Author: Zhu Yulong

After obtaining preliminary insurance data, let’s take a look at the situation in July.

Under strong stimulus, the total consumption of cars in July tended to be stable. From the rhythm perspective, the impact of the epidemic on car purchases in April made it the seasonal trough of this year. Climbing up from this low point, sales reached a small peak (1.932 million) last month, and thereafter, the total amount of car retail in July remained relatively stable— with a total insurance data of 1.79 million. A reasonable explanation is that in the orderly production of auto chips, the low point of April-May happened to be preparing for the off-season production in July-August.

Here are a few things to note:

-

Volume or profit? There have been differences in choices between companies such as Tesla and Great Wall, and BYD and Changan. The conversion of the second-tier new energy models and the increase in vehicle prices is also to ensure reasonable gross profit. The scene is like boiling oil on fire, with a riot of colors and brilliance.

-

According to the Deputy Secretary-General of China Association of Automobile Manufacturers, Chen Shihua, the profit of China’s auto industry in the first half of this year dropped by 25.5% year-on-year, while the revenue only dropped by 4% during the same period, which is very unhealthy. Especially in the field of new energy vehicles, the profits of upstream enterprises have skyrocketed, but downstream enterprises “can’t even get a sip of soup”.

-

And in the current situation, under the conditions of strong national stimulus, the most difficult thing to judge is the sustainability of subsequent car consumption. That is to say, the demand in July-August is to make up for the previous 4-5 months, and how much effect the current 5% purchase tax reduction and local car purchase efforts will have can only be determined in the latter half of August.

I personally think that car consumption is closely related to the macro level— what can consumers do with a car is actually very important to consider. With the change of young people’s concepts, we really need to think about this.

Note: Even in this high-temperature environment, Tesla is preparing to increase production capacity in the future.

