Patent Analysis

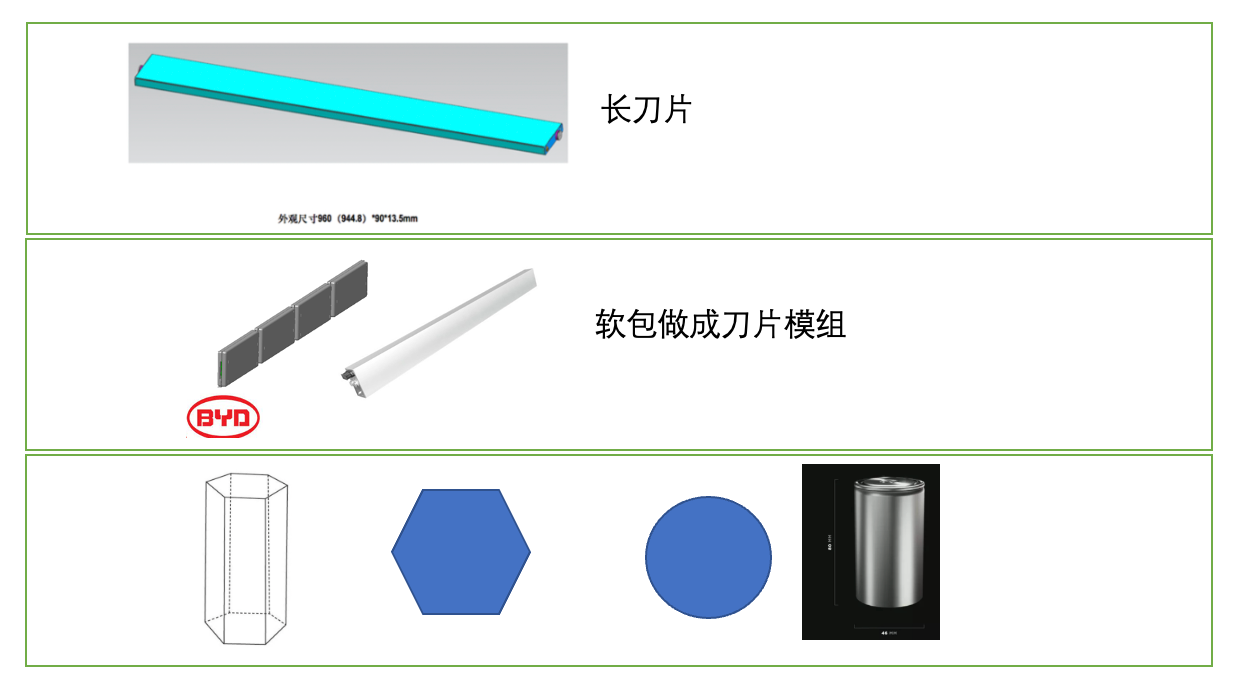

Recently, the patent application of a very special hexagonal prism battery cell attracted attention in the industry, submitted by BYD.

