Transformation is not a banquet, but a sacrifice.

On August 18th, Geely Automobile Holdings Limited (“Geely Automobile”) released its 2022 interim financial report.

The report showed that in the first half of the year, Geely Automobile’s sales volume decreased by 3% year-on-year, but operating revenue increased by 29% year-on-year to 58.2 billion yuan. Even revenue from directly related vehicle sales grew by 25% to 49.2 billion yuan.

Among them, sales of new energy vehicles grew by 398%.

However, the other side of the growth is a decline in profits.

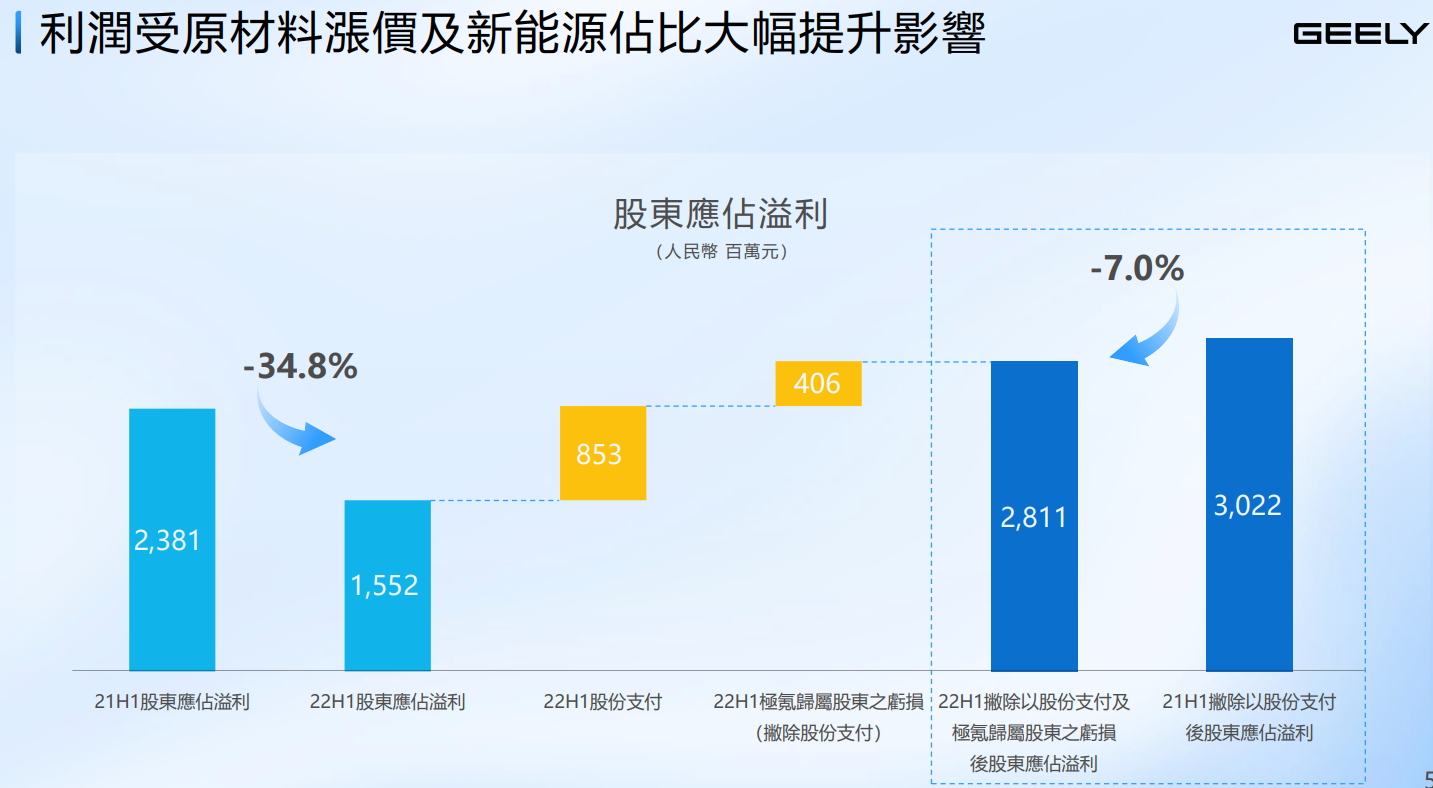

In the first half of the year, Geely Automobile’s gross profit only increased by 9%, and the gross profit margin decreased by 2.7 percentage points to 14.5%. The increase in administrative expenses, including research and development and financial expenses related to equity incentives, further diluted profits. In the first half of the year, Geely Automobile’s net profit decreased by 35% year-on-year to 1.55 billion yuan, even adjusted net profit still fell by 7%.

