Author: Tian Xi

Camping economy is booming, and automakers want a piece of the action.

With a relatively low barrier to entry and the satisfaction of a “micro-vacation,” camping has truly become the best way to travel outdoors under the epidemic.

From 2014 to 2021, the domestic camping site market has grown from 7.71 billion yuan to 29.9 billion yuan, becoming the only segmented market in the tourism industry that has grown against the trend.

Tents, mattresses, sleeping bags, cooking utensils, and a series of other sub-categories have quickly become hot-selling products in this multi-billion dollar market. As this growing market continues to expand, more and more sub-categories are also intending to get a piece of the pie, including today’s main protagonist — Radar Auto.

Positioned as a “new energy + diversification” outdoor auto brand, Radar Auto will provide users with travel solutions for more scenarios.

Radar Auto CEO Lin Shiquan said that Radar Auto is not only a brand that focuses on technology, but also a brand that emphasizes a diverse outdoor lifestyle.

What are the highlights of the first pure electric platform pickup truck in China?

On July 12, Radar Auto’s brand was officially launched, and the first model RD6 was officially unveiled and started its pre-order channel.

Although Radar Auto seems to be a new player, it’s actually a brand-new mid-to-high-end electric vehicle brand under Geely. You can understand it as Radar Auto, Smart, JEEKEE, and Lotus, which are jointly built based on Geely’s SEA architecture. Radar Auto’s first model, Radar RD6, will also be China’s first pure electric platform pickup truck.

Based on Geely’s SEA architecture, Radar Auto has advantages in space, evolution, interaction, and safety that are leading the same level.

Regarding the positioning of the Radar RD6, Radar Auto’s CGO Yi Han believes that this is an “all-around” vehicle that can be “in the city, or in the wild.”

Why say that? There are two reasons:

First, the Radar RD6 has leading NVH levels in the same segment and comparable comfort to new energy SUVs, but the specific technical parameters have not been disclosed by Radar Auto.

Second, the Radar RD6 has the unique feature of a mobile discharge platform in the same segment, with a large power supply capacity that can meet the electricity demands of daily outdoor life in terms of “food, shelter, and transportation.”

