Author: Xiong Ruifeng

New car sales have returned to the right track!

Halving the purchase tax may be the biggest news for the car market in June.

The 2022 preferential policy implementation/beneficiary range is arguably the most tempting one ever. Compared with the two times in 2009/2015 that only targeted the purchase tax exemption policy for passenger cars with a displacement of 1.6L or below, this time the standard has been raised to 2.0L or below (with a price of less than 300,000 yuan). This not only comprehensively stimulates the demand of domestic brands and joint venture car models in the market, but also benefits some entry-level luxury cars.

Just think about it, even mid-end luxury models like the BMW 3 Series, Audi A4, and Mercedes-Benz C-Class can enjoy it. This policy is simply too good to be true!

At the same time, thanks to the combined effect of policy drive and car market factors, the passenger car market trend is accelerating its recovery. According to statistics, the sales data in the car market in June 2022 far exceeded expectations, achieving comprehensive explosive growth. Among them, the passenger car retail market in June reached 1.944 million units, a year-on-year increase of 22.7%, and a month-on-month increase of 43.5%. Moreover, the month-on-month growth rate in June is the highest in nearly six years.

The cumulative sales volume from January to June (the first half of the year) also reached 9.261 million units. Although the year-on-year decline in the first half of the year was 7.2% due to the severe decline in March and April, with the outbreak of growth in June, the Chinese car market achieved certain repairs in the first half of the year.

Specifically, in June, the four major types of passenger cars in China (sedans, SUVs, MPVs, and crossover passenger cars) all showed a fast increase in sales data. Among them, the sales of SUVs and new energy vehicles in June showed the most obvious increase, with a month-on-month growth rate of 47.8%; while the sales of sedans also achieved a month-on-month growth rate of 40.5%.

## Fierce Competition in the Family Car Market

## Fierce Competition in the Family Car Market

Specific to each manufacturer, benefiting from the good control of the outbreak in June and the continuous improvement of logistics and supply chain, as well as the implementation of policies to stimulate consumption, the automotive industry achieved effective growth. There were five companies with retail sales exceeding 100,000 units, namely FAW-Volkswagen, BYD Auto, SAIC-Volkswagen, Changan Automobile, and Geely; especially FAW-Volkswagen easily took the first place with a sales volume of 210,175 units, far surpassing the second place BYD with 132,553 units, once again winning the championship.

In terms of sales in specific vehicle models, the domestic passenger car market achieved a sales volume of 987,000 units in June, a year-on-year increase of 28.3% and a month-on-month increase of 40.5%; while the cumulative sales volume from January to June was 4.585 million units, a 5.3% decrease year on year.

Dongfeng Nissan’s Sylphy once again surpassed the long-time champion Wuling Hongguang MINIEV, taking the top spot with 45,767 units sold. Thanks to the strong BYD brand, models such as the Qin and Han continued to make their way into the top ten passenger car sales rankings in June, and with the popular Wuling Hongguang MINI EV, there were already three autonomous brand models among the top ten passenger cars sold in June.

It’s worth mentioning that Tesla’s Model 3 returned to the list with 25,788 units sold due to the full recovery of production capacity at its Shanghai Super Factory.

Moreover, FAW Toyota Corolla, SAIC Volkswagen’s New Lavida, and FAW-Volkswagen’s New Bora also showed significant momentum. In addition, Guangzhou Toyota Camry, taking advantage of the “discount for volume” policy, achieved good sales results with 22,651 units sold, leading its old rivals Guangzhou Honda Accord (20,497 units) and FAW-Volkswagen Magotan (20,384 units).

In terms of cumulative sales from January to June, although the Nissan Sylphy won the championship with a total sales volume of 207,222 vehicles, the second place Wuling Hongguang MINIEV, with a sales volume of 188,653 vehicles, is accelerating to catch up and narrow the gap. The third place, without surprise, is the Volkswagen Lavida from SAIC, with a sales volume of 160,309 vehicles; the fourth place is BYD Qin with a sales volume of 146,490 vehicles; the fifth and sixth places are the Camry and Corolla, two evergreen models.

In terms of cumulative sales from January to June, although the Nissan Sylphy won the championship with a total sales volume of 207,222 vehicles, the second place Wuling Hongguang MINIEV, with a sales volume of 188,653 vehicles, is accelerating to catch up and narrow the gap. The third place, without surprise, is the Volkswagen Lavida from SAIC, with a sales volume of 160,309 vehicles; the fourth place is BYD Qin with a sales volume of 146,490 vehicles; the fifth and sixth places are the Camry and Corolla, two evergreen models.

I still remember that in my analysis in May, I mentioned that the BYD Han is eyeing the position of the BMW 5 Series, and statistics up to June show that the BYD Han has indeed surpassed it.

