Author: Zhu Yulong

The dynamic battery industry in China was in a very prosperous state in July: Production volume was 47.2 GWh, shipment volume was 24.2 GWh, and export volume was 2.0 GWh. From an overall perspective:

-

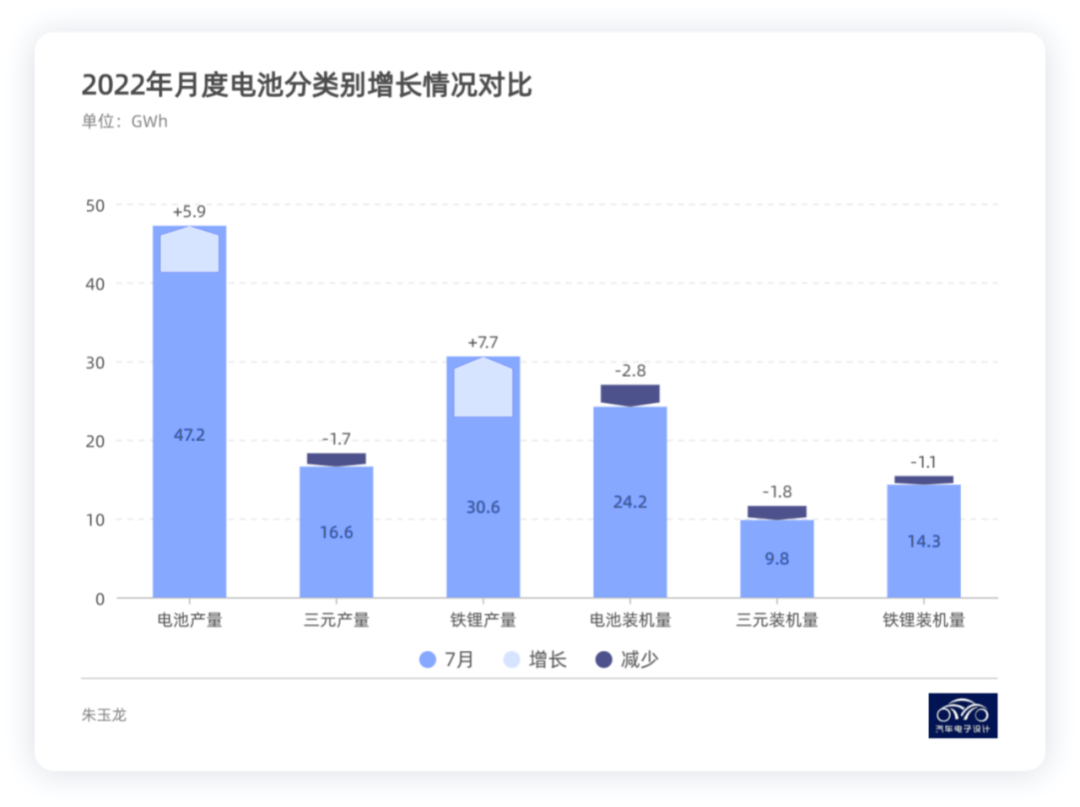

Production Breakdown:

The total production was 47.2 GWh, an increase of 172.2% year-on-year and a continued increase of 14.4% month-on-month, reaching a new high. The production volume of ternary batteries was 16.6 GWh, accounting for 35.1% of total production, with a year-on-year growth of 107.7% and a month-on-month decline of 9.4%; the production volume of lithium iron phosphate batteries was 30.6 GWh, accounting for 64.8% of total production, with a year-on-year growth of 228% and a month-on-month growth of 33.5%. In terms of demand, the advantages of lithium iron phosphate over ternary batteries are very clear. -

Shipment Volume Breakdown:

The total shipment volume was 24.2 GWh, with a year-on-year growth of 114.2% and a month-on-month decline of 10.5%. The shipment volume of ternary batteries was 9.8 GWh, accounting for 40.7% of total shipment volume, with a year-on-year growth of 80.4% and a month-on-month decline of 15.0%; the shipment volume of lithium iron phosphate batteries was 14.3 GWh, accounting for 59.3% of total shipment volume, with a year-on-year growth of 147.2% and a month-on-month decline of 7.0%. -

Export Volume:

The total export volume was 2.0 GWh, with the export volume of ternary batteries being 0.5 GWh, accounting for 25.6% of total export volume; the export volume of lithium iron phosphate batteries was 1.5 GWh, accounting for 73.6% of total export volume.

