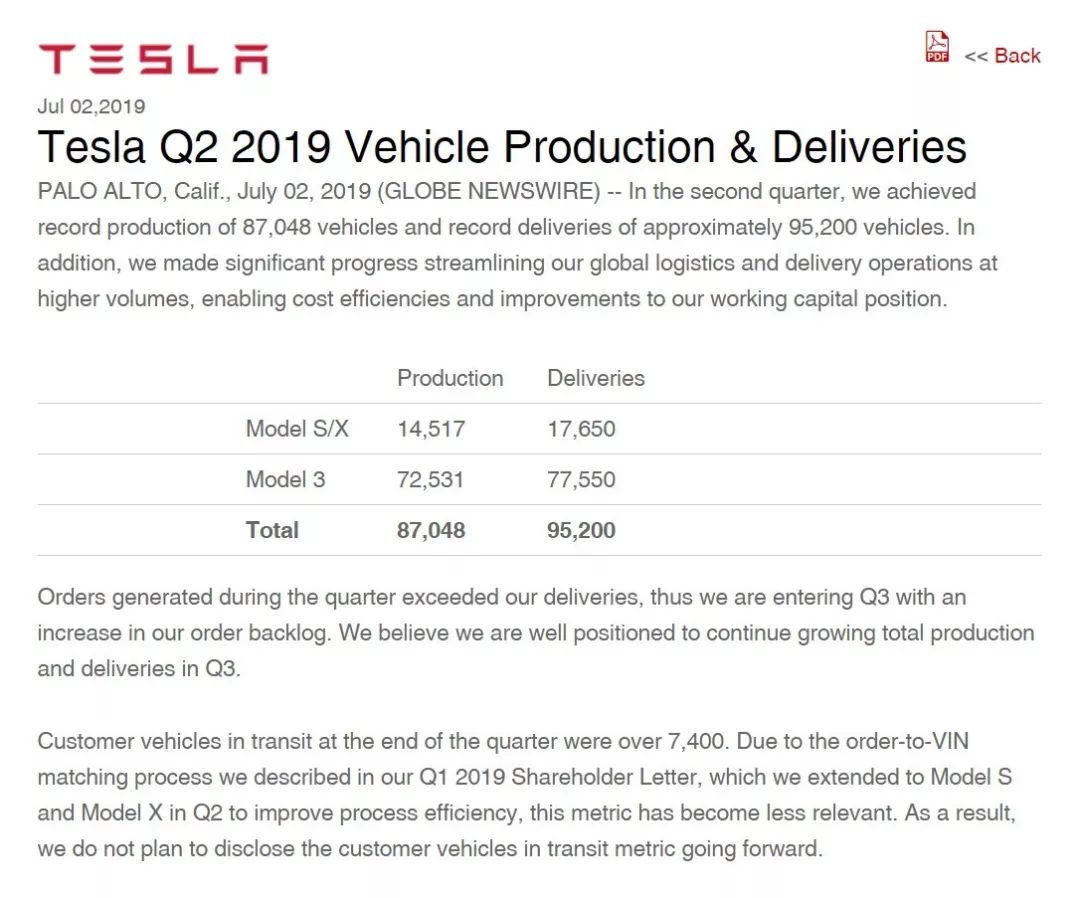

On July 2nd, 2019, Tesla released its Q2 production and delivery report.

Over the past quarter, Tesla delivered a total of 95,200 vehicles, representing a 51% increase QoQ and a 133.5% increase YoY in Q2 2019. This is the highest quarter sales record in Tesla’s history. Despite the global automotive market downturn and subsidy reductions for new energy vehicles in various countries, record deliveries exceeded everyone’s expectations.

Tesla’s Global Delivery Data Analysis

Breaking records is just the tip of the iceberg. If we delve into the actual Q2 performance of Tesla, we will discover more new findings.

In terms of vehicle models, Model S/X delivered 17,650 units in Q2. With the launch of the latest Model S/X, internally known as the Raven version, and no significant increase in price, sales for the two flagship models did not recover to the level of 20,000-25,000 and continued to hover at a low level.

This also indicates that Model 3 led the record-breaking sales in Q2. With sales reaching as high as 77,550 units, this means that the YoY growth rate of Model 3 reached 320% – a year ago, the single-season sales of Model 3 were only 18,449 units, and it was then the culprit for dragging down Tesla’s performance and severely damaging its financial performance.

Even though Model 3’s production capacity is currently stable, its QoQ growth rate still reached 52% in Q2. Considering that Tesla did not reproduce the backlog of demand from Q1 when it entered the two major overseas markets of Europe and Asia for the first time, a reasonable explanation is that Model 3 indeed has no demand problem.

Moreover, from a market perspective, Tesla can be divided into four major regions worldwide: the United States, Canada, Asia-Pacific, and Europe (in Tesla’s report, the United States and Canada are collectively referred to as North America), of which the United States sold approximately 53,000 units in Q2, Canada sold approximately 12,000 units, Asia-Pacific sold approximately 11,000 units, and Europe sold approximately 19,000 units.

Compared with Q1, it can be found that the growth driver for Tesla is in its homeland, the United States. However, outside of the United States, all regions have reproduced sustainable market demand, and no area has experienced a decline.

People often misunderstand Tesla’s sales policy as “weak demand, urgent promotion to maintain financial performance”, but the truth is: even in Q2, when sales reached a historic high, new orders for Tesla still exceeded production capacity—supply cannot meet demand, which is the best response to doubts about demand hell.

People often misunderstand Tesla’s sales policy as “weak demand, urgent promotion to maintain financial performance”, but the truth is: even in Q2, when sales reached a historic high, new orders for Tesla still exceeded production capacity—supply cannot meet demand, which is the best response to doubts about demand hell.

