Author: Zhu Yulong

By now, I believe everyone knows about the incident with Diess of Volkswagen Group. The deeper reason behind it is the relatively sluggish state of the European economy and automotive industry.

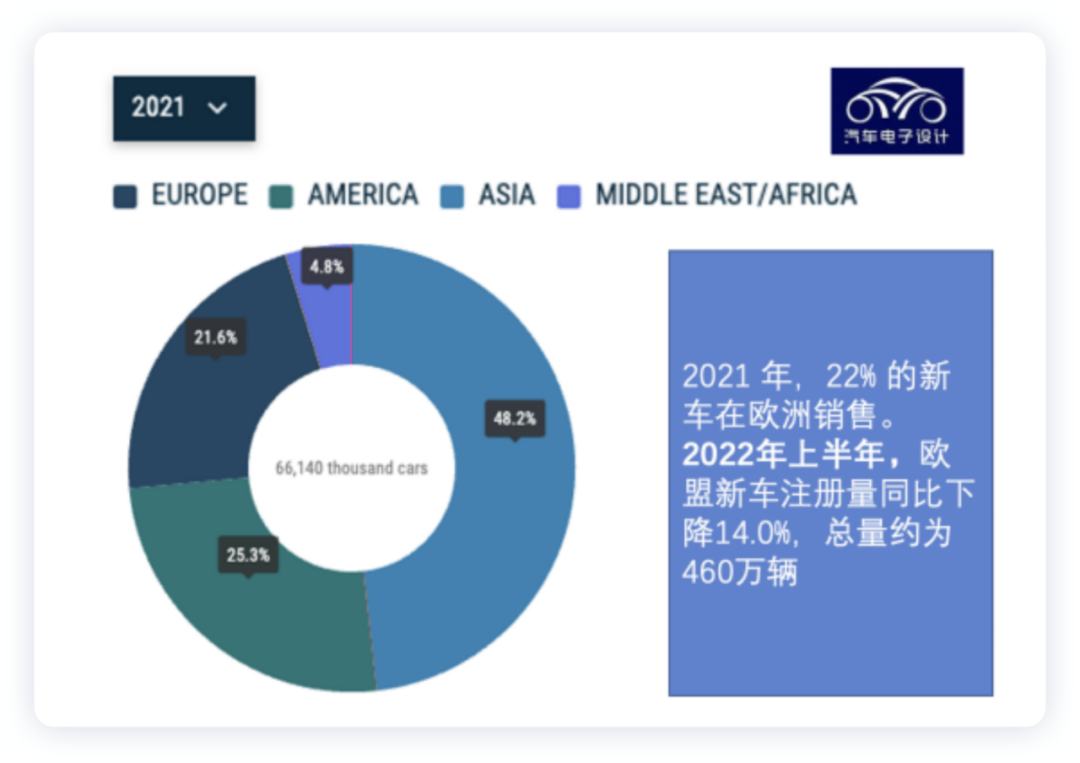

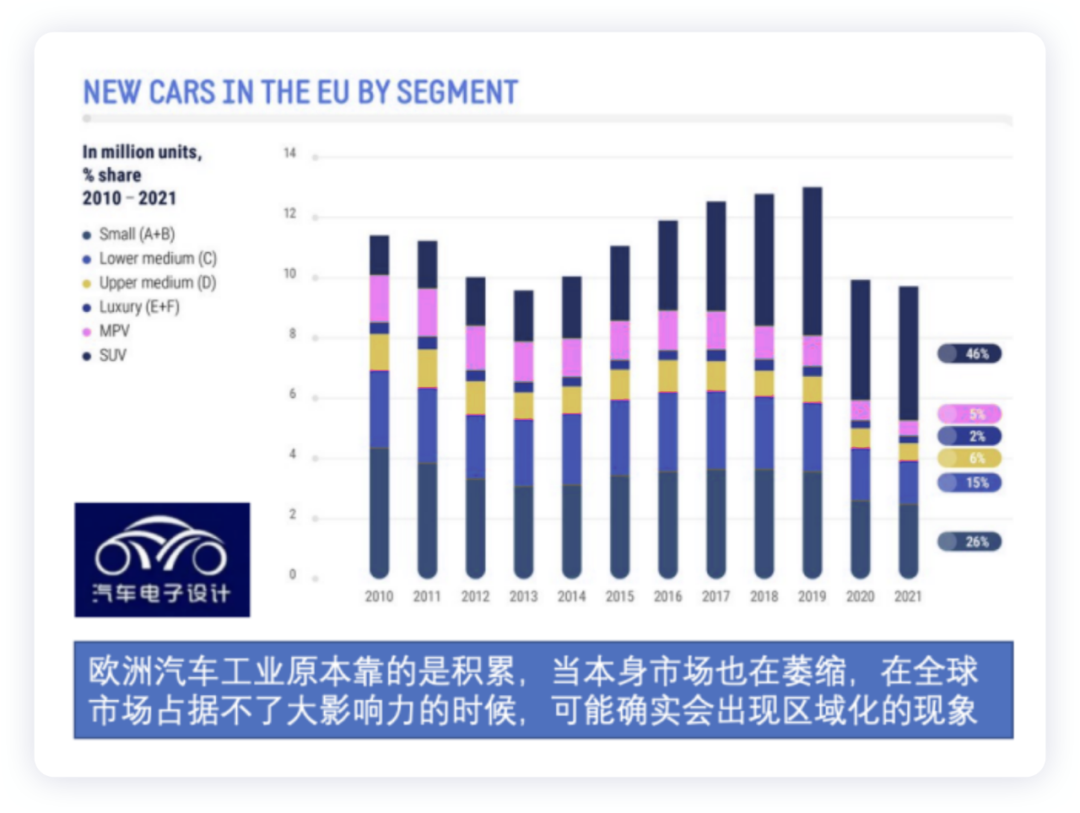

In the first half of 2022, the total car sales in Europe (including EU, UK, and the Nordic countries) were 5,597,656, compared to 6,485,862 in 2021 and approximately 8.5 million in 2019. In other words, the number decreased by 3 million compared to the better period in Europe. Under the influence of the entire economic cycle, it cannot simply be explained by the shortage of chips.

