Author: Wang Xuan

The popularity of famous actors is high, and tickets are hard to come by. If the seats are sold out, standing-room-only tickets, squatting tickets, and lying-down tickets are available. Finally, you can even hang a few seats from the ceiling fan. And to no one’s surprise, there are still a few gentlemen who won’t leave outside the theater.

Just like today’s booming B-class new energy vehicle market, Tesla Model 3, XPeng P7, and JiKe 001 are all hot. NIO ET5 and Zéro Run C01 are also eyeing their competitors off to the side. Last month, BYD Hai Bao, Changan Deep Blue SL03, and NETA S successively appeared, adding some fuel to this competition.

As we have summarized before, a segmented market can only accommodate up to three best-selling products that will enjoy success. Afterwards, sales will decline dramatically. However, nowadays, every product that enters the B-class new energy vehicle market comes with a “best-selling” label. Presumably, no one wants to be left hanging.

Of course, looking inside these few products, it’s easy to see that they each have different missions aside from pursuing sales.

Stocks still available, incremental growth focuses on “electric”

To understand why independent brands are targeting B-class car market and launching new products, it is necessary to know how much room the market has given them.

From a broad perspective, the B-class car market still only accounts for a small proportion of total passenger car sales. According to the latest statistics from the Ministry of Public Security, as of December 31, 2021, China has a total of 395 million motor vehicles, with 48% of the four-wheeled automobiles costing less than 100,000 yuan, 40% between 100,000 and 200,000 yuan, 8.4% between 200,000 and 300,000 yuan, 2.6% between 300,000 and 500,000 yuan, 0.8% between 500,000 and 1 million yuan, and 0.2% over 1 million yuan.

Based solely on this data set, the 8.4% of the B-class car market is not worth “investing” in compared to the 40% of the A-class car market. Of course, this is a set of data obtained from the general passenger car ownership, and the denominator of the ratio includes some products that are not commonly purchased by ordinary consumers. If we want to further understand the market situation, we need to continue to segment the market and look for incremental growth to stimulate the concentration of explosive products.