Overview of Insurance Data

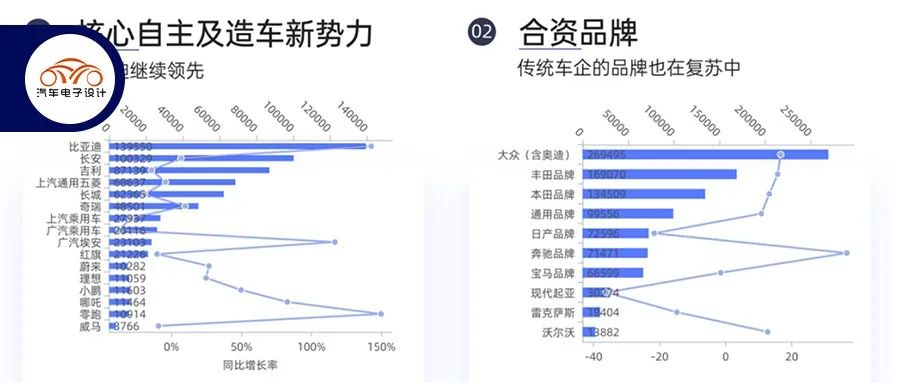

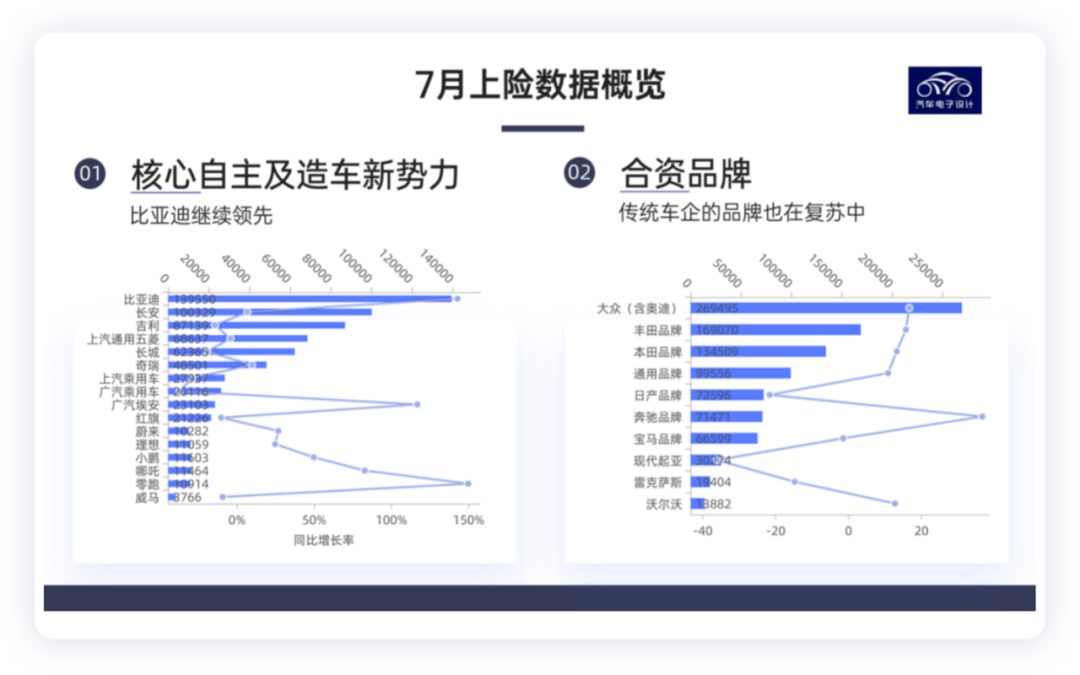

Figure 2 shows the data of independent and traditional car companies on the left and right sides, respectively.

Currently, BYD is approaching 140,000, which is quite competitive among all independent brands, second only to Toyota, and even greater than the total volume of Honda brand. The value of the brand is related to the overall market size and the price of single vehicles. Whether or not to pursue profit is actually a current choice. After the scale effect comes into play, there may be surprises.

Independent BrandsBYD is nearly 140,000, Changan is 100,000, Geely is 87,000, Wuling is 68,000, and Great Wall is 62,000. The entire independent brand fully reflects the changes in the reshaping of the new energy vehicle pattern.

Joint venture brands

Under Volkswagen, the total sales are nearly 270,000, while Toyota is 169,000 and Honda is 134,500, which are relatively strong brands. The luxury brands Mercedes-Benz and BMW are still recovering in July.

