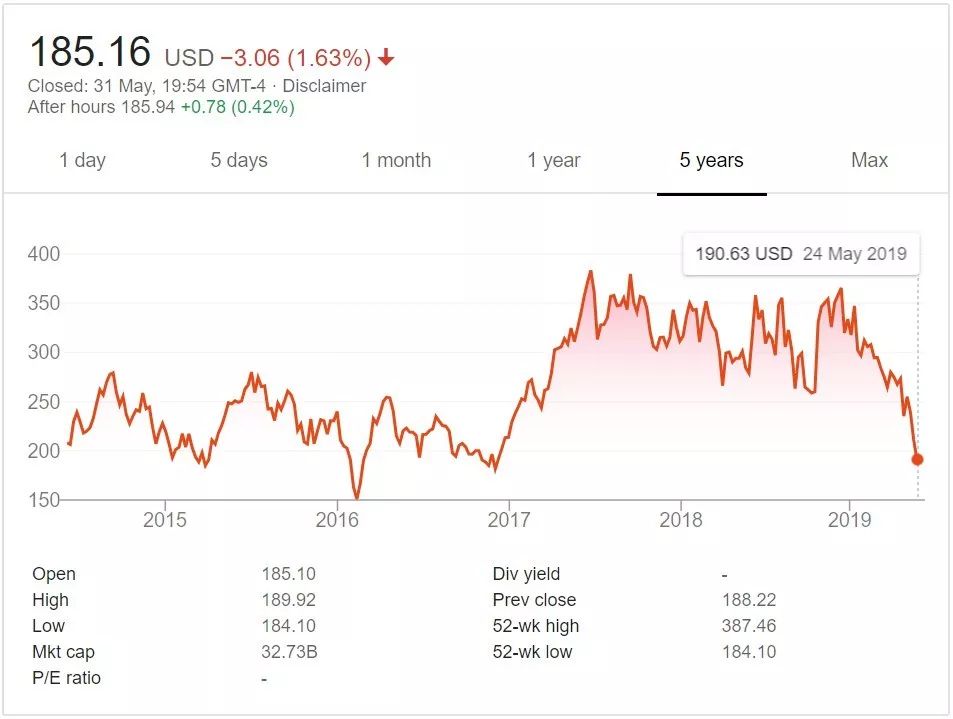

On November 14, 2018, Tesla’s stock price was $365; on May 30, 2019, Tesla’s stock price was $185, a decrease of 49.32% in six months, an authentic “halving”.

What happened to Tesla?

Demand Hell?

Who would buy a Tesla? The sustainability of demand for Tesla is an enduring topic of discussion.

On May 22, Business Insider published an article entitled “Tesla’s biggest bull turned bear explains the set of circumstances that were the ‘perfect storm’ for the change in view,” pointing directly at Morgan Stanley’s Tesla analyst Adam Jonas. In the first paragraph of the article, BI said:

No one can say that Adam Jonas has not been a true believer in Tesla. For years, the analyst has been one of the company’s biggest cheerleaders, an evangelist for its technology, and a supporter of Elon Musk’s vision for the auto industry.

There is no doubt that Adam Jonas is a loyal believer of Tesla. For years, Jonas has been one of Tesla’s most influential advocates, a preacher of Tesla’s technology, and a supporter of Elon Musk’s automotive vision.

What did Jonas say about Tesla’s bearishness in his phone call?

Today, supply exceeds demand, they’re burning cash, nobody cares about the Model Y, the company raised capital near lows, no strategic buy-in …“`markdown

Today, there is more supply than demand, Tesla is burning cash, no one is paying attention to Model Y, and Tesla is fundraising at a low point without strategic support…

Jonas concluded that Tesla’s Q2 sales were approximately 70,000, with annual sales expected to be around 250,000. Tesla is no longer a “high-growth” model, but a story of “credit crisis and restructuring”.

Analysts who are optimistic about Tesla in the long term believe that Tesla’s “supply exceeds demand” and that it is “no longer a ‘high-growth’ model”. The sustainability of Tesla’s market demand is becoming more and more noteworthy.

