Ao Ao Hu (Translation)

History tells us that after the feudal dynasties, we should go to sea. After Qin, Han, Tang, Song and Yuan, BYD’s new series “Surname” is the sea.

The earlier small car Dolphin was just a small matter, with a starting price of more than 200,000 yuan, based on the brand-new pure electric E-platform 3.0, and heading straight for Model 3, the seal is the first hard dish of the Ocean series. Despite having no new brands or special badges, the seal is the most eye-catching “high-rise” for BYD in many years.

Interestingly, few people seem to realize that BYD, as a global leader in electric vehicles, a topic of new energy from the automotive market to the stock market, and a dream of surpassing the bend of a rising power, was actually one of the few car companies without a pure electric platform before the launch of the Seal (not counting the ride-sharing exclusive series).

It was not until September last year that BYD released the brand-new E-platform 3.0. Before that, the small car Dolphin was described by the official as “E-platform 3.0 technology support,” but it was still too small in size and too low in price, and did not break away from the BYD image in people’s minds.

The Seal, on the other hand, is completely different. This may be the most hard-working effort by “King Di” in the past decade, and it is also the most different model among BYD models currently on sale.

Terete gas, still BYD

Whether it was the Qin, Tang dynasties that were once dominant, or the Han dynasty that sold out in the past two years, BYD’s dynasty series models have the same feature, catering to fuel, PHEVs, and pure electric. After stopping the sale of fuel vehicles, it was embraced with PHEVs and pure electric. We all remember those familiar suffixes: EV, DM, the latest DM-i, DM-p.

With such a large internal combustion engine position on the front of the car, even if it can be explained with “compatibility and symbiosis” and “synchronous development,” it is clear that it is not a native pure electric platform. To put it nicely, this is to accelerate the speed of research and development and landing, increase part commonality, reduce acquisition and maintenance costs, and achieve twice the result with half the effort through design optimization; to put it badly, let’s not.

In the case of the Seal, based on the completely new E-platform 3.0, it’s changing tracks after running for three days.

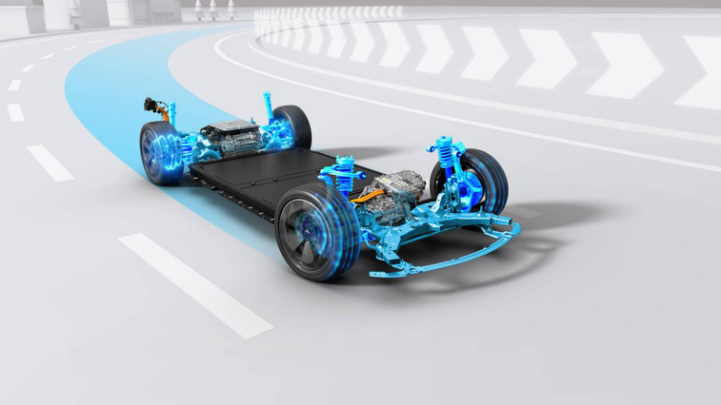

In the past, the most common bottom structure used by BYD’s mid- to high-end cars was the front and rear McPherson (Tang, Han), and this time the Seal was directly upgraded to the front double wishbone and rear five-link structure, which is the first time for BYD, and of course, it is also the most confident configuration of the chassis.If you have been paying attention to high-performance electric vehicle suspensions over the past two years, you will notice that the majority of them are equipped with the same structure. In comparison to the MacPherson strut, the double wishbone has its advantages, while the five-link has become the darling of electric vehicle rear axles. We have discussed the advantages of the double wishbone in “Why the Double Wishbone is Awesome” and “What’s Up with Electric Vehicles and Suspensions?” respectively.

The chassis configuration complements the power requirements, as the HB is the first BYD model to utilize a rear-wheel-drive powertrain as the primary option that supports optional four-wheel drive, now known as the “standard” for high-performance electric vehicles. The rear-drive version employs two types of power: a 150 kW or a 230 kW rear-mounted single motor. The four-wheel-drive version features a 390 kW two-motor setup, with 230 kW in the back and 160 kW in the front. The 0-100 km/h acceleration times are respectively 7.5 seconds, 5.9 seconds, and 3.8 seconds.

Nowadays, a 3.8-second 0-100 km/h time is no longer spectacular when considering the top-of-the-line Han EV had achieved 3.9 seconds a while ago. However, the HB adopts a rear five-link suspension, which makes it more adaptable to the large torque of the rear axle in terms of structure. As a four-wheel-drive with a dual motor, the front 160 kW and the rear 230 kW of the HB are more rear-drive characteristic than the front 180 kW and rear 200 kW of Han EV. Even though the paper specifications are similar, the fundamental structure of the HB is more conducive to performance.

