Author | Tian Hui

Editor | Wang Lingfang

The growing signs of BYD’s massive overseas expansion, including land purchase for factory construction, ship procurement for transportation, and active participation in international auto shows, indicate that BYD is preparing for a large-scale launch of its passenger vehicles overseas.

Unlike the previous tentative forays into overseas markets, BYD is making big moves this time. Not only is the speed faster, but the scale is also larger, and the preparation is very sufficient.

The reason why it is said to be fast is that in just one year from the summer of 2021 to now, BYD’s passenger vehicles have opened up markets in 15 new countries and regions, which is equivalent to the total number of the previous few years.

Perhaps the product maturity is already sufficient, and the overseas market is approaching the critical point of explosion. In any case, BYD, which has seized the opportunity, has taken action quickly. In the past month alone, it has successively entered three important markets. First, on July 21, it announced its entry into the Japanese market, then on August 2, it announced its entry into the German and Swedish markets, officially beginning to sell cars to traditional automobile powers.

As of early August, BYD has entered 32 countries and regions, and plans to further develop the Middle East, Africa, Europe, and Asia-Pacific markets this year, and is expected to enter the North American market next year.

It is said to be large-scale because BYD is preparing production capacity specifically for its overseas expansion. Since 2021, BYD has successively purchased land in the Guangdong Shenshan cooperation zone and Nanning, Guangxi in large quantities for the construction of automobile industrial parks, and has reserved production capacity for 300,000 vehicles and 45GWh of batteries.

It is said to be well-prepared because BYD intends to purchase ships for transportation by itself. Currently, BYD is in talks to purchase 6 to 8 7700 CEU liquefied natural gas dual-fuel car carrier ships (PCTC) to meet overseas transportation needs.

BYD, which has made sufficient preparations, is really going to show its strength in the overseas market.

Strategy comes first

BYD has a set of commercial paths to develop overseas markets:

First, open up the public-operating vehicle market to accumulate reputation and commercial partners, and then introduce private vehicle models to expand influence.

Take Singapore as an example. As early as 2018, BYD began to put e6 pure electric vehicles into the local taxi market. It was not until 2022 that BYD launched the ATTO 3 model, the Yuan PLUS EV, to develop the private consumer market.

For example, in countries such as Colombia and Chile, BYD started with exporting buses, trucks, and even track traffic commercial vehicles. They began selling electric passenger cars to the private sector in 2021, with the first batch of models being Yuan Pro EV and Han EV, which are popular pure electric vehicles in the Chinese mainland market.In the Brazilian market, BYD first provided vehicles for the cloud rail of the São Paulo Subway Line 17, followed by the introduction of Han EV sales with a similar approach.

In Japan, BYD’s market share of pure electric buses has reached 70%, and many medium and large buses are specially tailored. As for the private market, BYD will begin delivering passenger cars in Japan in 2023 and plans to establish 100 dealerships by 2025.

Firstly, promoting demonstration operations of operating vehicles to provide early education for consumers and accumulate a reputation, and secondly, BYD can continuously optimize products according to local circumstances and build vehicles that meet the needs of local people.

After determining the overall strategy, specific personnel are needed to implement it in different markets.

In the process of BYD’s passenger car going global, it is divided into four market sectors: America, Europe, Asia-Pacific, and the Middle East and Africa. The automotive sales directors of each segment are senior executives of BYD.

Li Ke, head of the American market, joined BYD in 1996, currently serving as BYD’s vice president and a member of the Information Disclosure Committee.

Liu Xueliang, head of the Asia-Pacific market, joined BYD in 2004, formerly served as BYD’s representative in Japan, and currently serves as the general manager of BYD Asia-Pacific Automotive Sales Division.

Shuyou Xing, head of the European market, joined BYD in 1999, currently serving as the general manager of BYD Europe, and the International Cooperation Division, as well as a director of BYD Toyota Electric Car Co., Ltd.

Huang Zhixue, head of the Middle East and Africa market, formerly served as BYD’s general manager of overseas new energy business and other positions, and currently serves as the general manager of BYD Middle East and Africa Automotive Sales Division.

