Author | Leng Zelin

Editor | Wang Pan

The first half of the year was impacted by various factors such as holidays and the pandemic, causing many car companies that had planned to expand to recognize reality, as demonstrated by the example of Yu Chengdong, who first set a goal of 300,000 vehicles, but changed his mind later.

As the saying goes, initial success is often followed by decline and eventual failure, but this does not apply to China’s new energy vehicle market. In the first half of the year, the retail sales of new energy passenger vehicles reached 2.248 million units, a year-on-year increase of 122.5%, maintaining a high growth rate.

As we enter the second half of the year, production has resumed and the supply chain has stabilized. Car companies have reignited their ambitions and have begun to launch new models. Compared to the domination of the new forces in the past few years, the new energy market in the second half of this year is particularly lively.

In the SUV sector, NIO has updated its old model, the ES8, and launched its first SUV on the NT2.0 platform, the ES7. Then we have Li-Xiang, Weltmeister, and XPeng, which have successively released their “best” SUVs under 5 million, 1 million, and 500,000 RMB respectively.

In the sedan market, Zeekr, NIO, BYD, and Changan’s deep blue electric car lineup, known as the “four small dragons of electric cars,” have successively released their prices. Three of the cars have been officially launched in the past week, covering the 170,000-300,000 RMB market.

Undoubtedly, this is a “charge” launched by Chinese automakers to compete with Tesla.

In addition, we will see some new faces in the second half of the year, such as the NV by Ziyoujia, a company that has transformed from electric two-wheelers, and the AVETA 11, a product of a tripartite partnership involving Changan, Huawei, and Contemporary Amperex Technology.

Of course, the focus of the competition is on plug-in hybrid and extended-range electric vehicles that have recently appeared on the hot search rankings. Great Wall’s Mocha, Latte, and Macchiato have all adopted DHT-PHEV technology. BYD DM-i continues to lead the market, and in addition to Li-Xiang, Weltmeister, and Voyah’s extended-range SUVs, several sedans have also chosen to launch extended-range versions.

New forces, traditional car companies, and internet technology companies are creating a market of vigorous competition.

The balance of power has shifted, with smaller players taking the lead

Since last year, NIO’s Xiaoli has been dominating the monthly new energy vehicle sales rankings. However, smaller players such as Zeekr and Weltmeister have also joined the race for the top spot.

This month, Zeekr once again ranked first with 14,037 vehicles delivered, followed by Weltmeister’s ZERO with 12,044 vehicles delivered. The others have also delivered over 10,000 vehicles per month. The remaining rankings are as follows: XPeng with 11,524 vehicles, Li-Xiang with 10,422 vehicles, NIO with 10,052 vehicles, and Jinko with 5,022 vehicles.

Except for Jinko, which has only just started deliveries, the rankings are inversely proportional to the price, for example, the top-ranked Zeekr primarily sells its models for below 100,000 RMB, while NIO, which ranks lower, has the highest average selling price among the several companies.Actually, this is a relatively normal market structure, as Chinese households who can afford car models priced above 300,000 yuan are still a minority.

Looking at the details, the delivery trends of the two main car models, NETA and Leapmotor, in the car companies priced below 200,000 yuan are very similar. Except for the influence of external factors in April and May, they have shown a steady upward trend.

Although both of their main car models are mixed in the mid-to-low-end market, their ambition has never stopped. Both have launched their own flagship car models in the 200,000-300,000 yuan sedan market.

Zero Run C01 has not yet been launched, with a pre-sale price ranging from 180,000 to 270,000 yuan. The versions mainly differ in terms of range and motor performance, still adhering to the previous high cost-performance and unified configuration mode.

On the other hand, the price of NETA S is set at 199,800 to 338,800 yuan. Its power modes include extended range and pure electric, and its drive modes include two-wheel drive and four-wheel drive. There are also three versions differentiated by size under each mode, as well as separate versions featuring laser radar and scissor doors.

