Author: Zhu Yulong

After receiving the data for June, I believe we can make a semi-annual review, focusing on a few interesting questions:

1) How are vehicles aimed at operations in 2022? Who sells the most? Which brands rely on operations for their existence?

2) What is the market situation for plug-in hybrids? Aside from the DM-i, how is the competition for extended-range vehicles going? What’s next for Huawei?

3) What is the distribution of pure electric vehicles among different levels? What is the market share of various brands in different subdivisions?

Today’s article is mainly used to answer these questions.

Leasing, Business, and Personal Use

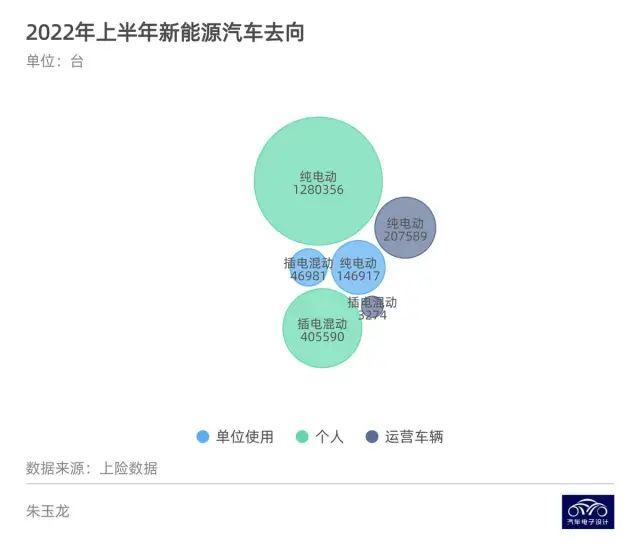

In the first half of the year, personal use of new energy vehicles accounted for more than 80%, with a total of 1,685,946 vehicles, 193,898 units for business use, and 210,863 units for 2B operation vehicles, accounting for about 10% of the total. Because of the constraints of operation vehicles on pure electricity, the overall classification is as follows:

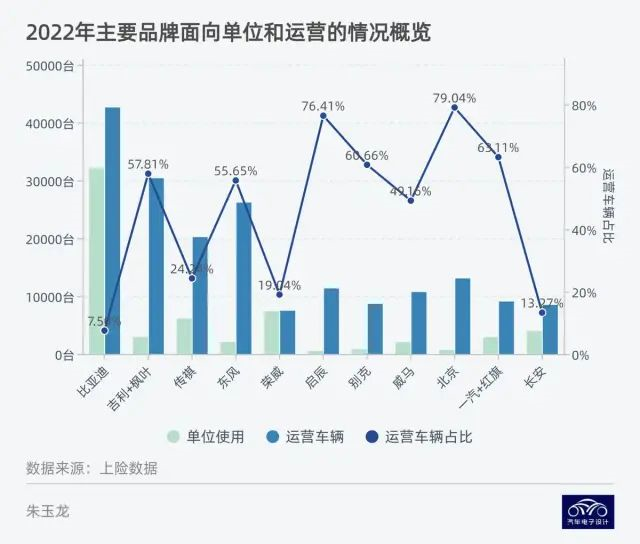

Because everyone is more interested in who owns these 210,000 operation vehicles, I have done some sorting, as shown below:

-

BYD: 32,162 units and 42,606 units in business and operation vehicles respectively, both being the most, but the overall proportion is still good.

-

Geely: It has risen rapidly during this period, but mainly in 2B vehicles. There are 2,952 units and 30,375 units for business and operation vehicles respectively, with an operational ratio of 57.81%.

-

GAC: Although the Aion S has a lot of operation vehicles, the overall operational ratio of the Aydan is about 1/4, with 6,118 units for business vehicles and 20,194 units for operation vehicles.

-

Dongfeng: 26,170 operation vehicles with an operational ratio of 55.65%.

A high percentage of operation vehicles is not good news for consumers.

