Author: Michelin

Do you still remember Elon Musk’s bold statement from a year ago during the earnings call, “I’m done with the earnings calls. They’re so boring“? However, he has almost attended every earnings call since then, including the Q2 2022 earnings call that ended on the morning of July 21.

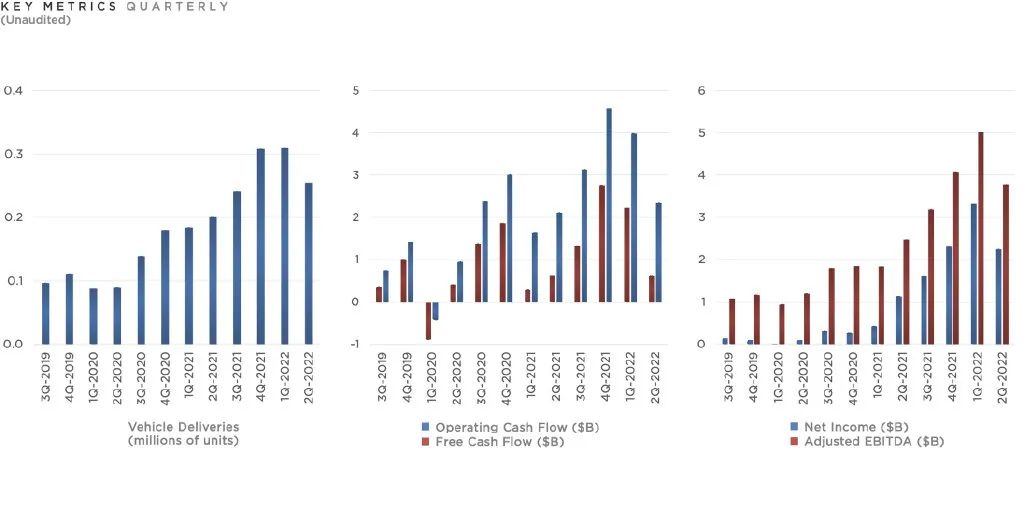

As he said himself, “If we only have good news to share, I will not participate in a call“. Looking at Tesla’s performance in the past quarter on paper, it is indeed not as good as before. After all, the data showing a decline in this quarter, following several consecutive quarters of “best in history” and continuous growth, looks particularly noticeable.

However, regardless of the reasons behind the second quarter’s production shutdowns and delivery declines, which everyone is well aware of, it is not the fault of any particular automaker. Therefore, compared to the temporary fluctuations in data, in this earnings call, we seem to be more concerned about the production recovery situation, how the performance will be in the second half of the year, and what new things Tesla has done in the past few months.

For example, a year ago, I was still using my fingers to calculate that Tesla could produce a maximum of 1.1 million cars a year. Unknowingly, Tesla’s global production capacity has almost reached 2 million now. How did they do it?

Let’s take a closer look at the earnings report.

The expected brief decline

In April, when Shanghai was hit the hardest by the pandemic, Tesla had more than half a month of production shutdowns, resulting in a delivery volume of only over 1,500 vehicles in China that month.

Although manufacturing rebounded in May and June, with the Model Y setting its own historical production record of 52,000 vehicles delivered in a single month, the overall revenue and profit for the second quarter were affected to some extent. The decline in various data was expected.

Due to the impact of bottoming out in car production and deliveries in April, the automotive business accounted for 86.2% of the total revenue in the second quarter, a decrease of 3.7% compared to the previous quarter. Tesla’s overall pre-tax net profit for the second quarter was $2.3 billion with a net profit margin of 14.6%, a 4.6% decrease from the previous quarter’s 19.2%, and the overall gross profit for the quarter reached $4.23 billion. To hedge against the uncertainty of the pandemic and the recent volatile fluctuations of Bitcoin, Tesla sold 75% of its Bitcoin holdings in this quarter.

The decline in gross profit naturally affected the profit margin. Compared to the sky-high gross profit margin of 30%+ in previous quarters, Tesla’s gross profit margin per vehicle for the second quarter was 27.9%., a drop of nearly 5%.Due to factors such as the epidemic shutdown, supply chain shortages, and the soaring prices of raw materials caused by wars and inflation in the second quarter, new energy vehicles from various manufacturers have raised their prices one after another in the past few months, including the Model 3 and Model Y in both China and the United States.

Despite facing various unfavorable factors, Tesla’s gross margin is still close to 28%, leaving many emerging forces struggling on the profitability edge and traditional car companies far behind. In addition to the scale effect, this is also due to the improvement in efficiency, such as the use of giant integrated die-casting machines, which have replaced 70% of welding robots on early Model 3 production lines and reduced workshop area by two-thirds. While Volkswagen CEO Diess was still planning to optimize the production line plan and cut jobs, Tesla has even started to “cut” robots. I wonder how many robots will be “laid off” when Musk’s Optimus enters car production.

Of course, with a gross margin of 28%, or even 30%, as a bottom line, it is no wonder that Musk recently stated that “we will lower the price at some point”, as the price has increased several times over the past year. We just don’t know if friends who plan to buy a car recently can wait for the price reduction of Tesla this year.

Unnoticed Capacity Growth: Can Tesla Deliver 2 Million Vehicles by 2023?

In the New Year outlook for Tesla by various media and institutions at the beginning of the year, one question cannot be avoided: how many cars can Tesla sell this year, 1.2 million? 1.5 million?

Half of 2022 has already passed, and it should be relatively accurate to estimate the delivery volume for this year at this time.

