Author: Ding Qi, et al.

“Charging Talks” is a live streaming program co-initiated by Tencent Technology, Power Plants, Photon Planet, and Future Auto Daily, focusing on the hot topics, technologies, and trends of new energy and intelligent automotive industries. The program airs every Tuesday at 20:00 sharp.

Key Takeaways

-

Truth 1: The choice of Tesla Model 3 for teardown is not only because of its revolutionary nature, but also considering cost issues.

-

Truth 2: The overall design concept and iterative design cannot be perceived until teardown.

-

Truth 3: The new energy industry is similar to the mobile phone industry, but its ecological capacity is inferior.

-

Truth 4: Tesla maximizes profit margins through architecture and overall design.

-

Truth 5: Tesla’s cabin design concept is more like a PC, emphasizing entertainment scenarios.

-

Truth 6: It is challenging to implement visual assisted driving. Other automakers prefer to use lidar for overtaking on curves.

-

Truth 7: The sales of new energy vehicles by traditional automakers are dismal, mainly due to the strong demand for traditional fuel vehicles.

-

Truth 8: The importance of automotive electronics will continue to increase, and new components are more expensive than traditional ones.

Overview

The smart electric vehicle industry in China is booming, and the domestic sales of new energy vehicles are expected to exceed 6 million this year, with a penetration rate of 27.4% in June. At the same time, the ADAS penetration rate of domestic independent brand vehicles has reached 33.9%.

To better study the trend of intelligent electric vehicle development, CITIC Securities TMT+Auto Team spent two months on-site dismantling the iconic Tesla Model 3 Standard Range Plus and released the report “Insights from Tesla Model 3 teardown: Trends in intelligent electric vehicle development.” This report has a strong lineup and comprehensive research, quickly becoming popular in the industry.

The report provides a detailed and in-depth analysis of Tesla’s E/E architecture, batteries, thermal management, and body, demonstrating the thinking of Tesla as a global leading automaker in the intelligent electrification of automobiles and clarifying the possible directions of subsequent industry development, better supporting related decision-making.

So, what is the original intention of creating this report? What secrets were discovered through the teardown of Tesla’s Model 3, and what is the current situation of the new energy industry?On July 19th at 20:00, the first episode of “Youdian Dialogue” invited Ding Qi, Senior Vice President at CITIC Securities Research and responsible for the Model 3 dismantling report, to discuss the initial intention of dismantling the Model 3, and interpret the current situation and future of the intelligent electric vehicle industry with Gao Yulei, founder of Dianchang, and Wang Pan, founder of Guangzi Planet, in an online live broadcast.

The following is a summary of the highlights of the live broadcast

How to choose the target model and dismantling partners

Gao Yulei: Why choose Tesla Model 3?

Ding Qi: Tesla is the most watched car company in the whole capital market and industry. Among all the cars, Model S and Model X have little significance in terms of dismantling because many of their structures are not very different from old car models. For example, the electronic and electrical architecture of Model X and Model S still use a distributed structure with many microcontrollers, but the current E/E architecture is moving towards integration and began using domain controllers from Model 3, which congregates all microcontrollers together, similar to having several computers on board, including the thermal management system, etc. Compared with previous products, Model 3 is completely different.

Tesla has truly undergone a transformation starting from Model 3. It is not just an electric car, but also takes a big step towards intelligentization, and has begun to be seen as a competitor by traditional car manufacturers. This is the important reason why we chose it. We also conducted a careful study on Model Y. However, the cost of Model Y is higher, which is the first issue to consider. Compared with other models, such as Model Y, although it has a larger sales volume, fundamentally speaking, there has been no revolutionary change in either battery or electronic architecture, just like how even though there are many generations of iPhones, only iPhone 4 was the revolutionary beginning. Model Y can be thought of as iPhone 5, with a larger screen. Therefore, it is not necessary to dismantle the latest iPhone 5, but to study iPhone 4.

Gao Yulei: I noticed that you have several partners, what roles do they play?