If you have been following Tesla for a long time, you will find that this issue has not become Tesla’s focus only recently. As early as the first quarter of 2019 financial report conference call, Tesla management, including Elon Musk, had multiple rounds of discussions with analysts about Tesla’s demand differences.

As many as nine questions in the financial report conference call questioned Tesla’s annual sales guidance of 360,000 to 400,000 vehicles as overly optimistic, while Elon and Tesla CFO Zachary Kirkhorn repeatedly emphasized that Tesla sees strong demand for Model S/X/3.

The Model 3 Standard Plus with standard autopilot is an incredible and eye-catching car. Many people are looking forward to the upgrade of Model S/X. Today’s upgraded Model S/X is a game-changer.

However, it must be admitted that Tesla did not provide specific data such as new orders to support the conflict between analysts and Tesla. In addition to Adam Jonas, analysts from Citigroup Itay Michaeli and Loup Ventures co-founder Gene Munster also questioned the sustainability of Tesla’s demand, and the world believes that Tesla has fallen into demand hell.

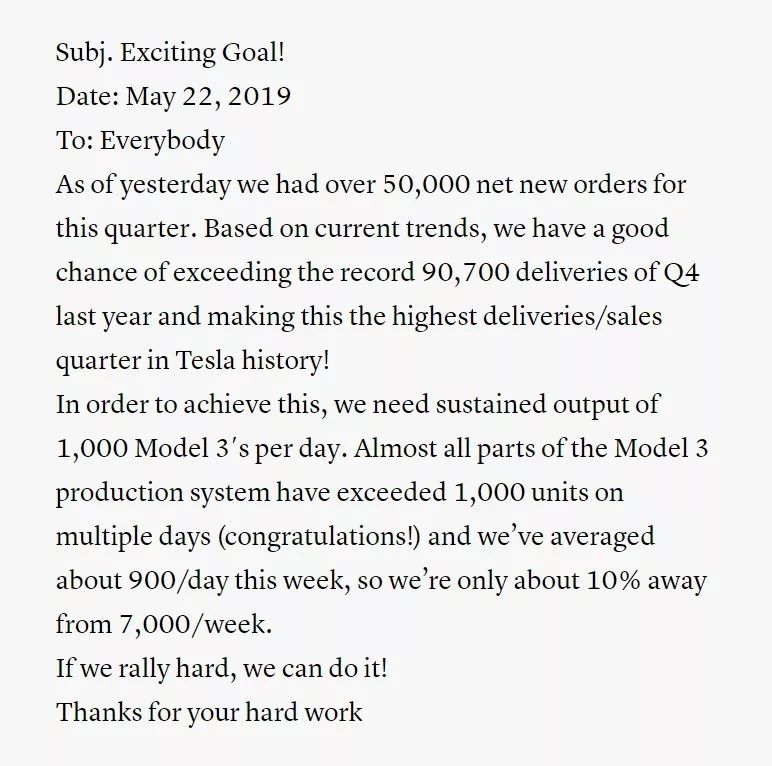

On May 22, the same day that many foreign media outlets, including BI, widely reported on Jonas questioning Tesla, Elon sent a company-wide email beginning to respond positively.

As of yesterday, we have added more than 50,000 new orders this quarter. Based on current trends, we are very likely to exceed the quarterly sales record of 90,700 vehicles set in Q4 last year, becoming the highest delivery/sales quarter in Tesla’s history!

“`To achieve this goal, the sustainable production capacity of Model 3 needs to reach 1,000 units per day, and almost all of the Model 3 production sub-systems have achieved continuous production capacity exceeding 1,000 units per day for several days in a row (Congratulations!). This week, we achieved an average of 900 units per day, so we are only 10% away from the goal of 7,000 units per week.

If we work hard enough, we will eventually achieve our goal.

Thank you for your hard work.

While Wall Street has widely questioned Tesla’s demand, Elon disclosed that he has received more than 50,000 orders. The timing is too coincidental, and Wall Street’s doubts about Tesla continue to be reflected in the stock price.

On May 29th, Elon sent another all-staff email, the theme still focusing on demand/sales/delivery.

Although our demand is strong, we need to deliver a large number of vehicles to achieve a successful quarterly sales volume.