These promoted managers have been working in their respective markets for many years and are familiar with the local markets to a degree not inferior to local business elites. After winning the trust of the BYD headquarters through their own performance, they were given higher authority, which allows them to respond more quickly and flexibly to situations without the need for hierarchical reporting.

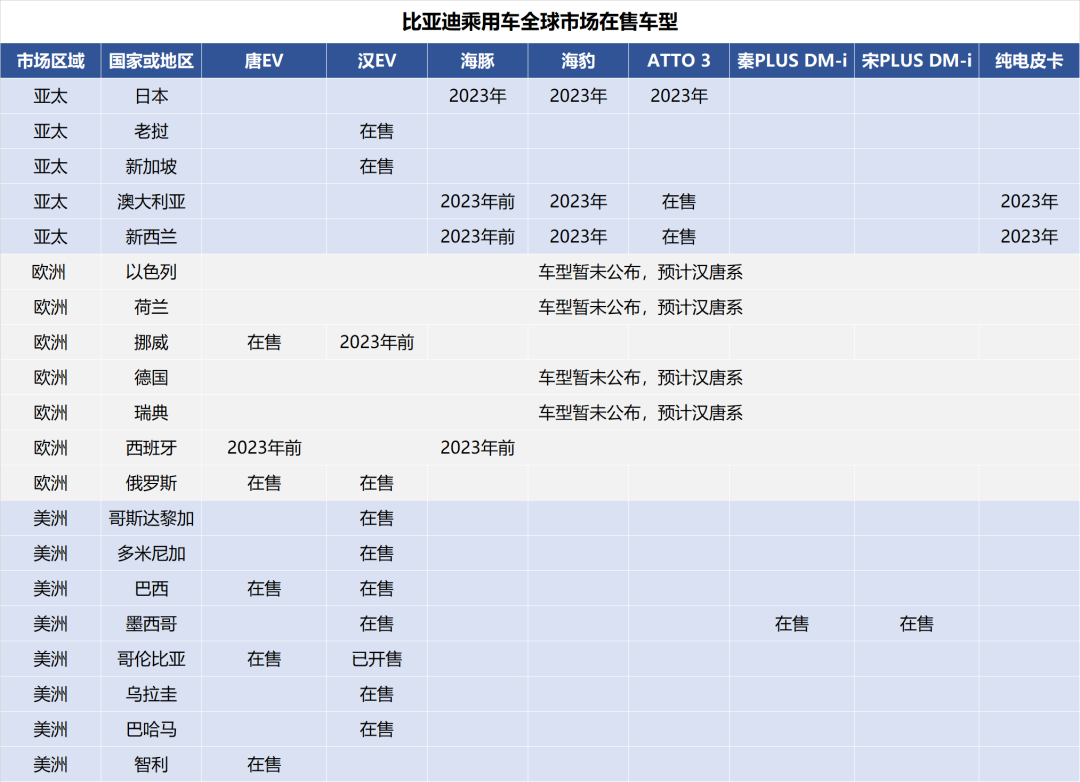

According to the characteristics of different regions, BYD also has a planned and selective strategy for placing vehicle models.

There are so many regions, with different political and economic situations and vastly different consumer preferences, and indiscriminate placement will inevitably lead to subpar results. To solve this problem, BYD has delegated model autonomy to responsible persons in each region.

For example, in right-hand drive regions such as Australia, Japan, Singapore, and New Zealand, the first models to be launched are the pure electric vehicles with e platform 3.0 technology.

Shortly after the launch of Yuan PLUS EV in China, the right-hand drive version ATTO 3 of this model was first sold in the above-mentioned areas. It is obvious that the overseas plan had been planned at the beginning of the vehicle design. Subsequent models such as Dolphin and Sea Lion will also gradually launch right-hand drive versions, starting from 2023, and commence deliveries in various markets.

In the Asia-Pacific region, Europe, and the Americas, BYD prefers to prioritize the sale of mature Han Tang series pure electric vehicles.

The only difference is that the car categories sold in the Americas are more diverse, including both pure electric vehicles and DM-i super hybrid vehicles, which are related to local market demands and market importance level.

Of course, this precise placement effect is very good.

