Author: Zhu Yulong

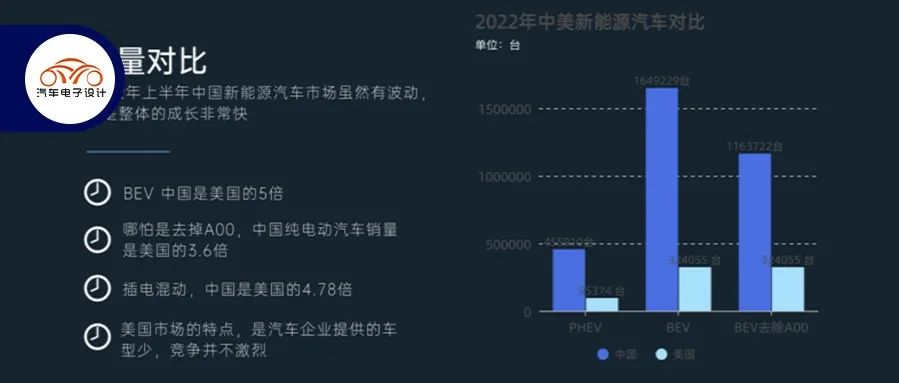

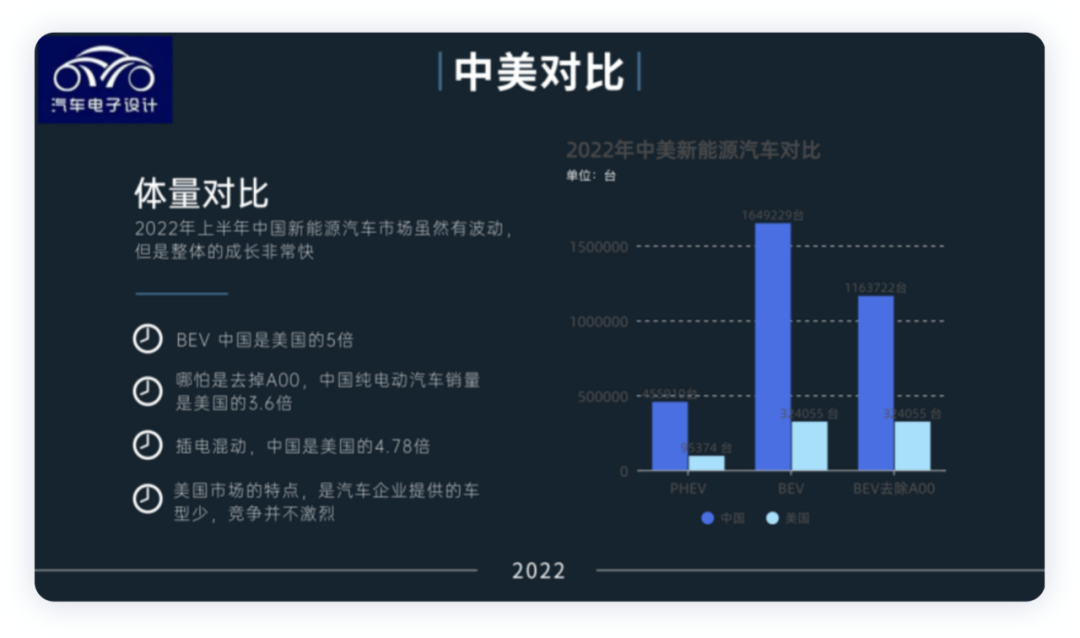

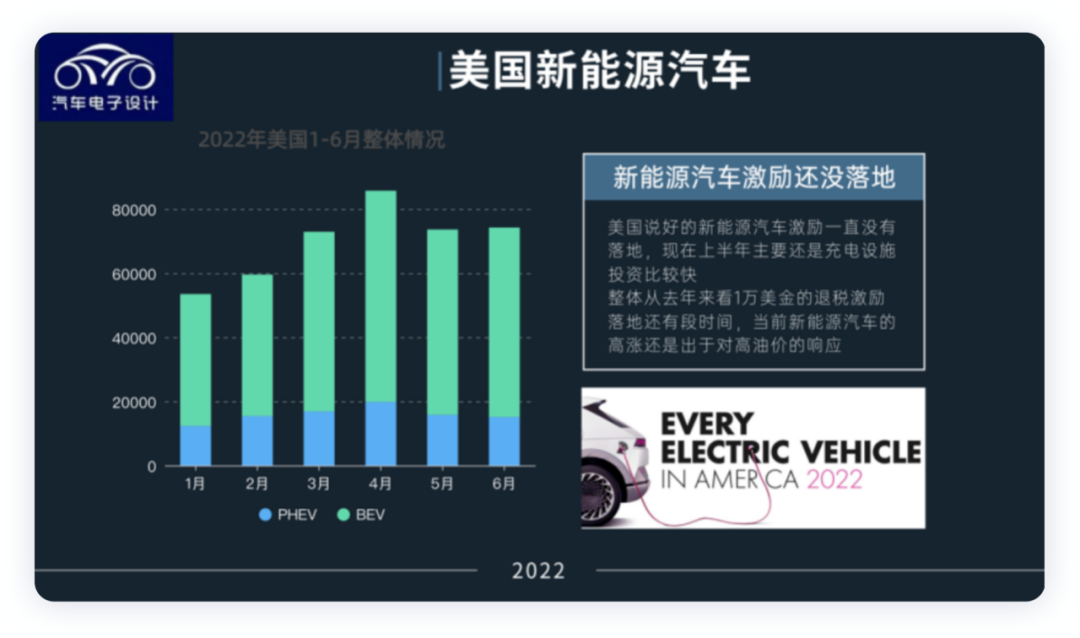

According to the integrated data from Argonne National Laboratory, the sales volume of new energy vehicles in the United States in June was 74,200, including 59,090 pure electric vehicles and 15,121 plug-in hybrid electric vehicles. In the first half of 2022, the cumulative sales volume of new energy vehicles was 419,000, including 324,055 pure electric vehicles and 95,374 plug-in hybrid electric vehicles, with a market penetration rate of 6.59%. The comparison between China and the United States is as follows, and I think the current situation is roughly as follows:

-

Before the reinstatement of the $10,000 tax credit in the U.S., the penetration rate of electric vehicles was slow. Currently, China’s incentives and public perception for new energy vehicles are changing much faster than in the U.S.

-

In the next stage of promoting electric vehicles in the US, our speed is actually relatively fast. With China’s (including new energy vehicles) export strategy, the product power of both sides has changed.

-

Currently, the development of new energy vehicles in the United States is still in the shouting stage. ZF has only pulled some investment in charging infrastructure, and the three major auto companies are estimated to really scale up in 2025.

Overall, it is still possible for the sales volume of new energy vehicles in the United States to reach one million in the first half of 2022, with a monthly impact of 100,000 in the second half of the year.

The overall penetration rate of pure electric vehicles in the U.S. is better than that of plug-in hybrid electric vehicles. This is because using the previous $7,500 federal tax credit for plug-in hybrids is more expensive than for pure electric vehicles, and several companies have focused their work on pure electric vehicles.