Starting tomorrow, I will have regular communication with the delivery teams in the United States, Asia, and Europe every other day to understand how we can speed up our delivery speed.

We also need to reduce the total cost of delivering vehicles from Tesla factories to users. In the last quarter, many urgent fees and inefficient logistics resulted in higher-than-expected delivery costs. This makes it harder for Tesla to achieve financial balance.

As I mentioned in my last email, if we execute well, Q2 will set the best car delivery records in Tesla’s history and achieve great victories!

Super excited to achieve our goals with you all!

Orders, production capacity, and delivery. The email has been written in such detail, it’s time to take a look at the actual level of demand for Tesla and see how far Q2 is from “Tesla’s highest delivery/sales quarter” yet.

Let’s compare the new orders in Q4 2018, Q1 2019, and this quarter. Here, let’s assume that as early as Q3 2018, Tesla had already digested all the backlogged orders for Model 3, and the sales volume of Q4 2018 to the present has been driven by new order demand. This is a harsh enough assumption.

Let’s first compare the daily new orders in Q1. Assuming that Tesla’s total sales volume of 63,000 units in Q1 all came from new orders, what was the total number of orders in Q1?As of the end of Q4 2018, Tesla had 2,907 vehicles in transit, which were included in the Q1 total sales of 63,000. By the end of Q1 2019, Tesla had 10,600 vehicles in transit, which were all new orders for Q1.

Therefore, the total order volume for Q1 is 70,693 vehicles, calculated as 63,000 + 10,600 – 2,907.

70,693/90 = 785 vehicles, which means that Tesla’s Q1 new order intake was 785 vehicles per day.

At the end of Q3 2018, Tesla had 11,824 vehicles in transit, and in Q4 they sold 90,700 vehicles, with 2,907 still in transit.

Using the same method, Tesla’s Q4 2018 new order intake was 889 vehicles per day.

So what about Q2 2019? According to Elon’s email, as of May 21, Tesla had added over 50,000 orders (rounded to 50,000). Therefore, Tesla’s Q2 new order intake is 980 vehicles per day.

Therefore, Tesla is currently experiencing its strongest demand quarter in history, and the questioning of “unsustainable demand” is becoming increasingly pale.

Of course, “questions” will continue to emerge endlessly. The simplest two questions are: what if there is a sharp drop in orders after May 21, only halfway through the quarter? Even if demand remains stable in Q2, what if it sharply drops in Q3?

These questions have been with Tesla since the delivery of the Model S in June 2012. Now, let’s take a look at how Tesla is addressing these questions.

On May 31, Tesla announced on Twitter that the Model 3 is now available in all right-hand drive regions including Australia, Hong Kong, Japan, New Zealand, Ireland, and Macau, which is a new wave of demand release.

