Author: Zhu Yulong

As the sales of new energy vehicles continue to rise, I think we need to do some sorting out of the growth, with the main focuses being the deployment rate of lithium iron phosphate and the diversified procurement of battery suppliers, which actually jointly lead the electric vehicle towards the next step.

From the sales data in July, the following situation can be seen:

-

Pure electric vehicles were 338,000 units in total, including 204,900 lithium iron phosphate, 130,000 ternary, and 3,670 ternary lithium iron AB batteries

-

Plug-in hybrid vehicles were 100,000 units in total, including 62,700 lithium iron phosphate and 38,300 ternary

-

From various brands, BYD and Tesla have already taken the lead in the dominant assembly of lithium iron phosphate

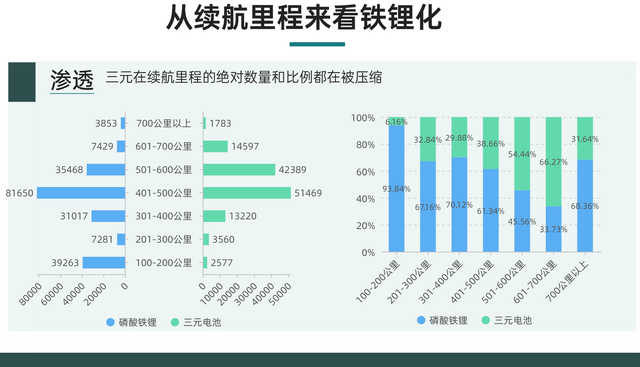

Regarding the range of BEVs, there was indeed a large amount of penetration:

-

Within 400 kilometers, lithium iron phosphate has an absolute advantage with around 70%, especially low range models of 200 kilometers have already been fully upgraded with lithium iron

-

Between 400-500 kilometers, the main direction currently is the switch from ternary to lithium iron phosphate; compared to previous data, this switching process is relatively fast

-

Ternary is currently more advantageous between 500-700 kilometers, but we see that the needs have been basically covered in the products under development

-

Above 700 kilometers, due to the relatively fast cost and scheme promotion of lithium iron phosphate in China, it now has a larger quantity of use

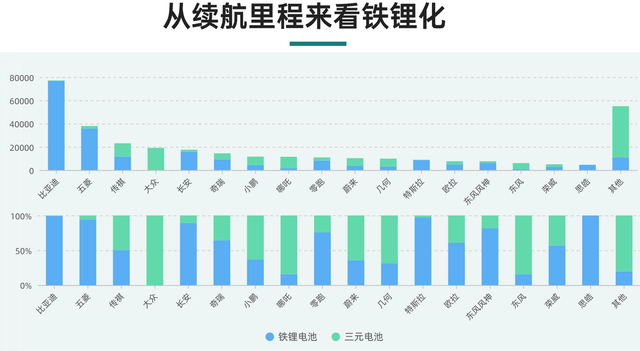

Degree of Lithium Iron Phosphate in Various Vehicle Models

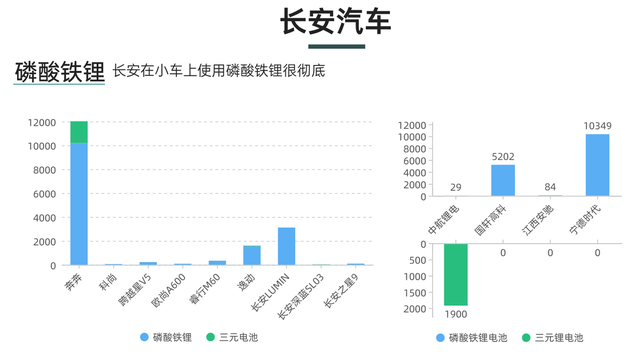

From various companies, BYD has the highest degree of lithium iron phosphate; but what surprises us is that Tesla, Wuling, Chang’an, Leapmotor, and Seres have almost fully upgraded to lithium iron phosphate, and Chery, GAC, Ora, and Roewe have almost half upgraded, so it depends on who can switch faster.

