Article by Joey

The first mass-produced model of Evergrande Auto, the Hengchi 5, has finally opened for pre-sale.

Compared to any new energy vehicle maker, both Evergrande Auto and its product, the Hengchi 5, are full of drama.

Rather than saying that the Hengchi 5 is Evergrande Auto’s first product that may achieve mass production, I’d rather call it Evergrande’s “straw.” However, this “straw” may either save Evergrande or crush it, as there are all kinds of variables involved, much like Schrödinger’s cat.

If we look back three to four years ago and imagine the future, it’s highly likely that many Chinese people’s daily lives would involve lounging in an air-conditioned house provided by Evergrande real estate, holding a bottle of Evergrande mineral water, watching Guangzhou Evergrande team winning the championship on TV, then calling friends out for a crayfish feast and driving the Hengchi car to the appointment.

At that time, powerful Evergrande had almost had the opportunity to integrate into every aspect of Chinese people’s lives. Investing 40 billion to build cars in 2019 also had significant meaning for Evergrande.

First, it creates another potential revenue stream beyond real estate (after all, the mobile phone is not profitable, football has been burning money, and selling water is also losing money). Therefore, developing a new strategic pivot for group operations was extremely important.

Second, during the period when all new energy startups struggled to survive and suffered from financing, Evergrande’s massive investment was the best showcase of its strength at the time.

Moreover, if investors recognize Evergrande’s strength, subsequent capital injections will help Evergrande quickly expand into new financing channels (later, the listing of Evergrande Auto on the Hong Kong stock exchange proved this point).

However, I stated “if nothing unexpected happens.” In fact, unexpected events did occur.

Is Hengchi the straw that saves Evergrande from decline?

Since last year, Evergrande’s funding problem seems to have become the most talked-about social topic. First, there were overdue commercial acceptance bills from Evergrande in several regions, then Fitch Ratings, one of the world’s top three rating agencies, downgraded Evergrande’s default rating, and then there was the tug-of-war between the outside world and Evergrande over debt issues.

Regardless of whether Evergrande admits it, the fact that it owes a large debt is a reality. Even if building cars is not the core reason for this problem, it is still very close to it.

In fact, if we give Xu Jiayin a chance to discuss whether he still wants to build cars when he thinks about it later, the answer may be different. Indeed, he would find that building cars is just too costly!

What is the concept of 400 billion for car manufacturing?

Compared with the new force of car brands that had to find ways to advertise on the media when they raised 10 billion yuan in financing to prove that they were still alive and vibrant, the 400 billion yuan invested by Evergrande is enough to make them envious. This can be seen from the CCTV advertisements and the overwhelming media reports when Evergrande Motors was first announced. However, if this money is really used to make cars, it seems to be far from enough.

How insufficient is it?

In 2019 alone, Evergrande announced an investment of 160 billion yuan to build a new energy vehicle R&D and production base in Guangzhou, and at almost the same time, they announced an investment of 120 billion yuan to build three new energy vehicle bases in Shenyang. Then they settled on the 400 billion yuan investment and continued to invest heavily. In fact, Evergrande’s factory investment is far more than in Guangzhou, they also have factories in Tianjin, Shanghai and other places, and the investment in these places is obviously enormous.

Because if Evergrande gives up later, the sunk cost of the previous 400 billion yuan investment is too high, and no investor can allow the operator to squander money like this. Continuously adding capital will undoubtedly increase the burden on the company and further increase the risk of the company’s funding gap. This seems like a controllable risk in an era when Evergrande’s main business is still prosperous, but once the main business encounters problems, car manufacturing will undoubtedly be difficult.

But as the saying goes, when fortune smiles, disaster lurks behind. It seems that not putting all the eggs in one basket is an investment method that will never go out of style. When Evergrande’s main business is encountering serious difficulties, persisting in car manufacturing seems to have become the most correct investment project when they don’t know when their real estate business can turn the tide.

In short, Evergrande Motors has become a “life-saving straw” for Evergrande. So, how important is this “straw”?