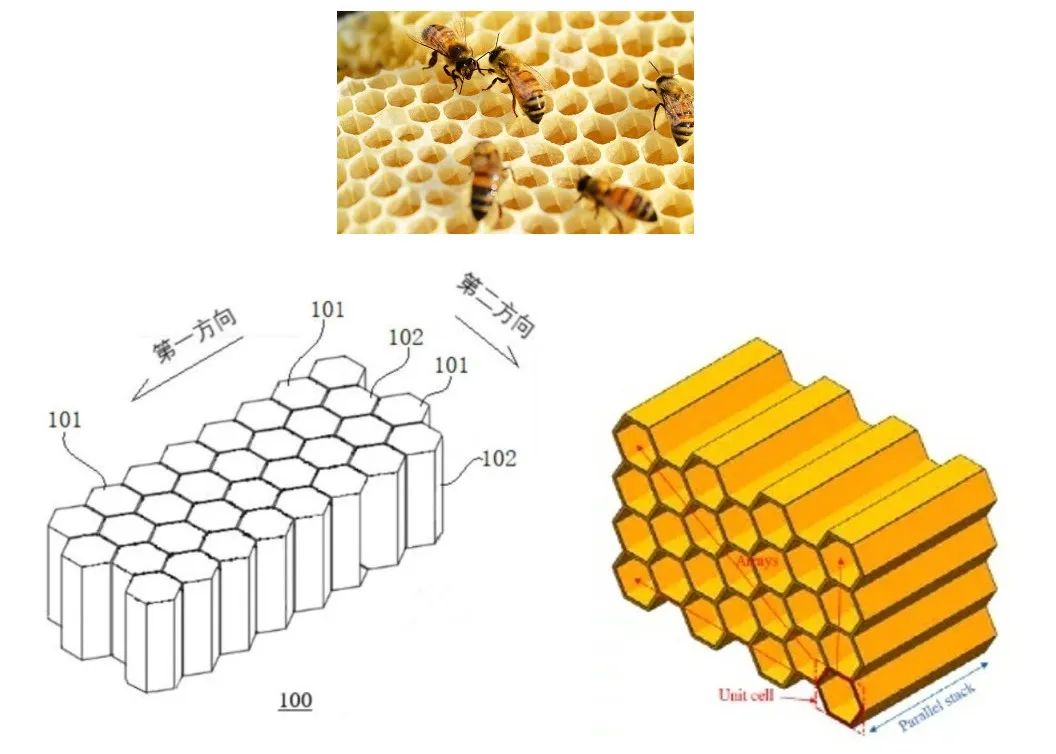

This is a utility model patent for “battery and battery module, battery pack”, which proposes a hexagonal prism-shaped battery cell inspired by the honeycomb structure.

This patent may be an interesting idea, my personal judgement is that the hexagonal prism shape is likely the “stack path” that BYD has taken, but “Chencang” is still a big cylinder.

In this patent, the battery pack is composed of several positive prism-shaped battery cells, each consisting of a shell and a cover. The overall effect of the design is indeed similar to the honeycomb structure, with one end of the shell open and the cover equipped with negative and multiple positive pole terminals. From this design feature, it does resemble a honeycomb, and the design idea is:

1) To increase the capacity of the pole core by improving the space utilization rate, the shell can accommodate more electrolyte to prolong the service life of the pole core, thereby extending the service life of the battery;

2) When connecting multiple batteries into a battery module, the external space utilization rate is effectively improved, avoiding battery short-circuit or open-circuit;

3) The battery can meet the layout requirements of various sizes of battery modules to make the battery module applicable to various environments.