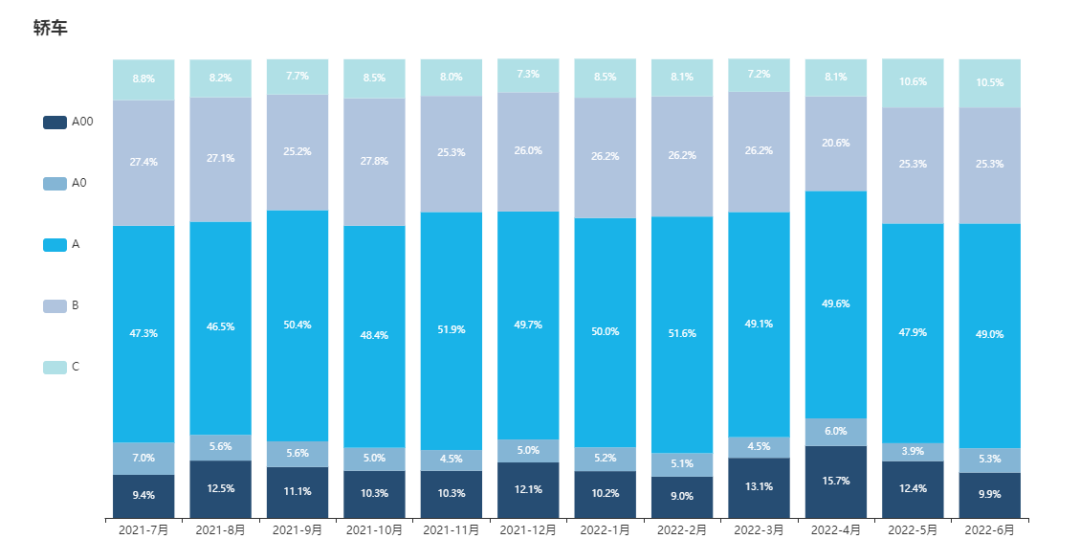

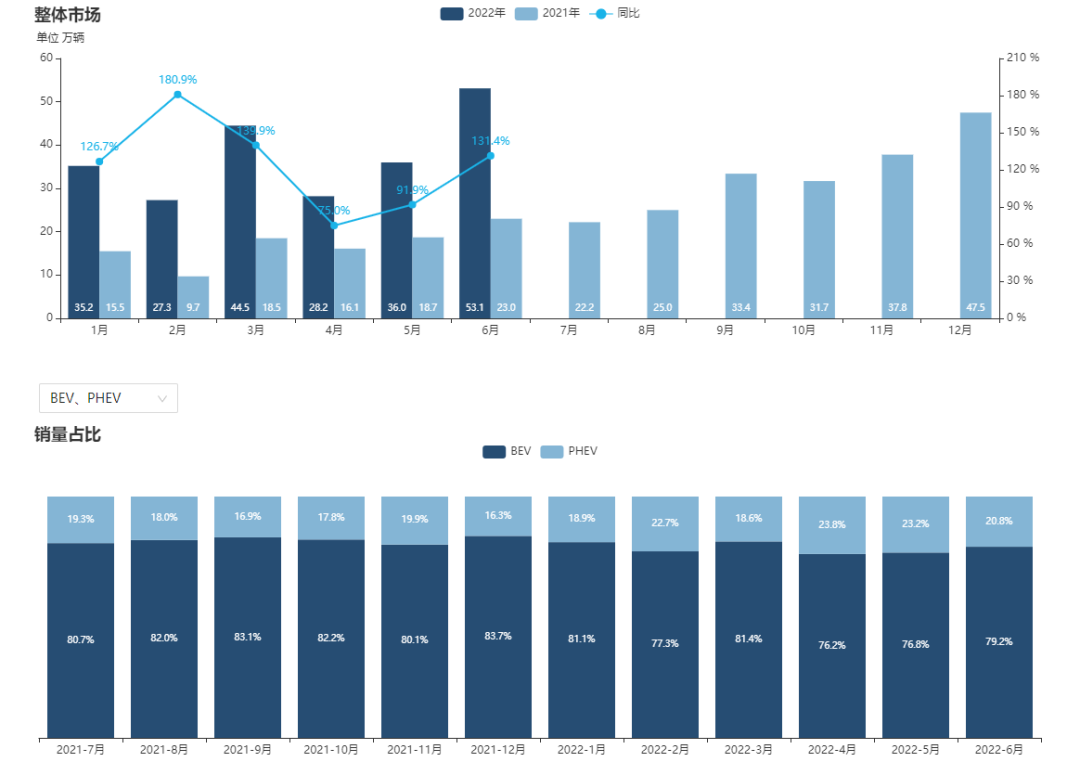

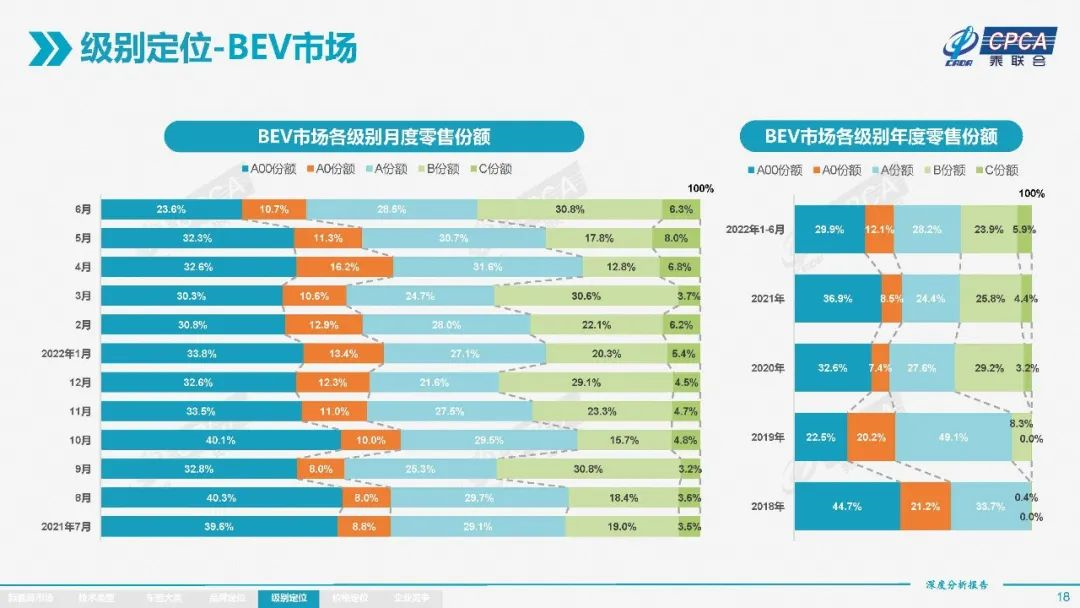

According to data from the China Passenger Car Association, in the past 12 months, the B-class car market accounts for about 25% of the sedan market on average. The overall data includes gasoline cars, PHEVs, and BEVs. In addition, there are two sets of data. Compared with the full year of 2021, the market penetration rate of new energy vehicles in the first six months of 2022 has increased significantly, with BEV models accounting for about 80%. In addition, since 2020, the sales growth rate of B-class cars in the BEV market has been rapid.

The high demand for pure electric B-class models is the core reason why various automakers are investing a large amount of resources. The size of the market determines whether it has enough attractiveness.

Of course, there are also some interesting phenomena in this competition, such as the BYD Dolphin, Deep Blue SL03, and Leapmotor C01, which deliberately positioned themselves against the Tesla Model 3 in terms of marketing channels. It cannot be denied that the Tesla Model 3 is the hottest product in the market, and wherever the consumer base is, there is still room for exploitation, which is similar to how a popular hot pot restaurant can ignite the entire food street.

The B-class market can meet the aspirations of brand upgrading

Although the current B-class car market is particularly lively, each product’s entry into this market is completely different. Taking some of the new products we mentioned at the beginning as examples, they can be summarized into three categories.