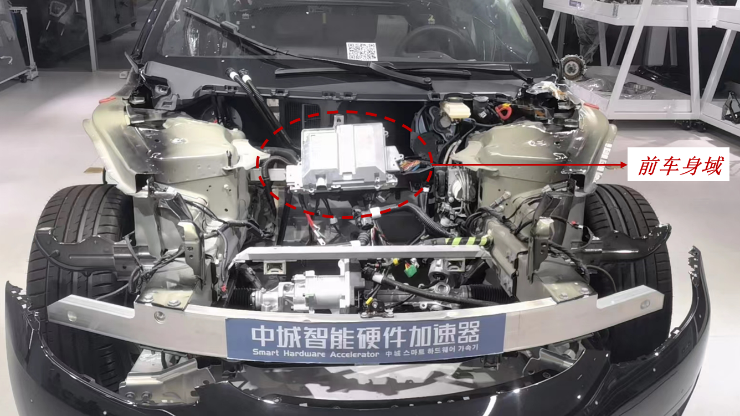

Ding Qi: Zhongcheng Intelligent Hardware Accelerator is the main direction of the dismantling, and also bears the main cost. They are relatively more experienced, and have a deeper understanding of the industry chain, macro market, and dismantling technology than us, so we work with them in this project. The advantage of a securities firm is a full-chain analysis of the industry.In the whole process, we naturally encounter various challenges. Although we have seen single-chip microcomputers like ECU, for the domain controller mentioned earlier, it is like a big computer, and we cooperated with Lingworld Technology, a professional enterprise specializing in domain controllers analysis.

AutoAI is responsible for the technical interpretation of the cabin and driving. They have a background in ZTE Communications because there needs to be communication in the cabin. Titanium and Barren are responsible for the analysis of electronic components. Of course, this includes my previous disassembly experience. I disassembled a 5G base station in 2019, as well as a Lidar.

Gao Yulei: Have you heard of XPeng and Ideal, have they taken apart a Tesla car before?

Ding Qi: It’s hard to judge. But generally speaking, everyone will analyze their competitors, and disassembling cars is also a way of research. In the traditional automobile market, everyone disassembles each other because this is a to-c product. Whether these three companies will disassemble Tesla, we don’t know.

Disassembly Experience: Leading-edge Integrated Design, Iterative Concept

Gao Yulei: What is your biggest impression after disassembling the car as a whole?

Ding Qi: I am still very shocked because it was leading edge at that time in 2018. Its pioneering features are mainly in these aspects –

First, as a latecomer, it has no historical burden, so many things can be designed as a whole. For example, the temperature control of the car. The parts that need temperature control on most cars (such as the cabin, batteries, and motor) are divided into different businesses for each management. But Tesla uses eight-way valves, as in the principle of the human heart pumping blood, to achieve an integrated design. Specifically, it can reduce the conversion efficiency of the motor by 75%. The heat emitted can be transported to the battery along the pipeline, which is equivalent to saving a heating plate. The cabin can also be heated through the motor or battery.

Then there is electronics and electricity. In the past, the electronics and electricity of the car body were responsible for different suppliers, but if modern cars want to go towards intelligence, the core concept that we need to emphasize is sustainable iteration and continuous upgrade based on user feedback and behavior habits. However, it is difficult to achieve this by splicing these single-chip microcomputers together to form a complete machine. Therefore, Tesla took the first step in making changes to this car’s electronics and electricity architecture.Translate the following Chinese text into English Markdown text, in a professional manner, keeping the HTML tags within Markdown and only outputting the result.

And take the example of a mobile phone, if the front camera, rear camera, microphone, and other components are all provided by different manufacturers to deliver a soft/hard integrated product, how can they push a new version to you every now and then? The reason why mobile phones can iterate so fast is because they have a unified computing power platform, where computing power can be centralized, and software can be platformized. Therefore, the automotive industry will inevitably follow the path of mobile phones. A typical case is that many new employees hired by vehicle companies are not from engineering and mechanical backgrounds, but from the electronic and software fields.

However, regardless of how it is, it is Tesla that takes the lead in this step. Although we have read relevant analysis before, it still amazes us during the dismantling process. But currently, many of our automakers, especially new forces, are getting closer and closer in this regard.

Wang Pan: Your report has sparked a lot of discussion, and some people have questioned how much of the report could only be obtained through dismantling, or what non-public information did you get through dismantling?

