Writing by: Liang Zhihao

For traditional automakers, this may even be the last straw that crushes second-tier brands.

In 2021, the sales ratio of new energy vehicles (NEVs) in China has reached 13.4%, a level sufficient to make us a leader in the global NEV market, considering the country’s huge sales volume. However, obviously, the government is still not satisfied with the numbers, because according to the previous plan of the Ministry of Industry and Information Technology, China aims to achieve a 25% sales ratio of NEVs by 2025.

To achieve this ambitious sales ratio, besides encouraging more people to choose NEVs, “forcing” more traditional automakers to transform towards electrification is also a major policy direction. Adjusting the existing “dual credit policy” may be the best solution.

New dual credit policy to be implemented soon?

On July 7th, the Ministry of Industry and Information Technology issued a decision on revising the “Parallel Management Methods for the Average Fuel Consumption of Passenger Vehicle Enterprises and the New Energy Vehicle Credit” (draft for comments). The revised credit calculation method for NEVs not only has several adjustments but also introduces the concept of “credit pool” for the first time.

After careful study, I found that the new policy to be implemented is a “disaster” for many joint venture automakers who were originally unable to meet the credit requirement.

Why do I say so?

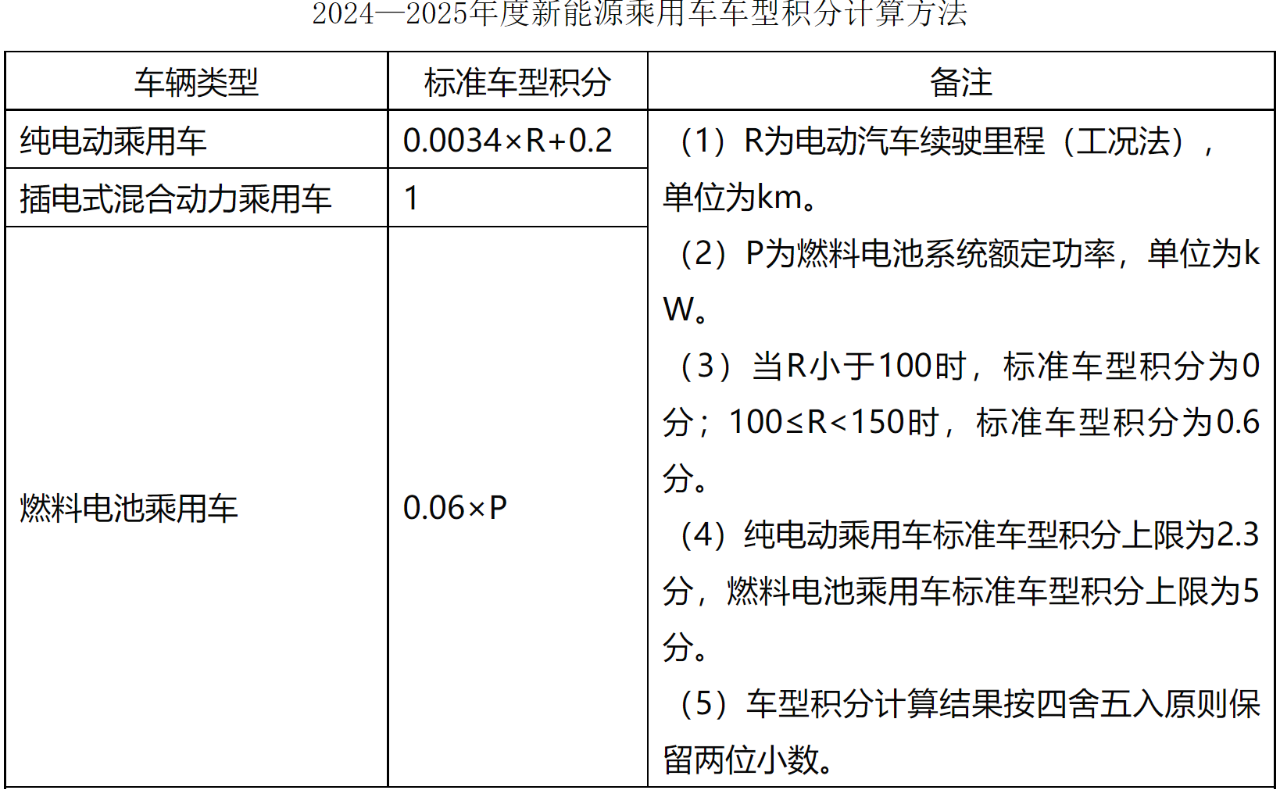

Let’s take a look at the new credit calculation method for NEVs under the new dual credit policy.

According to the calculation formula released by the Ministry of Industry and Information Technology, after the new policy is implemented, the “points per vehicle” will be significantly reduced, and based on the calculation of mainstream pure electric vehicle models with a range of 500 km, it can only get 3.3 points per vehicle before 2024-2025, but can only get 1.9 points in the assessment in 2024-2025.

For those A00-class micro electric cars that focus on low-price entry, the decrease in points is even more significant, as under the new policy, electric cars with a range of 150km will see the points they can earn drop from 1.24 points to 0.54 points, a plummet of 54%. The reduction in points that can be obtained per vehicle will, on the one hand, drive car manufacturers to develop more electric car models with longer ranges to obtain more points, and on the other hand, force them to produce more A00-class micro electric cars to compensate for the points shortfall.