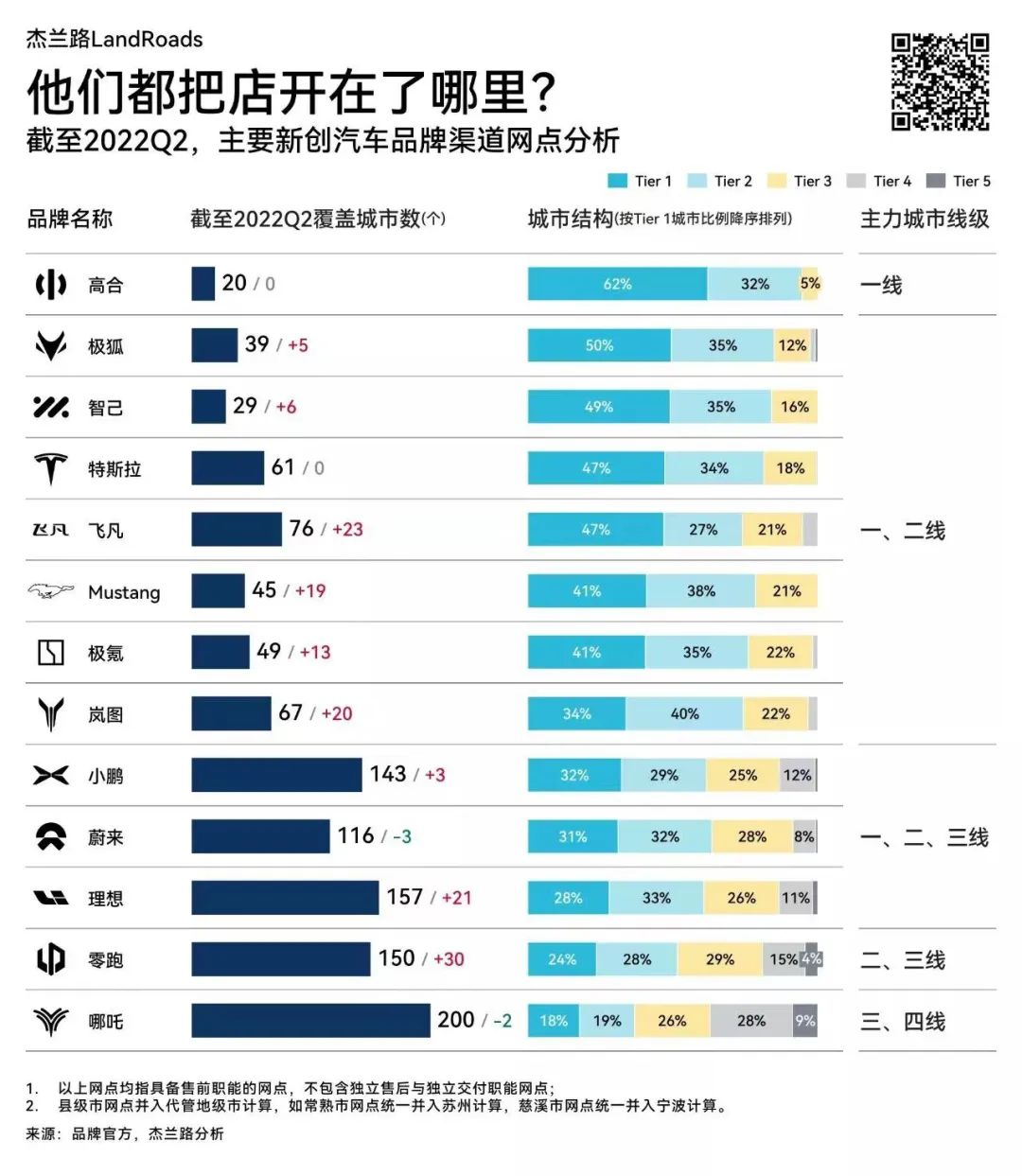

The first category is to upgrade the brand with the B-class as the endpoint, which is the most typical example of Leapmotor and NIO. According to the sales channel data of the new startup brand released by Gerui Lu on July 25th, Zero Run’s main sales channels are in second- and third-tier cities, while NIO’s main channels are in third- and fourth-tier cities.

Originally, we talked about the “New Forces Three Strong” as WmAuto Motors, and now Leapmotor and NIO, with monthly sales exceeding 10,000, have been promoted to the “New Forces Five Tigers”. However, the main channels of the latter two exposed the predicament of the products: it is difficult not to be labeled as “high cost-performance” when targeting lower-tier cities.

Therefore, developing B-class car products is also a way to further enhance brand power. However, I do not believe that they have the idea of climbing to the high-end market. One obvious point is that neither the Zero Run C01 nor the NIO S has abandoned the old tradition of focusing on product power.

In terms of size, the above-mentioned two products should be classified as C-class cars, but they are sold at B-class car prices. The C01 has a length of more than 5 meters, three-screen interaction in the car, and the high-end rear seats even have a boss seat. Leaving aside the experience, from a product power perspective alone, the Zero Run C01 does have strong competitiveness.

However, for a comprehensive lineup, the NETA S is the way to go. It offers extended-range and pure electric powertrains, as well as a version with a LIDAR system and a performance version. The models are named “large, medium, and small” to differentiate them.

However, for a comprehensive lineup, the NETA S is the way to go. It offers extended-range and pure electric powertrains, as well as a version with a LIDAR system and a performance version. The models are named “large, medium, and small” to differentiate them.

Almost any configuration, powertrain, or use case that a user can think of for a B-Segment car can be found in the NETA S. However, as B-segment cars continue to become more internally competitive, with ever-increasing product strength, questions arise as to whether this phenomenon is necessary to create chart-topping products or due to constraints in the product strategy. This question will be explored below.

The second type – starting with the B-segment car and moving upmarket – represented by the Zeekr 001 and Changan Shenlan SL03 vehicles. It’s undeniable that if a car manufacturer wants to establish a brand as high-end, starting in the B-segment market is the best option, as this decision aligns with consumer’s traditional understanding.

For instance, BBA (BMW, Benz and Audi) still have some A and A0 models that sell for less than RMB 300,000. However, most people don’t consider those models to be “mainstream” models, and BBA’s entry-level models are still considered the C-Class, 3-Series, and A4. Thus, the B-segment car market can be seen as the entry market for luxury car brands.

After the Zeekr 001, the company’s second model will be an MPV, the Zeekr 009. According to rumors, it will be priced significantly higher than the Zeekr 001. An example of Changan Shenlan’s exploration of higher-priced markets is the hydrogen fuel cell car priced at RMB 6.999 million that they recently announced, although most people consider that car to be mostly for show.