However, it is worth noting that among the many versions of NETA S, there is no one version that has multiple configurations at the same time. For example, choosing laser radar means there is no four-wheel drive, and choosing scissor doors means there is no advanced driving assistance at a higher level.

The reason is that the brand power of NETA itself is relatively weak and, therefore, it cannot risk launching a higher-priced car model. Consequently, it hopes to cover consumers’ needs more with different configuration combinations within the designated price range, similar to the product strategy of XPeng at present.

Now let’s look at the top new forces with higher prices, and they also present a similar trend in delivery volume.

Compared to the previous delivery trend of the middle forces, except for April and May, all three of NIO’s models went down in July. Although they still maintain a delivery capacity of more than 10,000 vehicles per month, they are in a declining state month on month.

Looking at the big picture, one reason is that the heat of new energy vehicle models is gradually focusing on those priced below 300,000 yuan. Furthermore, there may be a backlog of orders for the delivery peak reached in June.

But to be more specific, each company has its own difficulties to overcome.

The 2022 versions of NIO’s 886 and ES7 will start delivery in August, while ET7 has produced a few thousand fewer units because of insufficient die-casting supplies. Therefore, NIO currently belongs to the “discontinuation” phase in terms of its products.

According to Li Bin himself, NIO is not facing its most difficult and complex time yet. In August, the third-generation system will be synchronized, and the internal organizational structure is about to be adjusted. However, Li Bin believes that NIO will take a step forward in the fourth quarter.

IDEA is in a similar state. The 2021 model year ONE has been on the market for more than a year. The launch of new models such as the XPENG G9 and the WM MOTOR M7 will directly affect its competitiveness. The potential for a single model to continue to increase sales is not great. To further enhance the overall brand influence, it may be necessary to wait until the delivery of the L9 in August.

According to official data from IDEA, the number of confirmed subscription orders for L9 has exceeded 30,000, and the cumulative number of orders has exceeded 50,000.

Meanwhile, XPENG’s situation is slightly more complicated.

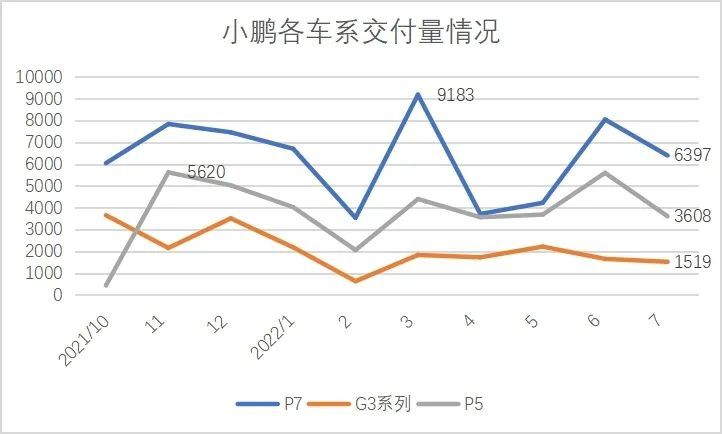

Looking at the recent sales trend, XPENG is also facing the problem of declining model competitiveness. For example, after reaching a delivery peak in March, the P7 has not been stable enough, mainly because of fierce competition in the 200,000-level sedan market.

Both those who want to move up, such as NIO, IDEA, and traditional automakers, and those who want to move down, such as XIAOPENG and ZERO RUN, have set their sights on this market.

At the same time, the P5, which was originally planned to have a large volume, did not make too much of a splash, with the highest delivery volume in November last year reaching 5620 units. This may also be due to the accumulation of orders.

Currently, the XPENG G9 has not yet been officially launched. According to official news, it will accept reservations in August and will be launched in September. The updated P7 from XPENG will also be launched this month. According to current news, it mainly upgrades to the 8155 chip and is equipped with a lidar. The advanced driving assistance function is also the most distinctive competitiveness of XPENG in the current fierce competition environment.

Overall, as the first month of the second half of the year, no car company has demonstrated their true capabilities in July. It is just a half-time break before the final sprint.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.