Author: Zheng Senhong

After overcoming supply chain difficulties, the ideal car was stuck at the bottleneck of product line transition.

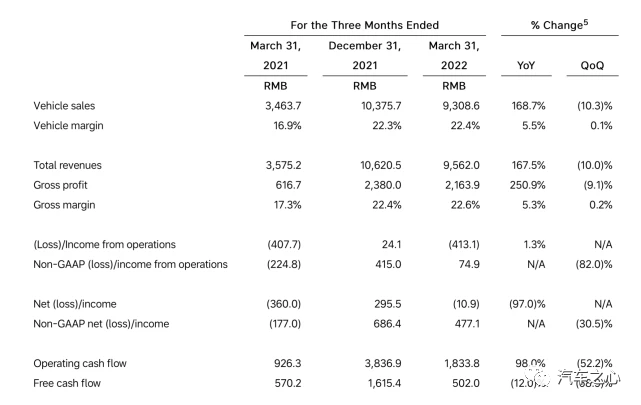

On August 15th, Ideal Automobile released its Q2 2022 financial report and held a conference call, but the data performance could not conceal Ideal’s predicament.

In Q2, Ideal delivered 28,687 vehicles, higher than the expected 21,000-24,000 vehicles in Q1, equivalent to selling nearly 9,562 vehicles per month. The ever-powerful Ideal ONE stands out with its product strength.

However, the delivery rate has decreased by nearly 10% compared to Q1, and the automotive sales revenue has decreased by 8.9% to RMB 8.48 billion on a month-over-month basis, affecting total revenue and gross profit margin.

Automotive sales revenue usually accounts for more than 90% of Ideal’s total revenue. Therefore, total revenue decreased by 8.7% on a month-over-month basis compared to Q1, and the vehicle gross profit margin decreased by 1.2%. This is also the first time that Ideal’s gross profit margin has declined since the launch of the new Ideal ONE.

It is not difficult to see that due to the limited production capacity caused by the supply chain constraints affected by the Shanghai epidemic in April this year, Ideal’s revenue and gross profit margin have both declined on a month-over-month basis in Q2.

But for Li Xiang, the bigger problem is how to avoid the high degree of overlap in product positioning.

Loss of RMB 23,000 for every car sold?

If we ignore the data on the revenue side, the biggest change in Ideal’s Q2 is on the profit level.

According to the financial report, Ideal’s operating losses in Q2 reached RMB 978.5 million, with a net loss of RMB 618 million. This is the highest quarterly loss in Ideal’s history, even higher than the full-year loss in 2021, which was nearly twice as high.

By comparison, the net loss in Q1 2022 was RMB 10.9 million, and the net loss for the full year 2021 was RMB 321.5 million.

In terms of per-car losses, the average operating losses per car of Ideal exceeded RMB 10,000 last year, rising to RMB 23,000 in the first half of this year.

What’s the concept behind this?

Taking the accumulated shipment volume of 60,000 units in the first half of this year as an example, Ideal has lost nearly RMB 1.4 billion.

In addition to the sharp rise in the prices of upstream products such as batteries, the increase in sales and R&D investment is also the reason behind the loss of high-speed expansion.The sales, general, and administrative expenses (SG&A) budget for the second quarter of the year for Ideal is CNY1.33 billion. For the past four consecutive quarters, Ideal has invested more than CNY1 billion in this area, mainly due to the addition of sales teams and the continuous expansion of its sales network.

As of the end of June, Ideal Retail Center has increased from 206 at the beginning of the year to 247, covering 113 cities, with a total of 308 after-sales and body-shop centers.

At the end of the second quarter, Ideal had a total of 525 channels and outlets (excluding independent after-sales and delivery functional sites), the highest among all new car manufacturers.

In terms of R&D, Ideal’s investment is also steadily increasing.

Ideal is known as the “thrifty factory” in the industry. Compared with the “spendthrift” NIO and Xpeng, Ideal has always emphasized cost control, whether in R&D investment or marketing expenses, Ideal is lower than the other two.

With the release of Ideal L9, Ideal is gradually becoming more generous as it enters an expanding product cycle.

Cumulative R&D expenses for the second quarter amounted to CNY1.53 billion, an increase of 134.4% from the second quarter of 2021 and 11.5% from the first quarter of 2022, mainly due to the addition of R&D teams and investment in R&D for new models.

Regarding future R&D investment plans, Li Xiang also has a standard: a continuous, long-term investment of over 10% of R&D expenses. Nowadays, Ideal has indeed achieved this, with this proportion reaching 18% in the second quarter.