Tesla’s Extraordinary Performance

In terms of SUV performance, the sales volume in June reached 879,000 vehicles, a year-on-year increase of 21.2%, and a sequential increase of 47.8%; the cumulative sales from January to June were 4.246 million vehicles, a year-on-year decrease of 7.1%.

There has been a dramatic change in the rankings, with two new energy SUVs occupying the top three positions. Tesla’s Model Y is in the lead with a data of 52,150 vehicles, and its year-on-year growth is even more impressive, soaring by 348.7% (straight up!); while the BYD Song family missed the SUV championship, ranking second with 31,787 vehicles. I thought the third place should be the Haval H6, but I did not expect that the Honda CR-V would perform exceptionally well, with a sales volume of 24,326 vehicles in June.

The Haval H6 was squeezed into fourth place (sales volume: 21,040 vehicles), but fortunately it still broke the 20,000 mark; followed closely by Changan CS75, ranking fifth with 19,696 vehicles. In the era of the rise of independent new energy vehicles, the impacts on previously popular models such as Haval H6 and Changan CS75 are also quite obvious.

In addition to the BYD Song family, BYD’s Yuan PLUS also achieved “ten thousand plus” in sales with 16,553 vehicles. The near-perfect product strength of the upgraded Yuan PLUS has once again gained market recognition for this small SUV, and has become the only model in the small SUV segment that can compete with joint venture brands such as Honda Vezel.

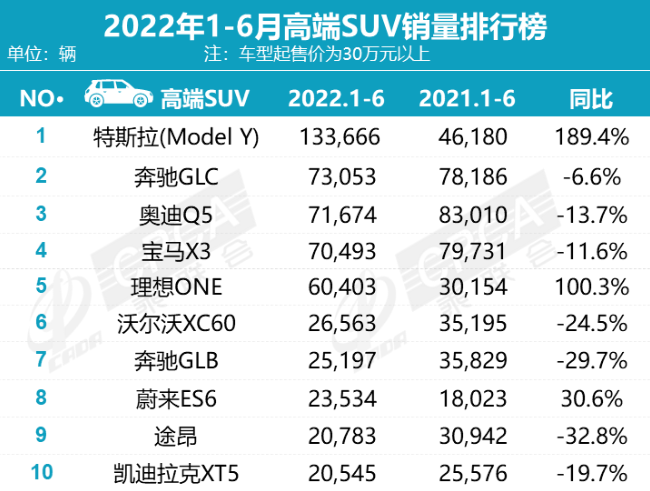

And in the cumulative sales ranking of SUVs from January to June, the BYD Song family continues to hold the first place, with a cumulative sales volume of 162,573 vehicles, a year-on-year increase of 113.3%. Tesla Model Y and Haval H6 ranked second and third, respectively, with sales volumes of 133,666 and 123,496. Honda CR-V and Changan CS75 also had cumulative sales of over 100,000, ranking fourth and fifth, respectively.

Luxury Brands Are Killing It

Thanks to the support of various policies, sales of luxury car brands (vehicles priced over 300,000 RMB) were in full swing in June.

In the luxury sedan field, Audi A4/BMW 3 Series/Mercedes-Benz C-Class regained the top-three positions. Among them, the Audi A4L achieved the top spot in the luxury sedan field with a score of 19,300 thanks to the increase in market terminal discounts, and the year-on-year growth also reached a staggering 109.8%. Mercedes-Benz C-Class also followed closely with a score of 18,769, thanks to the upgrade of its new generation of products, and the year-on-year growth also reached 52.8%. The third place was taken by the BMW 3 Series, with a monthly sales volume of 18,376.

The 4th to 6th places are still occupied by the mid-to-large BBA models, but the ranking has changed slightly. Among them, the BMW 5 Series far surpassed the Audi A6L (sales volume: 12,271 vehicles) and the Mercedes-Benz E-Class (sales volume: 12,259 vehicles) with a sales volume of 17,111, allowing BMW to make a comeback in the second tier.

It is worth mentioning that three domestic luxury brand models appeared on the top ten luxury car list for the first time, namely, NIO ET7 (sales volume: 4,349 vehicles), Hongqi E-QM5 (sales volume: 3,809 vehicles), and Hongqi H9 (sales volume: 2,774 vehicles). Although the sales volume data is quite different from mainstream BBA models, their strength should not be underestimated.

