New Energy Era of the Divine Cars Begins

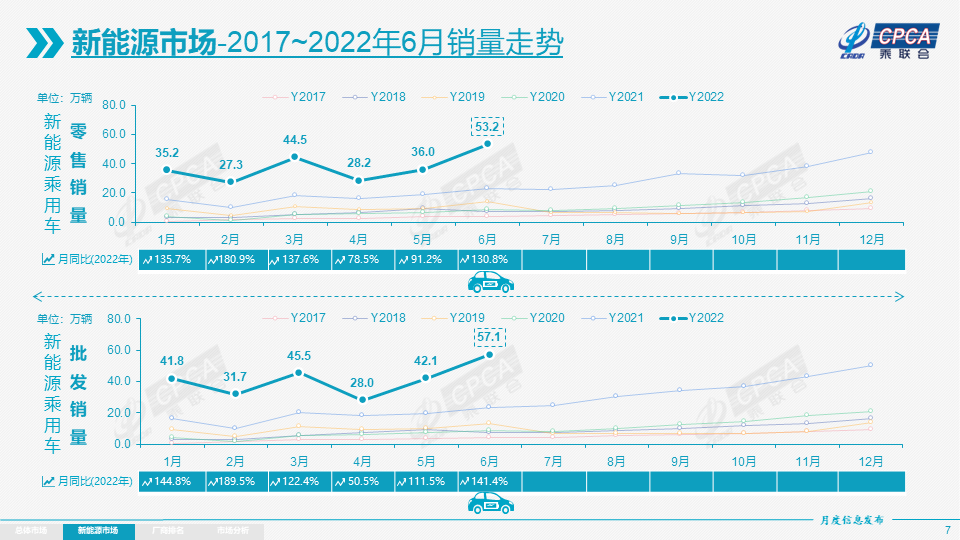

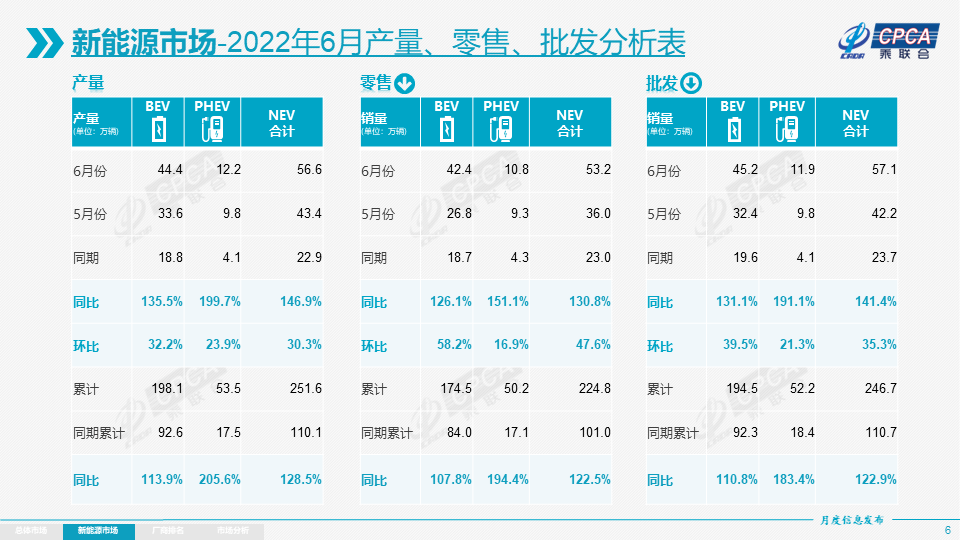

On July 8th, the China Passenger Car Association released data showing that in June, wholesale sales of new energy passenger cars reached 571,000 units, a year-over-year increase of 141.4% and a month-over-month increase of 35.3%; retail sales reached 532,000 units, a year-over-year increase of 130.8% and a month-over-month increase of 47.8%.

In the first half of the year, domestic retail sales of new energy passenger cars reached 2.248 million units, a year-over-year increase of 122.5%.

Tesla’s Model Y wholesale deliveries reached 52,557 units, making it the top-selling model of June’s Chinese passenger car market (including internal combustion engines), even approaching the monthly sales record of 70,000 units previously held by divine cars like Haval H6, Volkswagen Lavida, and Nissan Sylphy.

What is worth noting is that in the first half of 2022, Tesla’s Shanghai Gigafactory produced nearly 300,000 vehicles, accounting for more than 60% of the annual delivery volume of 2021, including nearly 100,000 units delivered overseas.