Sales of New Energy Vehicles

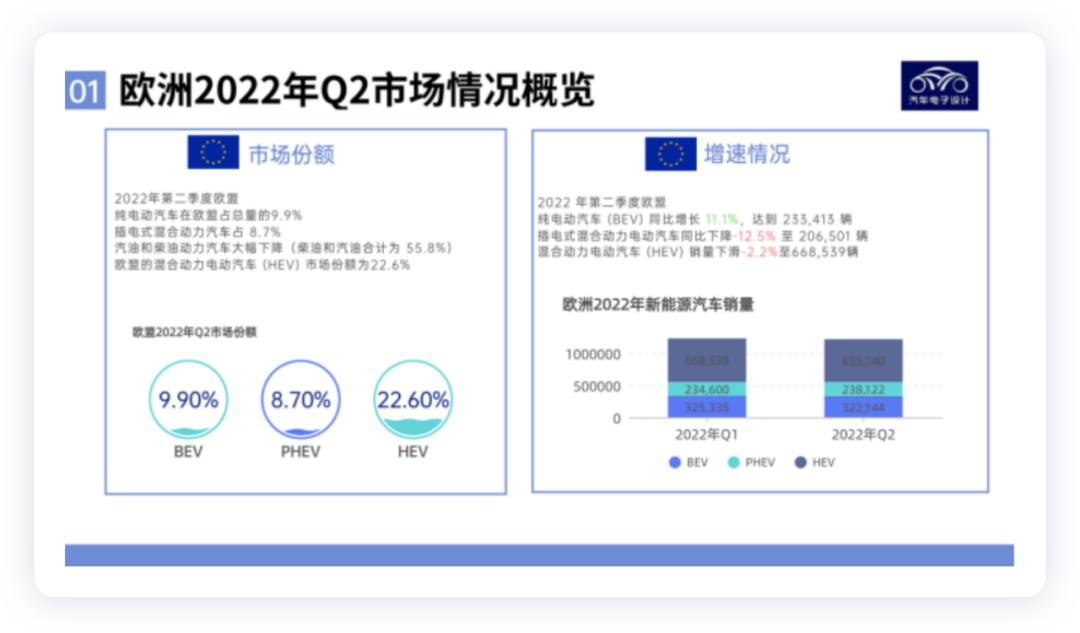

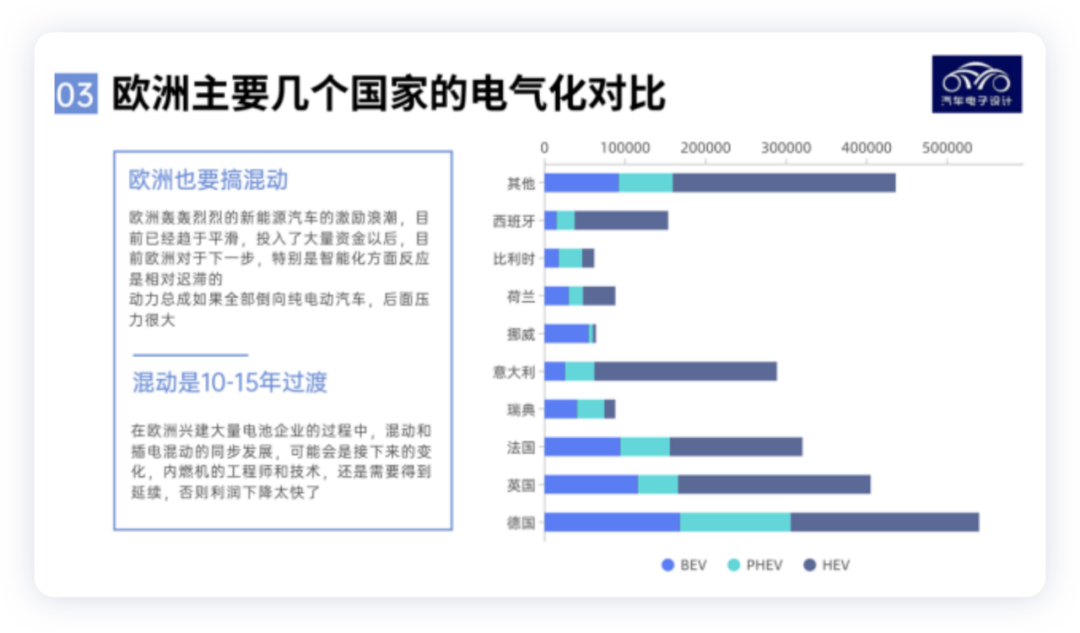

Compared to the overall market slump, the total situation of new energy vehicles and hybrid vehicles is still acceptable. Pure electric vehicles account for less than 10% in Q2, and hybrids account for 22.6%. In the process of declining base figures, electric vehicles are still popular under high oil prices. However, we can see that the year-on-year growth rate has also slowed down.

-

The year-on-year growth of pure electric vehicles (BEV) reached 11.1%, with 233,413 units sold.