On March 22 of this year, the second day when Evergrande’s stock was suspended, Evergrande’s boss Xu Jiayin did not appear at the global creditors’ meeting, but at the mass production mobilization meeting of Evergrande Motors’ Hengchi 5. It was at this meeting that the slogan of “realizing the mass production of Hengchi 5 in three months” was proposed. Behind this slogan, which is similar to a rallying cry for the college entrance examination, is actually a way for Evergrande to “turn the tide”: mass production of cars, people buying them, and financing.

Actually, whether a car can be sold or not is not the most crucial point. Even though the manufacturing process and technology of pure electric vehicles have become relatively easier than the era of internal combustion engines, it is basically impossible to manufacture a mature, perfect (not to mention leading), safe, and reliable product in three months and achieve profitability.

Actually, whether a car can be sold or not is not the most crucial point. Even though the manufacturing process and technology of pure electric vehicles have become relatively easier than the era of internal combustion engines, it is basically impossible to manufacture a mature, perfect (not to mention leading), safe, and reliable product in three months and achieve profitability.

Therefore, the significance of raising slogans is to let investors know that besides the struggling real estate business, Evergrande may have a way to succeed, with hopes of profitability and the possibility of earning money to repay the debts. Obviously, to some extent, this can alleviate the debt pressure faced by the company while “drawing a pie” for investors, giving them a chance to wait and see.

Of course, mass production is not something that can be achieved at will. In fact, in May of this year, Evergrande stated that the mass production of Hengchi 5 would be delayed (in fact, the earliest plan was to achieve mass production of Hengchi by the end of last year or the beginning of this year), with plans to begin delivery in October this year and achieve the target of delivering 10,000 vehicles in the first quarter of next year.

Therefore, since there are still three months before delivery, why rush to presale? Obviously, promoting the brand and continuing to reassure investors is one aspect, and more importantly, the funds need to begin to flow back, even though it may be a drop in the bucket.

However, the question now is whether Evergrande and other new forces that are rushing to presale without achieving mass production can be the same?

Presale, the last straw that breaks the camel’s back?

Of course, Evergrande Auto is different from other new carmakers.

First of all, Hengchi 5 seems to be different from the micro electric vehicles that are popular today or the high-end intelligent electric vehicles that emphasize technology. Judging from the presale situation, Hengchi 5, which uses lithium iron phosphate batteries, has a standard configuration and functions, such as a 602-kilometer CLTC cruising range, and cannot be considered to have very eye-catching technology and product features (so the concept of “the best pure electric SUV under 300,000 yuan” is basically subjective).

Secondly, the presale price of 179,000 yuan is obviously in the price range between running volume and below luxury and technology. It is in an embarrassing situation where running volume may not work and there seems to be no leading technology.

More importantly, leaving aside the product, whether consumers can trust Evergrande right now, especially whether they are willing to pay real money to buy their cars, is a question.Although the vast majority of new energy vehicle manufacturers have not yet achieved overall profitability, their funding channels have already started to revolve. That is to say, their hematopoietic function is perfect, and even if investors need to continue to invest later, it is only a small amount of supplement to the “blood”. The company itself will continue to invest the already returned funds through sales into plant construction and technology research and development as much as possible, thus moving closer to a virtuous cycle from a simple investment.

However, Evergrande is different. At present, debt has become the biggest problem entangling it. Therefore, whether to spend a 1000 yuan deposit or a 10000 yuan down payment seems to be something that consumers need to consider carefully. However, for the vast majority of consumers who want to buy electric cars, this amount of deposit is not high.

But that doesn’t mean that rich people are foolish.

