Author | Wang Yunpeng

In the past 100 years, every technological evolution in the automobile industry has accompanied the reshaping of the industry, from the structure of the industrial chain to enterprise positioning, and from the structure of sales to brand reconstruction. Some enterprises lead the way in the new race, while others get lost in it.

If we shorten the time frame to the last 10 years, the three words “new energy” have made the restructuring of the automotive industry even more intense. This is particularly evident in the Chinese market, which is regarded as a global cutting-edge position in the automotive industry. Therefore, including traditional car manufacturers, new forces, and new new forces, brands are all striving to get a share of it.

So, in this round of restructuring of the new energy vehicle industry, which is the most representative brand in the Chinese automobile market? The answer is undoubtedly BYD.

Fourteen years ago, BYD launched plug-in hybrid models, firing the first shot of the industry revolution. And today, 14 years later, BYD has become an important force in driving the electrification of the Chinese automobile industry.

Sales are the best proof of this. On August 3rd, BYD released its latest production and sales report, showing that the company’s cumulative sales had exceeded 800,000 vehicles from January to July this year, with sales in July of 162,530 vehicles, a year-on-year increase of 183.1%.

In the current environment where the COVID-19 pandemic has affected the industry, the prices of components and raw materials have risen, the production of some suppliers is limited, logistics are hindered, and there are shortages of electronic components such as chips. Under these difficult conditions, why can BYD achieve record sales?

Seizing the market high ground

From the perspective of current technological development and development planning for the new energy vehicle industry, whoever can seize the market high ground of hybrid and pure electric vehicles will become the leader of the next generation automotive industry for the next 10 to 20 years.

In China, the global cutting-edge position in the automotive industry, who has caught the direction of future change in the automotive industry and seized the market high ground?

Market feedback can give the most realistic answer. Since announcing a halt to the production of gasoline cars in March this year, BYD has thoroughly implemented its DM and EV pure electric “two legs, both walking” strategy and achieved impressive results. Taking sales in July as an example, the sales of BYD’s plug-in hybrid models and pure electric models were roughly equal, with 81,223 units and 80,991 units sold, respectively, accounting for 49.97% and 49.83% of the total sales of new energy passenger cars in the group.## Vehicle Sales of BYD in July

In terms of specific vehicle models, the flagship sedan of BYD, the Han, achieved a sales volume of 25,849 units in July, once again refreshing its best record since its launch, and becoming the leader in the high-end sedan market of Chinese domestic brands. Furthermore, benefiting from technologies such as DM-i super hybrid system, the Song family achieved a sales volume of 38,697 units in July, while the Qin family reached 34,114 units, with a year-on-year growth of 104.2%.

Turning to the car models under the Marine Network, currently there are two models for sale, the Destroyer 05 and the Dolphin. Among them, as the first car model of the BYD e-platform 3.0, the Dolphin has been receiving much attention since its launch due to its advantages in “new design,” “new technology effects,” “new experiences,” and “new smart connections.” In July, the car delivered a sales volume of 21,005 units, with a month-on-month growth rate of 102.4%.

It is worth mentioning that with the intensive release and launch of new cars such as the Sea Lion, Sea Gull, the Destroyer 07, the Frigate 05/07, which are based on DM-i, e-platform 3.0, and DM-p platform respectively, BYD will form an increasingly complete range of new energy vehicles, covering all product categories from sedans to SUVs, from A-class to C-class, from entry-level to luxury. And this will continue to drive BYD’s sales comprehensively upward.

Special Features of BYD

Since the birth of automobiles over 100 years ago, the automobile industry has been constantly advancing, and global automotive enterprises have experienced ups and downs. Looking back at each industry reshaping, the process follows the same logic, that is, from industry innovation to industry transformation, from corporate transformation to value re-creation, and ultimately completing the reshaping of industry structure.

Fast forwarding to 2022, with the impact of the epidemic, rising prices of parts and raw materials, manufacturing restrictions caused by supply chain disruptions, and shortage of components such as chips…it’s needless to say how many challenges and difficulties the automotive industry is facing.