-

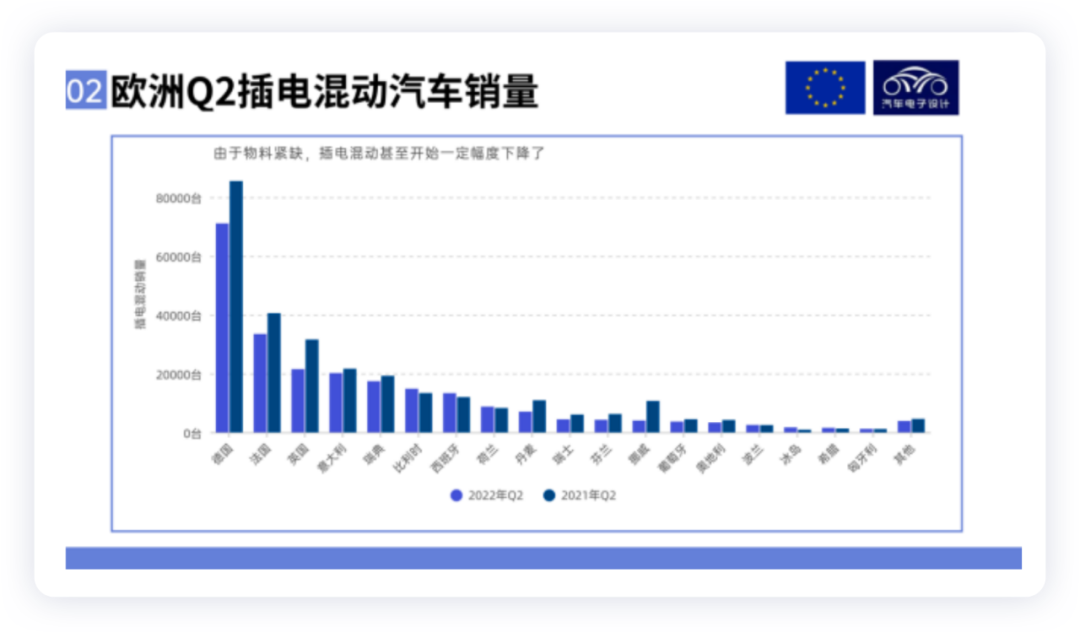

The year-on-year sales of plug-in hybrid electric vehicles decreased by 12.5% to 206,501 units.

-

Hybrid electric vehicle (HEV) sales declined by 2.2% to 668,539 units.

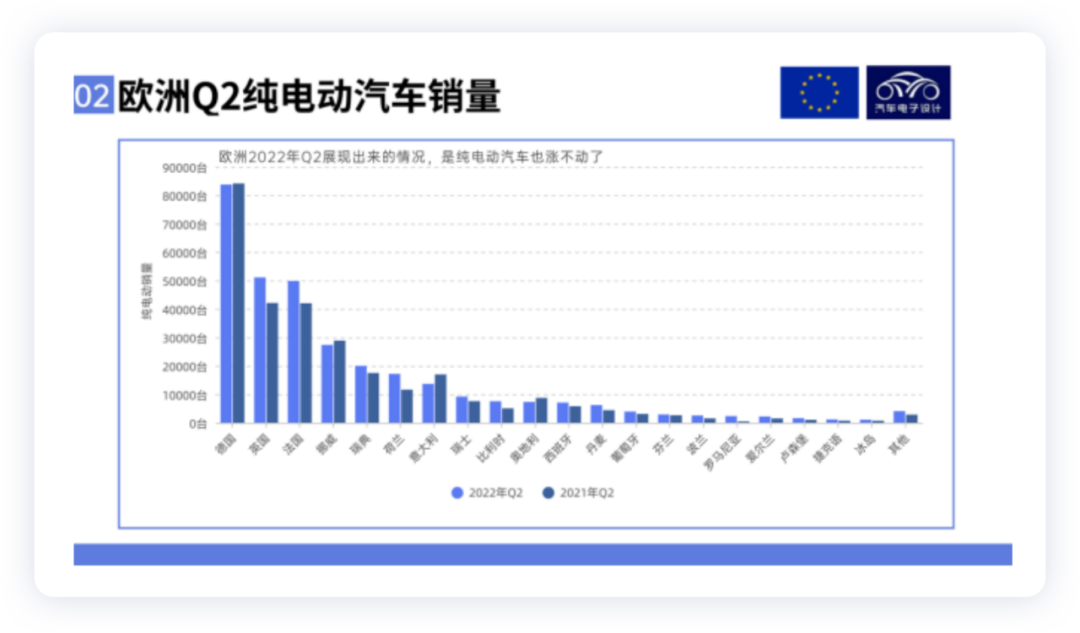

If we look at it from a country perspective, pure electric vehicles have begun to grow steadily in larger markets such as Germany, the UK, and France, as well as a slight decline in saturated markets such as Norway.

The situation of plug-in hybrids is even worse, with significant declines in major markets.

