Author: Mr.Yu

Last May, we wrote an article named “Just Heard That A Vehicle Enterprise is Going to Make Phones” which had a lot of our commenters guessing that it was BYD, while some others thought it might be Beiqi, Great Wall, or even Wuling.

Now, let’s congratulate those friends who said it was Geely, your eyesight is really sharp.

On July 4, 2022, Hubei Xingji Era Technology Co., Ltd. and Meizu Technology Co., Ltd. in Zhuhai held a strategic investment signing ceremony in Hangzhou, officially announcing that Xingji Era holds 79.09% of the controlling shares of Meizu Technology and has obtained separate control of Meizu Technology. Both sides will work together to provide users with core products that offer multi-terminal, all-scenario, immersion fusion experiences.

Li Shufu, Chairman of Xingji Era, Huang Zhang, founder of Meizu Technology, Li Donghui, CEO of Geely Holding Group, Shen Ziyu, vice chairman of Xingji Era and chairman of Meizu Technology, and other executives from both parties attended the signing ceremony. Wang Yong, CEO of Xingji Era, and Huang Zhipan, CEO of Meizu Technology, signed the contract on behalf of both parties.

After this transaction, Li Shufu, founder of Geely, will continue to serve as chairman of Xingji Era, Shen Ziyu, vice chairman of Xingji Era, will serve as chairman of Meizu Technology, and Meizu Technology founder Huang Zhang will hold 9.79% of the shares.

At the end of the official announcement poster, Meizu did not forget to put up the familiar phrase “Pursuing Is Born from Passion.” On the official Weibo of Meizu, they also changed to a picture that exudes a sense of great change and renewal.

We noticed that the Meizu official store also launched the “Meizu Fans’ Special Welfare Day” activity on July 4 and replaced the same main visual in a prominent position, suggesting that there might be a big feast on the way— and to clear some inventory.

Getting back to the point.

Official sources indicate that the Xingji Era will be committed to the development and construction of high-end intelligent smartphones, XR technology products, and wearable smart terminal products.On the other hand, according to official information from Meizu, after the acquisition, Meizu Technology will receive more support for industrial chain and ecological resources, Flyme system will continue to iterate and upgrade, to create better smartphones, and start a new integration across platforms and terminals. At the same time, Meizu Technology will operate as an independent brand, J.Wong (Huang Zhang) will continue to contribute as a product strategic advisor, and the top management team of Meizu Technology will remain stable.

Li Shufu stated that the technological innovation and ecological integration of the consumer electronics and automotive industries are imperative. The future race track for the two industries, namely intelligent automobiles and smartphones, will no longer be monotonous, and both will no longer function independently, but will form a integrated relationship that caters to common users and provides a multi-terminal, whole-scene and immersive experience. The deep integration of the consumer electronics and automotive industries through the layout of the smartphone business, cross-border creating a user ecological chain,can achieve super collaboration.

It seems that the acquisition of Meizu and the foray into the smartphone circle is something that Li Shufu values very much.

However, the reality seems to be not so simple.

The fiercely competitive smartphone market

For new players, the current smartphone market is not a good business.

According to the latest statistics from CINNO Research, the domestic smartphone sales in May were about 19.12 million units, an 8.6% increase compared to April, with a certain scale recovery. However, compared with the same period in 2021, the year-on-year decrease was still as much as 19.7%, the worst single-month sales since 2015.

According to data from Counterpoint Research, the non-increasing and decreasing trend in global smartphone market sales has been going on since 2018, and as of May 2022, it has fallen below 100 million units per month to 96 million. During the 2022 618 e-commerce shopping festival, the total sales of domestic smartphones decreased by 10% compared with last year.