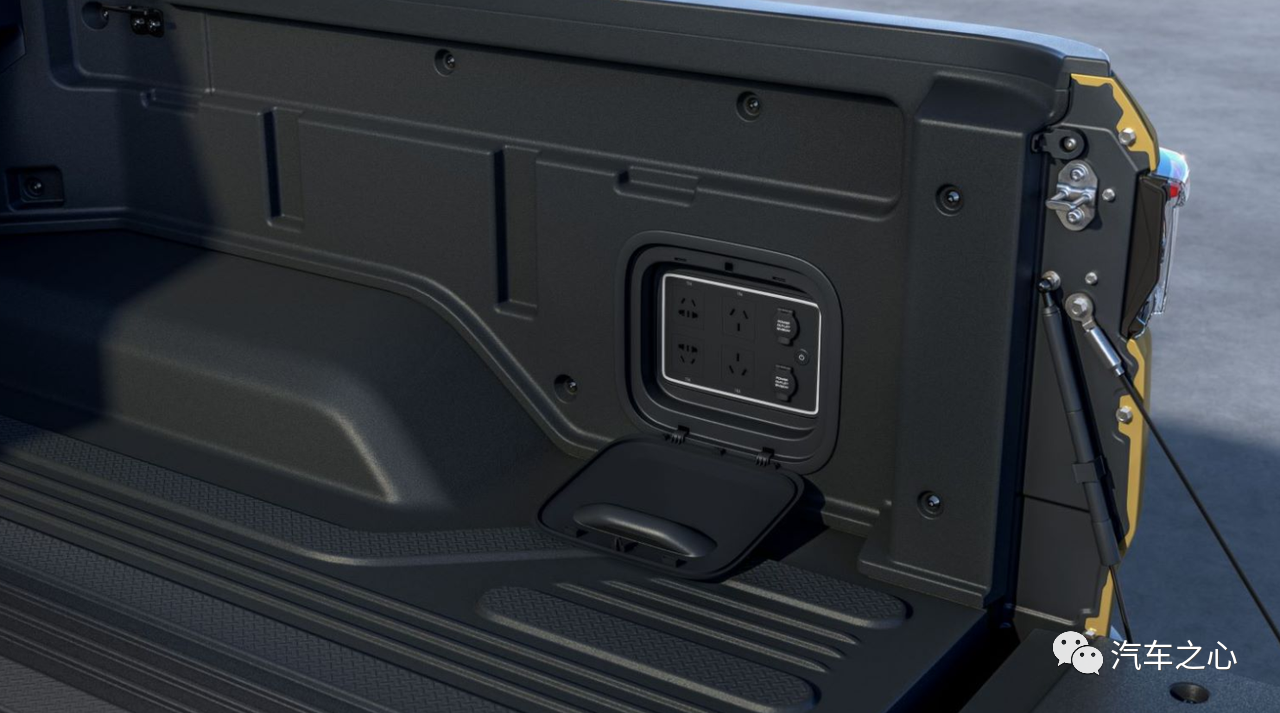

The large power output panel of the Radar RD6 is located in the rear container area of the vehicle, and can support 16A, 10A, three holes, double holes, and 12V interfaces at the same time, with a maximum discharge power output of up to 6kW.

This means that the radar RD6 can supply power to 3 units of 2000W power electric ovens simultaneously, or support 5 units of household air conditioners to work at the same time (under 1.5 horsepower cooling condition).

With the guarantee of 25% power reserve for vehicle return trip, the external output of radar RD6 can use electricity equivalent to the capacity of 75 units of outdoor 1kWh capacity mobile power supplies.

In addition to satisfying outdoor adventure needs with a super large mobile power supply, the radar RD6 provides a super large capacity rear compartment space, a 70L hidden front trunk, and a 48L storage box space under the seat, which can form a through-loading space when opened.

In terms of powertrain, the radar RD6 will be equipped with the same three-electricity technology scheme as Geely’s mid-to-high-end products, with a maximum motor power of 200kW, an acceleration time of 6 seconds per hundred kilometers, and a range of over 600km.

At present, there is not much specific information about the radar RD6, but in response to outdoor travel needs, it has released information about outdoor power supply and in-car space.

As for the information inside the cockpit, because of the advantage of SEA’s vast architecture, the radar RD6 may bring industry-leading performance in intelligent cabin and intelligent driving in the future.

It can be said that with the resources of Geely’s large factory as the backing, this new force in car manufacturing not only has the strength to compete with the mainstream players on the same stage but also opens up a new subdivision field market through a brand-new domestic car category.

Of course, although the first model radar RD6 is positioned as a pure electric pickup truck, it does not mean that radar cars are just a pure electric pickup truck brand.

It can be seen that the future product lineup of the radar car will extend from travel tools to all-scene categories. In addition to laying out pure electric pickup trucks and pure electric beach buggies in different sizes, it will also launch new energy off-road vehicles.

And in this subdivision market, BYD’s high-end brand, and Luoke Auto, founded by Stone Technology CEO Chang Jing, are also gearing up.

Ling Shiquan said that radar cars are automobile brands that cover outdoor travel, not just focusing on the pickup truck field. In the future, super hybrid power modes will also be launched according to user needs.

Who will buy the Pure electric pickup truck?The traditional pickup has always been on the edge of the mainstream market in China’s automobile industry. From the popular sedan market to the SUV market, to the family and business-oriented MPV market, pickup trucks have remained an insignificant category.

In 2021, the Chinese pickup truck market closed with a terminal sales volume of 554,000 units, compared to the accumulated 9,846,000 units in the sedan market and 9,221,000 units in the SUV market throughout the year. Pickup trucks are actually a small, marginal market, accounting for less than 5% of the total passenger car sales in the country, with a penetration rate of only 2.1%.

So why did RAD Auto, a new brand in the automotive industry, choose to launch its first product in a niche market?

By launching its first product in the pure electric pickup truck market, Lin Shiquan believes that RAD Auto has taken advantage of the opportune time, favorable policies, and diverse lifestyles of consumers.

- Opportune time: the trend of global new energy vehicles is developing rapidly.

- Favorable policies: the lifting of restrictions and restrictions on policies.

