Wen | Jinrong Street Lao Li

Ningde Times has brought the automotive industry into a new era, but its golden age is quietly changing.

In 2021, Ningde Times set historical record performances and market values. However, many friends in the research community have noticed that the market sentiment is not as high as before, even though Ningde Times has released the EVOGO battery swapping, Kirin battery, and sodium-ion battery consecutively.

Capital is more sensitive than the industry. Since April 27th, the new energy vehicle sector has been leading the entire market. However, the leader of this reversal trend is not Ningde Times, but BYD and various upstream lithium battery companies. Although Ningde Times is also reversing, its rising speed is far lower than last year.

Many friends are discussing Ningde Times’ future position. Today, Lao Li will talk with you from the perspective of capital: What is the pattern of new energy vehicle power batteries? What is the core competitiveness of power battery companies? What is the endgame of the power battery industry and Ningde Times?

From 0-1 to from 1-N

In July of this year, China’s new energy vehicle ownership officially exceeded 10 million, and the penetration rate of monthly sales of new energy vehicles has exceeded 20%. According to the China Automotive Technology and Research Center’s prediction, Chinese new energy vehicle sales this year may exceed 5 million, far exceeding industry expectations. Following the development law of emerging industries, the new energy vehicle industry has entered a growth phase from the embryonic stage. Correspondingly, as one of the most critical upstream sectors of the industry, the power battery industry has also achieved development from 0 to 1.

In the golden decade of the development of the power battery industry from 0 to 1, Ningde Times seized the industry’s opportunities and stood alone in the lead of the power battery industry. Lao Li mentioned in “Ning Wang and BYD: Love and Hate or Brothers” that there are two valuation passwords for Ningde Times: high-growth rate and high-market share, among which high-market share is the foundation of high-growth rate.

Ningde Times needs to meet two conditions to meet high-growth rates: one is that the new energy vehicle industry must maintain a relatively high growth rate, and the other is that Ningde Times must maintain a sufficiently large market share. The first issue has been accepted with a definite answer. Therefore, the issue people are concerned about is Ningde Times’ market share, which has been challenged constantly by three types of challengers: the first type is second-tier battery companies represented by CATL, the second type is top foreign companies represented by LG, and the third type is battery companies under vehicle enterprise systems.The first group of challengers is mainly composed of second-tier domestic power battery companies. A typical enterprise is CATL Aerospace (formerly known as CALB), which, after a change in its senior management in 2018, competed with Ningde Times through price wars and by grabbing customers. With the support of Guangzhou Automobile Group and Changan Automobile, CATL Aerospace’s installed capacity has steadily ranked third among domestic enterprises, second only to Ningde Times and BYD. Ningde Times and CATL Aerospace once fought a legal battle over intellectual property.

Yiwei Lithium Energy, the leader of 3C batteries, is also making efforts in power batteries. The long-endurance model of the XPeng P7 is already equipped with Yiwei Lithium Energy’s power battery and will also enter the supply chain of BMW, Hyundai, and other enterprises in the future. In addition, enterprises such as Xinwanda and Beijing National Battery Technology Co., Ltd. have also successively entered the automotive group system, and without exception, these enterprises are competing for Ningde Times’ customers.

The second group of challengers for Ningde Times are foreign companies represented by LG and SK On. Before the list of qualified power battery companies was released, LG had always led the development of the power battery industry. With the cancellation of the list, high-end foreign battery companies represented by LG and SK On will have more opportunities in the Chinese market.

Many researchers have said that the valuation effect of battery companies carrying high-end brands far exceeds that of ordinary companies. If a company is matched with Tesla, its valuation will be much higher than that of Hongguang MINIEV. Battery companies such as LG are competing for these high-end car companies.

The third group of challengers are the power battery companies of the automotive group system, such as Farasis Energy, Beijing National Battery Technology Co., Ltd., and Hesai Energy. In Li’s view, these enterprises are Ningde Times’ biggest competitors in the future. Currently, Farasis Energy supplies BYD and also supplies FAW Hongqi in addition to Tesla and Changan Automobile. In addition, there have been rumors that Tesla and Changan Automobile have designated Farasis as a supplier. Beijing National Battery Technology Co., Ltd. and Hesai Energy have long entered the supply chains of Volkswagen and Great Wall Motors, respectively.

It can be foreseen that in the future, large-scale vehicle enterprises will build battery companies through independent research and development or mergers and acquisitions to carry out self-supply of battery cells. On the one hand, this can ensure the safety of the supply chain, and on the other hand, it can control costs. In the case of little difference in performance and cost, vehicle enterprises will prioritize self-supply. Obviously, Ningde Times will lose these high-quality customers.

