Written by | Leng Zelin

Editor | Wang Pan

In May of last year, NIO broke the long-standing pattern and squeezed out Li Auto from the third position with a delivery record of 4,508 vehicles.

Of course, the factor of Li Auto upgrading their model also played a part. After the launch of the Li ONE 2021, the sales began to skyrocket, quickly regaining their position.

Under the favorable trend of the overall new energy market, NIO proved that it was not merely a flash in the pan. Not only did they attract investment from 360, but their sales also showed a beautiful trendline.

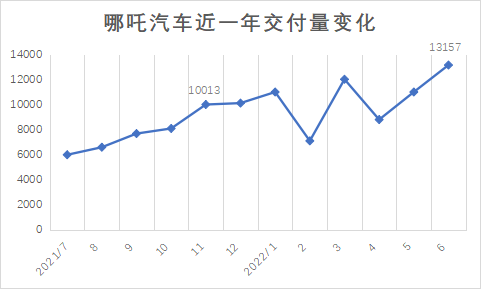

Since the first time they surpassed 10,000 deliveries in November of last year, they have maintained this record except for in February, April, and May, when affected by the off-season and supply chain issues. Their latest delivery record is 13,157, with 63,161 vehicles delivered in H1, only second to XPeng Motors.

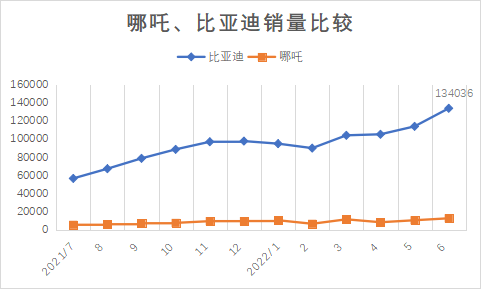

This is a good achievement among new forces, but when compared to the entire new energy market, NIO’s price and sales performance are somewhat pale in comparison. If compared to BYD, who also specializes in the 50,000-300,000 RMB price range, the difference is obvious.

In the past year, new energy car makers have broken their own sales records one after another in the “vertical” dimension. However, BYD has also constantly refreshed their sales record, with numbers reaching 60,000, 80,000, and 100,000. Their latest monthly sales have reached over 130,000, equivalent to the annual delivery record of most new energy car makers.

Li Auto can still compete by offering different prices, but for brands that linger in the mid-to-low-end market, such as NIO, they will find it difficult to improve their brand image in the short term. It seems that all car companies in this price range will have to ask themselves a question: “How to survive under the fierce attack of BYD?”

BYD Forms an Encirclement

In H1, BYD surpassed Tesla with a cumulative sales of 641,400, taking into account both hybrid and pure electric models, while Tesla only has pure electric models. Hybrid cars are an inevitable presence and have a huge market demand, but after 2023 or 2024, hybrid models will gradually decline, as stated publicly by the chairman of XPeng Motors, He XPeng.

Even though the range and charging systems have greatly improved, it is hard to deny that as a “productive tool” for the majority of Chinese families, the first car is still difficult to be purely electric.On the one hand, there is a lack of suitable home charging environments, and real estate, parking spaces, and property management will all limit the installation of home charging stations. On the other hand, there is the issue of charging efficiency. Although car manufacturers are all deploying 800V platforms and supporting high-pressure fast charging stations, in the short term, the cost and quantity will focus on middle to high-end users. Finally, the concern most people have about long-distance driving may only happen once a year, but it is also an important factor in purchasing a car.

Therefore, for a long time, there has been a phenomenon of “strong at both ends and weak in the middle” in the domestic new energy vehicle market, and only A00-class and pure electric vehicles priced above 300,000 RMB were selling well.

The 100,000-300,000 RMB price range is the largest market and the most difficult to serve, and it is also the market that values cost-effectiveness the most. Can it meet the various usage scenarios of families? Does it have cost-effectiveness? As for intelligence, from the sales comparison between the BYD Han and the XPeng P7, it is not yet the mainstream demand of this market segment.

To some extent, the launch of BYD’s hybrid system is the beginning of prosperity in the middle market.

Although traditional car manufacturers such as Geely, Great Wall, and Changan are also following up with hybrid models, BYD’s operation mode of the full industrial chain and early deployment gives it a cost-effectiveness advantage over vehicles in the same class. The sales figures, which consumers have invested real money into, can explain the problem. In the sales ranking of plug-in hybrid models in June, the top five were all models under BYD.

After standing firm, BYD’s other initiative was to rejuvenate its brand and focus on pure electric vehicles.

At the end of last year, BYD upgraded the e-network to the Ocean Network and launched the pure electric Ocean Life series based on the e-platform 3.0 and the DM-i hybrid technology-based Battleship series. The overall design style is more characterized by new energy and youthfulness.

