There have been two policy changes in the new energy industry recently. On June 21, the MIIT announced the repeal of the “Regulations on the Industry Norms for Automotive Power Batteries.” On June 26, the 2019 new energy vehicle subsidy policy was officially implemented. The implementation of these two policies reveals a significant signal from the national regulatory authorities regarding the attitude towards the new energy vehicle industry: the new energy vehicle industry is gradually returning to the market.

More than 50% Decrease

Below is a comparison of the subsidy policies between 2018 and 2019.

Compared with 2018, the 2019 subsidy policy raised the threshold for the driving range from 150 km to 250 km, reduced the subsidy amount by half, decreased the subsidy for plug-in hybrid electric vehicles from 22,000 RMB to 10,000 RMB, and more importantly, completely cancelled the subsidies in many major areas where subsidies accounted for more than half of the total (local subsidies will be invested in local new energy vehicle basic infrastructure construction instead), which poses a significant challenge for the new energy vehicle industry in terms of sales.

In addition to driving range, from the perspective of the power battery, the threshold for energy density is constantly increasing. In 2019, vehicles with an energy density lower than 125 Wh/kg cannot receive subsidies, and those with an energy density lower than 160 Wh/kg cannot receive 100% of the subsidy.

The 2019 subsidy threshold was raised in multiple dimensions, resulting in an actual decrease of more than 50%. Taking the NIO ES8 70 kWh version as an example, in 2018, purchasing an ES8 in Shanghai could receive a subsidy of 67,500 RMB (45,000 RMB from the central government and 22,500 RMB from the local government). However, according to the 2019 new policy, the same car model can only receive a subsidy of 115,200 RMB, a decrease of more than 80%.

Although the reduction of subsidies was already within the government’s working plan, due to the lengthy product development cycle in the automotive industry, many more car companies have not had enough time to adjust to the subsidy reduction. Moreover, the officially announced reduction is far beyond what the car companies expected. For car companies, the substantial tilt of policy resources accelerates the development of the new energy vehicle industry, and when this invisible hand is withdrawn, it will inevitably trigger a major shakeup in the industry.

Although the reduction of subsidies was already within the government’s working plan, due to the lengthy product development cycle in the automotive industry, many more car companies have not had enough time to adjust to the subsidy reduction. Moreover, the officially announced reduction is far beyond what the car companies expected. For car companies, the substantial tilt of policy resources accelerates the development of the new energy vehicle industry, and when this invisible hand is withdrawn, it will inevitably trigger a major shakeup in the industry.

As for the newcomers in the automotive industry, the most significant blow from the subsidy reduction is actually to the second-tier players such as Ai Chi and Byton. Compared with NIO, which has made certain progress in product development, sales, and services, these brands cannot save a cent of money with which they need to invest in product research and development, brand building, manufacturing (factories, qualifications), sales, and service system layout due to the late start and limited product cycle. However, their products will not be put into mass production until at least Q4.

The help from policy subsidies to the financial development of companies has become almost negligible.

Manufacturers need to face the dilemma of sacrificing gross profit margins for sales, promoting the decrease of operating costs through cost-effective methods and sales that bring considerable sales scale effects, or maintaining the original price to face the impact of subsidy reduction and bear predictable low sales volume and unavoidable operating losses. No matter which option is chosen, it is an extremely difficult choice for car companies.

For the first-tier players such as NIO, WM Motor, and XPeng, they all reached their sales target of 10,000 units before the implementation of the subsidy policy in 2019. While they generated positive cash flow, they also received the maximum subsidy bonus. But to say that they have already been on the right track, completely eliminating financial risks is too optimistic.

An interesting and convincing phenomenon is that the founder of NIO, William Li, the founder of WM Motor, Freeman Shen, and the founder of XPeng Motors, He XPeng, have all said that the capital threshold for new car companies is CNY 20 billion. Only by crossing this number can new car companies have the opportunity to operate positively and participate in the competition in the next stage.

However, so far, NIO has raised more than CNY 27 billion, WM Motor has raised more than CNY 23 billion after the C round of financing, and XPeng has raised more than CNY 25 billion in total after the B+ round of financing. More importantly, these three companies have not reached the stage of being self-sufficient with a positive profit and through their own cash flow for development and growth.