Although the overall unit price of BYD New Energy Passenger Vehicles exported to local markets is much higher than that of the same models in mainland China, the sales volume is quite good.

The Tang EV sold in Norway has entered the top ranks of the local monthly sales chart; the first batch of 400 ATTO models exported to New Zealand have been sold out, with news stating that there are still more than 10,000 orders waiting to be delivered.

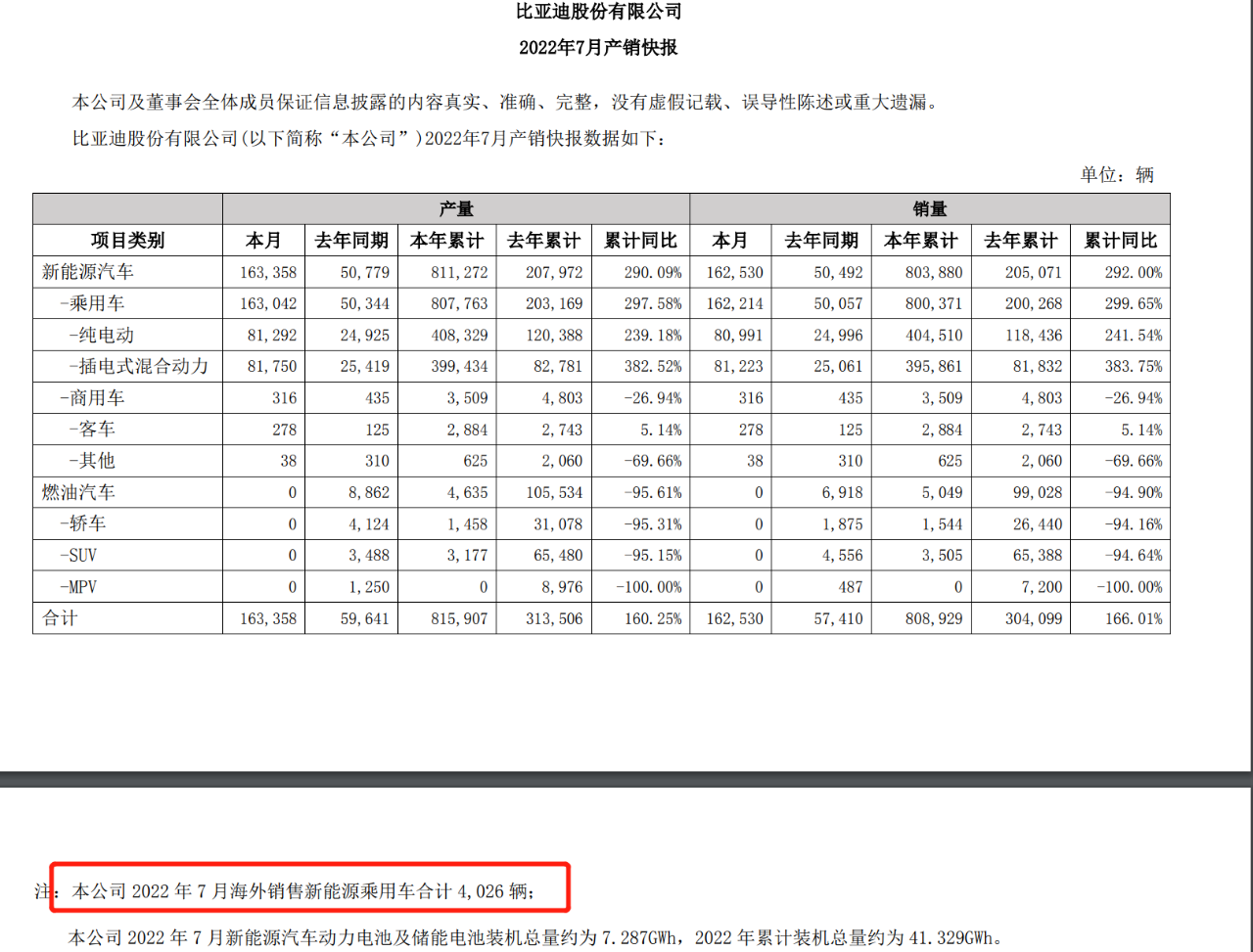

On August 3rd, BYD Company Limited announced for the first time the overseas sales situation, with a total of 4,026 new energy passenger vehicles sold overseas in July 2022, indicating that the annual sales volume is expected to exceed 50,000.