In July, Tesla’s Shanghai factory once again suspended operations for upgrades. After the upgrades are complete, the production capacity of the first phase will reach 1.1 million vehicles per year (according to Reuters), and the planned production capacity of the second phase will be 450,000 vehicles.

Hybrid Sales Growth Slows Slightly Month-over-Month

In June, pure electric vehicle wholesale deliveries reached 452,000 units, a year-over-year increase of 131.1% and a month-over-month increase of 39.5%; plug-in hybrid vehicle sales reached 119,000 units, a year-over-year increase of 191.1% and a month-over-month increase of 21.3%. From January to June, wholesale deliveries of new energy passenger cars reached 2.467 million units, a year-over-year increase of 122.9%.

The month-over-month growth of plug-in hybrid vehicles has slowed slightly.

In June, retail sales of new energy passenger cars reached 532,000 units, a year-over-year increase of 130.8% and a month-over-month increase of 47.6%. From January to June, domestic retail sales of new energy passenger cars reached 2.248 million units, a year-over-year increase of 122.5%.

As we can see, under the policy of halving purchase tax for cars, new energy vehicles not only have not been affected but also exceeded expectations with their month-over-month growth.

Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that this is due to the improvement in supply, combined with the anticipation of rising oil prices, driving a robust market. As oil prices rise and electric prices remain locked in, orders for electric vehicles have soared. The month-over-month trends of both new energy vehicles and traditional internal combustion engine vehicles in June were obviously driven by policy support. Encouraging consumption policies have been introduced nationwide, and some subsidies and consumer vouchers are on a first-come, first-served basis or expire at the end of June, further driving growth in the auto market in June.In terms of penetration rate, the wholesale penetration rate of new energy vehicle manufacturers in June was 26.1%, an increase of 10.8 percentage points from the penetration rate of 15.3% in June 2021. In June, the penetration rate of new energy vehicles for independent brands was 45.0%; the penetration rate of new energy vehicles in luxury cars was 27.5%; while the penetration rate of new energy vehicles in mainstream joint venture brands was only 4.8%.

In terms of retail, the domestic retail penetration rate of new energy vehicles in June was 27.4%, an increase of 12.8 percentage points from the penetration rate of 14.6% in June 2021. In June, the penetration rate of new energy vehicles in independent brands was 50.1%; the penetration rate of new energy vehicles in luxury cars was 28.0%; while the penetration rate of new energy vehicles in mainstream joint venture brands was only 4.5%.

From the grading perspective, the “dumbbell-shaped” structure of the pure electric market continues to improve. The wholesale sales volume of A00 level was 122,000, an increase of 15.0% compared to the previous month, accounting for 27.0% of the share of pure electric vehicles; the wholesale sales volume of A0 level was 73,000, accounting for 16.0% of the share of pure electric vehicles; A-level electric vehicles accounted for 24.0% of the share of pure electric vehicles; B-level electric vehicles had outstanding sales. In June, Tesla Model Y wholesaled 52,557 vehicles, while Wuling Hong Guang MINI wholesaled 46,249 vehicles, ranked the first two in overall passenger car sales.

Traditional Car Companies Are Still Strong

Independent brands still have an advantage in the new energy market, and the top companies are relatively stable. BYD’s pure electric and plug-in dual-power have solidified the leading position of independent brand new energy vehicles; traditional car companies represented by Chery Group and GAC Group have performed relatively well in the new energy sector. As independent car companies launch multiple products on the new energy route, the market foundation is continuing to expand.

Among mainstream joint venture brands, North and South Volkswagen was severely affected by the epidemic and has now returned to the battlefield. New energy vehicle wholesales are 13,825 vehicles, accounting for 63% of the overall share in the mainstream joint venture market. Cui Dongshu believes that Volkswagen’s firm electric transformation strategy is beginning to bear fruit, but other joint venture and luxury brands still need to make more efforts.

Specifically, there were 16 companies with wholesale sales volumes exceeding 10,000 vehicles (an increase of 3 companies compared to the previous month and 11 companies compared to the same period last year), accounting for 85% of the total new energy passenger car sales. Among them, BYD sold 133,762 vehicles, Tesla China sold 78,906 vehicles, SAIC-GM-Wuling sold 49,450 vehicles, Geely sold 29,671 vehicles, GAC Aion sold 24,109 vehicles, Chery Automobile sold 22,783 vehicles, SAIC Passenger Vehicle sold 17,985 vehicles, Changan Automobile sold 16,178 vehicles, XPeng Automobile sold 15,295 vehicles, SAIC Volkswagen sold 13,241 vehicles, NIO sold 13,157 vehicles, Ideal Automobile sold 13,024 vehicles, NIO sold 12,961 vehicles, Great Wall Motors sold 13,917 vehicles, FAW Volkswagen sold 12,272 vehicles, and Leapmotor sold 11,259 vehicles.