Situation of Electric and Hybrid Vehicles

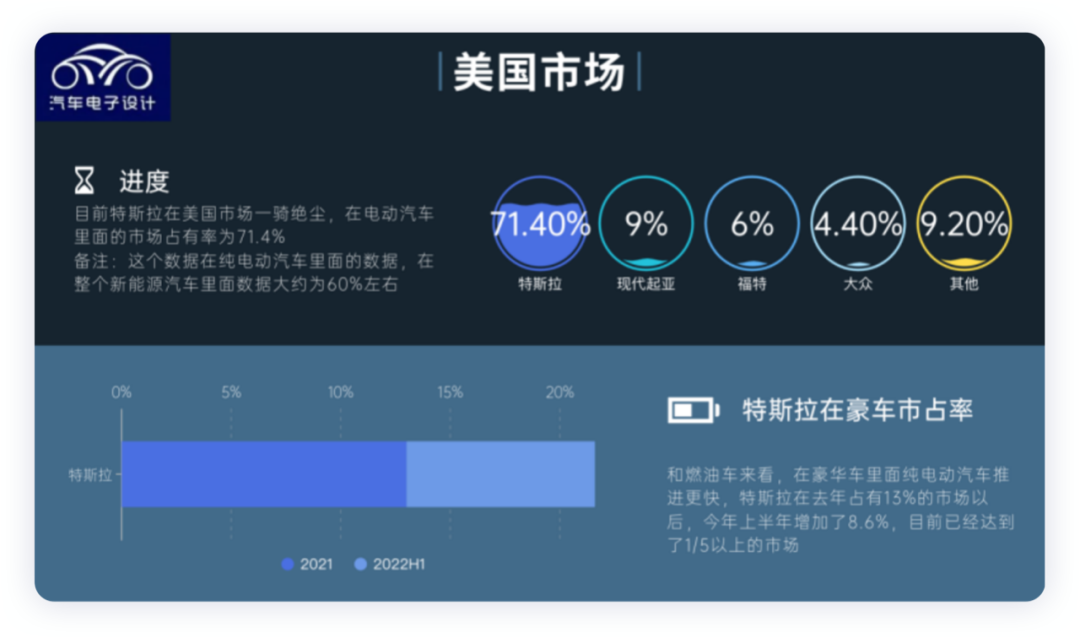

Market Penetration Rate of New Energy VehiclesThe overall market in the United States declined by 18%, but the electric vehicle market broke its sales record in 2022 after experiencing a period of stagnation, and the demand for electric vehicles in the United States began to grow. Currently, Tesla occupies 71.4% of the market share for pure electric vehicles, while Hyundai has 9%, Ford has 6%, Volkswagen has 4.4%, and others, including General Motors, account for 9.2%. With other automobile companies also starting to push electric vehicle platforms in large numbers, competition in the electric vehicle market in the United States is heating up, with Hyundai’s first electric sedan, the Ioniq 6, Ford’s F-150, and Volkswagen’s ID cars all taking a place in the American electric car market. In the luxury car market, Tesla also holds a 21.6% market share, continuing to eat into the market share of BBA in the United States.