Ding Qi: The biggest feeling we got from this dismantling is that we can view the problem with a holistic view. Usually, when we do research, we only look at one part, such as the domain controller, speed limiter, connector, etc. Only through complete dismantling can we understand the relationship between the three in a holistic way.

We believe that dismantling can help to understand this vehicle from a macroscopic point of view. I believe that many content, which we sit at home can be written, but it will lack a holistic view. You can clearly feel it from the first few chapters and the later chapters of the report. We have a comprehensive understanding of this thing. It can be described using the term used in martial arts novels: “Opening up the Ren and Du meridians”.

New energy vehicles are like mobile phones, but their ecological capabilities are still inadequate

Gao Yulei: Sometimes I feel that new energy vehicles are very similar to mobile phones, and Tesla is like the iPhone in mobile phones, while other cars are like Android phones.

Ding Qi: It is similar to mobile phones in some ways and different in others.

Android was originally a software package that dominated the market excluding iPhone because of its large number of apps in the app store, there are about 2.8 million apps, which is a very strong ecosystem, and any new ecosystems are difficult to grow without finding so many app developers. Maybe the challenge in the future will only be from HarmonyOS.

Ecosystems like Android are difficult to disrupt, but it is relatively less difficult to disrupt software. I don’t think the concentration of car software will be as high as that of mobile phones, especially now the car code is up to 100 million lines. Runnning so many lines of code effectively is also challenging, and more difficult lies in development, management, and continuous quality user experience.

Wang Pan: We often compare cars to mobile phones, such as traditional automakers are like Motorola and Nokia, and new forces are like Apple. What do you think of this kind of view?Ding Qi: I don’t think the two can be directly compared. Brands like Nokia did not lose in terms of quality control or design, but rather fell behind in terms of ecosystem. However, the automobile industry does not have such a strong ecosystem and thus its iteration is much slower than that of smartphones. Of course, the core control points of automobiles will gradually shift towards software and electronics in the future. Not everyone can complete this transformation, but some definitely can. Therefore, it mainly depends on whether you are willing to learn, how fast you can learn, and whether you have the courage and determination to make the change.

In addition, another characteristic of smartphones is that their hardware is becoming increasingly homogeneous, while cars will continue to bring more segmentation to the market. For example, if you want to buy a coupe, an SUV cannot be turned into a coupe. While software has indeed consumed smartphones, software cannot completely consume automobiles. Therefore, as a product that combines software and hardware, automobiles still have many things that need to be achieved through hardware, which will bring more opportunities to car manufacturers.

Tesla achieves maximum profit margin through overall design

Gao Yulei: We know that Tesla’s gross profit margin is 38%, while other new players are basically operating at a loss. Have you analyzed the relationship between their car architecture and the overall gross profit margin during this disassembly process?

Ding Qi: Yes, we have performed an analysis. Tesla is actually very strict in its cost control during its design process and tries to save wherever possible.

For example, if two PCBs can be combined, then no raw materials will be wasted. Another example is to save the cost of the wiring harness through domain controllers. Also, upgrading from a single-chip structure to a domain controller structure may cost the same as three PCs but it will be cheaper than more than 100 single chips. Tesla’s design considers both the durability of application iteration and cost control through centralization, so its high gross profit margin is also achieved through architectural design. Our research report presents many of its PCB details, such as how its domain controller is designed.

On the other hand, making money by achieving large sales volume is a crucial factor for Tesla. Three years ago, without the construction of a super factory in China, Tesla would not have been profitable. The automobile industry requires a certain scale to make money, because R&D investment is high, and depreciation and amortization investment is also high. I also believe that Chinese automakers will make money after surpassing the hurdle of 300,000 to 500,000 units, but we need to see who can get there first.

Another high-gross-profit brand worth mentioning is NIO. NIO actually follows the model of Apple, rather than Tesla. Firstly, it targets a relatively high-end customer group. Secondly, its sales philosophy of selling a single product dilutes its research and development costs. Therefore, its high gross profit margin is a rather normal phenomenon.