Toyota, which is known for its large R&D investment, has an R&D investment-to-revenue ratio of only 7.5%, while luxury brands BBA are only 7%. Insisting on investing 10% in R&D not only tests the profit-making ability of a car manufacturer, but also means that Ideal will continue to consolidate its competitiveness in the long term.

With the successive release of multiple new models, the expansion of the sales network, and the development of platforms for pure electric vehicles and the layout of ultra-fast charging stations, Ideal’s investment in sales, R&D, and other areas will continue to rise.

Of course, this investment is necessary, even if it brings short-term losses. As long as the cash flow remains healthy, it is beneficial to the long-term planning of the company.

At the end of the second quarter, Ideal’s total cash and cash equivalents, restricted cash, fixed-term deposits, and short-term investments amounted to CNY53.65 billion, the highest cash reserve in Ideal’s history.

At the same time, another positive signal for IDEAL is that IDEAL is finally ending its dependence on IDEAL ONE’s solo effort.

Shen Yanan, co-founder and CEO of Ideal Auto, said that the planned delivery volume of Ideal L9 is expected to exceed 10,000 units in September, with a higher vehicle gross margin than Ideal ONE and a monthly production capacity of about 15,000 units.

When all the data points to the fact that IDEAL’s performance in the next quarter will be better than in the second quarter, IDEAL’s delivery expectations for the third quarter come as a surprise to many.

IDEAL ONE, L8, and L9: All Essentially Family Vehicles.

For the third quarter’s revenue guidance, IDEAL expects to deliver 27,000 to 29,000 new vehicles with revenue of CNY 8.96 to CNY 9.56 billion.

Such a conservative performance guidance means that IDEAL’s expectations for the third quarter are on par with the second quarter, which was hit hard by the epidemic, and may even be worse.

Even with a maximum delivery volume of 29,000 units, IDEAL delivered only 10,422 IDEAL ONEs in July. In the following two months, IDEAL’s expected delivery volume will be no more than 18,578 units at most.

Based on this, and with Li Yanan’s advance spoiler that IDEAL L9 sales will exceed 10,000 units in September, IDEAL ONE is left with less than 5,000 units per month on average in the third quarter, which is equivalent to a direct halving of IDEAL ONE’s delivery volume.

As IDEAL’s first model, IDEAL ONE avoided the dependence of electric vehicles on external power supplies, avoided price conflicts with other competitors, and catered to the psychological needs of most domestic consumers, winning the recognition of consumers and laying the foundation for IDEAL’s 0-1.

With the imminent delivery of the second model, IDEAL L9, and IDEAL’s previously published data, IDEAL L9’s cumulative reservations have already exceeded 50,000, with confirmed orders exceeding 30,000. The outside world once had high hopes that IDEAL would break the record of monthly sales of 20,000.

However, the barrel of IDEAL L9 is aimed at IDEAL ONE.

Li Yanan said that there has indeed been a slowdown in IDEAL ONE’s orders, mainly because most of the customers who were originally interested in IDEAL ONE have switched to IDEAL L9 after experiencing it.

It is reported that IDEAL’s internal order conversion rate is beyond Li’s own guess of IDEAL L9 user profile, especially for users with particularly ample budgets.Li Xiang previously believed that the sudden increase from a budget of 300,000 to 350,000 yuan to almost 500,000 yuan would only apply to a few people, probably less than 10%, and would not be the real mainstream for the ideal L9.

In fact, the main reason for this is attributed to the ideal market positioning for its products, including the upcoming third model, the Ideal L8, which has already been identified as the “Ideal ONE substitute” before the product is released.

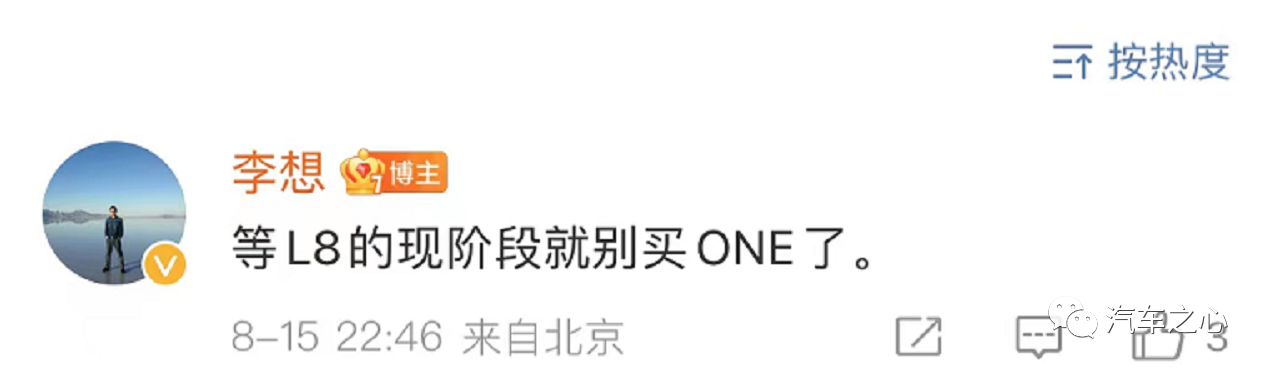

“Don’t buy the ONE while waiting for the L8.” This is a response from Li Xiang on social media to fans’ expectations for the Ideal L8.