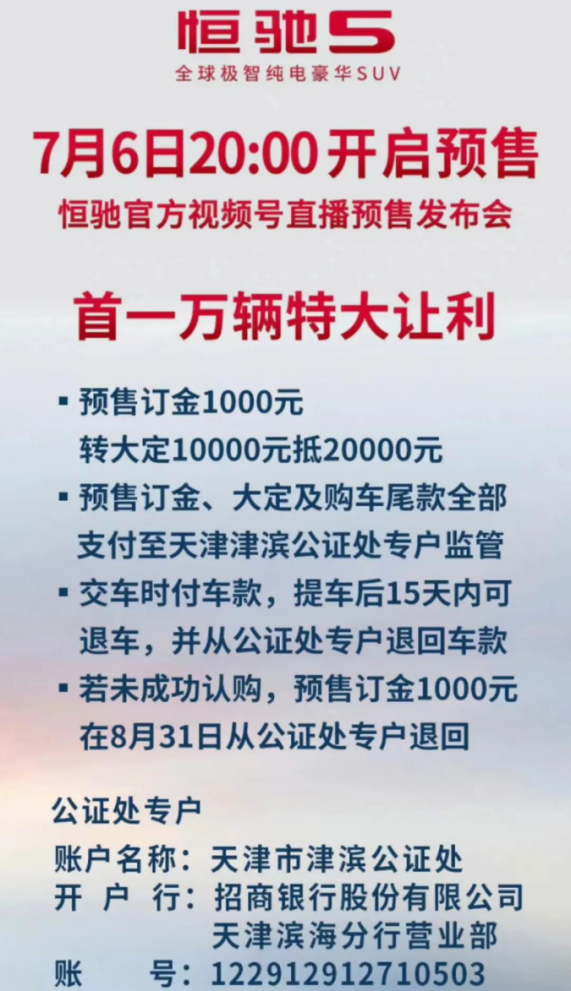

Therefore, Liu Yongzhuo, the CEO of Evergrande New Energy Automotive Group, emphasized at the pre-sale conference that in order to ensure the safety of consumer funds, pre-sale deposits, subscription funds and final payments will all be paid to a special account established by the Tianjin Jinbin Notary Office and supervised by the notary office.

This is considered an innovative approach in the world of automotive sales, but it can only be said to have its pros and cons if you say that it can solve all the problems.

The advantage is that this payment method that exists in the commercial form of needing a large amount of funds to purchase a house can to a large extent dispel consumers’ concerns about fund safety. For car buyers, this is undoubtedly an innovation.

However, the problem is that this kind of innovation cannot quickly solve the practical problem that Evergrande urgently needs to “hematopoietic”, that is, to quickly recollect funds. You should know that hoping to enter a virtuous circle by selling cars and attracting investors to “infuse blood” into the company to ease the financial situation is a good vision, but it is not a vision that can be achieved in the first step.

What can solve the current dilemma is the rapid recollection of funds. However, transferring money from the notarized account undoubtedly adds a link to the traditional automotive sales fund chain, which prolongs the cycle of fund circulation.

At the same time, Evergrande’s current financial situation is not clear, and whether the funds in the regulatory account may be used for debt collection through other legal means in the future is also a risk that cannot be ignored, which may result in Evergrande not receiving the money while users cannot receive the car. This risk is reminiscent of “unfinished buildings” beyond bankrupt housing projects.Assuming that the target of Evergrande is to deliver 10,000 cars by early next year, the deposit could generate a maximum benefit of 10-100 million yuan. This amount of money is not very helpful for Evergrande in terms of funding. However, if the risk materializes, it could create a situation where consumers are afraid to buy, leading to a lack of sales for Evergrande, which could affect subsequent financing, thereby forming a whole set of unsolvable cycles.

If such risks occur, it may turn Evergrande Auto from a life-saving straw to the last straw that crushes the camel.

For Evergrande, continuing to promote the development of its auto business may be the only way to go. The pre-sale of the Hengchi 5 that has started may not really dispel the market’s doubts.

On the one hand, the product has not yet reached the stage of mass production, and the actual manufacturing progress needs to be observed in the future; on the other hand, it is possible that the notarized account may not dispel users’ doubts about whether Evergrande’s debt problems will affect car purchases. Therefore, whether the Hengchi 5’s pre-sale can help boost car sales and delivery volumes will also need to be observed in the future.

In short, let’s wait and see whether Evergrande Auto will grab the straw or be crushed by it. The answer should be revealed soon.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.