The sales of the Mini EV from Wuling Motors exceeded 700,000 units, becoming the best-selling new energy vehicle in China for 20 consecutive months.

As expected, we believe that you have already guessed it!

Released in July 2020, the Wuling Hongguang Mini EV captured the global electric vehicle sales championship in less than 2 years.

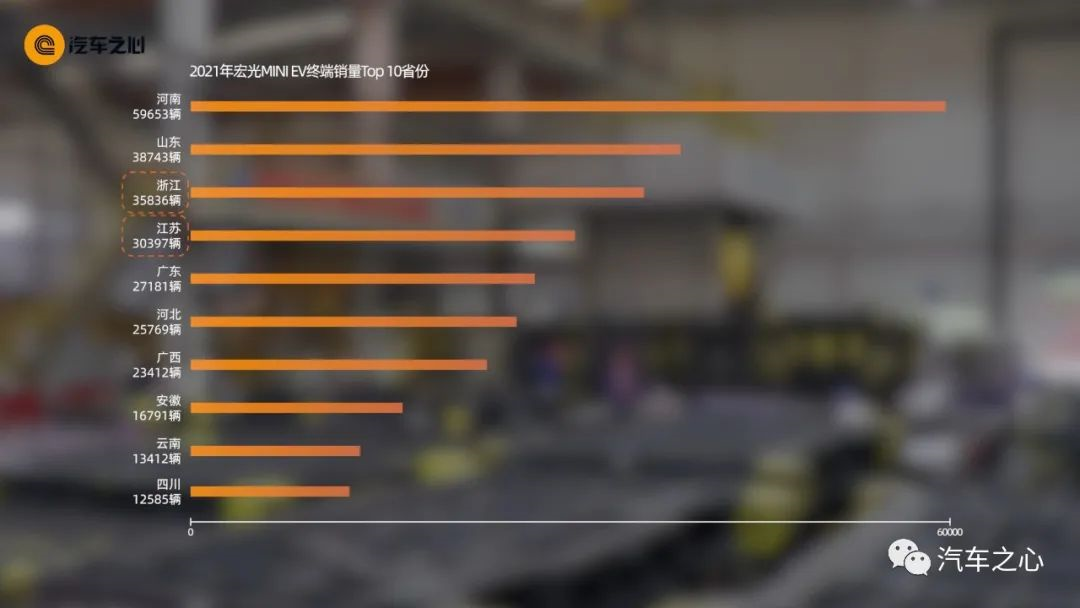

Looking at data from last year, the Mini EV sold the best in Henan and Shandong provinces.

It is worth noting that the Mini EV also has many fans in coastal provinces such as Jiangsu and Zhejiang.

Why is this the case?

One reason is that the production base of the Mini EV is located in Qingdao, Shandong.

Another reason is that eastern China has always been a major area for the consumption of new energy vehicles. Moreover, many first and second-tier cities in this region have license plate and traffic restrictions. Naturally, the Mini EV has also benefited from these policies.

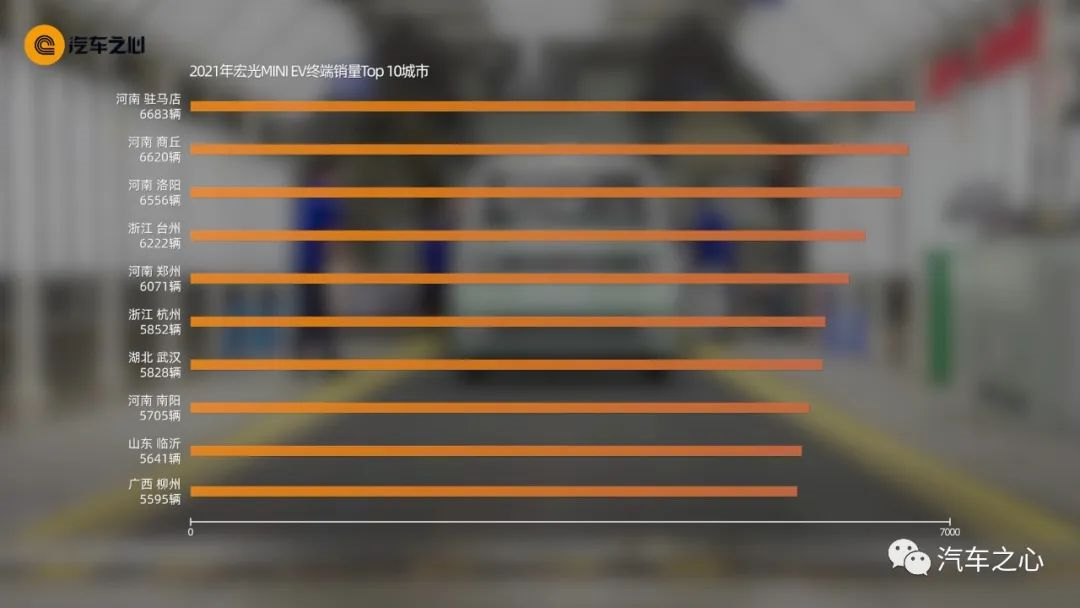

After discussing the provinces, let’s take a look at the sales ranking of cities.