New car makers have gone through more than ten years of burning money to compete for survival, and traditional car companies are beginning to feel the impact of the structural transformation of new energy products on profits.

“Maintain strategic focus”. Geely Automobile’s management team repeatedly emphasized their determination to transform towards new energy at a performance communication meeting under two blue Geely action plans. In the second half of the year, Geely Automobile will achieve a proportion of new energy vehicle sales of more than 30% per month; by 2023, the proportion of new energy vehicle sales per month will reach more than 50%.

Is the new energy sector profitable? How will Geely maintain its strategic focus and achieve a 50% monthly new energy structure transformation next year?

Is new energy profitable?

As of now, Geely Automobile has not yet “made money” in new energy.

In the first half of the year, Geely Automobile achieved a total sales volume of 614,000 vehicles, with new energy vehicle sales of 110,000 vehicles, accounting for 18%, and reaching 26.1% in July.

Among them, Jikua completed the delivery of 19,000 vehicles, Geometry’s sales increased by 293% year-on-year to 54,000 vehicles, Reblue sold 17,000 vehicles, and the total sales of pure electric vehicles reached 86,000, accounting for 78%.

The plug-in hybrid models of the Geely and Lynk&Co brands totaled 24,000 vehicles, and the hybrid models were 9,000 vehicles.

Jikua, whose average large order amount exceeds 335,000 yuan, Lynk&Co whose average price exceeds 150,000 yuan, and Geely’s high-end series China Star, which accounts for 25%, collectively drove up Geely Automobile’s single-vehicle sales revenue by 21% to 102,000 yuan.Therefore, although Geely Auto’s sales volume in the first half of the year decreased by 3% year-on-year to 614,000 units, its total vehicle sales revenue still achieved growth of 25% to 49.2 billion yuan. Additionally, the revenue from components, battery packs, and technology development of nearly 9 billion yuan further increased the revenue to 58.2 billion yuan.

Unfortunately, even for traditional automakers, the structural transformation stage of new energy is also a “burn money” period.

The high-end Jiexi currently has a gross profit margin of only 5%. At the same time, the cost reaches 40 million yuan for free replacement of Qualcomm 8155 (calculated at RMB 1,600) for 25,000 users, and the R&D investment in the new generation of intelligent cockpits compatible with 8155 reaches 300 million yuan.

Lynk & Co, one of the main sources of profit, suffered a decline in sales volume of 28.4% and a decline in net profit of 56.7% to 200 million yuan due to the switch to hybrid power system and the double impact of entering the European market.

Another major source of income, Geely brand, saw its sales volume in the first half of the year drop by 12.3% (excluding Geometry), to 446,000 units.

Although the significant growth of the Geometry brand has brought an increase in sales volume, the price range has fallen from the 150,000-200,000 yuan level to less than 100,000 yuan, which means that a larger scale is needed to achieve profits.

Geely Auto’s various sub-brands are facing a significant transition period to the new energy track, and they have also been hit by the rising prices of upstream raw materials and the transformation of intelligent technology in the second half of the year.

Affected by the price increase of raw materials such as lithium, the cost of power batteries, which accounts for the highest proportion of total automobile costs, has reached 60% this year, plus the rising prices of key components such as chips. Although fuel models still account for 82%, Geely Auto’s gross profit margin in the first half of the year has dropped by nearly 3 percentage points year-on-year to 14.5%.

While converting research and development investment in electrification into mass-produced products, Geely has also increased its research and development investment in the intelligent transformation of the second half of the year. R&D expenses in the first half of the year increased by 173% year-on-year to 926 million yuan, driving administrative expenses to grow by 43% to 4.66 billion yuan.

The decline in gross profit margin and the increase in expenses ultimately further reduced Geely Auto’s profit. Despite the revenue surging by nearly 30%, net profit still fell by 7% year-on-year to 2.811 billion yuan (excluding share-based payments and Jiexi’s attributable losses to shareholders).