In the just-concluded second quarter, Tesla’s total production volume was 258,580 vehicles, and deliveries were 254,690 vehicles, including 16,160 Model S/X and 238,530 Model 3/Y. The global average inventory cycle was 4 days. Although the inventory cycle increased by one day from the previous quarter’s 3 days, currently the cars are still being chased by production capacity. Once the cars come off the production line, they are immediately prepared to be shipped and delivered to users worldwide.Basically, Tesla’s ability to deliver cars depends on how many cars it can produce. So how many cars can Tesla produce currently?

According to Musk’s remarks during a conference call, the production capacity of Tesla’s Texas Austin and Germany Berlin factories climbed to over 250,000 vehicles per year in the second quarter, while the California factory can produce 650,000 vehicles per year. As for the Shanghai Gigafactory, which serves as an export hub, after optimizing its production lines, its current production capacity has reached 750,000 vehicles, making it the largest of the four factories.

In 2021, almost one-third of Tesla’s quarterly vehicle supply to Europe and surrounding regions came from the Shanghai factory, which has become Tesla’s global export hub. With the increase in production capacity of the Berlin and Texas factories, and the expansion of the Shanghai factory to 750,000 vehicles per year, the time for Tesla owners in China to wait for their vehicles may be shortened.

After looking at the production capacity of each factory, let’s do some addition. According to Tesla’s data, the company can produce 950,000 vehicles in the second half of the year. Adding the 564,000 vehicles delivered in the first half of the year, it should be no problem for the company to achieve Musk’s goal of 50% annual growth and deliver 1.5 million vehicles.

In Musk’s opinion, a capacity of 1.5 million vehicles is clearly not enough. He said that by the end of the year, the company will produce 40,000 cars per week. With 52 weeks in a year, Tesla’s production capacity will exceed 2 million vehicles next year. Keep in mind that the global annual sales volume of BBA is currently hovering around 2 million vehicles.

Although it seems that 2 million vehicles are still far from Musk’s promise of “20 million electric vehicles,” it is still a remarkable speed that the company achieved the goal through four models in just one year, from delivering 936,000 vehicles in 2020 to a production capacity exceeding 2 million vehicles in 2023.

Of course, all of this is based on the assumption that the supply chain will not be affected and that the pace of production and life will not be disrupted by the epidemic.## “The second half of the year will be very exciting,” how exciting?

After a brief decline in the second quarter, Tesla’s record-breaking production and sales in June have demonstrated a full recovery from the production shutdown. However, in Musk’s view, this is just an appetizer: “The second half of the year will be very exciting”. How exciting exactly?

Apart from the capacity expansion mentioned earlier, the Tesla FSD Beta North American public beta test will begin at the end of the year, followed by price hikes. In Musk’s view, once the FSD promotion is extended and the user base expands, the autonomous driving software will bring better experience and actual value, and the price hike will be “very cost-effective”. However, it remains to be seen whether it is cost-effective for domestic “futures” users who have purchased FSD.

Of course, more news about FSD, Dojo, and Optimus, Musk will keep it a mystery until the AI Day two months later. He said it will go “further than most people imagine”.

In addition to FSD, what everyone is most concerned about this year is the mass production of the 4680 battery. Almost every post about the 4680 battery has netizens asking “when can I buy a Model Y with a 4680 battery?”

Unfortunately, the answer to this question is that you still have to wait. In the last quarter, the first batch of Model Ys with 4680 batteries has been delivered. Currently, the Berlin and Texas factories can produce 1,000 Model Ys with 4680 batteries per week. As for the time of large-scale production, it may be “the end of this year”.

For Tesla now, large-scale production is obviously the most urgent issue. The production line for not only cars but also batteries needs to be expanded. “How fast battery production is determines the speed of the world’s transition to sustainable energy.” Perhaps it is due to the shadow left by the capacity hell of previous years. Tesla has directly elevated battery production capacity to the height of sustainable energy transformation. Currently, they are focusing on solving the problem of 4680 battery production and climbing the slope. As for further improvement of energy density with new materials and new technologies, it will have to wait until 4680 battery mass production.

By the way, in response to the current chip shortage issue, Tesla has stated that it has no plans to produce its own chips.

In Musk’s view, anything that can be achieved through cooperation with suppliers can be solved through deep collaboration, such as designing chips, customizing silicon wafers, jointly developing microcontrollers and BMS battery management systems; As for problems that suppliers cannot solve, he is prepared to take matters into his own hands, such as digging lithium mines and extracting high-precision lithium materials.

Finally

Recently, the bosses of domestic automakers seem to have developed a case of “adjective syndrome”, using various adjectives to define the scope of their products, such as “best under 5 million”, “best under 500,000”, “million-dollar luxury cars”, and so on.

Musk seems to have also caught the bug, saying that “Tesla China is the best EV company in China.”

Many people may not agree with this joke, but it is difficult to deny the importance of the Chinese market and the Shanghai factory to Tesla, as well as Tesla’s importance to the Chinese EV industry.

Just like the Shanghai Gigafactory, which, despite experiencing shutdowns and difficult restarts, was able to increase its production capacity to 750,000 vehicles in just a few months, becoming the largest production base. For Tesla today, “expanding production” remains the main theme: whether it is the expansion of vehicle production lines, the expansion of 4680 battery production, the launch of new models such as Cybertruck, or the promotion of FSD.

We once thought that the tech pioneer Tesla was “boundless,” but in these recent earnings reports, it has become increasingly pragmatic.

I wonder if the increasingly pragmatic Tesla, after the past three months of tests, can bring another “best-ever” earnings report in three months?

By the way, Musk said a few days ago that he had transferred his brain to the cloud; who will be speaking at the next conference call in three months, the Musk on the ground or the Musk in the cloud?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.