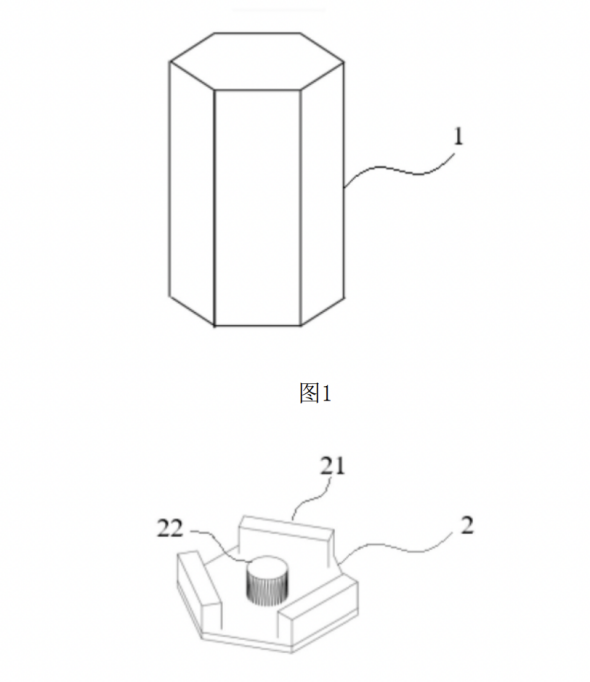

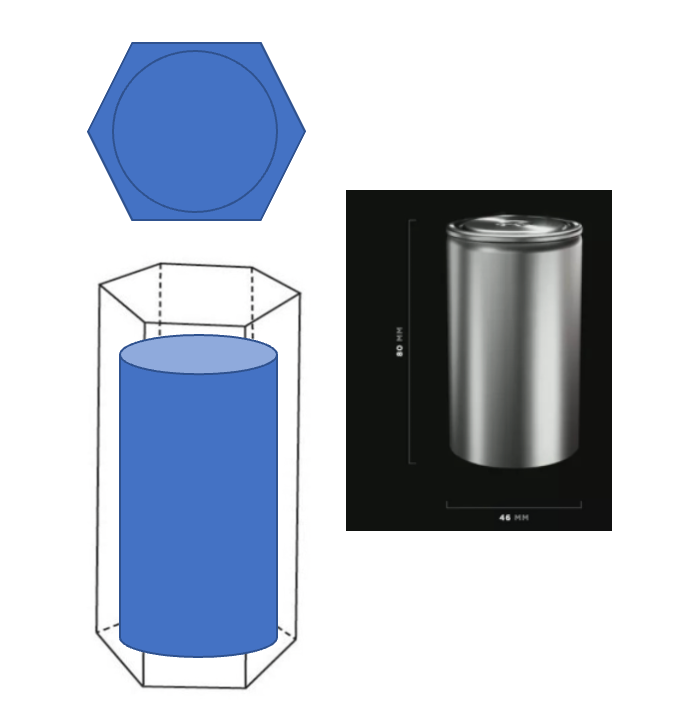

In the figure below, the cover is equipped with multiple positive pole terminals (the surrounding 3 protruding rectangles are positive terminals), the center cylinder is negative, and the shape of the battery cell shell is a regular hexagonal prism, made of aluminum alloy.

Patent Description: One end of the shell 1 is open, the shape of the shell 1 is a regular polygonal prism, the cover 2 is provided on the above-mentioned end of the shell 1, and the cover 2 and the shell 1 jointly define a accommodating space. The cover 2 is equipped with a negative pole terminal 22 and multiple positive pole terminals 21, and the multiple positive pole terminals 21 are spaced at intervals along the circumference of the cover 2. The pole core is disposed in the accommodating space.

The pole core is a cylindrical winding pole core located in the space of this regular hexagonal prism. The height of the shell is between 60~150mm, and the diameter of the inner circle of the shell is between 15~60mm. The corresponding Tesla 4680 has a height of 80mm and an inner diameter of 46mm, which falls within this range. The shell of this battery cell borrows from the structural design of a honeycomb. The hexagonal prism structure can improve the utilization rate of the entire space, while utilizing the shell structure to enhance the structural strength of the entire battery.My understanding is that BYD is still focusing on the previous idea of reforming the shell of the large cylindrical battery. Due to the limitation of the shape of the cylindrical individual battery, when a large number of cylindrical individual batteries are combined together, the space between adjacent cylindrical individual batteries is large, which causes the mechanical stability of the cylindrical battery group to be insufficient. When subjected to external vibration or impact, short circuit or open circuit is prone to occur, which will to some extent affect the working state and safety of the cylindrical battery group.

Through this structure, the cell can be coupled to a certain extent, and the shell can actually hold more electrolyte. This structure can also be used together with adhesive, making the mechanical stability of the entire battery stronger. The manufacture of the entire cell is still similar to that of cylindrical batteries.

New patents or implicit understanding about BYD’s high-nickel direction

The hot sales of BYD’s new energy vehicles are closely related to its strategy of adopting lithium iron phosphate battery first. Since September 2021, the use of lithium iron phosphate batteries has surpassed ternary batteries in China, and the use of lithium iron phosphate batteries outside China is gradually increasing. This is because the expiration of patents around 2022-2023 has opened up the use limit outside of China. The proportion of lithium iron phosphate batteries will increase rapidly. Due to the low energy density of lithium iron phosphate, it is mainly deployed in the field of small and medium-sized electric vehicles.