- Diverse lifestyles of consumers: the market is full of diversity.

New energy, known as the “fourth industrial revolution,” has brought together both hundred-year-old luxury brands and emerging brands on the new energy track.

From sedans to SUVs to MPVs, more and more subdivisions have become “replacement goods” on this track.

Pickup trucks are no exception. Overseas Ford F-150 Lighting, Hummer EV, Rivian R1T, and Tesla Cybertruck have all joined the electric pickup truck field and have accumulated hundreds of thousands of orders.

As of now, the Ford F-150 Lighting, which has accumulated 200,000 orders, was the first to be delivered in May this year, while other models are still awaiting delivery schedules.

Of course, the sales of these pure electric pickup trucks are related to the popularity of the overseas pickup truck market. In addition to relaxed policies, consumers in the United States, for example, emphasize versatility and practicality when buying cars, making pickup trucks the first choice.

For instance, the United States has consistently been the world’s largest consumer of pickup trucks, with pickup trucks accounting for almost one in every five cars sold each year, and often ranking in the top three in auto sales.

In contrast, in China, electric pickup truck models such as the Great Wall Cannon and SAIC Maxus T90 primarily serve in transportation scenes like ports and airports.Therefore, the RD6 radar, born from the pure electric original SEA architecture, not only has highly mature new energy technology, but also can ride on Dongfeng, the best-selling pure electric pick-up overseas, to set off a real wave of pure electric pick-ups in China.

Secondly, there are continuously relaxed and favorable policies.

Since 2016, when six provinces in China, namely Hebei, Liaoning, Henan, Yunnan, Xinjiang, and Hubei, were first included as pilot provinces for pick-up truck lifting restrictions, 15 provinces and many prefecture-level cities in China have lifted restrictions on pick-up truck travel. The cumulative coverage rate of cities that have relaxed urban entry restrictions has reached more than 70%.

Since this year, the national government has repeatedly proposed policies to relax pick-up truck restrictions, such as “accelerating the cancellation of pick-up truck entry restrictions in the city” and “promoting pick-up trucks to go to the countryside”.

It is precisely because of these favorable policies that the pick-up truck market in various regions has become more active. For example, after the comprehensive lifting of restrictions in the Chongqing area, the daily average number of newly registered pick-up trucks increased from the original 16.5 vehicles to 25.3 vehicles.

In 2021, China’s pick-up truck market broke the record of 500,000 vehicles, a year-on-year increase of 12.83%. The National Information Center and European IHS predict that the sales of the Chinese pick-up truck market will exceed 3 million by 2030, with great potential for growth.

From the performance of the domestic pick-up truck market in the past, the Northwest and Southwest regions have always been the main markets for pick-up trucks, with the two regions accounting for more than 40% of the market share. Behind this is the local demand driven by agriculture and construction projects, and pick-up trucks have naturally become the most convenient means of transportation.

If we refine the sales by distinguishing the first-tier cities and counties and townships, the rural areas accounted for 41.3% of the market share last year, becoming the main sales battlefield for pick-up trucks, while the first-tier cities only accounted for 3.7%.

With 15 provinces such as Geelyn, Guangdong, and Sichuan successively proposing to relax pick-up truck travel restrictions, whether the pick-up truck market in first-tier and second-tier cities can usher in explosive growth in the future may determine the height of the pick-up truck market’s growth.

Although the sales of new energy vehicles in China have continued to rise in recent years, the consumer groups are still mainly concentrated in key cities, which presents a significant gap with the distribution pattern of traditional automobile sales.

Especially for super first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, they have become the cities with the highest sales of new energy vehicles in China, with Guangzhou’s new energy vehicle penetration rate reaching over 40% last year, ranking first in the country, followed closely by Shanghai with a rate of 37.94%.

It can be seen that the terminal sales of new energy vehicles are closely related to factors such as regional economic development, population education level, and vehicle usage scenarios.Thus, whether it is product positioning or power endurance, pure electric pickup trucks will not completely replace the main force of the traditional pickup truck market. After all, a pickup truck with high practicality that can haul and carry is the consumer demand of the traditional pickup truck market.

The Radar RD6 pure electric pickup truck aims to meet the needs of outdoor life with diverse activities as its main selling point, such as family trips, short-distance and short-term driving, and around-the-city tours.

