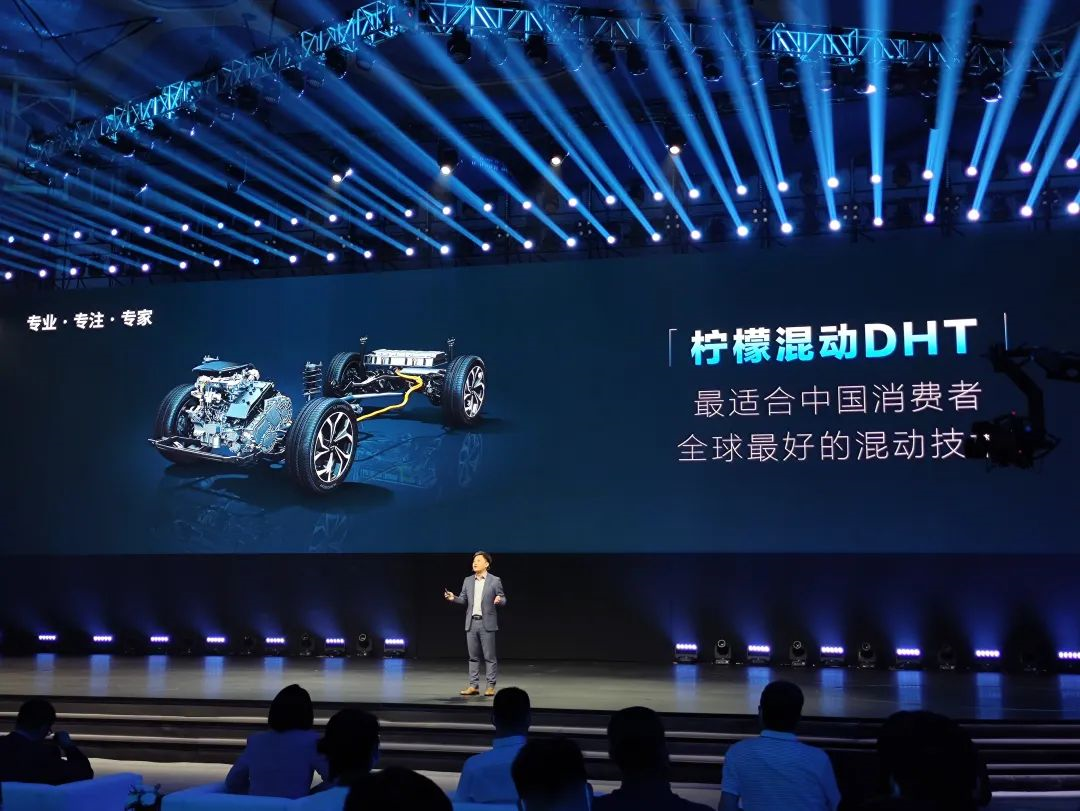

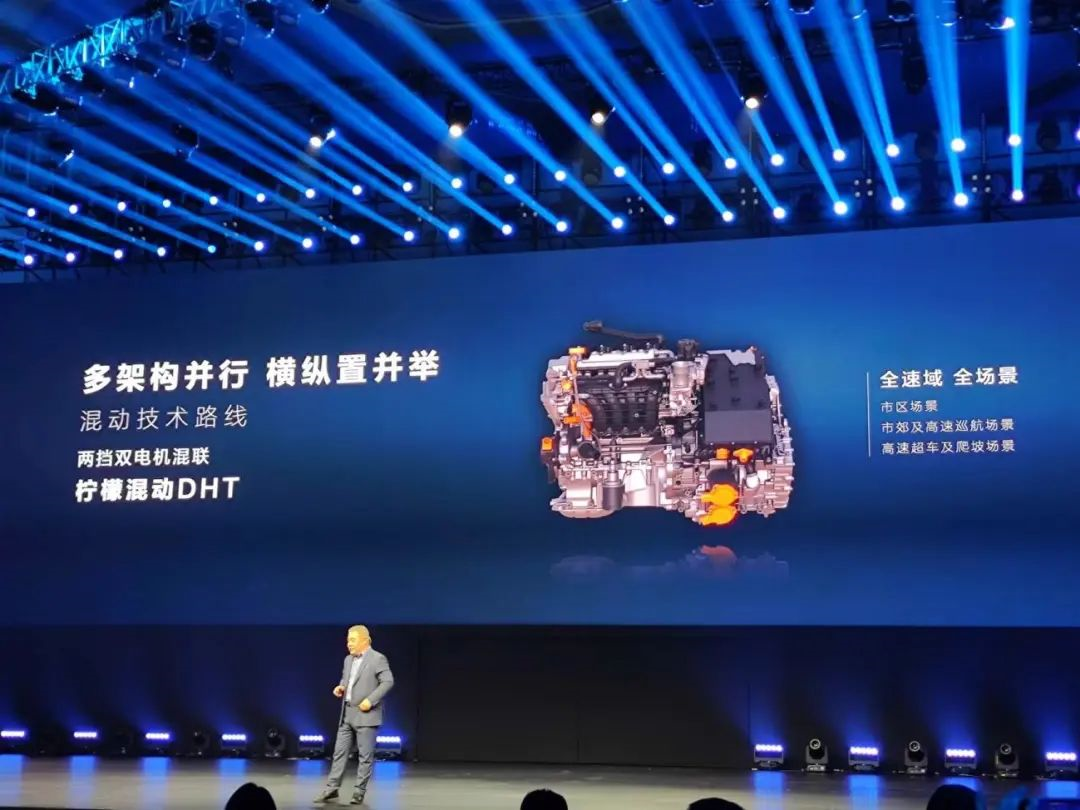

Recently, the discussion on DHT technology and range extender technology on Weibo was hotly debated. Both sides emphasized their advantages and attacked each other’s weaknesses, but at least I haven’t seen anyone say that Great Wall’s 2-gear DHT hybrid technology is outdated in terms of technical attributes. Being able to silence netizens means that Great Wall’s hybrid technology is already a force to be reckoned with.

If you ask whether Haval’s hybrid is just copying Wey’s, to be honest, products at different price levels will inevitably have different product positioning.

“DHT platform covers A-level cars to B and C-level cars, of course, there are differences in addition to the dedicated hybrid engine, including the matching architecture, network infrastructure, and battery,” said Haval CTO Lu Wenbin. But the core of Citroen’s hybrid technology, “ensuring power and fuel efficiency,” will not change.

And the zero to hundred acceleration of the Haval H6 hybrid model is 5.2 seconds, with a fuel consumption of 4.7 liters per hundred kilometers, which again calls back to the above statement.

Conclusion

In the 2023 new energy vehicle market, we have a strong feeling that any new force vehicle that catches our eye often spends a lot of energy on areas they didn’t value in the past, such as suspension, handling, texture, and luxury.

To put it in a more eye-catching way, outstanding new forces are beginning to converge with traditional automakers this year.

Coincidentally, Li Xiaorui also made a similar point.

“The new energy race is a marathon, and whether it is an independent brand, a new force, a traditional car company, or a car company that transitions faster, none of them are fully prepared yet, and each has its own advantages and weaknesses.”

We hope that emerging new forces can learn from traditional car companies in terms of chassis, luxury, and mass production technology, while traditional car companies can learn from new forces in terms of technology, innovation, and personalized services.

In essence, new energy vehicles are still cars. If a new energy car product wants to hold more water like a wooden bucket, the technology aspect cannot be short, the basic mechanical quality cannot be short either, and the experience of large-scale mass production cannot be short either…

Haval’s new energy strategy has been presented to the public. By 2025, the proportion of Haval’s new energy sales should reach 80%; By 2030, Haval will officially stop selling fuel vehicles.

The super-chaotic DHT twin stars of the third generation H6 are clearly a significant step towards this direction for Haval.

This is a small step in the journey of new energy, and it may also be a big step towards popularizing Chinese hybrid SUVs.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.