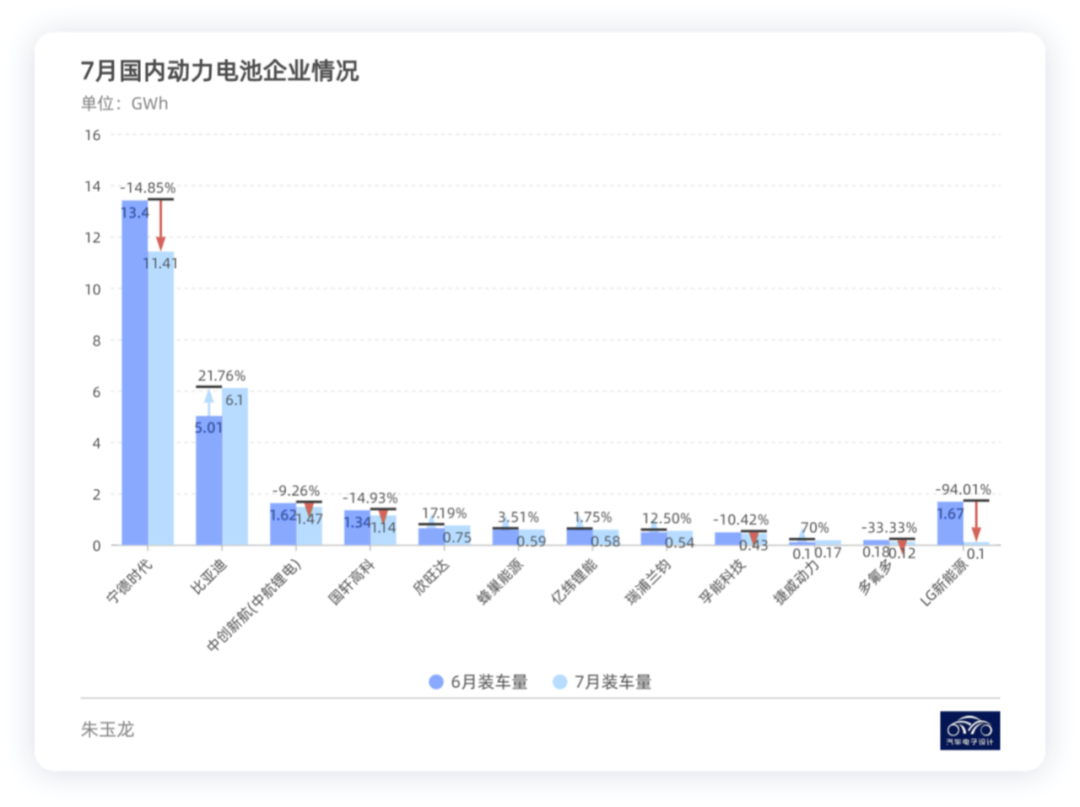

Manufacturers’ Status:

Everyone is interested in the situation in July, with the influence of Tesla:

-

CATL’s production was 11.4 GWh, a decrease of 14.85% month-on-month from last month’s 13.4 GWh.

-

BYD’s production increased from 5 GWh last month to 6.1 GWh, up 21.76% month-on-month.

-

Due to the weakening demand of Tesla, LG Energy was no longer on the ranking list.

In the subsequent ranking, CATL relied on ternary batteries and Guoxuan High-Tech relied on lithium iron phosphate to achieve a shipment volume of over 1 GWh, while the demand for Xinwanda, EVE, Yiwei Lithium Energy and Lishen-Ruipulanjun was still good.