Although there may be internal product competition, such as the Han EV and the Sea Lion, or the Destroyer 05 and the Qin Plus DM-i, the reason why BYD Group Chairman stated “Now it is not the big fish eating the small fish, it is the fast fish eating the slow fish” is clear.

Some traditional carmakers who have transformed slowly have become “slow fish,” and new forces like Nio, which focus on the mid-to-low-end markets, are both “slow fish” and “small fish.”

Nio’s Desperate Move

What is the first thing that comes to mind when you mention Nio? Who is its target user group or what is its brand positioning?

Those who focus on the B-side market may say that Nio is still an untested brand because more than 50% of the sales of its first model, the N01, were in the To B market; those who focus on the sinking market may say that Nio is a low-end brand because Nio’s CEO, William Li, previously required its sales and service networks to only enter third and fourth-tier cities, not first and second-tier cities.

Of course, this is also related to Li’s early strategy, which he called the “Toothless Wolf Strategy,” which is to create a market in the gap.

As mentioned earlier, in the early days of the barbell-shaped market, NIO did not find the so-called “gap”. Instead, the B-side market and the low-end market limited the brand’s further upward movement. Therefore, in 2020, NIO urgently opened offline stores in first- and second-tier cities. When announcing delivery results last year, the brand emphasized the proportion of “individual users”.

In addition, it is clear that NIO is eager to explore multiple markets. For example, last year NIO V launched two new models – the Magic version and the Witch version. The former adds a lot of sporty accessories to emphasize the performance, while the latter brings Chen Zhuoxuan to endorse, apparently aiming to grab the female market that was hotly contested last year by the Euler brand.

Afterwards, NIO also launched the Magic boy version, a toy car for children to “drive”, and held a “first car owner delivery meeting” at the end of the year. Of course, guardians accompanied the “car owners” for vehicle inspection.

Last year, for the NIO V model alone, NIO launched multiple versions such as Pro (divided into Smart Enjoyment and Smart Fun), Standard extension (divided into Normal, Entertainment, Upgrade, and Entertainment Upgrade), Long extension (divided into Smart Enjoyment, Entertainment Upgrade, and Smart Enjoyment Upgrade), and special versions for online booking and industry customization. There’s even a version dedicated to driving schools.

This year, the naming convention of NIO V changed again, collectively using the suffix “V·Tide.” Previous versions and the V Pro which was only on the market for a few months were all discontinued. However, attentive consumers can still find that the Tide 400 Pro and Tide 400 Lite Pink Custom versions correspond to the V Pro and the Witch version respectively.

The other NIO car, NIO U/U Pro/U Smart, also underwent such a tortuous naming route.

If BYD’s product line complexity is due to the objective factor of too many models, then NIO’s confusing naming rules are entirely self-inflicted. With a lack of continuity in the models, consumers face difficulty in choosing, while car journalists also have trouble sorting out the relationships. It feels as if NIO’s new car and restyling planning didn’t come from the same team.

Recently, NIO also released its new sedan – NIO S. Early announcements called it NIO S, but it was later changed to NIO S Yao. Similarly, it has multiple versions, such as the Bright World Edition that rivals the Xpeng P7 Pengyi Edition, the 715 Laser Radar version with Huawei hardware, and a power system with four-wheel drive, rear-wheel drive, and a range extender that has been popular for almost the past two years, with a total of six versions under different combinations.

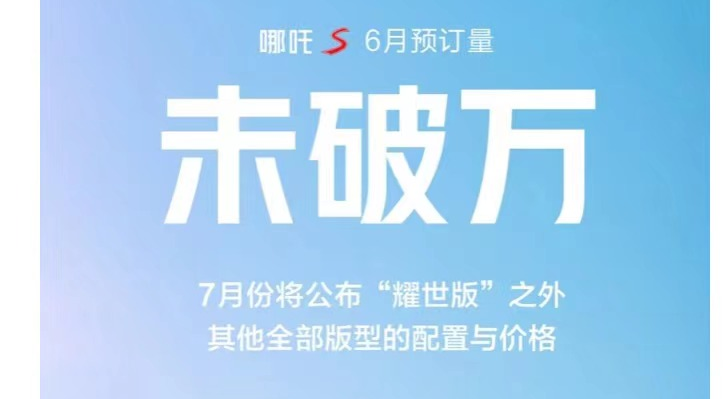

Currently, only the Bright World Edition is available for pre-sale, with a pre-sale price of 3.388 million yuan, a significant increase from the brand’s previous 100,000 yuan, and limited to 999 units. NIO is trying to create a “hot” atmosphere, but the actual effect may not be as satisfactory.