Tesla’s cabin design philosophy is more like a PC, emphasizing entertainment-oriented scenarios

Wang Pan: The report mentioned the cabin and believes that Tesla regards the cabin more like a PC than a smartphone. How should we understand this?

Ding Qi: Most car companies understand the cabin as a smartphone, so they use Qualcomm’s Snapdragon 8155 chip, which has been very popular in this industry and has a high market share. If you view the cabin as a smartphone, it may naturally suggest using Qualcomm chips, which could skip the tuning work of the ecosystem for APPs and bring the ecosystem of smartphones over. However, I think Tesla’s understanding of this thing is different – look at what Tesla has done in terms of promotion? Cyberpunk and rumors of introducing the Steam platform suggest it is more geared towards entertainment-oriented revamping than running in various life scenarios like a smartphone.

Our generation uses Intel’s A3950, while Tesla’s next generation uses AMD chips, which is the same model as the Xbox. Smartphones can be used in a variety of scenarios, but Tesla might be more of an entertainment-centric scenario, so naturally, AMD Ryzen was used, followed by the introduction of large games, so its orientation is towards this direction, and no other car company is doing this yet. It’s very interesting, and you can’t say this approach is right, and you can’t say it’s wrong.

Gao Yulei: Can we understand that Tesla actually provides a lot of performance redundancy software in automotive chips for future upgrades?

Ding Qi: Whether Tesla uses Intel or AMD chips, they are all based on the X86 architecture. The Tesla cabin uses Linux, and it’s very convenient to run Linux on X86 architecture. Linux is worse than Android’s ecosystem, but by 2025, it may be different.

Tesla’s driving also runs on Linux. Why did they do this? Because many AI models are trained based on Linux, and by 2025, it is possible to integrate the cabin and driving. Bosch and Qualcomm are both discussing this. Once the two are combined, the instrument panel and central control can be solved because they are both Linux, so multiple operating systems or virtual machines are not required. However, many manufacturers use a hypervisor virtual machine. I think the integration of the cabin and driving is also one of the considerations for adopting the X86 solution. But no matter whether it is benchmarked against a PC or a smartphone, it cannot be determined who is leading and who is more advanced because it’s far from the end game. Whether we mainly play games or use it like a smartphone in the car depends on how many applications are needed in this scenario. Once it is proved that various scenarios can be applied in the car in the future, Tesla can switch to ARM chips.

Vision-based self-driving solution is very difficult, and LIDAR can quickly catch up with the gap.Wang Pan: When disassembling the FSD chip, I suppose one might have had the thought of why using a visual solution instead of a LIDAR. It seems that there hasn’t been a consensus on which solution represents the future.

Ding Qi: Tesla’s pure visual solution is a highly challenging approach. Regardless, vision is always 2D and a 3D space needs to be calculated through repetitive 2D calculations. For instance, a security camera only requires 99.5% accuracy, whereas driving requires 99.9999% accuracy. If encountering cases where the algorithm can’t be calculated, such as the previous Tesla collision case, it means challenges are met when using 2D to calculate 3D.

We don’t know if they intend to continue on this path, but the key is to continually converge corner cases, even the most top-notch AI scientists may be unable to answer.

As for other car manufacturers, it is difficult to pursue this approach, while Tesla is already leading, whereas the addition of a LIDAR can quickly narrow the gap. Therefore, more companies tend to lean towards the LIDAR approach.

The importance of automotive electronics will continue to increase, new components are expensive, and sales are not the only indicator.

Gao Yulei: Do you predict which areas or companies will increase in importance, or benefit more in the future new energy industry chain?

Ding Qi: Many related cabin components have already been localized, such as wiring harnesses and connectors. However, our report mentions that the chips on top of the three boards have not been localized yet.

From another perspective, I believe that Chinese companies have many opportunities in the field of automotive electronics. Furthermore, chip development in China has grown rapidly in recent years. Considering different temperature and durability requirements for chips in various industries, once the consumer electronics sector has made a breakthrough, the relatively low-threshold industrial sector will not be an issue, including the automotive electronics sector. Therefore, the trend in the future is definitely towards automotive electronics.

Secondly, in low market share areas, such as connectors and domain controllers, Chinese companies are beginning to enter, and their market share in this direction will continue to increase in the future.