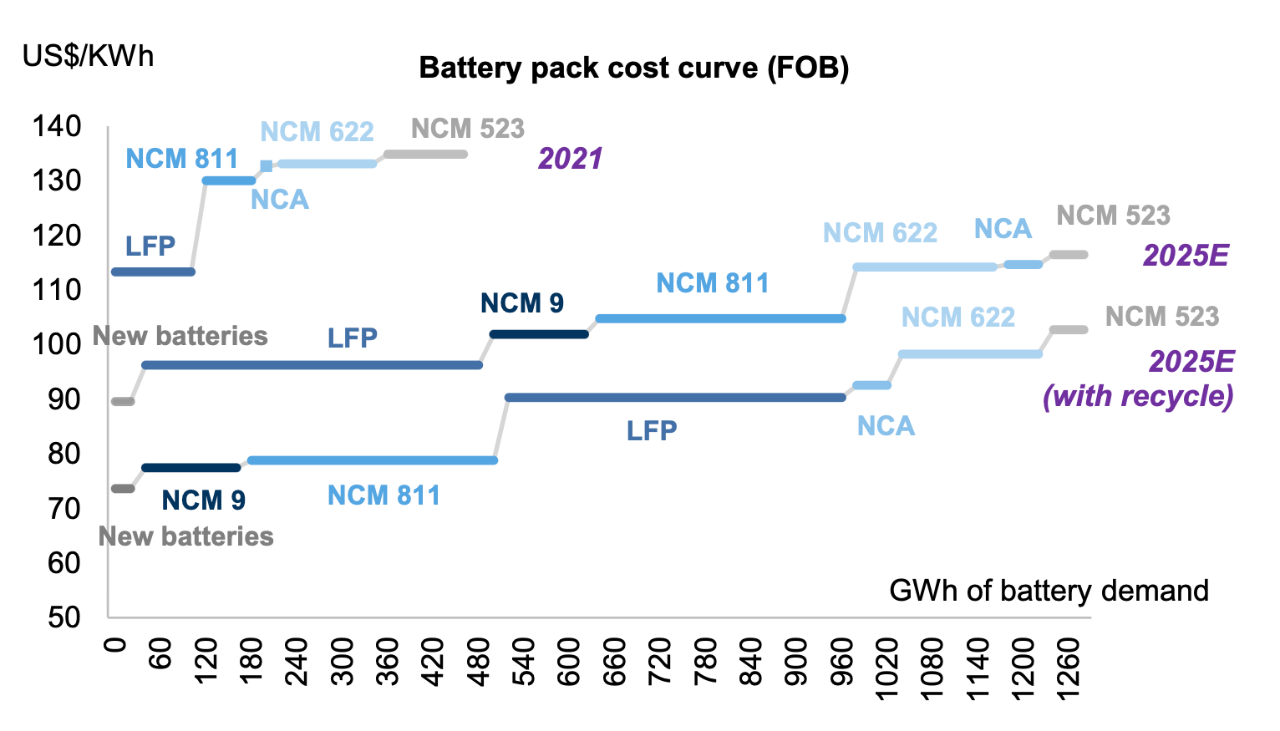

According to calculations, lithium iron phosphate batteries are 10-20% cheaper than ternary batteries in 2021. With China gradually canceling subsidies for electric vehicles, the cost advantage of lithium iron phosphate will become more prominent after 2022.

However, the market share of lithium iron phosphate is likely to begin to decline after 2030 due to the growth of the battery recycling market. The recycling value of lithium iron phosphate batteries is significantly lower than that of ternary batteries, which makes enterprises less willing to recycle them, and will lead to a decrease in the overall market supply. The market will be replaced by other new batteries represented by NCM811/Ni90 ternary batteries.

Regarding the development direction of high-performance batteries, BYD has not delved too much. In the current blade battery technology, there are some challenges in the process of cell grouping with high-nickel ternary batteries. Therefore, BYD has provided us with a new idea around the large cylindrical direction, and I think this method may not necessarily be a real thing, but it is possible to enter the field of large cylindrical batteries and produce 46 series batteries later.

BYD’s supply scale to Tesla can be expectedA few points can be seen regarding BYD Group’s relationship with Tesla:

1) BYD subsidiary, Fudi Battery, is indeed involved in project development and supply, including custom-made batteries such as the C112F model.

2) Tesla has not yet officially announced the use of BYD’s batteries.

Therefore, it seems that Tesla’s core logic in battery supply is to find multiple suppliers. From initially partnering with Panasonic, to importing LG batteries in the Chinese market, to later using CATL’s LFP batteries, the idea is to ensure low cost and safety. This is similar to BYD’s upcoming large-scale adoption of blade batteries, which provide low cost and safety benefits.

Currently, CATL holds a high proportion of Tesla’s market in China due to the pricing and competitiveness issues of LG batteries. In 2020, CATL supplied Tesla with 2GWh of batteries, which increased to 14GWh in 2021, and is estimated to be around 5.9GWh in the first five months of 2022. Tesla delivered 484,000 new vehicles in 2021, of which 321,000 were sold domestically in China, while the remaining 163,000 were mainly exported to Japan and Europe.

Given these estimates, BYD may produce a significant amount of batteries for Tesla in China to meet demand in the European market until Tesla’s Berlin factory produces its 4680 batteries.

In summary: The limited information available suggests that BYD and Tesla have yet to form an official partnership, but based on patent information and overall design strategies, BYD may have a role to play as a battery supplier.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.