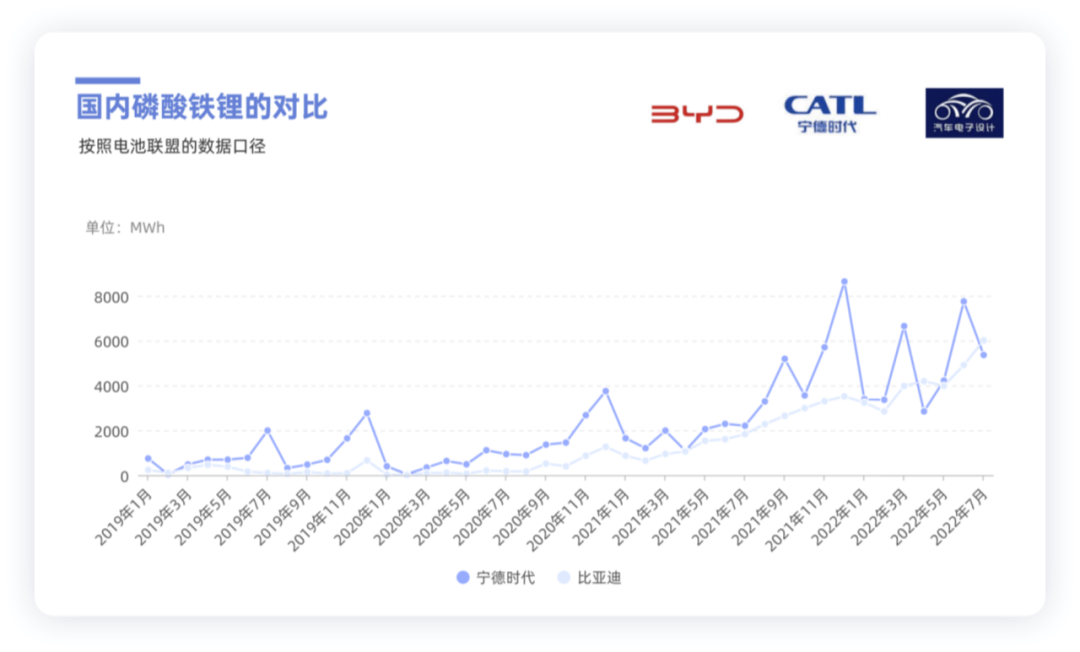

The most notable thing here is the sustained competition between BYD and CATL during the ternary era. After a previous overtake and nearness, they overtook each other again this month. At the end of the day, it is still the differences in their customer groups.