If the new car companies do not have the ability to continually raise capital, the subsidy reduction may become the last straw that breaks the camel’s back.The pricing of WM Motor and XPeng Motors’ products are both in the range of 150,000 to 200,000 yuan, with subsidies accounting for 20% of the car price. If car manufacturers face the impact of subsidy reduction, significant price increases could easily cause consumers to give up their choices. Currently, both WM Motor and XPeng Motors have chosen to maintain their original selling price and absorb the decline in gross profit margin in order to maintain their product competitiveness.

However, there is no doubt that “if they cannot quickly develop products that are still competitive without subsidies, the first-tier companies who benefited from subsidies will be no different from someone using boiling water to stop a gap”.

Traditional car companies all face their own difficulties, even though major multinational automakers have publicly stated that China is one of their most important markets. Yet, self-owned brands have a more sensitive perception of the direction of policies.

Many self-owned brands have set up specialized sub-brands for new energy vehicles. Many brands have been launching new energy vehicles for five years, and in this time, not only are their technology systems increasingly mature, but good sales have also made self-owned brands the biggest winners in terms of subsidies.

BYD is the best representative of this group of companies. On May 22, BYD announced that the new energy subsidies for 2016 and 2017 have been officially paid to its account, totaling ¥3.458 billion. In fact, since its listing in 2011, BYD has received more than ¥10.4 billion in subsidies.

What’s the concept of ¥10.4 billion? Most second-tier car companies have not raised more than ¥10 billion.

As mentioned in the announcement, the subsidy to the account will significantly improve BYD’s cash flow and have a positive impact on the company’s financial situation. In addition to this, in the past few years, BYD has far surpassed joint ventures in the R&D, supply chain management, and cost control of new energy vehicles.

Facing the subsidy reduction, BYD may be one of the few car companies with price adjustment space to resist subsidy reduction. In contrast to self-owned brands, joint ventures have slightly special cross-border operating mechanisms. Compared to self-owned brands, their actions in the field of new energy may be ignored. What impact will subsidy reduction have on them?Due to the restriction of the double credit policy, joint venture brands have to introduce some non-positive research and development, pure electric vehicle models designed based on the fuel platform. The inherent deficiencies at the platform level and the lack of attention at the group resource level have doomed the lackluster competitiveness of these products. With the subsidy cutback, the competitiveness of these products will become even more unappealing compared to fuel vehicles; however, the sales of electric vehicles in significant volume are policies that the government has to fulfill. Consequently, for joint venture brands, the subsidy cutback directly raises the cost of unit credit acquisition.

Subsidy cutback, battery manufacturers face technical challenges

In addition to the impact on auto companies, the subsidy cutback also affects domestic battery manufacturers. In addition to auto companies, the government has established the “Automobile Power Battery Industry Normative Conditions” enterprise catalog to support power battery manufacturers. Auto companies can only receive subsidies for manufacturing electric vehicles by using batteries from brands listed in the catalog, which can only be Chinese mainland power battery manufacturers.

In December 2013, South Korean power battery company SK Innovation and BAIC Group and Beijing Electronics Holding Co., Ltd. jointly established Beijing Easpring Material Technology Co., Ltd. to mainly produce power batteries, with a total investment of 1 billion yuan, the first Sino-foreign joint venture battery company in China at the time.

However, with the policy coming out, power batteries produced by SK Innovation became ineligible for subsidies, and the competitiveness of product prices became non-existent. BAIC had to terminate the three-party joint venture plan, and SK Innovation disappeared from the Chinese market as a result, with BAIC instead using locally produced power batteries.

Relying on the dividend of subsidy policy, domestic battery manufacturers became the biggest winners under the subsidy policy. They not only made a profit, but also developed their technical level rapidly driven by the demand of auto companies. Product indicators gradually caught up with the top Japanese and Korean manufacturers, including Contemporary Amperex Technology Co., Ltd. and Funeng Technology, which signed large orders with top brands such as Mercedes-Benz and BMW.

