Author: Zhu Yulong

The global new energy vehicle data for the first half of the year has been finally released. According to EV-Volumes, the global sales of new energy vehicles in June hit 913,479, a 54% year-on-year increase. The market penetration rate of new energy vehicles reached 16%, and pure electric vehicles achieved a 12% penetration rate.

-

Battery Electric Vehicles (BEV) sales: 685,000 units (a YoY increase of 65%) and a 12% penetration rate.

-

Plug-in Hybrid Electric Vehicles (PHEV) sales: 228,000 units (a YoY increase of 29%) and a 4% penetration rate.

-

Total sales of new energy vehicles: 913,479 units (a YoY increase of 54%) and a 16% penetration rate.

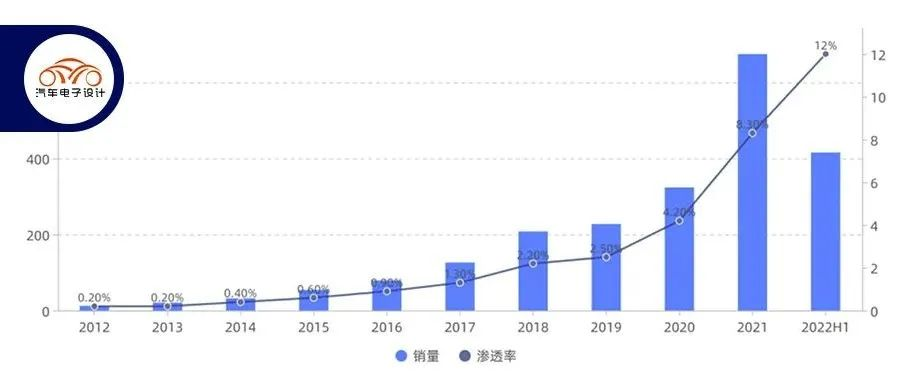

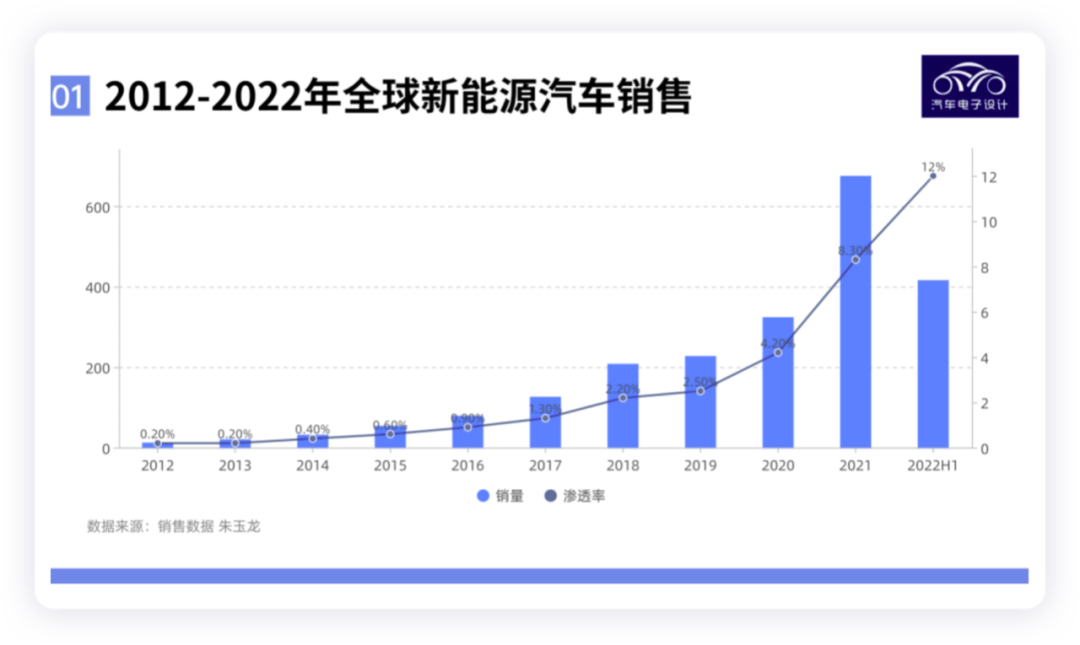

By H1 2022, global sales of electric vehicles reached 4.16 million units, a significant increase from 6.75 million units in 2021.

