Author: Zhu Yulong

Recently, the pricing announcements from new players in the automotive industry have been somewhat underwhelming, such as the S system recently released by NIO.

The newly released Deep Blue SL03 has a price range of 168,900-215,900 yuan (plug-in hybrid and pure electric), while the NIO S has two power systems, three versions, and eight sub-versions, with an official guided price range of 199,800-338,800 yuan. These models are layered upon each other, and currently not only compete in the gasoline car market, but also strive to seize orders from first and second-tier cities. I’d like to explore the pricing strategies of NIO and Zero Run in more detail.

My preliminary analysis is as follows:

-

In 2022, the price of batteries will rise by 50%, which is particularly difficult for new players. The core problem is to seek listing – sales growth is rigid, but battery costs may really account for over 50% of the current car prices, which is difficult to manage.

-

In order to seek improvement in gross profit outside of growth, improvements need to be made in the vehicle structure. This can be seen in the case of Zero Run, where the T03 model was downsized and given enough battery to the C11 model. Improvements in delivery and order structure correspond to the company’s operational health.

At this point, the problem is that if all 500 km pure electric vehicles can be quickly bought at a real transaction price of around 200,000 or even 250,000 yuan, then there will be doubts about the growth of pure electric vehicles in 2023, as everyone becomes aware of this situation after the subsidy declines. The expected downsizing for A00 models in 2022 has not been realized, but by 2023 it will be difficult to manage the entire range of vehicles costing less than 150,000.

Comparison of NIO and Zero Run’s positioning

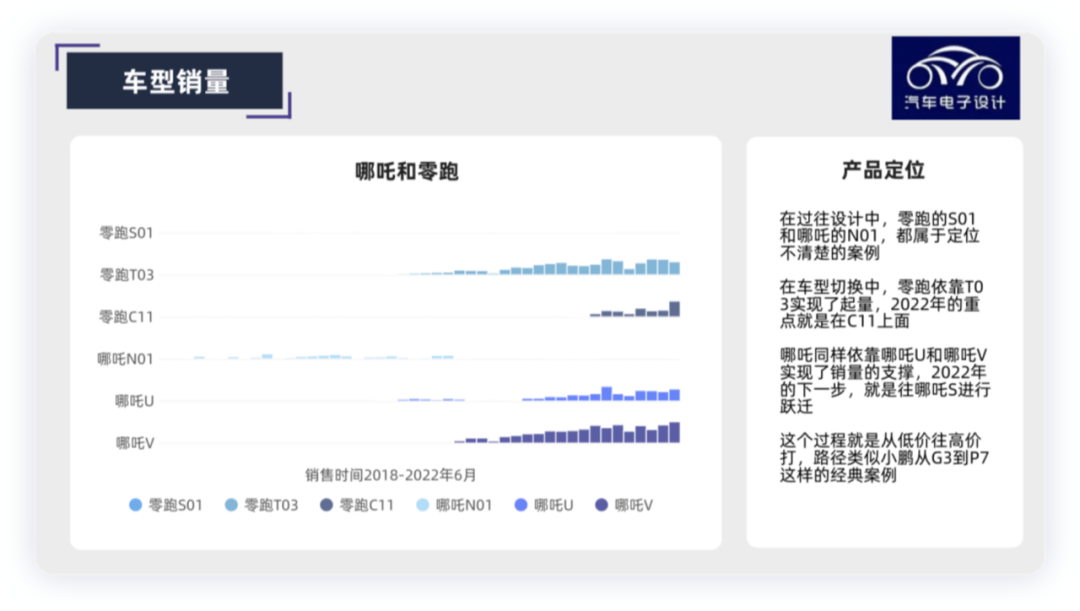

The situation of Zero Run and Hezhong Motors is quite similar; they were in a period of accumulation from 2018 to the first half of 2021. In the second half of 2021, they started to exert force and reached a monthly sales volume of 10,000 units through high cost-effectiveness and precise positioning.

In their past attempts, both S01 of Zero Run and N01 of NIO were cases of unclear positioning.In the car model switching, Leading Ideal relies on T03 to achieve volume, and the focus of 2022 is on C11. Similarly, NETA relies on NETA U and NETA V to support sales volume. The next step in 2022 is to make a leap to NETA S. This process is about moving from low price to high price, similar to the classic case of XPeng from G3 to P7.