Orders generated during the quarter exceeded our deliveries, thus we are entering Q3 with an increase in our order backlog.

Our new orders this quarter exceeded our deliveries, and our order backlog has increased as we enter Q3.

How was delivery hell solved?

Production hell, delivery hell, and demand hell are the three major challenges that Tesla faced during the Model 3 era. Many people were impressed by the Tesla China team working overnight to deliver half of the quarter’s sales in the last 10 days of Q1.

As mentioned in previous articles, this is essentially a conflict between Tesla’s direct sales-delivery system and the quarterly financial report system of a listed company.

So how did Tesla smoothly solve the “delivery hell” problem in the historic Q2? In the Q1 earnings conference, Elon Musk and Tesla CFO Zachary Kirkhorn repeatedly mentioned regional balance.

To better illustrate this, it is necessary to review Tesla’s embarrassing history in Q1. As mentioned earlier, Tesla completed half of its total deliveries in the last 10 days of Q1. Tesla’s sales, HR, legal, design, and engineering teams worked to the last minute, but still failed to deliver a large number of vehicles to customers.

This is because in the first two months of Q1, Tesla focused on producing international versions of Model 3 for Asia and Europe, and resumed production of US domestic versions in March. Finally, in mid-March, all vehicles arrived in Asia, Europe, and the US East Coast. In addition, Asia and Europe were the first markets where Model 3 was launched, which further increased the complexity of certification and delivery.

Regional balance is not complicated. Simply put, Tesla will adjust from the manufacturing end, changing from producing models in batches for regional markets to producing according to the global market order growth rate. In other words, throughout the world, throughout the quarter.

The improvement it brings is obvious.

The improvement it brings is obvious.

-

Fully optimize the user’s delivery experience

-

No longer need to equip additional venues and teams for delivery and logistics work

-

Significant reduction in delivery and operation costs

On April 24, during the Q1 financial report conference, Tesla announced that “the Model 3 has implemented a regional balance policy, and the Model S/X will also be implemented in the next 1-2 weeks.”

On May 22, Elon began to send emails to the entire team to improve production capacity and sprint for new sales records. In a subsequent email, he mentioned that he would “communicate with the delivery teams in the United States, Asia, and Europe every two days to speed up delivery.”

Finally, Tesla specifically mentioned the effectiveness of the regional balance policy in the Q2 delivery announcement.

We made significant progress streamlining our global logistics and delivery operations at higher volumes, enabling cost efficiencies and improvements to our working capital position.

We have made significant progress in streamlining our global logistics and delivery operations at higher sales volumes, improving capital efficiency and improving working capital.

The regional balance policy has far-reaching effects. We have realized that the production model of manufacturing model-specific vehicles in batches in regional markets has a problem of vehicles cannot be delivered in a timely manner. In the era of the Model S/X, Tesla would mention “vehicles in transit” in its announcements. This indicator, together with the delivery volume, represents Tesla’s actual performance in a single quarter.

However, as mentioned above, the larger market scale of Model 3 magnifies this problem. After Tesla covered the regional balance policy to the full product line, the “vehicles in transit” indicator will maintain a low level for a long time, and this indicator is no longer valuable for reference.

For example, in Q2, Tesla’s “vehicles in transit” were only more than 7,400, a decrease of more than 30% month-on-month. As the regional balance policy continues to be implemented, the scale of “vehicles in transit” will continue to decrease. That is why Tesla said in the delivery announcement that Tesla will no longer disclose “vehicles in transit” data in the future.

Why did Tesla only make this seemingly childish adjustment now? Why haven’t traditional car companies encountered similar problems?### Redesign of Model S/X

The fundamental difference between the traditional dealership chain of traditional automakers and Tesla’s direct sales was not the main reason why this issue was not highlighted enough to affect the financial report in the Model S/X era. Fundamentally, the adjustments made by Tesla are paving the way for every new carmaker who insists on direct sales and is committed to long-term globalization.

Tesla’s delivery announcement was very short but contained much information.

We continue to analyze Model S/X. Tesla delivered 17,650 Model S/Xs in the second quarter, but only produced 14,517. Although the sales growth rate increased by 45.9% compared to Q1, the production increase rate of 2.6% to 14,150 was negligible.

The Model S/X production capacity remained unchanged while the sales continued to grow, which further confirmed our earlier judgment: Tesla is continuously clearing inventory to transition to the release of the redesigned Model S/X.

Now it seems that CFO Zachary’s statement at the Q1 earnings conference call that “Tesla’s Model S/X production capacity will be higher in Q2 than in Q1 and will return to normal levels in Q3” was more of a deception for the real redesigned Model S/X.

As we mentioned earlier in terms of research and development investment, the Model 3 production capacity had stabilized by 2019, and there will be no more massive investment. However, Tesla announced quarterly sales guidance of 90,000 – 100,000 vehicles during the Q1 earnings conference call, and on the other hand, hinted that losses were still inevitable in Q2 and are predicted to return to profitability in Q3. The regional balance policy has significantly increased operational capital efficiency, so where did the money go?

All signs point to anonymous sources’ disclosure: Tesla will introduce a redesigned Model S/X in September.However, this leads to a new question: Model S/X sales will remain low in the next quarter. Considering a sales target of 360,000 to 400,000 vehicles for the year, the average quarterly sales in the second half of the year must reach at least 100,000 units.

Tesla said in the announcement that we believe we are ready to continue to increase capacity and total sales in Q3. This is their next challenge towards annual sales, and Tesla believes that Ta is ready. Do you believe it?

-

From Tesla’s QQ music, talking about Tesla China’s intelligent challenge

-

Under the haze of spontaneous combustion, Tesla’s “New Challenge”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.