On one hand, it targets the group of third- and fourth-tier cities who prefer utility vehicles; on the other hand, it targets the group of first- and second-tier cities who seek outdoor experiences. Radar Automotive has chosen the latter.

Behind the continued performance improvement of the pickup truck market, Great Wall Motor was actually the first auto company to benefit from it. Since 1998, Great Wall Pickup truck series has been the best-selling brand in China’s domestic market for 24 consecutive years, with a market share reaching 50% at one point. This means that for every two pickup trucks sold in China, one of them is made by Great Wall.

The Pao series has been an important driver of the rapid growth in market share of the Great Wall Pickup in recent years, selling over 100,000 units in the first year and reaching 300,000 units within three years, becoming the first Chinese premium pickup brand to exceed 300,000 units. Undoubtedly, the Pao series is currently the best-selling model in China’s pickup truck market, accounting for nearly a quarter of the entire market share.

In the face of the opportunity of government actively promoting policy relaxation, competing with an industry leader that has been in the market for a long time is a huge challenge for new entrants into the pickup truck market. The most promising way to win is to create differentiated products.

Compared with the Pao series, the biggest difference of the Radar RD6 is the adoption of pure electric power system, although it still faces the problem of range anxiety. In contrast, the Radar RD6 has obvious advantages over traditional fuel-powered pickup trucks in economic efficiency, space utilization, comfort, and intelligent interaction.

It is crucial to tell a localized and personalized story to resonate with customers. In the past, the image of pickup trucks in China was often associated with a robust workhorse for transporting goods. However, with the booming demand for outdoor lifestyle among consumers and the efforts of auto companies, the image of a pickup truck in China has been transformed into an ideal vehicle for outdoor adventures.

Therefore, as a translator, I have only made corrections and improvements to the English text, retaining the HTML tags inside the original Markdown. No explanation is given.From “tool trucks” for loading and unloading goods, to “equipment trucks” for refined camping, pickup trucks are no longer just practical helpers for those who work in maintenance, decoration, and delivery in the city.

Pickup trucks demonstrate the advantages of outdoor living in this diversified life, with high space utilization during camping, the rear bucket serving as a platform for fishing or carrying cargo during outdoor cycling.

At the same time, the success of the Great Wall Cannon precisely meets consumers’ demand for high-quality, diverse pickups, comparable to the comfort of sedans, the off-road performance of hardcore SUVs, and the loading capacity of light-duty trucks.

Meanwhile, Great Wall often guides consumers from the concept of tool trucks in the past to the realization of refined outdoor life through organizing or participating in outdoor activities, scientific expeditions, public welfare, and other activities.

The appearance of the RD6 radar not only meets consumers’ high requirements for pickups on multiple levels but also convinces trend-seeking young people to watch movies or drink coffee more appropriately outdoors with outstanding product capabilities such as flexible space and discharge function. Isn’t this the most persuasive reason for purchase?

Beyond the product, RADAR Automotive proactively guides consumers’ transformation of the “coarse and wild” representative terms for pickups.

RADAR Automotive has created the RADAR Weekend outdoor merchandise sub-brand, such as the “Guarding Natural Wonders” launched with National Geographic and multiple camping equipment co-branded launches with the global one-stop camping equipment brand Naturehike.

Imagine driving a silent pickup truck and setting up a floor tent, grill, coffee machine, and projector to chat with family and friends. Isn’t this scene the outdoor life that young people pursue?

For young entrepreneurs selling on the street, a mobile power supply with a power of up to 6kW and an oversized rear platform, isn’t this more creative than “trunk economy”?

Starting with pure electric pickups, RADAR Automotive advocates changing the fixed label of the pickup truck as a tool truck, and has opened up a new direction for domestic car categories and seized the opportunity in the relatively blank field of pure electric pickups.

At the same time, with the advantages of Geely’s supply chain, sales channels, technology, and other resources, RADAR Automotive obviously has a higher starting point than others.

As a potential stock in the new track, pure electric pickup trucks may allow RADAR Automotive to take a new approach, but the key lies in how RADAR Automotive can continue to meet users’ outdoor needs.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.