However, it is not only Geely Auto that is not making profits. In the world’s largest market for new energy vehicles, the entire industrial chain of China’s new energy vehicles has indicated that they are “not making profits.”

The most popular BYD Q1 and related business saw revenue growth of 34%, with a gross profit margin of only 17%.

At the World Battery Conference in July, Guangzhou Auto Group Chairman Zeng Qinghong said, “We are working for Contemporary Amperex Technology.”Ningde Times Chief Scientist Wu Kai responded: “Although our company has not lost money this year, we are basically struggling on the edge of slight profitability, which is very painful. It can be imagined where the profits are going.”

Tianqi Lithium, which we can imagine, although it has made a lot of money on the surface, is under severe cash flow pressure due to the huge financial expenses brought by buying mines with borrowed money in 2018.

Others are making money. In the first half of the year, Tesla’s automotive business gross margin reached 30.5%, and the company’s net profit margin was 17.7%. Coupled with low liabilities, it is dubbed by investors as a “money-making machine carrying empty bags”.

This is Tesla’s third year of profitability, preceded by a long period of burning money in 2016, which shows the importance of “strategic decision-making”.

Accelerating the Switch to New Energy Product Structure

However, the market will clearly not give traditional automakers like Geely the same long window of opportunity as Tesla.

“In the future, Geely Automobile will further accelerate the comprehensive transformation of new energy through technological ecology empowerment, and achieve a monthly new energy sales ratio of more than 30% in the second half of the year. By 2023, through improving product layout, we will achieve a monthly new energy sales ratio of over 50%, and enter the first tier of new energy enterprises.” said Geely Automobile Senior Vice President and CFO Dai Qing at the half-year performance communication meeting.

If the top three are divided into the top group, Geely Automobile is only one step away from the first tier of new energy.

According to data from the China Association of Automobile Manufacturers, in the first seven months of this year, new energy vehicle sales of BYD, SAIC-GM-Wuling, and Tesla China were 793,000 units, 248,000 units, and 206,000 units respectively, with Geely Automobile ranking fourth, selling 133,000 units.

Data from the Ministry of Industry and Information Technology shows that the new energy vehicle market penetration rate in the first half of the year was 21.6%. Previously, Wang Chuanfu, chairman of BYD, estimated that the penetration rate of new energy vehicles in China could reach 35% by 2023. Roughly estimating based on this, if the top three maintain the same growth rate as the market (+13.4%), the sales range of the top group at this time next year will be 900,000 to 2.4 million units.

If Geely Automobile wants to replace one of them, it needs to sell at least 250,000 new energy vehicles, which is 34% of its sales ratio in the first seven months of this year. Currently, Geely Automobile’s new energy vehicle sales from January to July is 142,000 units, accounting for 19.2%, leaving considerable room for improvement.)

To achieve this, Geely Automobile will make concerted efforts to promote the rapid switch of new energy product structure from the aspects of vehicle models, sales networks, infrastructure, intelligentization level, and overseas market expansion.

In terms of product, Geely Auto will launch more than ten new models in the second half of the year, including two new models under Geely brand, four E-motive hybrid versions under Lynk & Co brand, 009 MPV model under Geometry brand, and the new model Geely Xingyue L with 200 km range E-motive technology.

In terms of product, Geely Auto will launch more than ten new models in the second half of the year, including two new models under Geely brand, four E-motive hybrid versions under Lynk & Co brand, 009 MPV model under Geometry brand, and the new model Geely Xingyue L with 200 km range E-motive technology.

Among them, JiKe brand aims to achieve its annual sales target of 70,000 units at the average monthly sales of over ten thousand units in the second half of the year.

The hybrid system of Geely brand’s Emgrand has completed the climb of production capacity and will achieve significant growth in September. And with accumulated orders for over 30,000 units, the Emgrand L Super Hybrid-Electric Vehicle (SHEV) and Xingyue L will first adopt “Leyue” hybrid technology with a range over 200 km;

Geometry brand will collaborate with Huawei to develop a smarter, internet-connected product experience based on the Harmony OS.

Lynk & Co will launch E-motive models with longer mileage for its main products 01, 05, and 09 in the second half of the year, achieving full electrification of its main products. Moreover, Lynk & Co will upgrade the electronic and electrical architecture from Geea1.0 to Geea2.0 for a smarter, new cabin experience. The brand plans to achieve 100% electrification by 2025.