According to the data provided by NETA, it appears that the Yao Shi version has not sold out after two weeks of presale. The restrictions on purchase have become redundant, and the orders of other car models are not as impressive as the “Electric Four Little Dragons” (Deep Blue SL03, BYD Dolphin, and Leap Motor C01) during the same period. However, such data has been suspected of false ordering by some media reports.

The model director of NETA S, Liu Yupeng, previously registered an account in the auto community for promoting the new car. However, after the launch of the new car, he stopped updating the account for more than a month due to the criticism from car owners.

Whether the NETA S model is competitive or not remains to be seen by the sales figures. However, this model, which carries the upward vision and intelligent label of the NETA brand, has “crashed” in marketing.

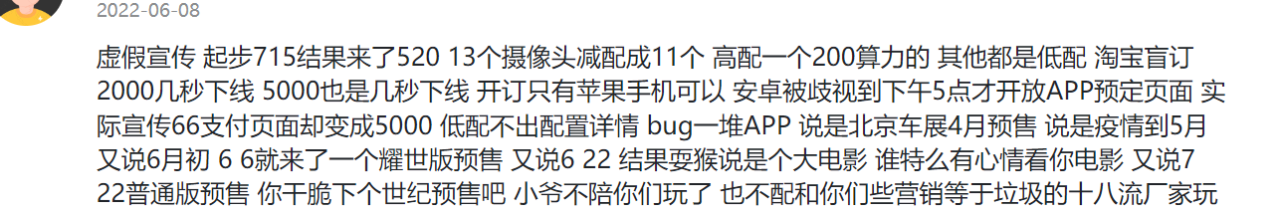

According to feedback from car owners, the focus of the problems mainly centers on three points. The first is that the early publicity and actual release configuration are inconsistent. For example, it was previously promoted that the range starts from 715km, whereas the current version has a range of 520km, and the number of cameras has been reduced from 13 to 11.

Secondly, the blind booking price is not uniform. Car owners found that there were three different prices of 66, 2000, and 5000 yuan. At the same time, there were also frequent bugs on the APP, such as the color of the exclusive version changing to the paid version of the ordinary version, and the rendering of the Samurai Orange interior not being completed. When car owners raised concerns, they were told that the development of the car machine and APP were not handled by the same team.

In addition, the configuration of the car model is more of a gimmick than practical. For example, it was always advertised that the Huawei MDC computing platform and LIDAR are only equipped on one model, while the other models are equipped with dual TDA4 chips from Texas Instruments, and there is a significant difference in computing power between the two types. The former has 200TOPS while the latter has only a single chip 8TOPS. The Yao Shi version is the top-of-the-line model, but it does not have a corresponding auxiliary driving system, and the version of the intelligent driving system is TA PILOT 3.0 instead of 4.0.

In summary, the root cause is that NETA still lacks confidence in the selling price of the product.According to the report from Zosi Automobile Research, the lightweight parking solution based on TI TDA4 and Horizon J3 chips has a cost reduction of about 30%-50% compared to the solution powered by Nvidia Xavier chips. Meanwhile, the reason why NETA TA PILOT4.0 system adopts Huawei MDC610 chips instead of 810 is also due to the former’s cost advantage.

In fact, in sales, marketing, and product collaboration, NETA has always made the outside world feel “discordant”. On the one hand, it wants to break through the high-end market, while on the other hand, it is either reducing costs or competing with LaoTou Le in speed. On the one hand, it wants to demonstrate its independent research and development and intelligence capabilities, while on the other hand, it is slightly conservative in hardware configuration.

Although NETA has tried several markets in the past, it has not kept up with the branding and product promotion when it directly jumped from 100,000 yuan to 300,000 yuan. The reason is that the NETA S model is not aimed at the original user group, and it seems that the business department has not adapted to such a significant market switch.

As shown in the WeChat public account push article in June, the “unbroken ten thousand” words of the reserved amount of NETA S were placed in the center, causing confusion about whether it was “self-deprecating” or “showing off.”

It is not difficult to see that NETA has been walking on the road of “copying homework” under the sandwich of old and new forces, and not only copying the homework of one brand.

BYD has a variety of product lines, and NETA keeps renaming and releasing new versions; the swapping mode became popular, so NETA U launched the swapping version; the extended-range SUV was sought after, so NETA introduced the extended-range sedan; XPeng labeled itself as intelligent by relying on the P7 Pengyi version to move the brand upward, so NETA S also wanted to use the “Hunt Yiba” dazzling edition to attract public opinion.

However, the application of each technology is actually a reflection of the brand tone and culture. For example, Ideal considers that the extended-range is the best power mode for family users, while XPeng attracts young people by sticking the intelligent label on itself.

At the same time, each route requires a lot of time, money, and effort. As a second-line automaker, NETA does not have such conditions, and simply learning on the surface will only piece together a “four unlike” NETA.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.