BYD also introduced the iTAC intelligent torque control technology this time, which accurately distributes torque between the front and rear motors to avoid acceleration skidding and other problems. What sets iTAC apart is that it relies on higher-precision motor rotation sensors, rather than wheel speed sensors, as the data source. BYD believes that iTAC can complete actions 50-200 milliseconds earlier.

For the four-wheel-drive model, if you opt for the sport package, BYD will gift you a dedicated super iTAC, which offers new playing methods such as the racing mode and drifting mode, among others- Tesla Model 3 Performance sounds familiar.

As a new platform, the “new” in e-platform 3.0 is embodied by the CTB battery pack, which caused a stir not long ago. As the launch preceded the ZERO RUN C01, and Tesla’s CTC+4680 battery pack has not yet entered the domestic market, BYD CTB became the first mass-produced battery with vehicle body integration technology.BYD’s CTB, as well as Tesla’s and Linglong’s CTC, have integrated the battery pack with the vehicle body structure, respectively removing certain structural redundancies, reducing weight and strengthening the vehicle structure. However, the three companies have different ways of “eliminating redundancies”, each with its own challenges and risks, as detailed in “CTC, CTP, and seal: the entire CTB”. Overall, BYD’s CTB approach is less risky and has been implemented earlier.

CTB also clarifies the identity of the e-platform 3.0 as a pure electric platform. The battery pack can now be integrated with the vehicle body structure with partial floor removal, and the boundaries between it and the previous hybrid platform have been removed. With the CTB method, the blade battery is installed, and the seal’s range is not a concern, with the CLTC’s range being between 550km and 700km, and it supports half-hour fast charging from 30% to 80%.

From the robust front and rear McPherson suspension to the high-performance front double-wishbone/rear five-link; from the shared platform that accommodates the hybrid version to the latest CTC/CTB battery-integrated body in the pure electric platform; from the previous front-wheel drive derived from fuel to the equal front and rear-wheel drive, and then to the seal, which embodies the advantages of the electric vehicle layout with rear-wheel drive as the main focus and performance-oriented four-wheel drive…

The seal is no longer like any previous BYD, but rather like a BYD version of Model 3. Especially when comparing it to Han EV, which is in a similar price range, the seal is a new and “Tesla-fied” BYD. As the latest product targeting Model 3, BYD is learning from Tesla’s technical strengths to compete head-to-head.

With a price range of around RMB 200,000 to 280,000, the seal is priced just below Tesla’s Model 3. This price difference basically meets the public’s expectation for the price difference between Tesla and BYD models of the same level. Therefore, even though the price range of the two does not overlap at all, they can still be seen as a classic ‘displaced competition’ pattern between domestic and foreign brands.

However, before that, the seal will also face an unexpected but expected competitor: Han EV, which is priced almost entirely in the same price range.The reason why Sea Lion is called “BYD’s version of Model 3” instead of “Teslafied Han EV” is that Sea Lion’s size is specifically aimed at the Model 3, especially the (relative) extra-long wheelbase provided by the e-platform 3.0 that is unique to Sea Lion’s pure electric platform models.

Sea Lion and Han EV have the same 2920mm wheelbase. However, because the former is based on a pure electric platform, the wheelbase can be (and needs to be) larger for vehicles of the same length, which in turn allows for shorter vehicle length. Sea Lion’s length of 4800mm is about 100mm longer than the Model 3, making it a slightly larger mid-size car. As an old car based on an oil-electric shared platform, Han EV’s length of 4995mm is surely in the mid-to-large car segment.

Although the length difference is almost one level, the longitudinal passenger space is theoretically similar due to the same wheelbase. Behind these number games, there is a subtle change: BYD has started to try to compete head-to-head with Tesla using a same-level car, not a car that is one level larger.

BYD’s corporate status is climbing rapidly, but its brand value remains relatively weak when it appears as a consumer brand in front of a few people like me. For people like me, BYD is still a self-owned car brand known for its reasonable prices and friendliness, and still has some distance from Tesla, which has at least one foot in the luxury car sector.

Brand upgrading is not an overnight process, and Sea Lion is trying to move the first brick: no longer relying on a larger opponent of the same level, but daring to confront a same-weight opponent. This is of course due to the space liberation gained by switching to a pure electric platform, but not entirely so. Even with e-platform 3.0 (covering wheelbases of 2500-3500mm), the platform fully supports the creation of a mid-to-large car of the same size as Han but with a longer wheelbase- however, BYD doesn’t have it, and it has a trick up its sleeve.