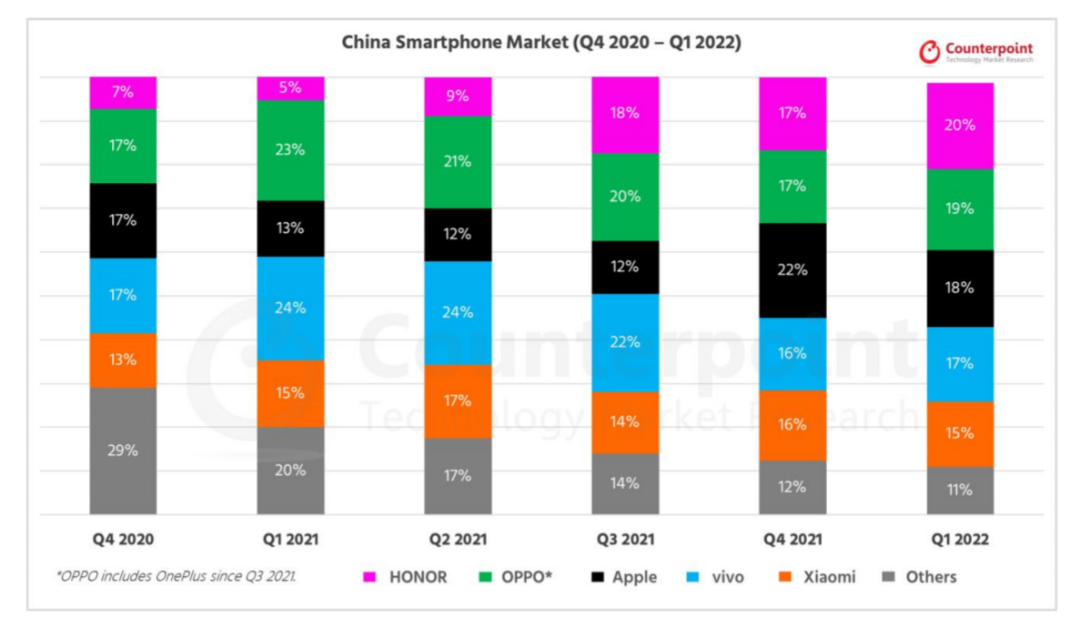

Faced with the global economic slowdown and the various uncertainties brought about by the COVID-19 pandemic, the replacement cycle for domestic users has extended from 24.3 months in early 2019 to 31 months now.The competition pattern of the domestic smartphone market has already shifted from “Huami OV” to the top four players, which are Honor, OPPO (including the return of OnePlus), Vivo, and Xiaomi. In addition, Apple has taken a significant share of the high-end market left by Huawei’s setback, these top players have already taken 89% of the domestic smartphone market.

This means that any new player entering the market must first compete with the remaining 11% of players – this includes both old players like ZTE, new upstarts like Realme who have taken a share of the European market, and Huawei who is prepared to make a comeback to the top tier.

This year, offline dealers are also having a hard time. The days of big profits are over, and losses and store closures are spreading. At the macro level, Apple, Samsung, Xiaomi, and Blue-Green factories are all lowering production or revising sales expectations.

In the environment where the overall smartphone market is declining and there is a lack of innovative drive in the industry, many brands insist on playing the “flagship series iterated once a year, cost-effective series iterated at least twice a year” card, which largely maintains the product line and the influence in users’ minds.

The era of the smartphone market’s brutal growth has passed. The term “shanzhai” is even hard to hear anymore, it has been digested by the extremely saturated environment.

If the so-called new Geely phone brand enters the market rashly without basic recognition, it is important and urgent to solve problems such as how to establish its own brand route, how to maintain positive accelerated growth in shipments, and how to compete with a strong supply chain, etc.

As we all know, the leader of Geely Automobile has always been ambitious, but before achieving that, taking steady steps on the ground is essential.

Looking back one year ago, on September 28, 2021, Xingji Era and Wuhan Economic and Technological Development Zone signed a strategic cooperation agreement, officially announcing an investment of 10 billion yuan to focus on the high-end smartphone market.