For those A00-class micro electric cars that focus on low-price entry, the decrease in points is even more significant, as under the new policy, electric cars with a range of 150km will see the points they can earn drop from 1.24 points to 0.54 points, a plummet of 54%. The reduction in points that can be obtained per vehicle will, on the one hand, drive car manufacturers to develop more electric car models with longer ranges to obtain more points, and on the other hand, force them to produce more A00-class micro electric cars to compensate for the points shortfall.

Yes, perhaps many people don’t know that low-cost micro electric cars like the Wuling Hongguang MINI EV and the Changan Benben E-Star have not been developed by car manufacturers for profit, but rather to “sell numbers” and obtain sufficient positive points to avoid fines.

Introduction of “Points Pool” to Control Points Price

Just before the new policy was announced, the relevant departments released the “2021 Annual Average Fuel Consumption and New Energy Vehicle Points of Chinese Passenger Car Enterprises,” revealing the “non-compliance” situation of many car companies, which is truly shocking.

SAIC-GM and FAW-Volkswagen have negative points of 710,000 and 440,000 respectively, while in terms of independent brands, Chery and Geely, with negative points of 460,000 and 410,000 respectively, are the most eye-catching.

If the points cost exceeded RMB 2,000 per point in 2021, SAIC-GM alone would have to spend nearly RMB 1.5 billion just to meet the standard. As the points that can be obtained per vehicle decrease in the future, if these manufacturers do not hurry up to launch more new energy vehicles, their points gap will become larger and larger. Once their total profits earned in the country cannot cover the cost of buying points, “a dead end” awaits these brands.

So why don’t these car manufacturers seem to be in a hurry?Due to the unstable price of credits, which has become a well-known fact that credit trading has already become a “business”, for example, Tesla can earn billions of dollars in extra profits every year just by selling credits. However, with more and more brands starting to produce new energy vehicles, many car companies have accumulated a large number of credits waiting to be sold, resulting in “supply exceeding demand” for new energy credits, which has led to a continuous decline in credit prices.

In 2021, the average transaction price of new energy credits was 2088 yuan/credit. Industry insiders predict that if the sales volume of new energy vehicles continues to rise this year, the price of credits may fall to the level of 500 yuan/credit in 2019.

This result is obviously not what the country wants to see, because it means that those “stubborn” car companies will be able to continue to produce fuel vehicles recklessly because “credits are not expensive, and if I don’t have enough, I just can’t buy them!”

On the other hand, the decline in credit prices will also hit the enthusiasm of new energy vehicle companies, after all, buying and selling credits is an important source of profit for many new energy vehicle companies.

Therefore, in the new policy, we first saw the concept of “credit pool”.

In the future, new energy vehicle companies or companies that hold a large amount of positive credits can choose to put their own credits into the credit pool. When there is “supply exceeding demand”, everyone can put their credits into the pool, and when there is “supply less than demand”, they can take out their credits and sell them. The so-called credit pool is like a reservoir, a dam, or a granary, which plays a role of regulation and buffering, avoiding the great ups and downs of credit prices in the market.

In addition to the downward adjustment of single car credits and the introduction of credit pool, from 2024, the credit assessment ratio will also become stricter. The so-called credit assessment ratio is actually a baseline set by the Ministry of Industry and Information Technology for car companies.

For example, in 2021, the credit assessment ratio for new energy was 14%. For the sake of convenience, let’s assume that Company A produced a total of 1 million fuel vehicles in 2021. This company will be given 140,000 negative new energy credits. To offset these 140,000 credits, the company either needs to spend money to buy credits on the market or produce new energy vehicles to obtain positive credits for offsetting.In 2021, the assessment ratio is 14%, which rose to 16% this year, and will be 18% in 2023. What? Do you think the assessment ratio in 2024 is 20%? Wrong! According to the new policy, the assessment ratio for new energy credits will be raised to 28% in 2024! And in 2025, the assessment ratio will rise further to 38%!

Based on the sales volume of 1 million cars, this means that in 2035, this A car manufacturer will simultaneously produce 380,000 plug-in hybrid models or 190,000 pure electric vehicle models. This ratio is unbelievably high… In this case, for traditional automakers, the pressure to score credits will increase sharply, and this may even be the last straw that crushes second-tier gasoline car brands.

No turning back from electrification

A few days ago, Germany, as a pioneer in European environmental protection, was reported by the media to have canceled its “carbon neutrality by 2035” target. Of course, later we found out that this was just a misinterpretation by the Chinese media, and they only gave up on the target of “100% renewable energy supply by 2035” they had previously proposed, but Germany’s recent retreat (previously they also opposed the ban on gasoline cars in Europe) has also sparked a lot of arguments.

But regardless of how the wind blows abroad, for the Chinese market, there is no turning back from electrification. On the one hand, by vigorously promoting new energy vehicles, we have successfully gained rare discourse power in the world’s automobile industry. On the other hand, new energy vehicles and related industrial chains have become an important part of our economy.

In the future, even if Western countries return to a conservative approach to electrification, we can only stay firm and continue to move forward on this path by using our own influence.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.