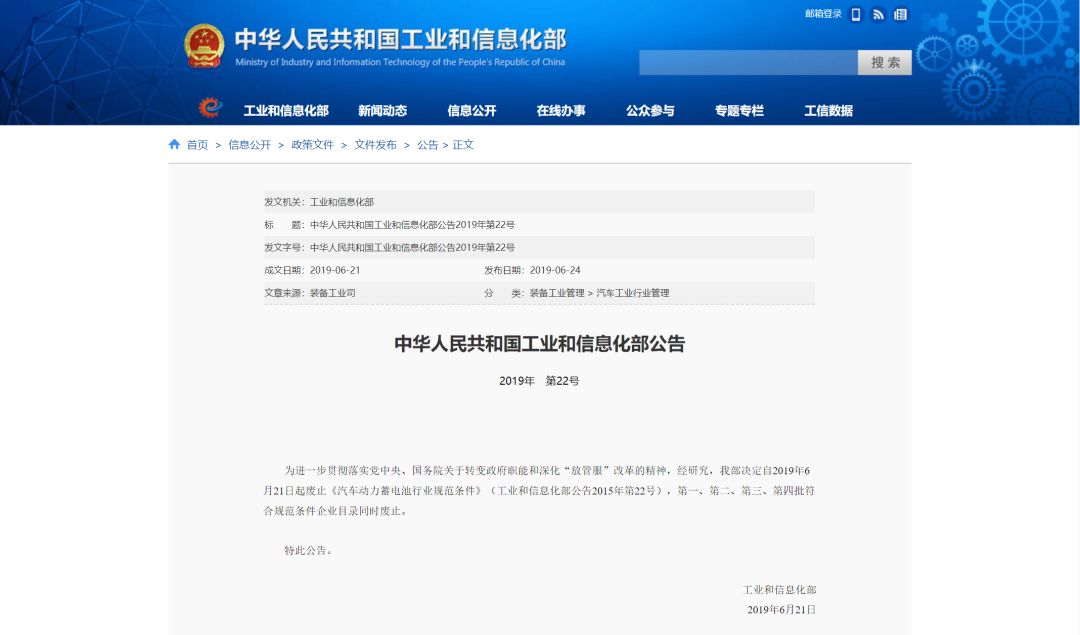

On June 21, the Ministry of Industry and Information Technology officially announced the abolition of the “Automotive Power Battery Industry Normative Conditions” effective from June 21, 2019, and the catalogs of the first, second, third, and fourth batches of companies meeting the normative conditions were simultaneously abolished.

This means that the policy restrictions on auto companies in the field of power batteries have been officially lifted after four years, and many foreign battery giants have turned their eyes back to the new energy vehicle market in China.Last year, SK Innovation established an automotive battery materials factory in Changzhou, and restarted the joint venture battery factory project with Beiqi Group and Beijing Electronics Holding Co., Ltd. The new factory is also located in Changzhou, China, covering an area of 90,000 square meters, planning a production capacity of 7.5 GWh, and is scheduled to start production in 2020.

LG Chem will invest $1.84 billion to expand its power battery manufacturing business in Nanjing, and Samsung SDI also plans to invest $115,000 to expand its battery production business in Tianjin and Xi’an.

The influx of more power battery manufacturers into the market means that automakers have more choices, no longer being led by battery suppliers and having more room to choose suppliers. Conversely, it will also force battery manufacturers to continuously improve their product competitiveness.

Policies are only guidance, while the market is the true operator

In the early stage of industrial development, when the domestic new energy industry had the weakest foundation, the country supported the industry chain by policy resources at the top-level design level. Today, global automakers have turned to electrification, and China’s new energy automotive industry chain has developed to the level of positive competition with foreign giants or even partial overtaking.

In 2019, policies orderly withdrew and the industry returned to the market. Broadly speaking, the new energy automotive industry chain enterprises have a broader development space and can launch positive PK with more pure product power. On the other hand, market competition will become more intense. Stronger companies will become even stronger, and weaker companies will become even weaker. The industry survival of the fittest is unfolding.

Industry reshuffle is imminent, and I wonder if major enterprises are ready?

* Leapmotor: Focusing on Niche Market Instead of Subsidies | CES Asia

* Leapmotor: Focusing on Niche Market Instead of Subsidies | CES Asia

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.