-

Battery Electric Vehicles (BEV) sales: 3.05 million units and an 8.8% penetration rate.

-

Plug-in Hybrid Electric Vehicles (PHEV) sales: 1.11 million units and a 3.2% penetration rate.

-

Total sales of new energy vehicles: 4,161,123 units and a 12% penetration rate.

At this pace, sales could reach between 5.0 and 5.5 million units in H2 2022, and a significant impact of 10 million units for the year could be achieved.

Interestingly, due to the effect of the Shanghai factory, BYD’s sales in H1 reached 640,748 units, surpassing Tesla’s 564,873 units and becoming the first-half champion. SAIC-GM-Wuling ranked third with 233,017 units. Of course, this competition is essentially a sign that the top two companies are leading the way.

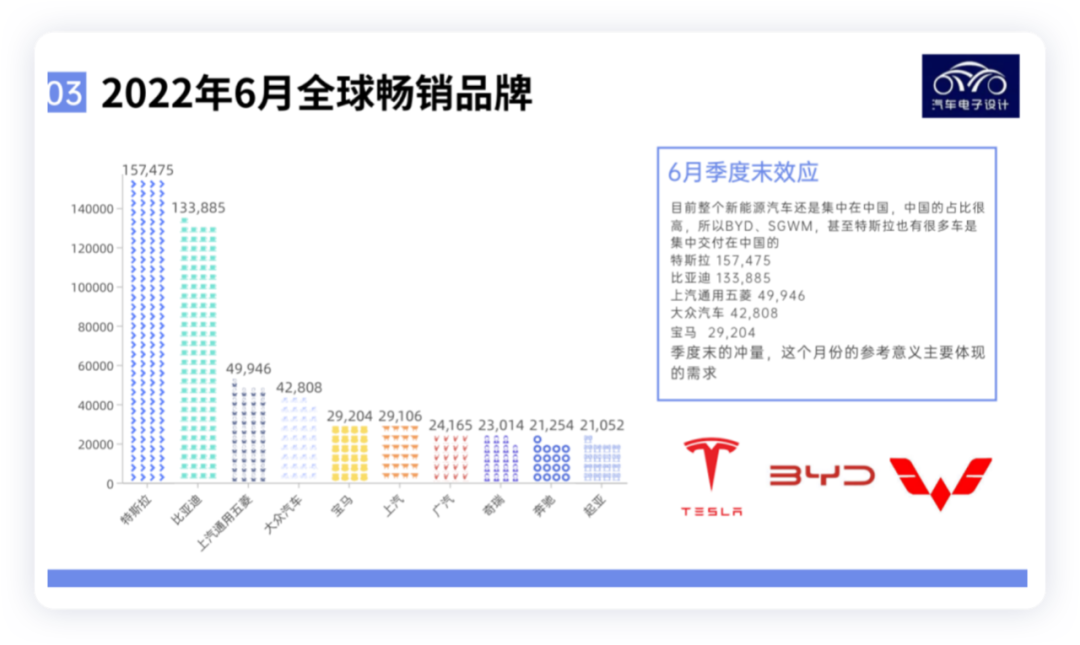

Best-Selling Brands

First, let’s look at the top ten sales by brand and then by model. Chinese car companies accounted for half of the top ten sales in June.