In terms of network and infrastructure, JiKe’s sales network will exceed 260 outlets by the end of the year, and there will be 600 charging stations; Geely Auto plans to complete the layout of more than 200 battery swapping stations by the end of the year, focusing on core cities such as Chongqing, Hangzhou, and Jinan.

In terms of intelligence, Geely Auto will mass-produce One OS, its self-developed new generation of cockpit operation system, which will support one software covering multiple models. The brand focuses on the layout of L2+ and L3 intelligent driving technologies. Starting from the fourth quarter, the brand’s latest product, the new generation of “NOA autonomous driving navigation system,” will be applied to Lynk & Co, Geely, and Geometry.

Internationalization is also a key strategic layout of Geely, aiming to achieve a 20% overseas sales ratio by 2025.

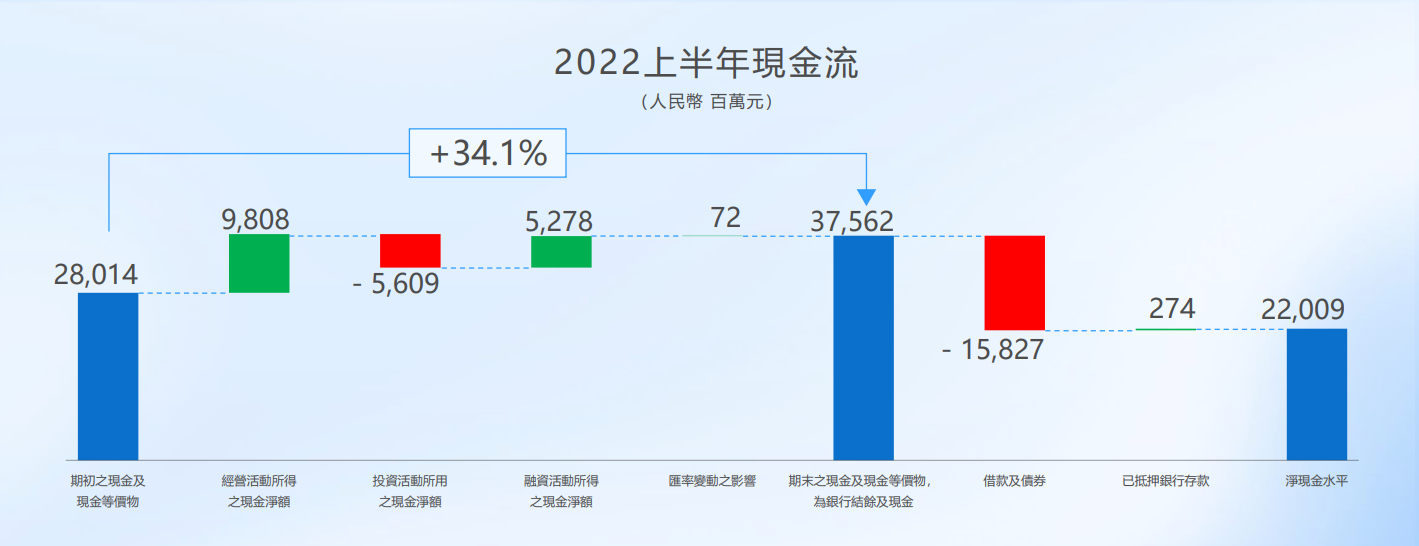

Geely brand will focus on main markets such as the Middle East, Asia-Pacific, and Latin America; Baojun will focus on Southeast Asia, accelerating the development of emerging markets such as Thailand and Vietnam; Lynk & Co will continue to promote its “European Strategy” and “Asia-Pacific Strategy.” Additionally, Geely Auto will also use innovative models such as technology authorization, subscription, and cooperation with local auto manufacturers to export its hybrid, pure electric, and other new energy technologies and products globally.To maintain the continuous momentum required for transformation, Geely Automobile has also strengthened cash management. The net increase in cash was as high as RMB 9.48 billion in the first half of the year, with cash and cash equivalents reaching RMB 37.56 billion as of the end of June, compared to RMB 19.8 billion in the same period last year. In addition, net cash flow increased from RMB 20.8 billion at the beginning of this year to RMB 22.0 billion.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.