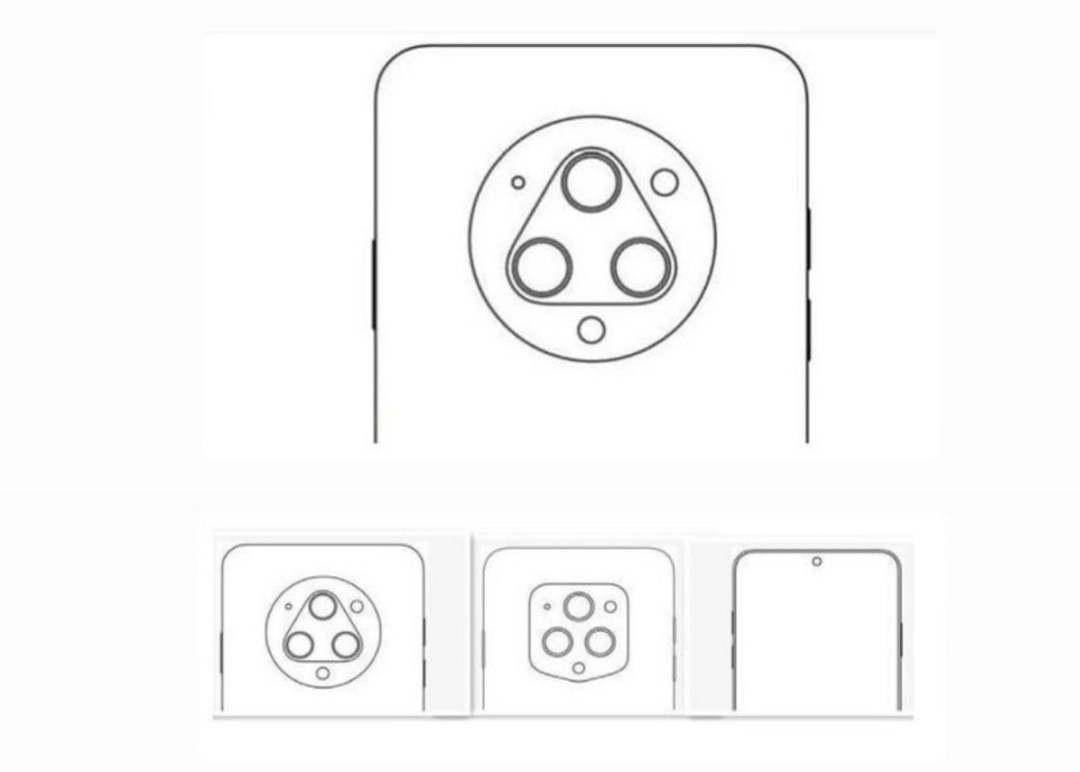

I’m not sure when it started, but there is a group of suspected Geely phone camera designs and location plans circulating online, and the lens arrangement design is reminiscent of Huawei’s flagship Mate series.

Making phones is not just about selling phones# Regarding another car company that is rumored to make phones, the founder of NIO, Li Bin, has his own views: “The phone is the most important device connected to the car, but Apple is currently very closed to the automotive industry. For example, the UWB equipped as standard on the NIO’s second-generation platform is not open to interfaces by Apple, which puts NIO in a passive position. From the perspective of user benefits and experience, NIO also needs to carefully study smartphones and smart terminals centered on cars, in order to match them with NIO cars and firmly grasp user data in its own hands.”

Li Bin’s view is backed by simple and solid data analysis. Through big data analysis, it was found that the smartphone brands of NIO car owners are composed of 50% Apple phones, 40% Huawei phones, and 10% other branded phones.

Apple’s road to making cars is not going smoothly, and the new version of CarPlay needs to be seen again; Huawei’s development speed in the automotive field is there for all to see.

Yes, why not keep the core traffic and data in one’s own closed loop?

Although the complexity of the industrial structure differs greatly, the most fundamental elements of the automotive and smartphone industries are surprisingly similar: money, people, and supply chains.

Backed by Geely, the Star Era is unlikely to be financially constrained. The Star Era, where Li Shufu himself serves as chairman, has a management team including Star Era CEO Wang Yong, who previously served as Vice President of ZTE Communications, and several high-level executives from ZTE Communications, such as Zhang Yadong, who previously served as the General Manager of the PHS Product Line, the Deputy General Manager of Mobile Phone R&D, and the General Manager of the Mobile Broadband Product Line.

According to a report by 36 Kr in January 2022, employees with backgrounds from Xiaomi and OPPO have joined the Geely mobile phone team. Sources from Xiaomi and OPPO disclosed that Geely is recruiting employees from its own company, covering positions in multiple fields.

To want to do everything oneself, the most reliable method is naturally to build one’s own stage and perform oneself. However, smartphones, like the automotive industry, are complex in technology and have many tricks. Therefore, acquiring a team from a complete and experienced company naturally became the best option to overtake on a curve.

Although Meizu, since falling from its peak of selling 20 million mobile phones annually in 2015 due to issues with product planning and strategy, has been struggling to survive for a long time and even sold its cost-effective brand Meilan (Blue Charm), which was once known as a “youthful and good product,” these do not prevent it from still being a smart phone brand with a complete system and processes.And, Shen Ziyu, the Vice Chairman of Star Era, mentioned in an interview with Huxiu that Meizu’s profit situation was not bad last year, and as an enterprise, its nature and assets are very good.

Although there were some detours before, Meizu’s experiences in smartphone design, materials, and systems are still online. In addition, Meizu’s Flyme system is still one of the most user-friendly Android OEM manufacturers.