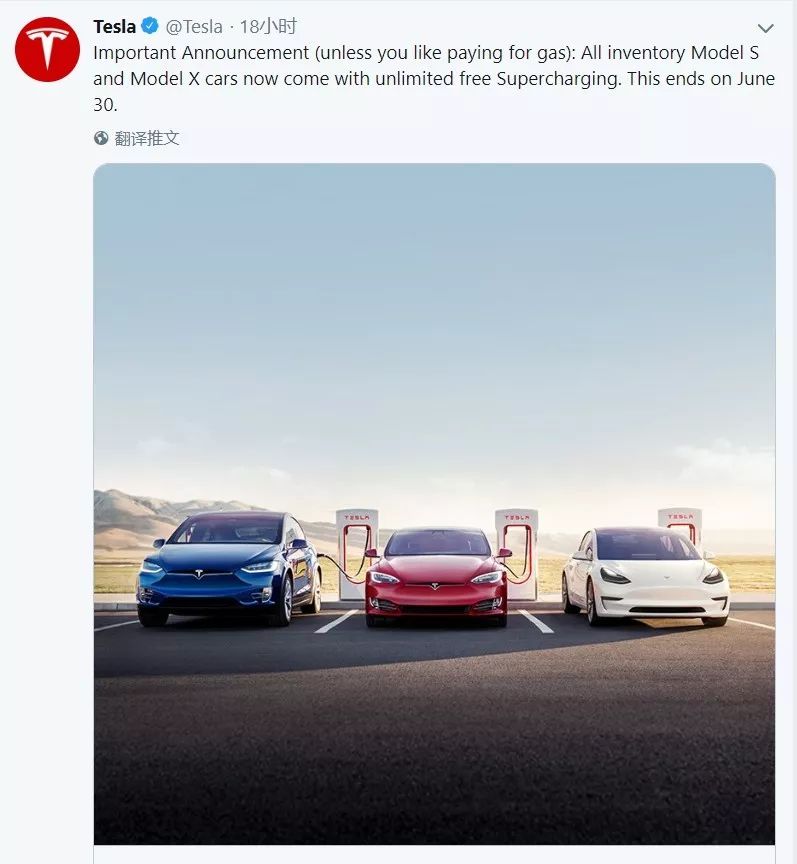

There is also a detail worth noting: the interior of the Model 3 is symmetrical and the left and right interior are completely symmetrical after the removal of the steering wheel. Compared with the interior theme of driver orientation, the symmetrical interior will significantly reduce the cost of research, development, and production for left-hand drive and right-hand drive models, including time and team costs.Just 18 hours ago, Tesla tweeted again: Important Announcement (Unless you like paying for gas): All existing Model S/X cars now support permanent free supercharging, ending on June 30th.

At the same time, Tesla China’s WeChat update announced: Choose the financing plan to purchase the imported Model 3 Long Range Rear Wheel Drive / Dual Motor / Performance and enjoy 3 years of 0 interest.

In fact, Tesla has adjusted its sales strategy numerous times this year to stimulate sales.

On March 1st, Tesla simultaneously adjusted the Model 3 China price, Autopilot pricing, sales and service policies. After that, Tesla has made several regional adjustments to various sales strategies.

The Supercharging network, Autopilot, financing plans, high gross margin support for price reductions, and even layoffs in the face of predictable demand downturns. Tesla has too many ways to reduce costs and stimulate demand. By insisting on direct sales, Tesla can directly control global online and offline sales organizations and support updates to meet the needs of performance growth.

Similar adjustments have been repeated over the past few years. We have to admit that the Tesla sales team has the strongest organizational resilience in the entire industry. For Tesla, “demand downturn” is unsustainable.

The true redesign of Model S

As mentioned earlier, “doubts” can also bring new things. For example, the sustainability of a company that has been unable to profitability for more than a decade is questionable.

In 2018, Tesla successfully stopped loss-making under the premise of no new production lines. However, in 2019, Tesla returned to a loss. If Q1 had a reason, on March 1st, the convertible bond of up to 920 million US dollars and a one-time fee of 188 million US dollars for “restructuring and inventory price changes” dragged Tesla into a loss abyss.

The loss in Q2 is completely illogical: according to the financial report, Tesla will not establish a new Model 3 production line (** relying on existing production lines, Model 3 production capacity has increased from less than 4,000 vehicles/week in Q2 last year to the current nearly 7,000 vehicles/week**), and the initial investment of 35 GWh/year production capacity in Giga 1 has been completed in Q4 last year.

The Shanghai Giga 3 factory, the only major investment project, was supported by a $500 million loan from Bank of China.

So where did the money go?

On May 29th, CNBC’s report connected all the clues.

CNBC learned from several current and former Tesla employees that Tesla is undergoing a major restructuring of its Fremont factory, the only factory currently producing Model S/X/3.

Tesla is designing and developing a new Model S, with core updates including Model 3-style minimalist interior design, longer-lasting battery packs and powertrains at the same level as the Model 3.

On May 19th, Elon replied to a comment from a netizen about a factory tour, revealing that some facilities at the factory were being upgraded. This is official evidence of the “major restructuring of the factory”.

Tesla is pushing for concurrent production of the Model S/X, freeing up space for the future Model Y assembly line. To that end, Tesla has slowed down Model S/X production, with workers only producing during the day and stopping production on weekends and at night.

Tesla’s goal is to start production of the new Model S in September of this year.