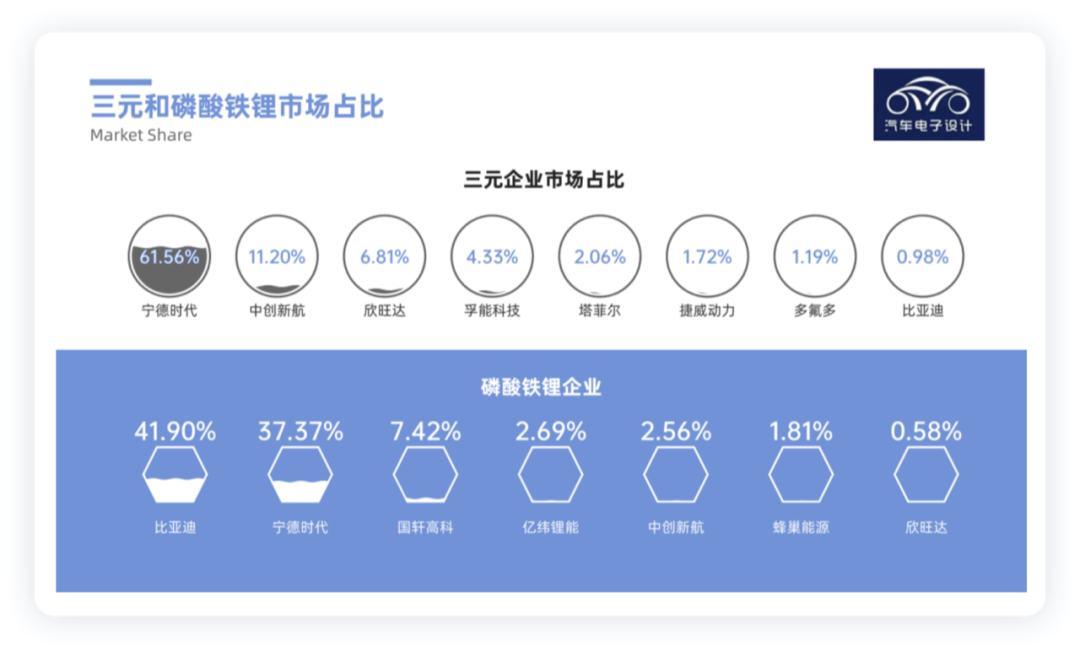

In July, 37 power battery companies in the new energy vehicle market achieved matching of installed battery packs, which is a decrease of 8 compared with the same period last year. The top 3, 5, and 10 power battery companies in terms of installed power battery capacity were 19.0GWh, 20.9GWh, and 23.2GWh, respectively, accounting for a total installation proportion of 78.5%, 86.3%, and 95.9%, respectively. From the current market situation:

-

Ternary batteries: CATL accounted for 61.56%, followed by CALB and EVE.

-

Lithium iron phosphate (LFP) batteries: BYD surpassed CATL, followed by Gotion High-Tech.

Technological Direction in China

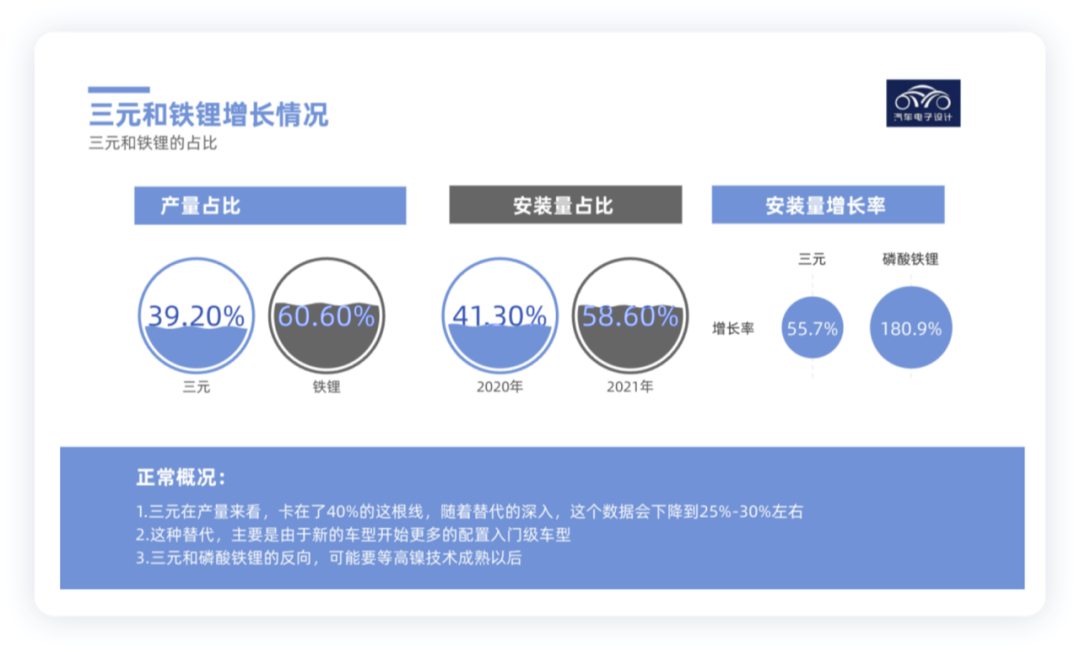

From January to July, the cumulative production of power batteries was 253.7GWh, and the cumulative production of ternary batteries was 99.5GWh, accounting for 39.2% of the total production and an accumulated year-on-year growth of 121.9%; the cumulative production of LFP batteries was 153.8GWh, accounting for 60.6% of the total production and an accumulated year-on-year growth of 227.1%.

From January to July, the cumulative installed capacity of power batteries in China was 134.3GWh, with an accumulated year-on-year growth of 110.6%. The cumulative installed capacity of ternary batteries was 55.4GWh, accounting for 41.3% of the total installed capacity, with an accumulated year-on-year growth of 55.7%. The cumulative installed capacity of LFP batteries was 78.7GWh, accounting for 58.6% of the total installed capacity, with an accumulated year-on-year growth of 180.9%.

Conclusion: With the long-term development of China’s power batteries, the data in July is just the beginning of the peak phase. According to the expectations of various automakers, the delivery and production peak may come around October.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.