This can be verified in the cooperation between Sony Xperia phones and Meizu. While insisting on a native Android system, Sony seeks to localize its user experience through Flyme’s application store, information, negative screen, and security center.

Regardless of whether Meizu, which will continue to operate independently after the acquisition, or the high-end smartphones that Star Era is going to make, they will benefit from Geely’s expertise in automobile materials and engineering and transform them into a high-level design with strong identity. It is also necessary to integrate Geely’s self-developed chips and its low-orbit satellite plan.

Geely has been stepping up its pace towards the starry sky. The most recent one was on June 2, 2022. Orient TimeSpace, a subsidiary of Geely, successfully launched nine satellites at the Xichang Satellite Launch Center.

According to Geely’s plan, it is expected that there will be 63 satellites in orbit by 2025, forming a “Future Travel Constellation” composed of hundreds of satellites.

Deploying low-Earth orbit satellites can not only provide systemic positioning services for high-level intelligent driving but also provide other commercial uses, such as communication support for large-scale sports events.

It’s the Geely version of Starlink.

On the one hand, it deploys low-orbit satellites to provide systemic positioning services for high-level intelligent driving, improving users’ intelligent travel experiences comprehensively.

On the other hand, after the 7nm vehicle regulation SoC chip completed production in 2021, Geely’s subordinate chip company, XinQing Technology, is producing a 5nm vehicle-mounted integrated supercomputer platform chip, and Star Era’s 4nm smartphone chip is also on the way.

More than 20 years ago, Li Shufu’s “crazy talk” still delights some people today: “What’s so great about cars? Isn’t it just four wheels, two couches, and an iron shell?”# A Translation of the Markdown Chinese Text into English Markdown Text

Take a look at Geely today, a Fortune 500 company for ten consecutive years, the only privately-owned automaker in China on the list, ranked ninth in R&D investment among Chinese companies in 2021.

Regarding the attitude of building mobile phones across industries, Li Shufu said: “The phone business is of great significance to the entire Geely automotive industry. The phone is a fast iteration portable terminal, it is the application carrier for electronic product market verification and software innovation, which can enable users to share innovative results as soon as possible and transfer some secure & reliable results for application in automobiles to achieve a close interaction between vehicle and mobile phone software technology.”

Geely’s investment in industrial layout has always been comprehensive. As mentioned earlier, it seems more in line with Geely’s style to hold the key technology and channel in its own hands than to rely on others.

According to Geely Automotive Group CEO An Conghui’s statement at the “Smart Geely 2025” strategy release conference, Geely is currently the only car company in the world that has its own designed automotive satellite communication and positioning system, high-precision maps and navigation, and an automotive chip that covers software and hardware.

Some always compare smart cabins to getting into a car with a mobile phone, unaware of the numerous differences between them, such as CarPlay.

With over a decade of operating system development experience and accumulated users of hundreds of millions, experience in smart wearables/VR/IoT, a complete team, familiarity with user operations, and a large number of loyal fans… the acquisition of Meizu is like filling in an important puzzle piece for Li Shufu’s cross-platform cross-terminal collaborative plan.

As a former user who has tried four Meizu phones for myself and my family, I am very impressed with the friendliness and ease of use of Meizu in terms of user experience.

According to public information, on June 6th of this year, Meizu Technology released a Weibo post announcing its collaboration with Geely’s Lynk & Co to create a new in-car system called Flyme on Car. Previously, a video of a suspected Meizu car system was also posted on Bilibili.

As of the time of writing, I could not find this information on Meizu Technology’s Weibo account, and some media outlets that had previously published information had deleted related content.

It seems that things have changed.

Considering the Zeekr 001 being criticized by users and the media for various reasons such as car computer freeze and interaction design after delivery, even though it has been visibly fixed and supplemented through OTA, it still sounded the alarm for Geely, the industry, and beyond.It seems that Meizu, which has been secretly deploying in the field of intelligent connected vehicles, may parallel with Ecarx and become another leg of Geely in the smart cockpit.

We believe that the motive of acquiring Meizu is not as some people say that Geely wants to replace it as another Ecarx. Instead, Meizu after the acquisition will inject new momentum into the user experience of Geely’s smart cockpit system, specifically in human-machine interaction.

Therefore, whether the new flagship smartphone will help Meizu return to the mobile phone market as some mobile phone industry insiders have said may not be so important to Li Shufu, Geely and Geely’s car users.

Geely’s idea is not necessarily aimed at smartphones.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.