Product technology is highly competitive

The reason why good sales can be achieved is not only due to the precise product placement, but also due to the technology that is not inferior to that of Europe, America, Japan, and South Korea, which is the biggest competitive edge of BYD passenger cars.

The advantage of the electric vehicle’s range is the biggest competitive edge of BYD passenger cars.Taking the example of Tang EV, which is exported to Norway, the car has a range of over 600 kilometers, while the Volkswagen SUV, which has the same size but weighs more, has a range of only about 500 kilometers. However, the price of Tang EV is basically the same as that of BYD and Volkswagen, which naturally makes it more competitive than BYD’s pure electric vehicles.

In addition, BYD’s e platform 3.0 technology for pure electric passenger cars is one of the few in the world that is based on a heat pump-based whole vehicle thermal management technology platform. In the winter when the European market is relatively cold, this technology can effectively improve the winter range.

The DM-i series plug-in hybrid vehicles sold to Latin America perform well in energy consumption and power, and are not inferior to the European cars that dominate the local market in terms of power, but have lower fuel consumption.

Since 2021, a significant change in the global new energy vehicle market pattern is the significant increase in sales of vehicles using lithium iron phosphate batteries. International automakers, especially Tesla, have begun to supply lithium iron phosphate battery vehicles to developed countries such as Europe, the United States, and Japan in large quantities, making local consumers begin to accept and recognize this technology.

Lithium iron phosphate batteries are the most advantageous battery category for BYD, and the company has more than 20 years of technical experience in this field. The latest blade battery technology has been proven to be a success in the mainland China market.

After going global, BYD passenger cars equipped with lithium iron phosphate batteries no longer need to educate consumers in the market, which reduces the difficulty of sales.

Land acquisition, ship purchase, joint venture, and speeding up are ways to accelerate the overseas expansion plan. Production capacity is the biggest limitation of BYD’s passenger car going global plan. At present, BYD’s production capacity has not been able to meet the needs of the mainland China market, let alone the overseas market.

At the same time, transportation is also one of the problems that must be solved in the process of expanding overseas markets. BYD’s solution is to buy land to build factories, buy ships for transportation, and try various joint venture solutions.

To increase production capacity, on the one hand, BYD squeezes out some production capacity to deal with overseas markets based on existing production capacity. However, the ultimate solution is to build independent factories for the overseas markets, and to build supporting battery factories and parts industrial parks.

In August 2021, BYD and the management committee of the Shenshan Special Cooperation Zone in Shenzhen signed a strategic cooperation agreement to invest RMB 5 billion in building the BYD Automotive Industry Park. Six months later, BYD announced an additional investment of RMB 20 billion.

According to the supplementary agreement between the two parties, the planned capacity of the BYD Shenshan Auto Industry Park will reach 600,000 vehicles. The project is expected to be put into operation as soon as October 2023.

BYD’s decision to build an auto industry park in the Shenshan Cooperation Zone in Shenzhen is aimed directly at overseas markets.

The BYD auto industry park in the Shenshan Cooperation Zone is only about 10 kilometers away in a straight line from Xiaomo Port. According to official information from BYD, the Tang EV model exported to Norway is transported through Xiaomo Port and then shipped to Shanghai Port and then to Norway.

According to the plan for Xiaomo Port, it will have two 100,000-ton multi-purpose berths and one 50,000-ton working boat berth. The designed annual throughput of the port is 4.5 million tons, and the long-term plan is to build 49 berths. The total shoreline is about 14.5 kilometers, and the total land area is about 11.9 square kilometers, with an annual throughput of 75 million tons.

Transportation Solution

Recently, news has emerged from the shipping industry that BYD plans to purchase 6-8 liquid natural gas dual-fuel car carrier vessels with a capacity of 7,700 CEU. At present, BYD has contacted several Chinese shipyards, including China Merchants Industry Holdings, Guangzhou Shipyard International, Huangpu Wenchong and Zhejiang Yangfan Group. The new vessels are expected to be delivered in batches from 2025.