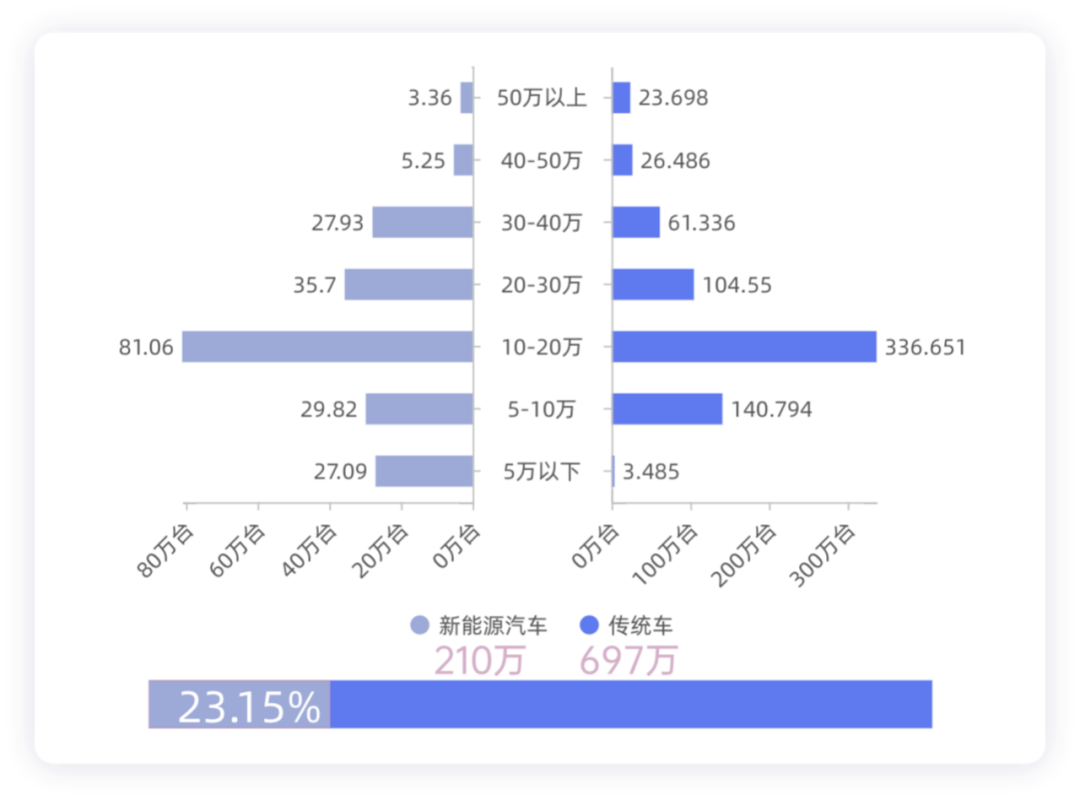

Looking at the overall data of the insured cars in the first half of 2022, new energy vehicles have made effective breakthroughs in models above 200,000 yuan, but the overall demand is still in the range of 100,000-200,000 yuan. Under the current status of battery prices, PHEV and EREV are better, and the survival status of pure electric vehicles is indeed mediocre.

Overview of main companies

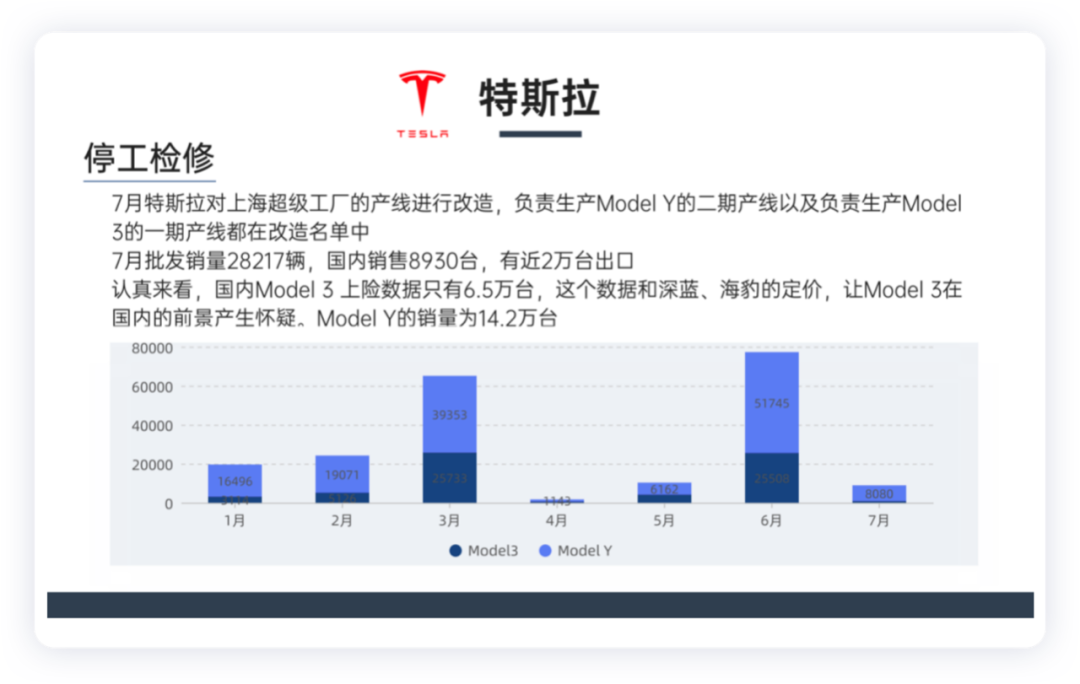

In July, Tesla transformed the production lines of Shanghai Super Factory—the Phase 2 production line responsible for producing Model Y and the Phase 1 production line responsible for producing Model 3 were both on the list of renovations. The wholesale sales in July were 28,217, with 8,930 sold domestically and nearly 20,000 exported. Looking closely at the data, the number of insured Model 3 vehicles in China is only 65,000. Compared with the pricing of Shenzhen and Hai Phong, this insured data causes doubt about the prospects of Model 3 in China. In comparison, the sales volume of Model Y is 142,000.

Of course, I think Model Y has indeed cut off some of the orders of Model 3. Given the current price and configuration of Model 3, it is not easy to return to last year’s status. Currently, it is only at the level of less than 10,000 units per month.