According to Cui Dongshu, the performances of mainstream new energy passenger vehicles have become more prominent. The sales of new energy vehicles from the vast majority of mainstream car companies have exceeded 20,000 units per month, forming a certain scale and manufacturing advantage. In June, the export volume of new energy passenger vehicles was 31,000, and with the support of policies to resume work and production during the pandemic, the continuous improvement of China’s manufacturing new energy products’ recognition abroad, and the improvement of service networks, the market prospects are improving. SAIC’s new energy export volume was 10,861, Dongfeng Yituo exported 5,445, Geely Automobile exported 3,157, BYD new energy exported 2,177, Tesla China exported 968, Dongfeng Peugeot Citroen’s DS Automobiles exported 525, JAC Motors exported 361, Chery Automobile’s new energy export was 283, FAW Hongqi exported 192. New forces for export are gradually starting: Skyworth Auto exported 181, Aiways exported 177, NIO and WM Motor also began to increase their export efforts.

Traditional Car Companies Gradually Prosper in New Energy Field

In Cui Dongshu’s view, traditional car companies have performed better in the new energy field recently. Cui Dongshu analyzed the reasons for the rise of traditional car companies from the demand side and supply side.

From the demand side, Cui Dongshu believes there are mainly four reasons.

First, the greatest advantage of new energy vehicles is their low operating cost under a purchase price that is basically on par with that of fuel-powered vehicles. Relative to oil prices, electricity prices are taxed minimally, and the lower-priced A00-level and A0-level models have lowered the entry-level threshold in the car-purchase phase. The low ownership cost that has multiplied several times is an important basis for the strong growth of this sub-segment market. The innovation of new energy vehicles in intelligent interactive systems has also gradually cultivated user adaptation to more comfortable usage scenarios and expanded the usage of vehicles as a third space.

Second, female consumers have become the main purchasing group for economical electric vehicles. The best tool for daily travel such as commuting to work, pick-up and drop-off for school or shopping is an economical electric vehicle.

Third, the road privileges of new energy vehicles further drive the buying enthusiasm for new energy vehicles in cities with purchase and use restrictions.

Fourth, the mainstream group has a large scale and strong purchasing power. In the trend of common prosperity, the high income brought by the Internet bubble is gradually returning, and the purchasing power of mainstream groups is the biggest blue ocean. Therefore, the development of new energy by mainstream companies is stronger, and the individual product sales of A00 and A0-level economical electric vehicles in the market are also higher.

From the supply side, traditional car companies have six major foundations.

First, the manufacturers of small and micro electric vehicles are mainly supported by independent brands with strong production capacity, such as SAIC-GM-Wuling, Chery Automobile, and Changan Automobile, and the advantages of the micro-electric vehicle production industry are obvious.2. Second, traditional car companies have strong innovative capabilities. BYD’s breakthrough in plug-in hybrid technology has changed the declining trend of plug-in hybrids and has become a popular brand among consumers.

-

Third, the dual credit policy for new energy and fuel vehicles was designed for the transformation and upgrading of fuel vehicle products. Therefore, mainstream car companies are enthusiastic about developing new energy vehicles.

-

Fourth, as the management of personal data and information security is standardized, consumers’ acceptance of high-cost intelligent suites needs to be improved. Intelligent technology has formed its own user preferences in driving safety and in-car control, but in the short term, the application of V2X technology on passenger cars has not yet formed a scale effect.

-

Fifth, currently, the vast majority of society’s goods are not sold through direct sales models. The new energy vehicle logistics model has not reduced costs, but has saved sales promotion costs and part of the silent costs of production forecasting. However, when sales are flat or slow, these costs cannot be saved. The mainstream car companies’ 4S channel model still has strong vitality, and the services of high-quality 4S stores are limited to internal brand promotion and user word-of-mouth recommendations.

-

Sixth, mainstream car companies of self-owned brands have great capacity flexibility and can support the rapid and sustained growth of new energy vehicle production and sales.

Talking about the high growth of new energy vehicles, Cui Dongshu believes that this is because under the epidemic, more public transportation has been replaced by private cars, and consumers are choosing new energy vehicles more in the context of high oil prices and world inflation, which has made China’s advantage in new energy industries further become an incremental advantage.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.