In the ceiling of the sedan market that Han EV has pioneered, Sea Lion has finally become a mid-size car of the same level as the Model 3. It can be understood that BYD is confident enough to sell mid-size cars at the price of their original mid-to-large cars, indicating that BYD can also sell its flagship mid-to-large car at a higher price market that it has never reached before.To put it bluntly, if the BYD Dolphin can remain stable in the price range of RMB 200,000 to 280,000, it means that mid-size sedans and mid-size SUVs based on the e-platform 3.0 are now able to breakthrough in the RMB 300,000 price range, which also means that BYD will raise its sales to reach the level of a quasi-luxury brand.

This is something that independent brands have not dared to imagine for decades, before the rise of new car manufacturers.

“BYD’s bid for the high-end market” has been an industry topic for many years. On one hand, DY fans believe that the company’s technological innovation competes with marketing strategies, and lament that the company’s future is hindered because its children focus solely on learning instead of being more balanced; on the other hand, critics mock that BYD overvalues its products and that its sales priced too high for what it’s worth.

New car development has transformed the landscape of the Chinese automobile industry, making it possible for Chinese brands to sell vehicles that cost tens of thousands of yuan. To the extent that when we typically use the terms “independent brand” and “new car manufacturer” interchangeably, we have a tendency to forget that the likes of Li Xiang and others are still technically independent brands themselves.

Moreover, well-established independent manufacturers are creating high-end brand offshoots such as LYNK & CO, Wey, and Tank, whose models are aimed at the elite market, as well as EV brands Geely’s Geometry and Blue Geely, Smart EV from Great Wall, and Aiways.

This is a time when automobile manufacturers are booming, and an era of high-end independent brand wholesaling. Nowadays, large independent companies need to have at least one or two high-end sub-brands or else they will lose prestige.

Among the country’s major auto manufacturers, only BYD – alongside Changan- have exercised a degree of restraint in not racing to the top end of the market. Changan created Avita, but it was developed in partnership with Huawei and CATL, so it doesn’t quite qualify as an in-house independent high-end offering. Although BYD has expertise in high-end manufacturing, it took some false turns before it reintroduced its high-end brand, the DENZA, which was one of the earliest and most well-resourced of China’s partly self-funded brands.

Avita and the previous DENZA brand have some similarities. Both brands have a superior positioning compared to their parent company’s original brand, making it difficult to market it directly under their primary brands. They also rely on powerful collaborative partners, which to some extent determines the height of their positioning. In this sense, both Changan and BYD face similar challenges, in that there is a large empty space above their primary brands.

Going into 2022, Changan, long known for its independent UNI series of sedans and SUVs, finally launched its true independent high-end sub-brand, the Deep Blue. However, its high-end positioning is still quite restrained, with the Changan prefix still attached to the brand name, and the price is not even that high. Meanwhile, after successfully launching the Wangchao series, BYD remains committed to a strategy emphasizing series, while downplaying brand, launching an Ocean series under the BYD brand umbrella.“`markdown

Not following the trend of Geely and WEY’s autonomous high-endization a few years ago may not be a bad thing for BYD and Changan, after all, neither of them is completely worry-free until today. The high-end sub-brand is a must on the road of China’s automobile rise, but the control of the pace requires decision-making.

The Shenlan SL03 and the Haibao are also considered autonomous high-end, but they are no longer independent and upgraded in pricing, but limited to high-end within the original main sales price range, commonly known as step-by-step advancement. One focuses on extending range, and the other is entirely pure electric. One tops out at two hundred thousand, and the other has a lower limit of two hundred thousand. Although there will be competition where there is overlap, the similarity in the paths and strides of the two based on their respective current situations is also to be admired.

Shenlan is the product of the UNI series’ smooth progress, and the philosophy of simultaneously extending range and considering pure electric is based on Changan’s existing basic platform. Haibao, on the other hand, is a continuation of Han EV’s success, and now that the pure electric platform has brought “benefits,” BYD chooses to realize its potential for further high-endization in the future, rather than being satisfied with strengthening its position in the current price range. It is probably because the foundation of the Han series is stable enough.

Whether the mentality is to welcome the king’s arrival or to wait and see the joke, people have long awaited BYD’s bold move. The hidden high-endization of Haibao is letting BYD and us have a clear idea about the consumer groups of BYD’s brand, how many of them are willing to pay for higher quality? BYD, which was once able to gain market share solely through internal combustion-electricity synergy, how much incremental growth can it achieve after switching to a pure electric platform?

Haibao still carries BYD’s banner but is truly charging upwards.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.