What is the core competitiveness?

As the leading enterprise, Ningde Times predicted the industry’s changes three years ago. Li has visited Ningde Times many times for research. Since its listing in 2018, Ningde Times has developed layouts in technology, products, markets, and industrial chains to deal with challengers in order to maintain market share and a high market occupancy rate.

To maintain a high market occupancy rate, it is necessary to maintain competitiveness, and Ningde Times’ market share reflects a common commercial problem – what is a company’s core competitiveness?In different stages of enterprise development, the answer to core competitiveness varies. In the early stage of the lithium battery industry, technical stability was the core competitiveness. CATL (Contemporary Amperex Technology Co., Ltd.) established its technology competitiveness in the passenger car and commercial vehicle fields by supplying batteries to Brilliance BMW and Yutong.

Facing the changing pattern of competition in the lithium battery industry, CATL has launched many layouts to maintain its leading position in the industry and compete for market share. These layouts reflect CATL’s core competitiveness in the next five years, which mainly include three aspects:

Firstly, ensuring sufficient production capacity. In the high-growth stage of the industry, whoever owns battery production capacity will have market share.

Three years ago, the “capacity race” between top domestic and foreign lithium battery companies had already begun, and a video of CATL’s capacity oath-taking conference was once circulating online. According to incomplete statistics, CATL’s planned capacity in 2025 has already exceeded 500 GWh, while the planned capacity of CALB (China Aviation Lithium Battery) and SVOLT (a subsidiary of Great Wall Motor) will reach 500 GWh and 600 GWh respectively. From the planned capacity, it can be seen that CATL’s capacity proportion is decreasing.

From the perspective of capacity landing, although LG, CALB, and BYD have higher planned capacity, the landing situation of their capacity is not ideal. CATL’s capacity still ranks first in the industry with stability.

Secondly, establishing a stable upstream supply chain, which has been the underlying logic of CATL’s external investment in recent years.

In addition to competing for production capacity, power battery companies also need to compete for the supply capacity of upstream raw materials, equipment and other aspects. In recent years, CATL has invested in a large number of upstream enterprises, such as THT (Tianhua Tech Co., Ltd., an advanced anode material manufacturer), Hunan Yunteng (a lithium resource company), Xindouxin intelligent (a lithium battery equipment manufacturer), and Xingyun Shares (a battery testing company).

According to incomplete statistics, CATL has invested in more than 30 upstream power battery companies, with the core objective of ensuring the stability and low cost of supply chain, and thus gaining advantages in the competition among battery companies.

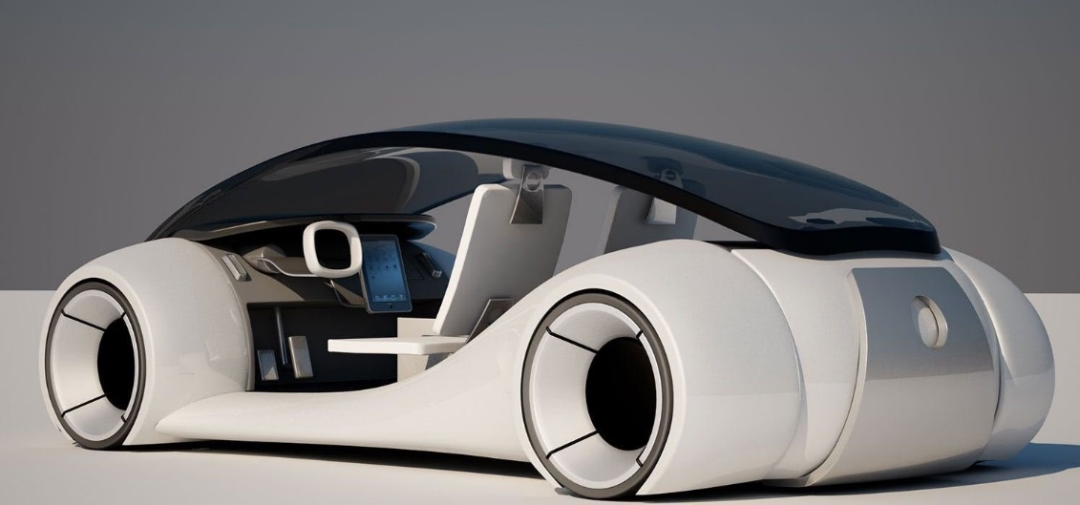

Third is to establish a downstream customer ecosystem, expand the power battery market or channels, which can be simply put as “building good relationships” with auto companies. The new energy vehicle industry shows characteristics of decentralization and variability. Decentralization refers to the low concentration of the automobile industry, while variability is that car companies tend to choose multiple upstream suppliers. In this context, CATL must maintain a good relationship with the entire vehicle enterprises. If CATL enters into Apple’s supply chain, its market value will double.