-

Tesla: 157,475 units

-

BYD: 133,885 units

-

SAIC-GM-Wuling: 49,946 units

-

Volkswagen: 42,808 units

-

BMW: 29,204 units

From the current point of view, the market competition is becoming increasingly fierce. BYD sold 640,748 units in the first half of the year, surpassing Tesla’s 564,873 units, becoming the half-year champion. SAIC-GM-Wuling ranked third with 233,017 units sold. Hyundai sold 220,000 units in the first half of the year, which is a very good result considering the limited market share in China. The Matthew effect has now appeared in China’s car industry, especially with so many car companies locking in battery supplies. If they cannot digest the cost of batteries, they will lose money and make noise.

From the current point of view, the market competition is becoming increasingly fierce. BYD sold 640,748 units in the first half of the year, surpassing Tesla’s 564,873 units, becoming the half-year champion. SAIC-GM-Wuling ranked third with 233,017 units sold. Hyundai sold 220,000 units in the first half of the year, which is a very good result considering the limited market share in China. The Matthew effect has now appeared in China’s car industry, especially with so many car companies locking in battery supplies. If they cannot digest the cost of batteries, they will lose money and make noise.

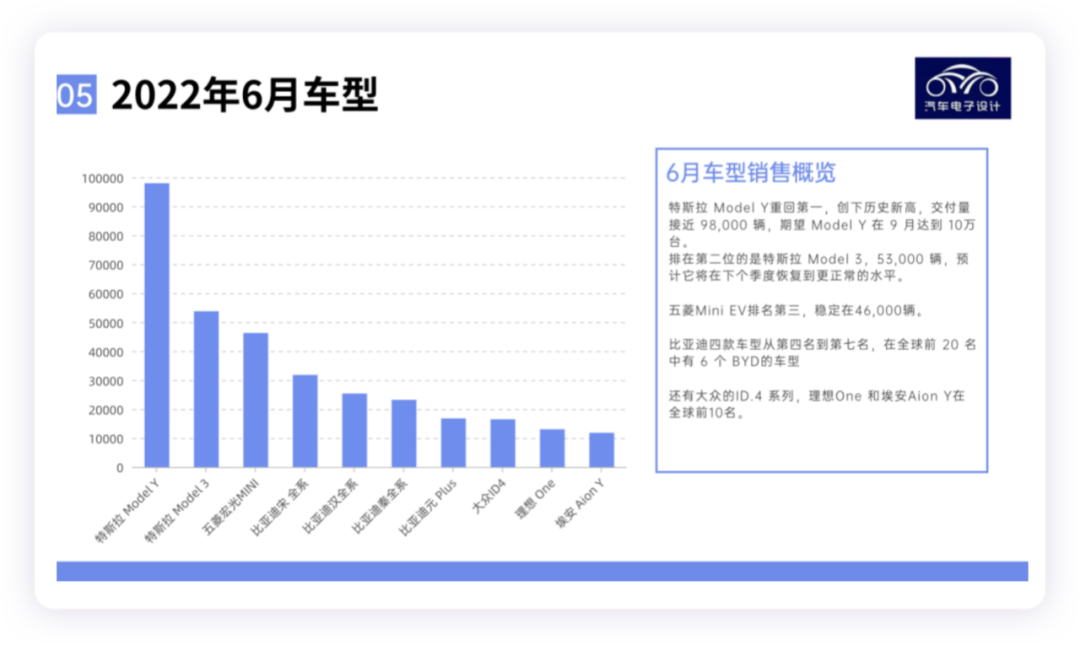

Best-Selling Models

The top 10 models before June are all included here, and BYD is a bit dominant. Tesla Model Y returned to the first place and set a new record with nearly 98,000 deliveries, expecting to reach 100,000 in September. Tesla Model 3 ranked second with 53,000 units delivered, and it is expected to recover to a more normal level in the next quarter. Wuling MINI EV is ranked third with a stable delivery volume of 46,000 units. Four BYD models rank from fourth to seventh, and six BYD models are among the top 20 in the world. Volkswagen iD.4 series, Li ONE, and Aiways Aion Y are in the top 10 globally.