However, on the other side of the challenge lies the opportunity, and the cliff edge may also be another opportunity. Focusing on China’s automotive industry and market, a new pattern has quietly formed.

This point can still be seen from BYD. In the first half of this year, while most domestic automakers were suffering from the problem of disrupted parts supply, BYD achieved sales of over 100,000 units for five consecutive months, demonstrating its strength in adaptability and self-sufficiency.BYD is so different from other auto companies for reasons that can be traced back to its supply chain, technology, and brand.

Firstly, BYD has established a comprehensive supply chain system which has helped to maintain its leading position in the new energy vehicle industry, amid the uncertainties of supply chain pressure, skyrocketing prices of key raw materials, and resurgences of COVID-19.

Furthermore, with a vertical supply chain system led by Fudi and BYD Semiconductor, BYD has achieved self-sufficiency in the production of core components such as power assembly, battery, chassis, interior and exterior decorations, making it one of the deepest layout new energy vehicle companies in the upstream supply chain domain, not just in China, but globally.

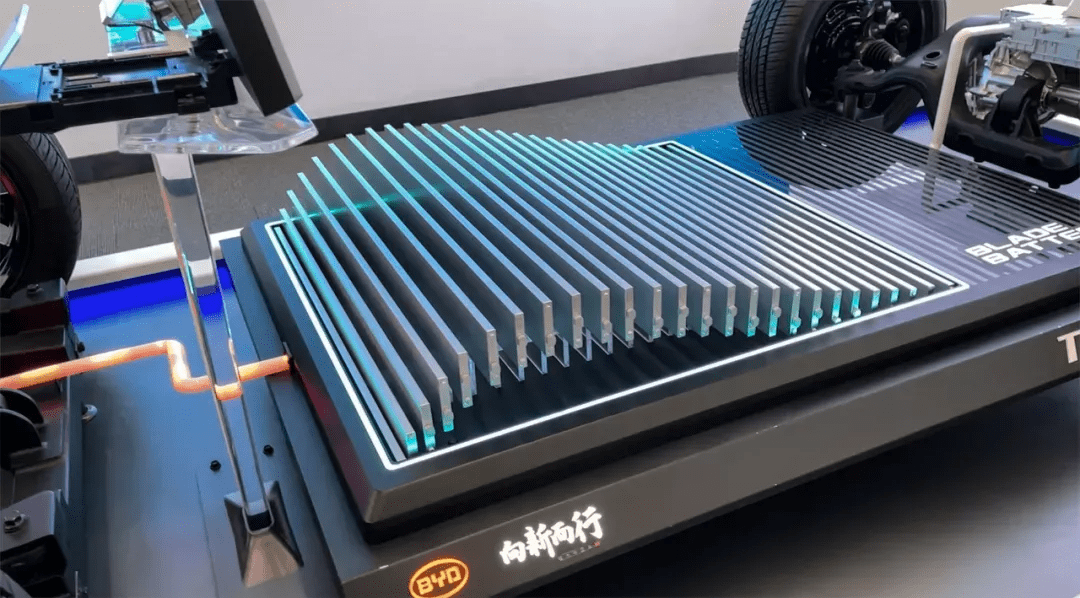

Secondly, as the American scientist Roy Amara once pointed out: “People tend to overestimate the short-term impacts of new technology but underestimate its long-term effects.” The key technologies in BYD’s “technology pool”, including blade batteries, EHS,1.5L/1.5T plug-in hybrid special high-efficiency engine, DM-i/p, and e-platform 3.0, have been underestimated by people but have the potential to create long-term impact.

Among them, DM-i super hybrid technology allows BYD to bridge the gap between the price and performance of plug-in hybrid models and gasoline vehicles. E-platform 3.0 covers all vehicle models from A to D-class, supporting three power forms- front-wheel drive, rear-wheel drive, and four-wheel drive. This technology can help further modularize and streamline BYD’s electric vehicle models.