In other words, Ideal will accelerate the pace of L8’s release, indirectly proving that L8 will be the successor of Ideal ONE.

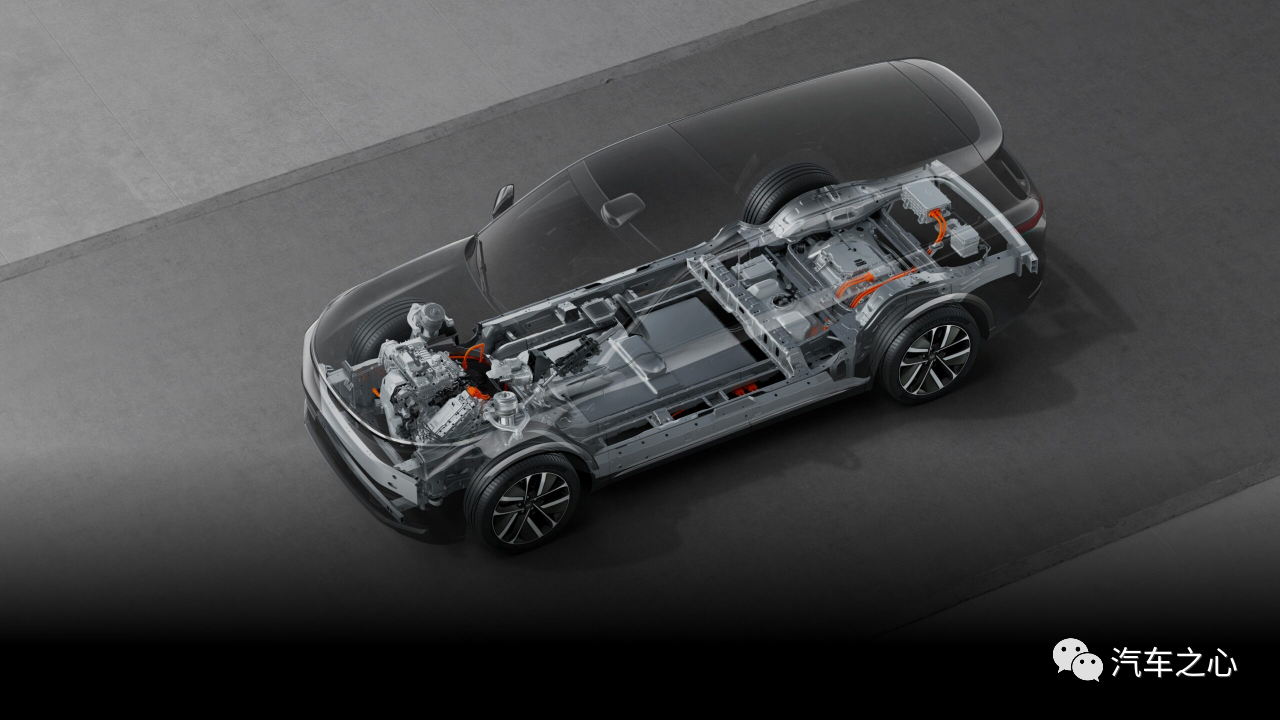

It is understood that the Ideal L8 will be the second model of the Ideal X platform. With a mid-to-large size SUV positioning and equipped with the same plug-in hybrid system as the Ideal L9, it may be released this year.

According to the Ideal’s product strategy of releasing a popular product every 100,000 yuan, the Ideal L8’s price is likely to be between the Ideal ONE and the Ideal L9.

But in essence, Ideal ONE, L9 and L8 are all “six-seater SUVs for families”, just placed at different prices in the “family user” segment.

Ideal is a high-end brand that has descended to users’ lives and has also created the concept of “mobile home”. The good news is that Ideal is the only winner in this segment of the market, but on the other hand, Ideal has been constantly cannibalizing itself along this path and eventually forming a “new models are highly anticipated, old models depend on discounts” vicious circle.

At the financial report conference call, Li Yanan confirmed that Ideal ONE currently has a terminal discount policy of 7,000 yuan, and in some regions, customers can receive their car the next day without selecting any specific configurations.