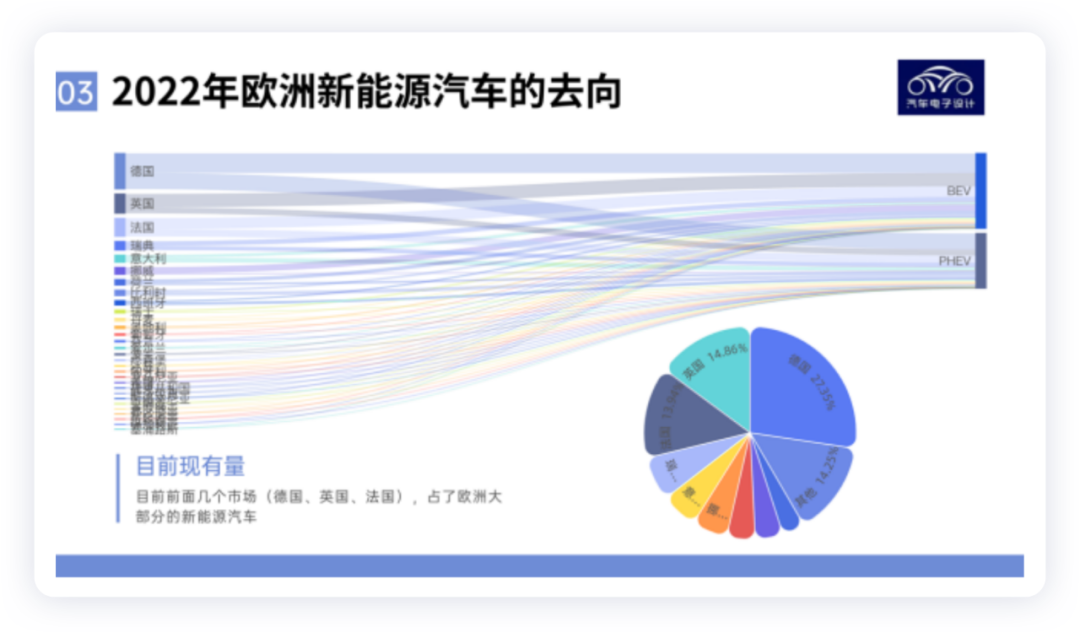

A larger problem is that the sales proportion of several main countries in Europe in the first half of 2022 is too high.

-

Germany 27.35%

-

UK 14.86%

-

France 13.94%

As of now, in these major markets, the demand for hybrids exceeds that of pure electric vehicles. If we categorize hybrid, plug-in hybrid, and range extender as one category, it is impossible to switch to a pure electric vehicle route before establishing battery production capacity in Europe. European batteries are more expensive than those in China, and the proportion of lithium iron phosphate is lower. From the dynamics of the market, subsidies still occupy the main supporting force.

What’s Next for the European Automotive Industry?

Let’s take a look at some numbers. The current contradiction is not only about how companies develop, but also about what happens to the companies in the industry chain behind them.

12.7 million Europeans (directly and indirectly) work in the automotive industry, accounting for 6.6% of all jobs in the EU.

-

The automotive industry accounts for 11.5% of manufacturing jobs in the EU, about 3.5 million.

-

Motor vehicles have brought 398.4 billion euros in tax revenue to governments in Europe.

-

The automotive industry has created a trade surplus of 76.3 billion euros for the EU.

-

The turnover generated by the automotive industry accounts for more than 8% of the EU’s GDP.

In such a development process, the most a country can do is to develop the industry as much as possible and push enterprises to be more enterprising at key points. When a big technological change occurs, employment and economy, the two most important aspects, cannot be solved by just a few entrepreneurs.

As French and Korean cars become less and less common in China, Japanese and German car series still remain relatively strong. Looking ahead for 5-10 years, the influence of the European automotive industry in China will also gradually decline. With the export of Chinese cars, I think that the collision of powerful enterprises within the economic system is inevitable.

Summary: I think that the Chinese automotive industry will continue to dominate the global market through the development of new energy vehicles and intelligent technology within the next 5-10 years. This trend is expected to remain unchanged and may prove challenging for other countries’ automotive industries.

Summary: I think that the Chinese automotive industry will continue to dominate the global market through the development of new energy vehicles and intelligent technology within the next 5-10 years. This trend is expected to remain unchanged and may prove challenging for other countries’ automotive industries.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.