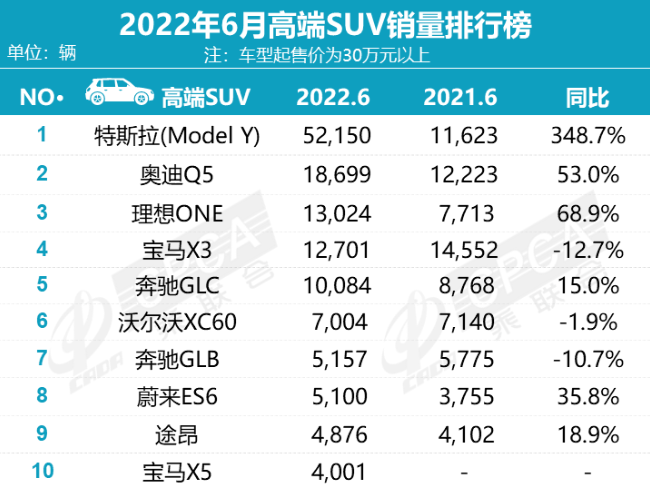

In the luxury SUV market, Model Y has become the top-selling car in June without any surprises (sales volume: 52,150), and has opened up a large gap with the second-ranked Audi Q5L (sales volume: 18,699). The third place is occupied by the familiar face, Ideal ONE, with a monthly sales volume of 13,024.

In the luxury SUV market, Model Y has become the top-selling car in June without any surprises (sales volume: 52,150), and has opened up a large gap with the second-ranked Audi Q5L (sales volume: 18,699). The third place is occupied by the familiar face, Ideal ONE, with a monthly sales volume of 13,024.

In addition, the sales volume of the domestically produced BMW X5, which was launched in March, continued to rise. It increased from 2,965 in May to 4,001 in June, ranking 10th on the list.

However, in terms of cumulative sales of luxury SUVs from January to June, Tesla Model Y still ranks first, relying on its strong performance in the first quarter. Mercedes-Benz GLC closely follows, and the third place is Audi Q5. As for second-tier luxury brands, it seems that there is basically no significant change in sales rankings.

It is not difficult to see that both the luxury car and SUV markets have fully recovered, just like the overall market. Especially in the luxury SUV market, there has been an explosive growth. With the implementation of relevant subsidy policies and the full connection of the supply chain, luxury brand sales have basically recovered to pre-epidemic levels.

Tesla breaks its own record again

In the new energy vehicle market, the improvement in supply combined with the expectation of rising oil prices has brought about a market boom. The rise in oil prices and the lock-in of electricity prices have driven the sales of electric vehicles, among which the sales volume in June alone reached 531,000, a year-on-year increase of 130.5% and a month-on-month increase of 47.8%, forming a “W-shaped” trend from January to June. The cumulative data from January to June reached 2.247 million units, a year-on-year increase of 122.4%. According to the monthly trend, the annual production and sales in 2022 are expected to exceed 5 million units.

The impressive growth of 228.8% YoY and the sales volume of 132,553 units have brought BYD to the top of the chart, with an enviable market share of 24.9%, becoming the only new energy vehicle brand with over 100,000 units sold. Tesla regained the second place, with a monthly sales volume of 77,938; SAIC-GM-Wuling (SGMW) came in third with 43,491 units.

It’s worth mentioning that all the companies in the top new energy vehicle sales list achieved positive growth, indicating that the market penetration of new energy vehicles will continue to rise.

Wuling Hong Guang MINIEV, with a sales volume of 39,798 units and a YoY growth of 36.6%, retained the top spot in the new energy mini-car segment. The second, fourth, and fifth spots were occupied by BYD Qin New Energy (26,383 units sold, YoY growth of 70.1%), BYD Han (25,209 units sold, YoY growth of 201.1%), and BYD Dolphin (10,282 units sold), respectively.

Looking at the sales volume from January to June, Wuling Hong Guang MINIEV, BYD Qin, and BYD Han continued to dominate the mini-car segment, with Tesla Model 3 coming in fourth.

In the new energy SUV segment, I thought BYD Song would still hold the top spot, but Tesla proved their dominance with a staggering 52,150 units sold.

BYD Song came in second, with a sales volume of 31,787 units, followed by BYD Yuan Plus (16,553 units sold) and the new force brand’s Ideal ONE (13,024 units sold, with a YoY growth of 68.9%).It’s worth mentioning that thanks to the influence of Huawei, Wanjie M5 also continued to enter the top ten with a score of 7,021 this month. In addition, the top three cumulative lists from January to June are BYD Song, Tesla Model Y, and Ideal ONE.

Looking forward to the second half of the year

Although the domestic auto market experienced a severe decline from March to April, fortunately, the passenger car market gradually stabilized in May, and the passenger car market saw explosive growth in June, which allowed the Chinese auto market to be repaired to a certain extent in the first half of the year. The overall performance still presents a beautiful scorecard. With the start of the second half of the year, the competition between car companies will become more intense. If they wish to grow on the basis of last year’s sales, it is indeed not an easy task.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.