For consumers, Ideal currently offers models priced at more than 300,000 yuan, and choosing Ideal is more due to the premium experience of its products. Why not choose a better and newer Ideal car?

For Ideal, when performance guidance is not an overly cautious expectation due to supply issues, but rather due to demand issues, sales volume becomes the primary issue that must be considered.After all, relying solely on a segmented market may be insufficient to support the ideal 2025 strategy. At least for now, the phenomenon of “replacing old with new” has already appeared among the products with different positioning under the brand, and the launch of the Ideal L8 in the future will only accelerate the delisting pace of the Ideal ONE.

In order to have a decisive advantage in the next round of competition, Ideal also needs to provide consumers with more differentiated choices on the basis of large cars, luxury, and household use.

The Next Decade: Pure electric, range-extended parallel hybrid

Against the background that there will be a total of 8 million intelligent electric vehicles in China by 2025, Ideal plans to capture 20% (1.6 million vehicles) of the market share.

This is the “2025 Strategy” of Ideal.

Li Yanan once believed that it is necessary to get 20% of the market share in order to become a leading company based on the prediction of the competitive situation in the next 5-10 years. If it fails to get 20%, it will fall into the long tail and gradually be eliminated.

Therefore, Ideal will adopt a dual strategy of pure electric + range-extended parallel hybrid in the next decade:

- A range-extended electric platform with urban pure electric and long-distance power generation as user value.

- A 400kW ultra-fast charge high-voltage pure electric platform with 10 minutes of charging and a range of 300-500 kilometers.

“In the 1.6 million sales in 2025, range-extended models will still account for 40%-50%.” Li Yanan still believes that range-extended systems will have market competitiveness in the next few years.

Li Yanan believes that range-extended systems are still the best solution for SUVs in the next five years. The sales of BYD Han DM-i are better than BYD Han EV, while the sales of Tang DM-i are higher than Tang EV. This is because when the budget reaches 200,000 yuan or more, users will have very detailed plans, and long-distance demand is higher. A range-extended system is the best choice for SUVs.

By comparison, the SUV models that satisfy both urban and suburban driving needs to pursue beauty and freedom are equally important if the budget is set at RMB 200 thousand.

He XPeng, CEO of Xpeng Motors, believes that the layout of long range, fast charging, and charging piles “triple-1” is the competitive advantage for pure electric vehicles with a price point above RMB 200 thousand.

Different directions of the racetrack naturally lead to diversified solutions. At present, fast charging, battery swapping, and hybrid are all different solutions for the range and energy supplementation of new energy vehicles, and each has its own opinion.

However, in the long run, XPeng He’s viewpoint is not conflicting with that of Li Xiang, because Ideal is also planning to develop super-fast charging technology, including 480kW Supercharger, 850V high-voltage platform, 4C battery, and building a closed-loop service network system of “vehicle-charge-cloud” to enter the field of pure electric vehicles. Ideal also plans to build more than 3,000 super-fast charging stations nationwide by 2025.

However, in the long run, XPeng He’s viewpoint is not conflicting with that of Li Xiang, because Ideal is also planning to develop super-fast charging technology, including 480kW Supercharger, 850V high-voltage platform, 4C battery, and building a closed-loop service network system of “vehicle-charge-cloud” to enter the field of pure electric vehicles. Ideal also plans to build more than 3,000 super-fast charging stations nationwide by 2025.

According to the plan, Ideal will launch its first pure electric vehicle in 2023. Currently, the experimental stage of Ideal’s pure electric vehicle has achieved a charging time of ten minutes and a range of 400 kilometers.

Li Xiang said that the layout of pure electric vehicle models is to replace fuel vehicles on a large scale and allow former fuel vehicle users to recharge without worry.

Based on the user profile of Ideal L9, Li Xiang has also initially planned the layout of charging stations. 80% of L9 users can install charging stations at home and have a 100% recharging environment, so recharging in urban areas is not the core pain point, but rather ensuring the recharging system between construction areas in the Yangtze River Delta, the Pearl River Delta, the Beijing-Tianjin-Hebei region, and other regions.

This is actually consistent with XPeng He’s direction. For example, apart from layout and construction in the top ten cities ranked by G9 orders, Xpeng supercharging stations, including Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Wuhan, Hangzhou, and highway entrances and exits, will form a high-density recharging circle.

It is not difficult to see that Ideal is aware that if it misses the window of pure electric vehicles, it will inevitably perish in the era of pure electric vehicles due to the lack of pure electric vehicle technology after the advantage of extended-range hybrid technology disappears.

However, at present, Ideal still needs to solve the problem of the transition between old and new products.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.