The Mini EV is concentrated in second and third-tier cities. From this, we can see that the car not only performs well in small towns and rural areas, but it has also successfully entered the cities.

If you don’t think it’s exciting enough that the Wuling Hongguang Mini EV has entered the cities, let’s take a look at the owner data. The proportion of owners under 35 years old is as high as 72.6%, of which the proportion of post-90s owners is as high as 54.6%.

Overall, the user base of MINI EV is concentrated in the sinking market, and the main buyers have become the post-90s generation.

Overall, the user base of MINI EV is concentrated in the sinking market, and the main buyers have become the post-90s generation.

Congratulations to Wuling Hongguang for successfully getting rid of the “old man’s car” label.

But why is it selling so well?

This is mainly determined by the positioning and usage of MINI EV.

MINI EV is a model defined from the demand and practical angles. Its most obvious label is “commuter car”.

Let’s first understand the usage scenarios of “commuter cars”. Picking up and dropping off children at school, shopping for groceries. Usually, the one-way distance is only a few kilometers, and the speed is generally not more than 40-50 kilometers per hour.

The typical demands of commuter car owners focus mainly on the following aspects:

1) the price must be low and offer the best value for money;

2) easy to drive, park, and use, and pursuit of practicality;

3) safe and reliable with quality guarantee.

Since the commuting distance is short, the battery life is not of great concern to the car owners. MINI EV precisely hits all the requirements.

So how does MINI EV achieve the best value for money?

The team of Nagoya University in Japan disassembled MINI EV and compared it with the popular K-Car in Japan, found that its length is almost 50 centimeters shorter, but still performs well in space.

For example, when the rear seats are completely folded down, the luggage compartment volume reaches 741L, almost exceeding the volume of most three-box sedans.

In terms of cost, anything that can be saved, will be saved. For example, the core motor of MINI EV is a motor with a power of only 20kW, and the maximum speed is only 100 km/h, while other vehicles in the same class uses a 55kW electric motor with a maximum speed of 120 km/h.

Although the speed is sacrificed, the cost saved is not just a few hundred yuan for the motor price difference, but also the cost of a series of supporting facilities such as battery packs and cooling systems. For example, a 20kW motor can use a low-cost air-cooled system, which directly saves the cost of the coolant circulation system.

Another example is that MINI EV does not have a power recovery system, and the cost is also reduced by nearly 900 yuan.

The vehicle body structure of MINI EV is also cost-reduced. The front anti-collision beam is directly connected to the longitudinal beam, eliminating the energy-absorbing box.The majority of parts for this car, such as the bearings used in the motor reducer, are chosen from existing components instead of specially designed ones to maximize their functionality.

As there was no need for excessive intelligence in the MINI EV, household semiconductors were used in the onboard chips.

Regardless of labels like “for elderly”, “no air conditioning”, “no safety airbags”, or “no fast charging”, the MINI EV can still compete with Tesla in terms of sales.

It is its remarkably regional and label-centric positioning that has helped it pave its own unique path.

From the Wuling Sunshine, Wuling Hongguang, Wuling Baojun all the way to the Hongguang MINI EV, Wuling’s products have always been distinctive and well-received in terms of sales and reputation.

Whether in the era of fuel-powered cars or electric cars, why can Wuling always produce popular products? As an example of the MINI EV, a simple analysis can be made.

Most car manufacturers design products based on user surveys and from the perspective of selling cars, stacking features, competing in terms of specs, and doing everything possible to make additions.

The MINI EV, on the other hand, takes a completely different approach.

The research and development of the Hongguang MINI EV was completely based on the market exploration of the Baojun E100 and E20 new energy vehicles in Guangxi, and through in-depth understanding of user needs, large amounts of data on small electric vehicle users, use scenarios, and the final selection of the “short-distance travel market” demand.

Starting from the perspective of user needs, redefining the product, and making category innovation within a segmented market.

At the product level, this car also refreshes the limits of automobile manufacturing costs.

Many companies have been researching Wuling and Baojun and have discovered their strong market insights and cost control capabilities. Insights can be borrowed, but cost control is difficult, and thin profits can only be achieved through large-scale sales and reducing marginal costs.

According to existing information, the Hongguang MINI EV reportedly only has a 2-3% profit margin, which means that for every car sold, only about 500-1000 yuan can be earned.

Beyond the product, policies and channels were also taken into consideration.

Wuling and the Liuzhou municipal government have pioneered a promotional model of government-enterprise collaboration called the “Liuzhou Model”. The specific manifestation is that “no matter where you are, you can find a charging station within 10 minutes.” It has since received support from the Guangxi province.In terms of channels, the number of sales outlets for Baojun and Wuling is over 3,000, with coverage rates reaching 99% for prefecture-level cities and 79% for county-level areas.

While other manufacturers are calling for deeper penetration into third-tier cities, Wuling has already entered fourth- and fifth-tier cities. When others talk about targeting fourth- and fifth-tier cities, they have already established a presence in counties and towns.

Returning to the question at hand, why can Wuling always create explosive sales?

Of course, everything cannot be separated from the sales system that supports Wuling’s penetration into lower-tier markets and their deep understanding of the micro-car market. However, I think the most important point is that they realize the importance of category innovation from the user’s perspective, are able to discern their true needs and are able to meet them.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.