Situation of Plug-in Hybrids

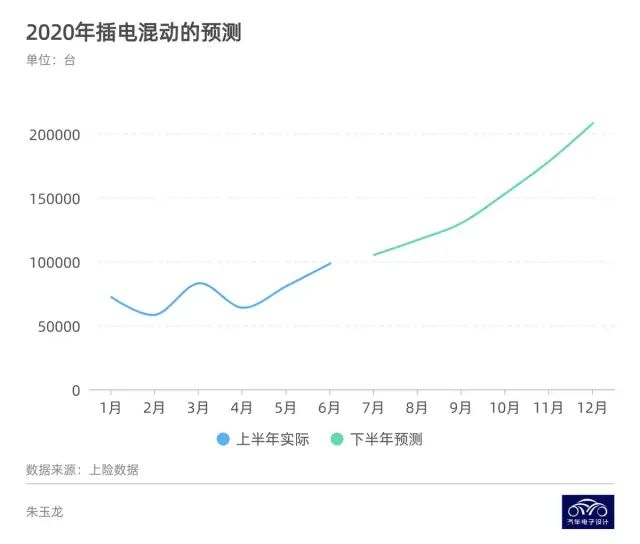

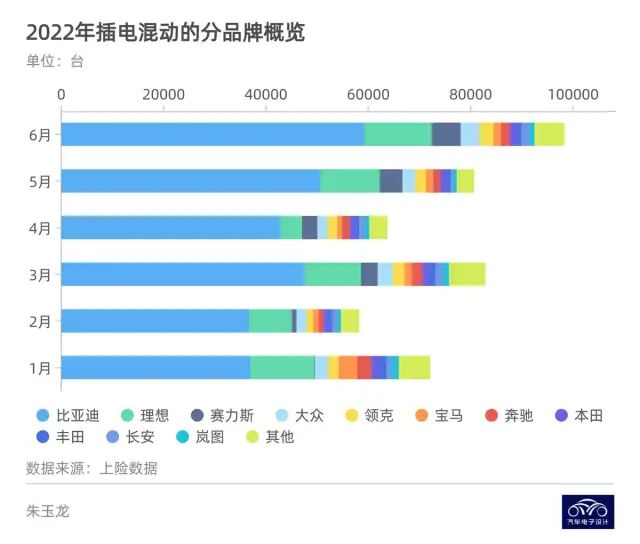

In the first half of the year, plug-in hybrids came as expected, with 456,000 units, nearly 98,000 units monthly (nearly 100,000 units), which is very consistent with the situation in the second half of the year and my previous estimate.

The logic of this judgment is still based on the fact that several major enterprises will strive to try in the second half of the year. As of 2022, BYD is still the dominant player with 273,945 cars sold, accounting for 60.09% of the market share.

The logic of this judgment is still based on the fact that several major enterprises will strive to try in the second half of the year. As of 2022, BYD is still the dominant player with 273,945 cars sold, accounting for 60.09% of the market share.

Ideal Motors sold 60,801 cars, accounting for 13.34% of the market, while SAIC-GM-Wuling sold 17,346 cars, accounting for 3.80%, and Lynk & Co sold 12,197 cars, accounting for 2.68%. Changan Automobile sold 7,146 cars, accounting for 1.57%.

The logic for the 100,000 to 200,000 RMB price range mainly considers the delivery plans of BYD, Huawei’s SAIC-GM-Wuling, and Ideal Motors in the second half of the year, as well as the product portfolio of Geely, Lynk & Co, Changan Automobile, and Great Wall Motors after switching to DHT. In fact, even Wuling, the company that produces the cheapest cars in China, has a strong push in the hybrid market.