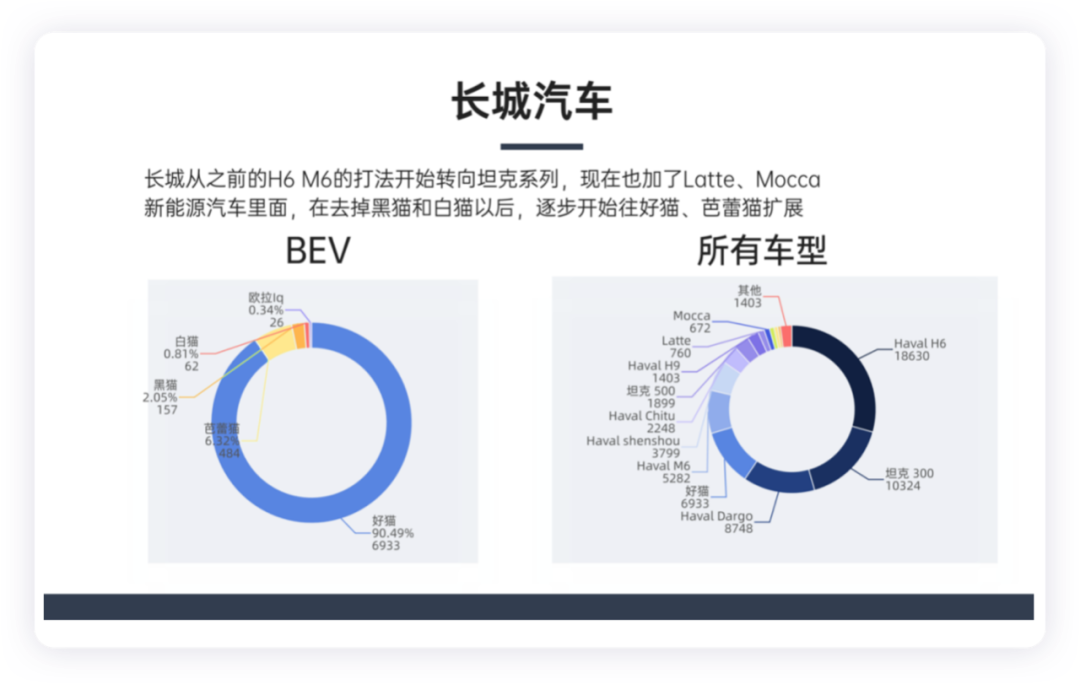

The situation of Great Wall is also similar, and the strategy around SUVs has been restricted under high oil prices. Currently, in the strategy of fuel vehicles, Great Wall has shifted from the H6 M6 strategy to the tank series, and now it has added the Latte and Mocca to realize the hybrid strategy. In the field of new energy vehicles, after removing the Black Cat and White Cat, they are gradually expanding towards Good Cat and Ballet Cat.