Third is to establish a downstream customer ecosystem, expand the power battery market or channels, which can be simply put as “building good relationships” with auto companies. The new energy vehicle industry shows characteristics of decentralization and variability. Decentralization refers to the low concentration of the automobile industry, while variability is that car companies tend to choose multiple upstream suppliers. In this context, CATL must maintain a good relationship with the entire vehicle enterprises. If CATL enters into Apple’s supply chain, its market value will double.

Tesla, NIO, Li Auto, and XPeng are CATL’s core customers, and XPeng has begun to seek suppliers such as EVE Energy and CALB. This demonstrates that CATL’s downstream customers are not stable. In addition to joint venture factories, in recent years, CATL has also invested in a number of car companies such as ABT Electronics, Xpeng, and NIO in order to “tie” the vehicle companies through equity investment and establish a stable downstream customer ecosystem.

What is the endgame?

At this point, many friends may be concerned about the endgame of the power battery industry and CATL. Answering these two questions can roughly predict the trend of CATL’s future market value.

From the perspective of the endgame of industrial development, it is an inevitable trend for car companies to supply their own batteries. Coupled with industry competition and other factors, this is indeed a challenge that CATL will face. At present, BYD has supported Faraday’s production ranking second in the domestic market through self-supply, and Faraday’s production capacity will be prioritized to supply BYD. Volkswagen, while using CATL batteries, has switched to its own shareholding Greenland Technology for the next generation of models. Although some models of the WEY brand still use CATL batteries, its subsidiary, FCE Energy, is gradually increasing its supply proportion.

We can imagine that after five years, the industrial development will enter a more mature stage, and the core competitiveness of CATL in production capacity, upstream, and downstream will gradually weaken. With the diversification and differentiation of new energy vehicle enterprises, it is difficult for individual battery companies to achieve a market share of over 50%. The entire battery industry will be in a state of “diversity and vigorous competition”.

My personal judgment is that after five years, whole vehicle enterprises with an annual sales volume of more than 500,000 units will establish their own supporting system through acquisitions or self-research, and will play a more important role in the industry in addition to big players like CATL. Chinergy Power, FCE Energy, and other power battery companies will also play a more important role in the industry.

CATL’s valuation password lies in high market share. At present, the capital market is not very concerned about CATL’s financial performance but more sensitive to market share and core customers. Teaming up with Tesla can support a market value of hundreds of billions of dollars, while losing Tesla can also result in a loss of hundreds of billions of dollars in market value.

For CATL, exploring more downstream applications is the key to maintaining its valuation in the next phase, as the structure and supporting relationships of the power battery market gradually stabilize. Lao Li believes that from next year on, CATL’s valuation code will no longer be growth rate and market share, but rather shipment volume.

At a Shanghai Jiao Tong University alumni gathering, Zeng Yaqun expressed CATL’s three major development directions for the future. First, he hopes to make power batteries the core technology and replace mobile fossil fuels. Second, he hopes to combine energy storage and power generation, especially new solar cells, to replace fixed fossil fuels. Third, they intend to cooperate in specific fields to implement intelligent and electric solutions.

In addition to the power battery field, CATL has also established joint ventures with KSTAR, YF Power, Eastar and State Grid Comprehensive Energy Company to jointly develop the photovoltaic energy storage market. In the field of household energy storage, CATL and ATL have established a joint venture.

Over the years, compared with other power battery companies, CATL has taken the lead in realizing layouts in multiple scenarios, such as from power batteries to energy storage batteries, from commercial vehicles to passenger vehicles, from four-wheel vehicles to two-wheel vehicles, from large-scale energy storage to household energy storage. This is CATL’s absolute advantage in the next phase of development.

CATL is also aware that maintaining the first market share for a long time in the power battery industry is not realistic due to the special supporting relationships in the automotive industry. Only by exploring a broad enough range of application scenarios and breaking away from the power battery industry can CATL digest its huge market-leading capacity and ensure its dominant market position in terms of market share and be given a market value of trillions by the capital market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.