As of 2022, BYD’s “technology pool” is continuously expanding. According to public information, BYD currently has over 40,000 R&D personnel, leading the domestic auto enterprise; its authorized patents are about 24,000, which is eight times the average value of China’s Top 500. In the first half of the year, BYD had introduced the CTB battery-integrated vehicle technology and iTAC intelligent torque control system, which promoted the upgrade of technology in both hardware and software.

Lastly, BYD has been actively building its brand through innovations. With “Blade Battery” and “DM-i Super Hybrid” technology, they have positioned themselves as leaders in the new energy vehicle industry. Furthermore, BYD was one of the first Chinese brands that has been able to gain recognition by international customers for its quality products.

Some say that BYD is the Toyota of China, and some say it’s the Tesla of China. But in my opinion, neither of these descriptions is accurate, because BYD has both Toyota’s stability and innovation, as well as Tesla’s advantage in all-round independent research and development and benchmarking the times.

It is worth mentioning that these are exactly the unique features of BYD as a typical representative of China’s upward automotive brands.

Aiming for Higher Sales Targets

At present, China has become the world’s leading market for electric vehicles, and it is also the “must-win battlefield” for all carmakers.

According to the China Passenger Car Association, the cumulative sales of new energy vehicles in China this year are expected to exceed 6 million units, with a market penetration rate of about 22%. For BYD, standing on the increasingly promising wind, it needs to ride the wind and challenge higher goals.

It is worth mentioning that BYD has a clear understanding of this. In the previous investor conference minutes, BYD stated that the conservative sales target for 2022 is expected to be 1.5 million units.

Now, 7 months have passed and BYD is still less than 700,000 units away from the 1.5 million unit target, which means it needs to sell an average of 140,000 new cars per month for the rest of the year to achieve the sales target. So, can BYD achieve the above sales target in the remaining time of 2022?

In my opinion, the answer is yes. Based on the current information, BYD still holds very abundant “trump cards” in the second half of this year. Among them, the most eye-catching “card” is the Hanbao, a B-class pure electric sedan that has been prepared to challenge the Model 3 since its birth.

On July 29th, BYD Hanbao was officially launched, with a total of 4 models available, and an official guide price ranging from RMB 209,800 to 286,800. As the culmination of BYD’s e-platform 3.0 technology, Hanbao has many advanced technologies and innovative designs, and the longest range can reach 700 kilometers (CLTC). In terms of market attention, the car already had 60,000 orders when it was launched.

At the same time, similar players with known identities, such as Seagull and Destroyer 07, are also about to enter the game, further supplementing BYD’s product matrix.

In addition, for any brand, users are the foundation for upward development. In order to gain user recognition, in addition to striving for excellence in product development, a brand must also put in a lot of effort to build good user services.

In addition, for any brand, users are the foundation for upward development. In order to gain user recognition, in addition to striving for excellence in product development, a brand must also put in a lot of effort to build good user services.

BYD (Build Your Dreams), for one, has a clear understanding of this. Therefore, as early as 2006, BYD established the “Jing Cheng Service” service brand, always adhering to the brand mission of “providing worry-free guarantee for vehicles and better service experience for customers”. Currently, not only has it launched diversified, personalized, transparent, and cloud-based (such as Difen Hui mini-program, Jing Cheng Chang system) services, but also added value services such as worry-free roadside assistance, peace-of-mind accident services, free in-store charging, free routine maintenance, lifetime warranty of three-electric systems, and tire replacement services.

In other words, while continuously enriching and improving its products, BYD has also brought a more reassuring driving experience to users through its leading industry quality assurance policies, network layout, parts supply, and maintenance standards.

With the continual expansion of its product matrix, the constant optimization of user experience, and the sustained increase in the penetration rate of new energy vehicles… Under the aggregation of multiple benefits, BYD’s sales target for 2022 can surely be achieved.

Lastly

This is an era of constant change, but also an era full of endless opportunities. Changes make it difficult to accurately grasp the next trend, but new opportunities can always make well-prepared people seize them, contribute to the times, and lead other colleagues to advance. More specifically, in the new round of industrial revolution triggered by the dual-carbon goal, we need not only the breakers but also the leaders, and in the Chinese automotive industry, who is the leader is clearly written on the wall.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.