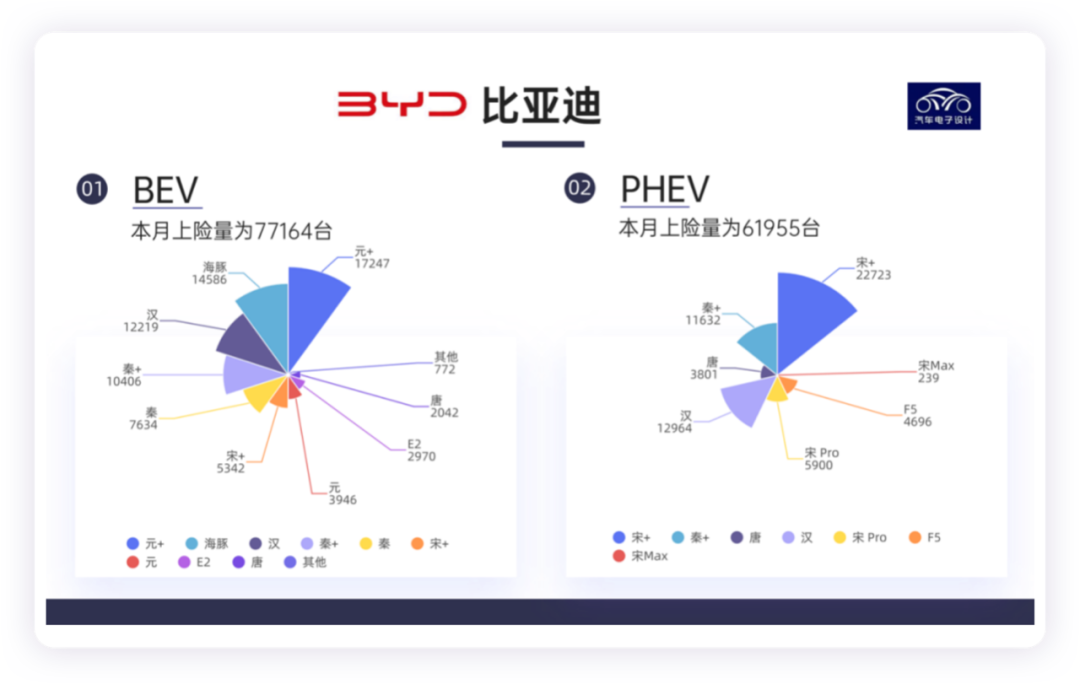

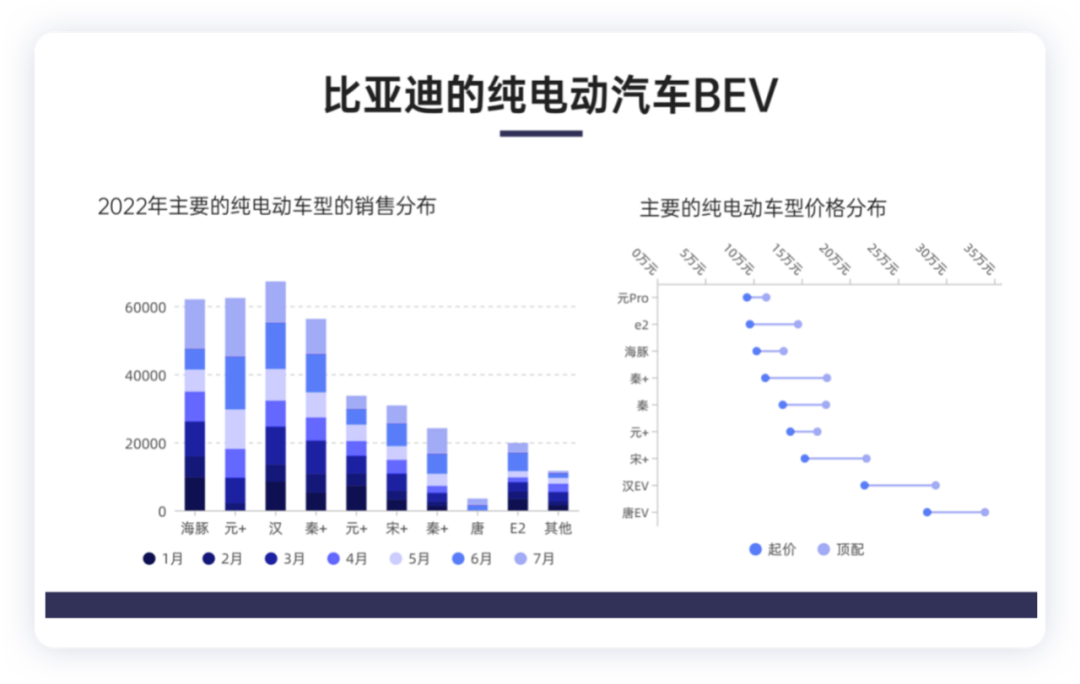

In July, BYD’s pure electric vehicle sales reached 77,100 units, and plug-in hybrid electric vehicles approached 62,000 units. In terms of vehicle models, mainly around the Yuan +, Dolphin and Qin + Song DM-i and other models. To some extent, this is influenced by Tang’s products.

Within pure electric vehicles, I also did some sorting: Tang EV is gradually selling, and it is difficult in this price range. At present, Han EV is still the main model, and the overall sales of high-volume models such as the Dolphin, Yuan Pro+Plus, and Qin Plus are still below CNY 150,000.

Summary: The data for July is undoubtedly affected by the weather, and there are many variables disturbing this. We hope that the economy can be more stable and that automobile consumption can stabilize.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.