This is also supported by official information. At Tesla Q1’s earnings conference, Tesla CFO Zachary Kirkhorn previewed production adjustments for the Model S/X and even the factory’s restructuring plan:> Just on the production side of S and X. We did reduce production in Q1 as was noted. That was part of the retooling that we put in place to get the longer range vehicle out with the improved suspension. So just for the pervasive expectations, we will exit Q2 at a higher production rate than we did in Q1 on S and X and then return back to a more normal volume in Q3.

On the production side of Model S and Model X, we did reduce production in Q1 as previously noted. This was part of the retooling that we implemented to manufacture a longer range vehicle with improved suspension. For the general expectations, we will have a higher production rate for Model S and Model X at the end of Q2 than we did in Q1, and then we will return to a more normal volume in Q3.

The factory restructuring requires a large amount of additional investment, which explains why Tesla has continuously incurred losses for two quarters. Starting production and listing in September also coincides with the turning point of Q3 from loss to profit. Note that the “restructuring and inventory price change one-time charge” of $188 million was mentioned in Q1, which also refers to factory restructuring.

All details indicate that the launch of the new Model S has been set. The next question is, what features will the new Model S have?

First, as mentioned earlier, the battery pack will have a longer range. Model S can finally accommodate the 2170 battery with full power. CNBC revealed that one of the design goals of the new Model S is a range of 400 miles, with an EPA rating of 400 miles, meaning that there is no doubt that the NEDC rating will exceed 800 km.

How will such a long range be achieved?

Firstly, there is the new generation powertrain, which is as high as 93% in energy efficiency, just like that of Model 3. The new version of permanent magnet motor, silicon carbide electronic components, and optimization of bearings and wheels will make the new Model S the most advanced and efficient powertrain of Tesla.

The second point is simple but effective. The credit should go to the significantly large 2170 battery pack. However, the advantages brought by the battery pack are not limited to the longer range.According to the conversion of the parameters of the Model 3’s 80.5 kWh and 250 kW, the peak charging rate of the 2170 battery exceeds 3C. Assuming the new Model S battery pack has a capacity of 120 kWh, the peak supercharging power of the new Model S can be pushed to over 360 kW, and it can recharge 60 kWh of energy in just 10 minutes.

You may say that with the workmanship at the 200,000 CNY level, I’m not interested no matter how far it can go. On April 6th, Electrek also received news from an anonymous Tesla employee that Tesla’s core goal in the interior design is to “make the new interior more suitable for the era of autonomous driving”, and improving the craftsmanship of the interior is also a top priority.

According to Electrek’s report, Tesla has received feedback from the group of car owners and will make a series of improvements to the interior to catch up with the luxury car market competitors (BBA?), and differentiate it from the Model 3.

For example, better materials, softer and more comfortable seats, improved rear seat comfort and armrest box space layout, wireless charging, improved front storage compartments, etc.

Finally, CNBC and Electrek jointly mentioned the introduction of the Model 3’s family design language, including simplified steering wheel interaction logic and horizontal central control screen. And the crucial “kill the instrument panel”.

Now let’s summarize the features of the new Model S: all-new motor/control/battery and an all-new interior. With such significant updates, why is it called a “true redesign” rather than a “complete generational change”?

Internal documents show that Tesla defines this update as the third generation of the Model S, and through this update, the life cycle of Model S/X will be extended until 2021.

What about the Model X? Remember, it’s what Elon called the “most complex and difficult-to-make car in the world,” and its redesign is not that simple.

Tesla has made no comment on CNBC’s report on the Model S redesign. On February 6th of this year, Elon commented on the Model S redesign: “We do not have a plan to retrofit Model S/X with 2170 batteries and cannot comment on major product iterations. After all, the current Model S/X will continue to be sold.”

Therefore, while simultaneously promoting Semi Truck, pickup trucks, and Model Y, Elon is pushing for both the production capacity and sales records of Tesla, as well as the redesign of the Model S.In August 2016, the Model S P100D was officially launched, and 36 months later, the upgraded Model S is coming soon. The global intelligent electric vehicle market needs to answer one question: has the Model S P100D, which was discontinued three years ago, met a decent rival?

Tesla will eventually recover, despite the “halved” stock price.

Reservations for the domestic Model 3 can scan the QR code below ↓

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.