Wang Pan: In your opinion, which aspects of domestic production are relatively close to Tesla, and which have obvious gaps?

Ding Qi: Our so-called leadership is actually based on the dimension of time. Tesla is still ahead of us in many areas, but we are approaching in the areas of domain controllers and thermal management design, that are where Tesla first started. So the gap between us and Tesla is definitely still there, but it is gradually narrowing. The first movers certainly have their advantages, while sales can provide us with an answer as to who is closer and who is farther from Tesla.

Wang Pan: Speaking of the issue of sales, BYD’s sales have surpassed Tesla’s in the first half of this year, does this imply that BYD has accumulated more technology than Tesla?

(Note: Nothing needs to be corrected or improved in this question.)Ding Qi: Sales volume is certainly a reference indicator, but not the only one. For example, Apple does not sell as much as Samsung and Xiaomi. On the other hand, gross profit margin can also be used as a reference dimension. How much premium it can sell reflects to a certain extent what people think of it.

Wang Pan: For new energy vehicles, in addition to the high cost of core components such as batteries and chips, are there any other components that account for a high proportion of the overall cost of the whole vehicle?

Ding Qi: We are of course also concerned about this issue of value. In addition to the high value of batteries, we will see many new and expensive components. For example, domain controllers, LiDARs, and linear chassis are clearly an increment and something that we need to pay attention to when dismantling.

Traditional car companies with poor sales of new energy vehicles, essentially still too focused on their traditional business

Gao Yulei: From the perspective of domestic sales, the sales of electric vehicles from traditional automakers have always been poor, making it difficult to reach the targets set for their own transition. What is your opinion?

Ding Qi: I think everyone may not be that urgent. Because no matter how much electric vehicle sales are, fuel vehicles are still a very, very large market. The main obstacle for traditional fuel vehicles was in the engine and transmission, and after transitioning to electric vehicles, the barriers have decreased significantly. There will not be too much differentiation, and innovation will be on the intelligent cockpit, driving experience, and other areas. The threshold of the whole racecourse will also switch. So under the premise that the original pie is still so large, they will not be in a hurry to do this.

We need to look at how fast electrification is being promoted in Europe and the United States, then we can look at the corresponding markets. Traditional car companies may be more sensitive to the local market and their layout in this area may be more informative.

Gao Yulei: In the field of traditional fuel vehicles, Chinese companies are unlikely to have a chance to surpass these luxury cars and big brands. However, in electric vehicles, because the barriers to entry in hardware and software are not as high, the barriers are not so strict, giving them the opportunity to rise locally.

Ding Qi: Yes, this is basically recognized by all automakers. The threshold of internal combustion engines and transmissions has been calculated over decades. It will take a long time to catch up. China is already relatively strong in electric motors. The production of electric motors is much easier than that of internal combustion engines. Therefore, when the electric vehicle market emerged, Chinese manufacturers flocked to it. In this process, the properties of electronics will become more and more important, and the properties of traditional automobiles will become less. In addition, China’s batteries are also very strong, so it is not surprising that China’s electric vehicle industry can rise.

Wang Pan: I have always had a view that sometimes the factor that made you successful in the previous era might become a hindrance to your success in the next era.Ding Qi: Every enterprise that undergoes transformation will encounter such a problem, that is, the original market share is too large. So, naturally, everyone would hope to keep the original market share. When facing new things and a new wave, it is natural to have resistance. I think this is a very normal phenomenon. In fact, we can see similar situations in many industries, whether it is mobile phones or tablets.

I think automobile enterprises in various countries will attach great importance to this process, and it is not like mobile phones, where the window of opportunity is only two years. You can see that the surviving mobile phone manufacturers in China are those who came out during that time window. I think the window of opportunity for automobiles will be a bit longer. Android quickly dominated the market in just two or three years. But who will dominate the automobile market? It is still early and difficult to see. I think the automobile industry has a longer window of opportunity. So, there is more time for them to accept these new things and catch up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.

![[Overview] Electric Dialogue Episode 01 | Disassembling a Tesla, Revealing 8 Truths About New Energy Industry.](https://upload.42how.com/en/2023/03/20230313064230721.png)