- Tesla Model Y – 97,950

- Tesla Model 3 – 53,768

- Wuling Hong Guang Mini EV – 46,250

- BYD Song (BEV + PHEV) – 31,787

- BYD Han (BEV + PHEV) – 25,356

- BYD Qin Plus (BEV + PHEV) – 23,176

- BYD Yuan Plus (BEV) – 16,764

- Volkswagen ID.4 – 16,462

- Li ONE EREV – 13,024

- Aiways Aion Y – 11,801

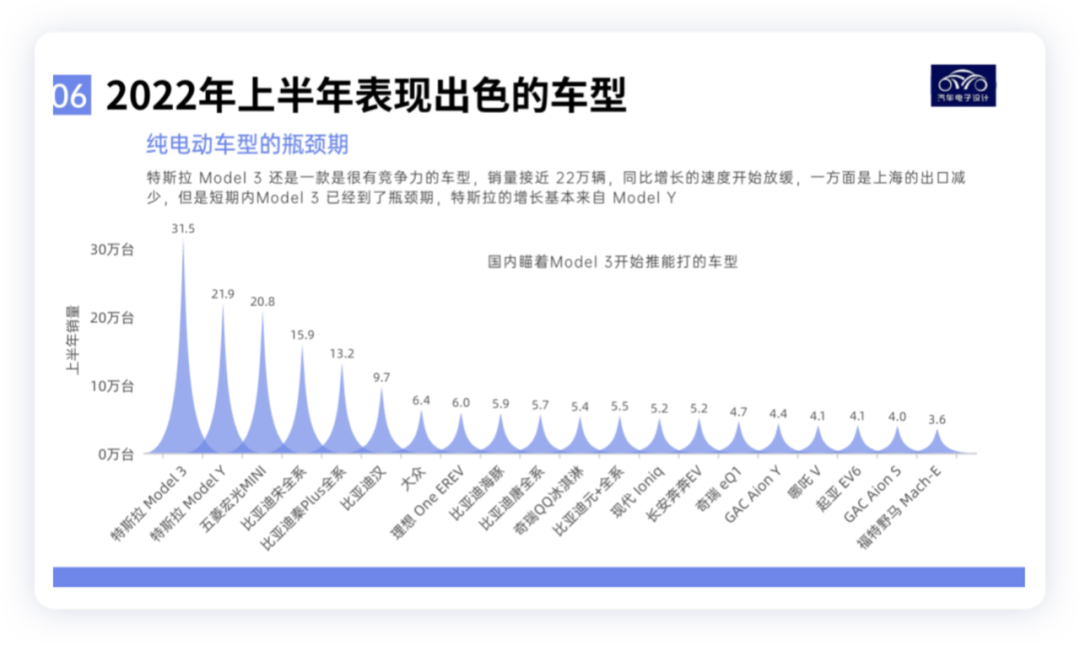

From the current point of view, Tesla Model 3 is still a very competitive model, with sales approaching 220,000 units and the growth rate starting to slow down year-on-year. On the one hand, exports from Shanghai have decreased, but in the short term, Model 3 has reached a bottleneck period, and Tesla’s growth is mainly coming from Model Y.

-

Tesla Model Y – 314,921

-

Tesla Model 3 – 219,095- Wuling Hongguang MINI EV – 207,829

-

BYD Song (BEV + PHEV) – 159,091

-

BYD Qin Plus (BEV + PHEV) – 132,495

-

BYD Han (BEV + PHEV) – 97,225

-

Volkswagen ID.4 – 63,597

-

Li Xiang One EREV – 60,404

-

BYD Dolphin – 58,613

-

BYD Tang (BEV + PHEV) – 57,000

Summary: It is interesting to review these data. From the current situation, July-September is a difficult period, and car manufacturers are starting to lower the prices of their car models, which has a greater impact on other car manufacturers; the weather is hot and the delivery speed of orders is slow. The next wave will reach its peak in November-December.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.