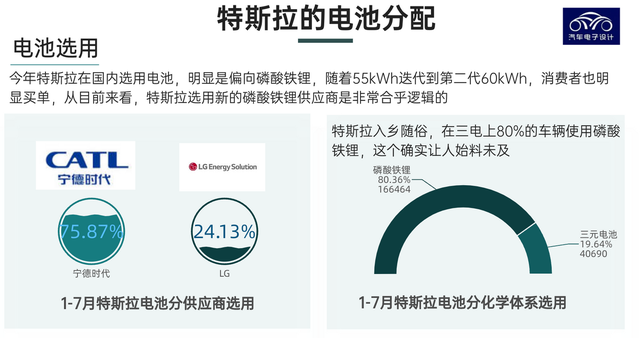

– Tesla is indeed fast in this regard: From January to July, 60kWh of lithium iron phosphate has accounted for three-quarters of usage, and LG Energy’s products have entered the fast lane, which has already exceeded 80% of vehicle quantity.

– Tesla is indeed fast in this regard: From January to July, 60kWh of lithium iron phosphate has accounted for three-quarters of usage, and LG Energy’s products have entered the fast lane, which has already exceeded 80% of vehicle quantity.

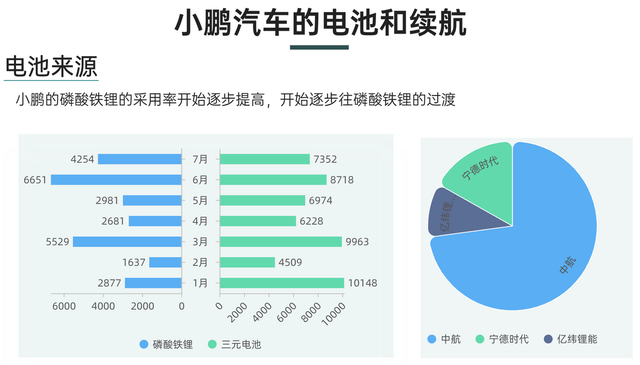

- XPeng Motors has an outstanding position in the new forces, so we can see the speed of lithium iron phosphate by choosing different suppliers.

Especially when we see the P7 version with 480 kilometers of range, it is similar to the three-element versions of about 600 kilometers, so consumers’ demand for 600-700 kilometers is not rigid and is basically powerless in the face of price.

Future trend of lithium iron phosphate

With the evolution of the lithium iron phosphate battery structure and the expectation of the subsequent lithium iron manganese phosphate, we do have doubts about the prospects of the three-element being adopted on existing models, and I think there are several main problems:

Safety

Due to the actual characteristics of the three elements in the past and the increasing requirements for thermal runaway spreading experiments, the version using lithium iron phosphate still has some bottom line support in this regard. It will also burn, but the overall propagation speed is relatively slow.

Cost expectations

From a long-term perspective, it is always expected to be unaffected by nickel price fluctuations and only linked to lithium carbonate prices.

Leadership effect

This can be seen in the achievements of brands such as Tesla and BYD, as well as Changan and Wuling.

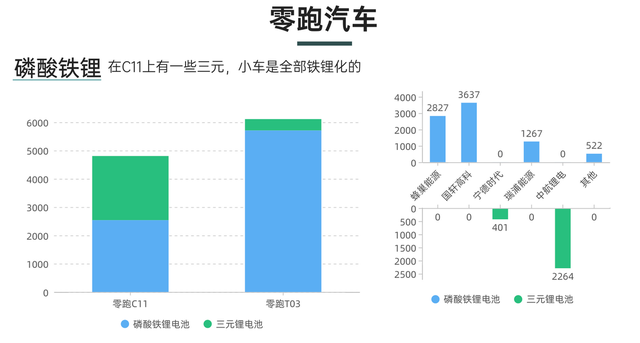

I didn’t expect that C11 on Leading Ideal Motors would also have half of iron phosphate, and currently Battery Systems, Guoxuan Hi-Tech, and RuiPulanJun all offer lithium iron phosphate solutions, so the substitution rate in this area is also very fast.

Summary: In my opinion, the industry’s turning point lies in the transition to iron-lithium batteries. Once this transition is complete, safety requirements for suppliers will be reduced. Price, consistency, and overall quality will become the benchmarks for supplier comparison. The speed of this transition will continue until 2023, which presents an opportunity for each automotive company to make a choice.

Summary: In my opinion, the industry’s turning point lies in the transition to iron-lithium batteries. Once this transition is complete, safety requirements for suppliers will be reduced. Price, consistency, and overall quality will become the benchmarks for supplier comparison. The speed of this transition will continue until 2023, which presents an opportunity for each automotive company to make a choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.