The third type – enriching the product lineup with B-segment cars as entry-level products – represented by the BYD Dolphin and NIO ET5. However, both of these vehicles have a key issue: they are not well-differentiated from their premium counterparts.BYD Dolphin overlaps with BYD Han EV in terms of price, but the former is only available in pure electric version based on the e-platform 3.0, with a shorter body length than the latter although with the same wheelbase. Although there are not many differences in product power and configuration, Dolphin can help BYD reach younger users based on Han.

Recently, I found that most of the potential female users of new energy vehicles mentioned that they were discouraged by the temperament of BYD Han, making differentiation in product style a good decision.

At last year’s NIO Day, Li Bin was asked by various media whether NIO ET5 would compete with ET7. Apart from the difference in size, the two were extremely similar. However, for NIO, they need a product that can bring down the overall car price. After choosing the BaaS solution, users can experience NIO’s products with less than 300,000 yuan as a down payment. Perhaps there might be internal competition between products, but the price advantage of ET5 over even BBA’s petrol cars might cause them discomfort.

“Adding” is not the popular logic in product planning. Nowadays, independent brands have a strong momentum in catching up with joint ventures in terms of product power. However, in the phenomenon of fully entering the B-class car market, it is also easy to find that most brands are strong in product power but exhausted in the product itself.

Benchmarked product is an effective logic for independent brands, and adding configuration is a shortcut to demonstrating product power. Products like NIO Zero Run C01, and NIO ES6 have a body length around 5 meters, selling cars of C-class size at the price of B-class cars.

Although there is no clear feedback on these two products in the market, there are also precedents to learn from, such as the Voyah Free. They also went with the “I want all” route, from acceleration performance, comfort configuration, high-end decorative materials in the interior, to the lifting screen with large imagination. Although the product seems impeccable, the sales performance is not as good as the excellent ONE.

This raises the question of what restricts the outbreak of B-class cars with product power as the core, in a situation where capability and positioning are online.

Based on observations of various new products over the past year, I found that, apart from capability and positioning, there is another crucial reference – product planning path. Everyone rushed into the B-class car market together, which is a typical traditional product planning strategy, defining the development path by segmenting the market, whether it is from low to high, from high to low, or filling gaps.Here is the English translation in Markdown format, with HTML tags preserved:

What other unique paths do these companies have in their product planning? Here are two examples for easier understanding.

The first is Ideals. It is undeniable that Ideals ONE is a popular hit, as it is the only car in the entire new car manufacturing industry that can sell tens of thousands of units per month. The path that Ideals takes to create their products is based on the advancement of family size. The Ideals ONE is known as the “Daddy’s Car,” while the Ideals L9 should be called the “Family Car.” The most obvious difference between the two lies in the emphasis placed on the second-row passengers, which corresponds to the change in the passenger base.

Although perfection cannot be achieved in product design, all products follow the same planning path. For example, the Ideals L9’s right side of the second row has a boss seat, a small table behind the co-driver seat, a headrest TV in the back row, a refrigerator, and an air suspension with convenient boarding and alighting functions, among other features. These additional features differentiate the two models based on the number of passengers—one is more for parents with children, and the other is more for seniors.

On top of the core path, we can understand why Ideals’ SUVs are getting larger. The next model introduced will be an MPV, without a clear sedan layout.

The second path is Xpeng’s, which is not about their car products themselves but rather their focus on intelligence. In Xpeng’s team, the entire vehicle and intelligence are two independent and separate R&D tracks. Hence, we have seen some unusual steps that Xpeng has taken, such as the lower-cost Xpeng P5 being equipped with a LiDAR sensor one step ahead of the P7.

Xpeng has some similarities with Li ONE and NIO, starting from the low-end G3 and gradually increasing toward high-end P7. When the P7 was first released, there were many sceptical voices. However, the product’s outstanding performance in the market is not only due to design, performance, endurance, and other factors, but also thanks to the excellent voice system, assisted driving, automatic parking, and other intelligent features.

Therefore, Xpeng’s brand promotion lies in telling the story of intelligence to external audiences, rather than just adding features to their car products.

Finally

Today, sales data for every automaker in July has been released, showing that all companies performed quite well. Li ONE, Zero Run, Xpeng, Ideals, and NIO all sold over 10,000 units last month, followed closely by WM Motor and Ji Ke. The collective strength in the B-class market reveals another signal: each company is still actively building its product ecosystem. We can assume that the Chinese new energy market will continue to grow significantly in the coming years.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.