After these vessels are delivered, BYD will become the second automaker in China with its own shipping fleet, with an annual sea transport scale of more than 500,000 vehicles.

Overseas Joint Ventures

On July 5, Guangxi ASEAN Freddie Battery Co., Ltd. was established with a registered address at No. 18, Ningwu Road, Guangxi-ASEAN Economic and Technological Development Zone. From the name, it can be seen that this battery factory mainly exports batteries to the ASEAN market.

With the battery factory leading the way, BYD will have big moves in the ASEAN market.According to overseas media reports, BYD is preparing to form a joint venture with Thailand’s local company Sino Automobile Group to build a complete vehicle factory to supply automobiles to right-hand drive markets such as Thailand, the UK, and Australia, with an initial production capacity of 100,000 units per year.

According to Thai media reports, on August 8th, BYD will hold a press conference to release its automotive brand, Rêver Automotive, and announce the listing of the Dolphin.

It is expected that from 2023, BYD’s overseas export business will gradually explode and become a new growth point for its sales.

Is BYD’s rival BYD itself?

Chinese car companies selling cars overseas are not new, and BYD is not the first, nor the last.

However, most Chinese car companies export cars to developing countries, and there are not many cases where they export to Europe, America, and Japan. BYD’s brave move to sell cars in Japan and Germany will inevitably pose a challenge to traditional car giants such as Volkswagen, Toyota, and Honda.

It may sound incredible to compete with Volkswagen in Germany and Toyota in Japan, but it is also possible in the electric vehicle market. The automobile industry chain in Germany and Japan is perfect, but the electric vehicle industry chain is weak: the battery is insufficient, and there is a shortage of chips, leaving room for BYD.

As long as the speed is fast enough, BYD’s overseas plan will achieve phased success before the electric vehicle industry chain is improved in Germany and Japan.

Speed is BYD’s strength, but the challenges are also evident.

In the new changes and transformations of the global new energy vehicle market, consumer demand for new energy vehicles has increased significantly, and BYD needs to deliver cars to consumers faster.

BYD Chairman Wang Chuanfu has said that the new energy vehicle market is a place where the fast fish eat the slow fish.

Therefore, in the new market environment, BYD needs to break through the existing commercial paths and execute the overseas plan more quickly.

At the same time, BYD’s overseas plan is already a massive and complex plan. Compared with traditional automobile groups, BYD lacks local market core dealers. Sales networks can be quickly established, but the construction of after-sales networks is more challenging and requires stronger support from partners.

In terms of product technology, accurately grasping local market demand and adapting products to meet local needs involve the integration of corporate product culture and local automobile culture.The above challenges are inevitable when multinational car companies enter new markets. What sets BYD apart from traditional multinational car companies is that their time window is shorter, and by the time international car companies wake up, the time window may have already closed.

As for the local acceptance of Chinese new energy vehicles by consumers, it is relatively secondary. After years of development, the new energy vehicle markets in Europe, America, and Japan have already completed the initial market education. BYD’s going overseas is not like coming down the mountain to pick peaches, but it is as if they are better than coming down the mountain to pick peaches. They will certainly be able to pick some peaches, but how many peaches they can pick will be a test for BYD.

In short, BYD, the fast fish, is about to go overseas to eat the slow fish.

Sources of this article include, but are not limited to:

- BYD’s new energy passenger car “Going Abroad” situation overview, written by Chang Pao Chang Ying.

- Chinese automaker BYD tipped to enter shipowning with large PCTC orders.

- BYD’s vehicle and battery factory production capacity overview and sales forecast for the second half of the year, written by T.K. Shu Chang.

- Additional investment of 20 billion! BYD deepens cooperation with Shenzhen-Shanwei Cooperation Zone, what will this billion-level project bring?

- New BYD Thai factory to make electric cars for RHD markets.

- Part of the content from the official WeChat account of BYD International Department “Disheng Piaoyang”.

- BYD invades Thailand through Rêver Automotive and establishes a company on August 8th.2022 BYD Electric Car 亚洲官方授权经销商 Rever Automotive 8 月 8 日正式开张!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.