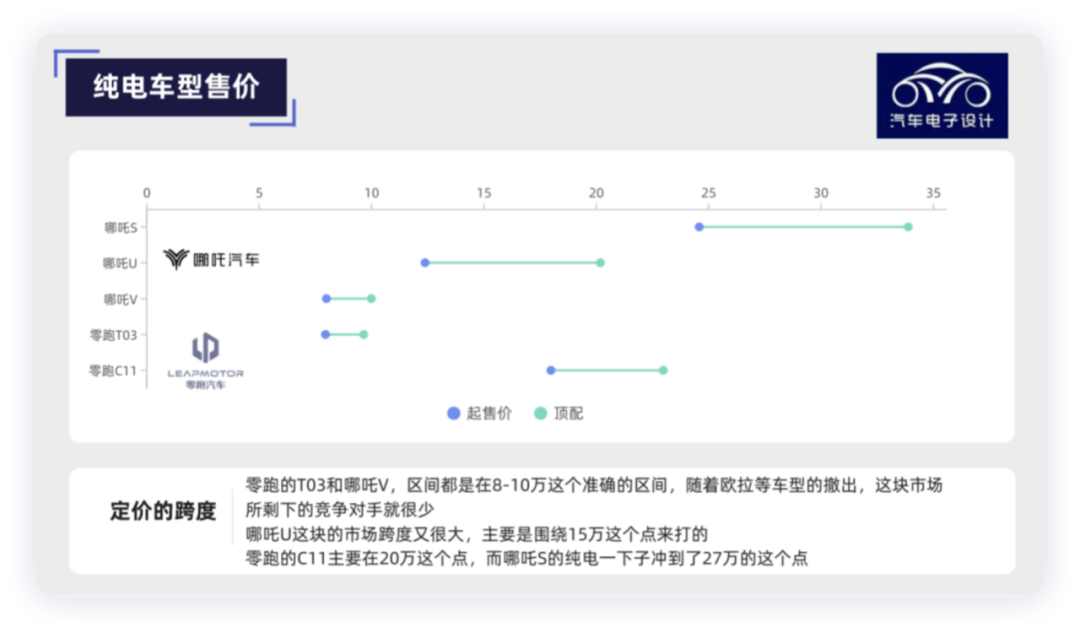

Here, let’s take a look at the price ranges of several cars from these two new forces:

Leading Ideal’s T03 and NETA V are both priced in the accurate range of 80,000 to 100,000 yuan. With the withdrawal of models such as Euler, there are not many competitors left in this market, giving these companies the confidence to have monthly sales of 5,000 to 8,000.

The market span of NETA U is quite large, mainly around the price point of 150,000 yuan (with monthly sales of 3,000 to 4,000), while Leading Ideal’s C11 is mainly positioned at the price point of 200,000 yuan (with monthly sales over 6,000 in June).

Meanwhile, NETA S, an all-electric vehicle, is positioned at a price point of 270,000 yuan (Tesla’s Model 3 is also priced at 279,900 yuan).

C11 and NETA S are both examples of these companies thinking about their positioning after transformation. C11 centers its strategy around becoming an entry-level version after becoming expensive, by reducing the battery capacity and relying on the sales point created by NETA S’s long range extension to boost sales of the pure electric version.

The range extender model provided here is NETA S, which is equipped with a 43.5 kWh battery and has a pure electric range of 310 kilometers, the longest range among range extender models currently available.

Smart technology is based on whether or not consumers accept it. In the first two generations of models, NETA V is an economical type, and NETA U may be used both for operation and public use. Therefore, in terms of intelligent technology, NETA hopes that NETA S can be positioned as a high-intelligence level model, achieving flattening of generation one, making many intelligent configurations as standard, such as the intelligent cockpit named NETA SPACE, which uses the Qualcomm 8155 chip (already a representative name in the industry).- Intelligent Driving: Two options are available, NETA PILOT 3.0 and NETA PILOT 4.0.

- The self-developed hardware and functions of NETA PILOT 3.0 will become standard across the entire series, providing multiple intelligent driving assistance functions such as NNP NETA highway cruising assistance, and NTP NETA memory parking assistance.

- The NETA PILOT 4.0 intelligent driving assistance system is equipped with a LiDAR and a high-performance platform. By utilizing the Huawei MDC610 computing platform with 200TOPS high computing power, along with 2 solid-state LiDARs and more powerful sensing hardware, the system can provide NCP NETA city cruising assistance, and meet the actual demands of multiple scenarios such as highways, cities, and parking.

- The issue here is whether or not consumers will recognize these features, and currently, it seems that NETA’s gamble is quite risky.

- Summary: New forces in the automobile industry are facing cost issues as well as tough competition after price increases. With an expansion in workforce and structural costs, the market isn’t as easily breakable when considering that the penetration rate is already at 25%, and in order to achieve the next step of 50% growth, market share won’t be easy to acquire.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.