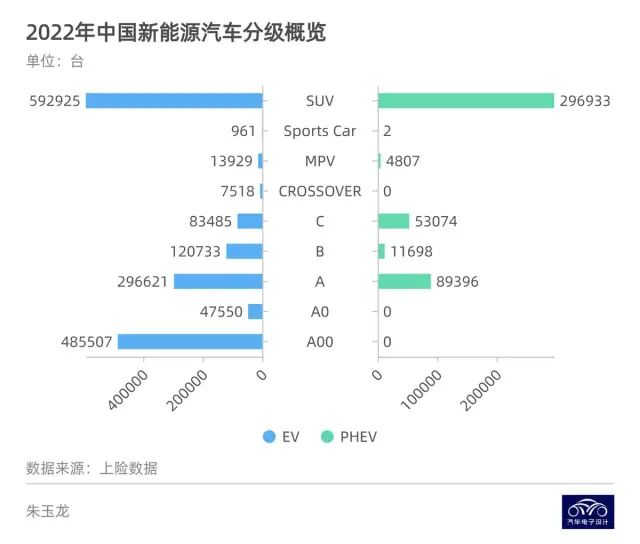

With the continuous growth of plug-in hybrids in the SUV segment, it will happen within a year that plug-in hybrids (including extended range) will catch up with pure electric vehicles in the compact, midsize, and full-size SUV categories.

Different Grading Levels

I created a table from which you can see a lot of information:

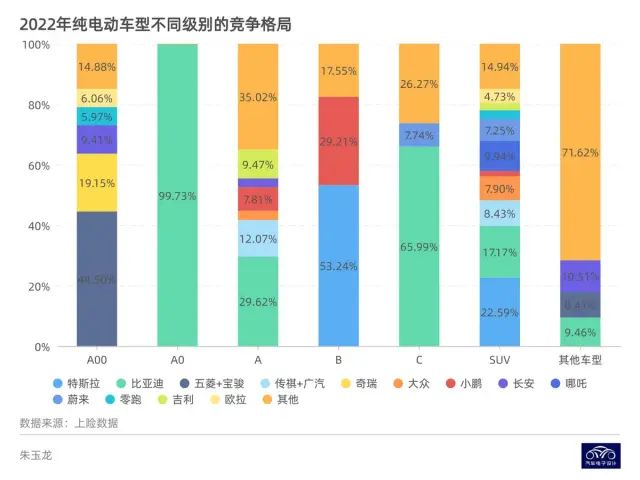

I singled out pure electric vehicles from different brands in the market:

Market Share of Different Grading Levels

Tesla dominates the market for B-level electric cars, and Xpeng has also secured a place in this niche with the P7.

In the SUV segment, there is no single dominant player. Tesla mainly operates in first-tier cities, while BYD focuses on the small and compact car market.

-

A00-level market still has a few players that include Wuling, Chery, and Changan, but Lyoup is gradually falling behind.

-

Dolphin is making a good impression in the A0-level sedan market.

-

Guangzhou Automobile Group is more firmly positioned in the A-class market.

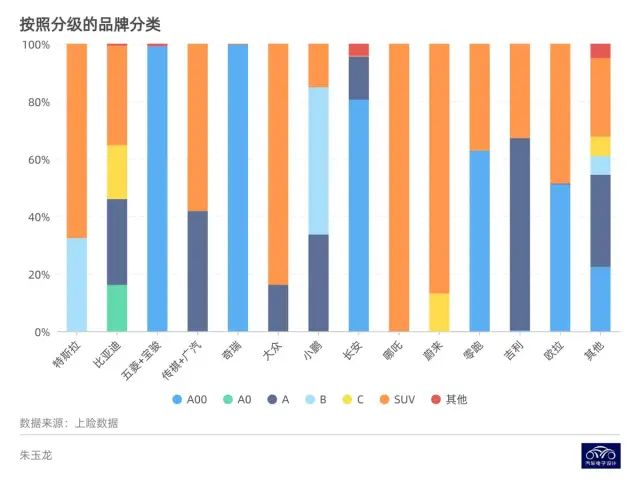

Grading Levels of Different Companies## Different Positions of Brands in the Pure Electric Vehicle Segment

The following classification allows us to see the different positioning of various companies in the pure electric vehicle industry. Each company adopts its own strategies, but in the process of brand building, everyone takes what they need.

Summary: To be honest, it’s difficult to make money solely on electric cars. From the current perspective, the amount of batteries used in the short term is not particularly meaningful, and it is still necessary to see who can completely switch from the electric racing track to the intelligent track after the subsidy reduction and production bottleneck in 2023 among these enterprises.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.