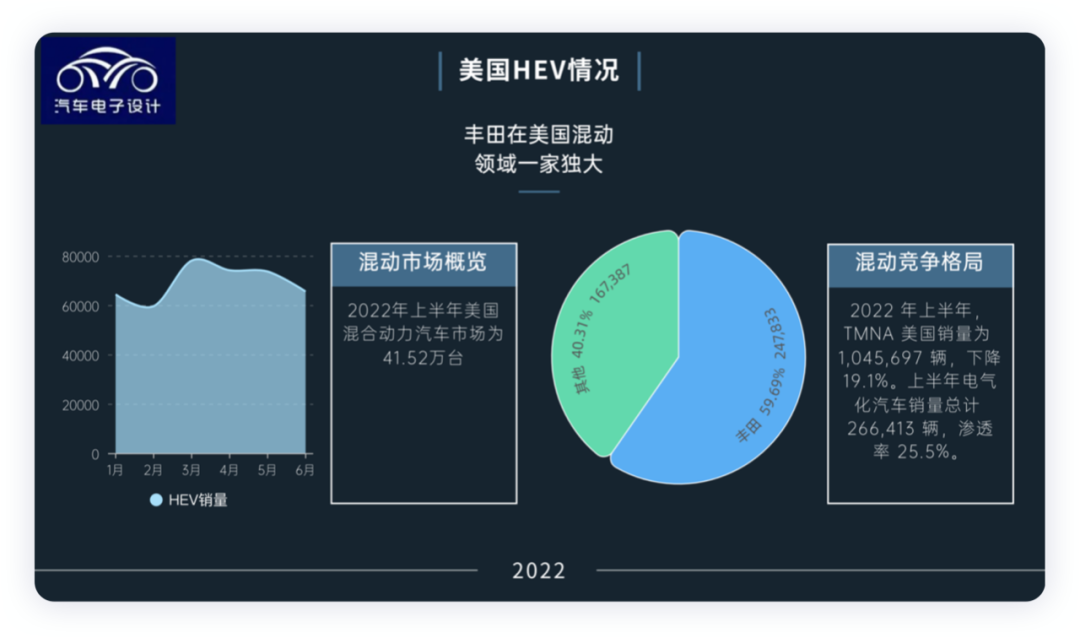

Hybrid Situation

In terms of hybrid vehicles, the U.S. hybrid vehicle market in the first half of 2022 amounted to 415,200 units. In the first half of 2022, TMNA sold 1,045,697 vehicles, a decrease of 19.1%. The total sales of electrified vehicles in the first half of the year were 266,413 units, with a penetration rate of 25.5%. Therefore, if we look at the free market, Toyota accounts for 60% of the U.S. market, which has been an advantage continuing.

Potential of the U.S. Market

Overall, the U.S. market can be divided into several aspects:

-

Supply chain: The United States still has a sustainable market, and is currently planning to create a controlled chain outside of East Asia’s power battery and electric vehicle supply chains.

-

Tax rebate policy: The $12,500 electric vehicle tax rebate policy has not yet been implemented and will not be implemented in the short term.

-

Automobile companies: In addition to Tesla and General Motors, Ford and Stellantis are also increasing their investment, and with American innovative car companies, the American electric vehicle industry is undergoing transformation.

-

Infrastructure: Here we can expand a little.

Due to the large area of the United States, the investment in charging infrastructure is also being gradually increased. Currently, approved investments total $700 million, which will help build 250,000 charging stations every year (part of the Infrastructure Act, with $7.5 billion to establish a nationwide electric vehicle charging network), aiming to achieve convenient and unified charging for homes, workplaces, and the whole country.

Due to the large area of the United States, the investment in charging infrastructure is also being gradually increased. Currently, approved investments total $700 million, which will help build 250,000 charging stations every year (part of the Infrastructure Act, with $7.5 billion to establish a nationwide electric vehicle charging network), aiming to achieve convenient and unified charging for homes, workplaces, and the whole country.

-

Electrify America, Siemens, and the Volkswagen Group invest $450 million to support the rapid deployment of up to 10,000 ultra-fast charging stations at 1,800 charging stations, exceeding the number of high-power charging stations currently available in the United States. Siemens has also invested $25 million in a minority stake in a US-based wireless charging company.

-

ABB E-mobility has established a product development and research institution to design, develop, and test electric vehicle charging stations for the US market.

-

ChargePoint is expanding its partnership with SMTC Corporation to increase the production of DC fast chargers. A Level 2 charging station production line is being established at the Milpitas, California factory, and by 2026 the factory will be able to produce 10,000 DC pedestal chargers and 10,000 Level 2 charging stations.

-

North American electric vehicle charging network operator FLO will produce more than 30,000 charging stations annually by 2028, creating more than 730 jobs and supporting Michigan’s economy with $76 million.

-

Tesla is expanding its Gigafactory in Buffalo, New York, to increase production capacity of ACDC power electronic components, charging cabinets, busbars, and cables. Tesla will also start producing new Super Charging equipment.

-

Tritium will manufacture its fast DC chargers in the third quarter of 2022.

At present, the United States is still gradually improving its charging infrastructure, mainly due to the availability of land, and better coordination between the microgrid construction and the local power grid.

In summary, in terms of electric vehicles, the previously leading United States has fallen behind, but in the field of intelligence, it seems that we still need to use American chips.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.