Karakush

An eventful June saw NIO achieving record-breaking performance by delivering 12,961 new vehicles, proving wrong the naysayers who tried to discredit the company’s success.

Since last year, NIO has been labeled as “left behind,” relentlessly compared to its peers despite having prices several times higher than that of comparable products. With performance lingering below ten thousand units for the first five months of this year, it seems that such criticism has been justified.

Moreover, bad news never comes alone as short-selling company Grizzly Research recently accused NIO of exaggerating its revenue and profit through its BaaS services, thereby questioning the commercial model for battery leasing.

However, despair is more of an atmospheric feeling than an actual indication of strength. This description befits NIO perfectly. As they say, a true warrior can face life’s hardships head-on and always finds a way to turn the tables.

Delivering over ten thousand vehicles this time might just be the long-awaited tipping point for NIO.

Unexpected But Not Surprising

The situation had been brewing for some time, and there were two main factors leading to this breakthrough.

Firstly, it was due to the increase attributed to new products, with the ET7 kicking things off when it started deliveries at the end of March this year.

With its second-generation platform, ET7 represents the latest and greatest technological standard for NIO. Since its release, it still boasts significant competitive advantages, leading the trend in intelligent electric vehicles in the past year and a half.

Its market positioning is also very practical – as NIO’s first sedan offering, it provides a whole new supplement to the outdated product line of ES8/ES6/EC6 with very few competitors.

Despite being a flagship model priced around 400,000-500,000 RMB, people have high expectations for its sales volume, just like the ES8, which was infamous for igniting the high-end market back in 2018. The ET7 has the potential to replicate this success and reignite the market for high-end electric vehicles.

The trend toward sedan models was also apparent in NIO’s June report, where ET7 represented almost a third of total deliveries.

Secondly, the company added another 220 battery swapping stations and 2,640 charging piles in the first half of this year, further reinforcing its charging infrastructure.By now, there are 997 battery swapping stations across the country, including 254 ones on highways; 890 supercharging stations with 4,861 chargers; 771 destination charging stations with 4,644 chargers. In addition, over 510,000 third-party charging poles have been connected.

These magnificent numbers not only mean better post-sales energy replenishment experience, but also become a substantial means of expanding consumption boundaries for the sales side.

As the penetration rate of new energy increases, an important change is the diffusion from home charger users to non-home charger users.

The data from NIO itself can illustrate the issue. In the early days, the proportion of home charger installation by NIO was close to 80%; by January this year, public numbers showed that NIO had delivered 100,000 home chargers and 176,700 vehicles in the same period, and the rough estimate of the installation proportion has dropped to 56%.

Not having a home charger is not because people do not like it, but because they do not have the conditions, which is a collateral damage of housing. In the short term, the experience of public charging, which is weak in proportion to the growth of ownership, will be maintained.

The fear of energy replenishment will become a strong argument in the competition for green vehicle license plates. Since the second half of last year, sales of hybrid models that do not depend on charging poles have soared, which is also demonstrated by facts.

Based on this situation, the value of constructing an energy replenishment system as a growth engine is seriously underestimated, especially for the time-cost-favored battery swapping, which will broaden the safety boundary of a large number of non-charger users. The experience of going for battery swapping and going for refueling is rapidly converging.

NIO has a concept of “electrical zone housing”, which refers to a residence within three kilometers of a battery swapping station, where psychological comfort can be ensured within this reach. Last year, 42% of NIO users lived in electrical zone housing. NIO’s goal is to reach 90% by 2025. At least for NIO users, no charger does not cause anxiety.

Under the dual force of the above two factors, a boom will not be absent, but it did not expect to be so relaxed. Although the first half of the year was a time of collective hardship for the industry, NIO’s starting difficulty was a bit higher.

First of all, as a company in the Yangtze River Delta industrial belt, its operations were severely obstructed during the epidemic, and it was much more difficult than other places, with no good outcomes. On the supply side, NIO announced on April 9th that its inventory of parts had been exhausted and that production of whole vehicles had ceased. On the demand side, important markets such as Shanghai were off-track in terms of deliveries, and Shanghai in particular had a greater impact on NIO than many other brands.

Secondly, high-end attributes and technical standards will bring extra complications in the style of Versailles. According to the prospectus of NIO’s Hong Kong listing, most of the parts used by NIO are provided by a single supplier without spare tires, because NIO “adopts the most advanced and reliable technology, and these technologies are often provided by leading enterprises in the industry with limited numbers.”This is not to say that NIO lacks risk awareness. They have a long-term strategy for sourcing from multiple channels and have corresponding mechanisms for key components with concentrated risks. For example, for the challenging problem of chips, NIO will group them according to supply risks and communicate directly with component suppliers or chip manufacturers to strive for supply guarantees, while also establishing a potential supply network.

However, short-term fluctuations are inevitable.

Therefore, the low delivery in April and May is more a reflection of dynamic difficulties in production, transportation and delivery, rather than a fundamental problem of demand growth. This is a positive signal. After the external factors return to normal, vehicle production and delivery speed will quickly improve. NIO stated in its Q2 guidance given in early June that delivery in June will hit a historical record high.

High-end Can Grow Again

Confidence is not just retaliating against cancelled orders.

NIO revealed that new orders in May also hit a historical high, especially with the continuous strong performance of ET7, the future growth engine.

From the perspective of enterprise development rhythm, NIO needs faster scale growth in the future, and ET7 is the vanguard of this wave of growth. It is not enough to summarise its representative changes in tactics with “comprehensive improvement in product strength”. The qualitative leap lies in that it has no shortcomings.

Compared with the original ES8, which required a lot of understanding in terms of endurance, chassis, software and other aspects, it was a tear of the times. By contrast, the service long-board is more prominent, allowing NIO to run a unique user-oriented business model.

After achieving high-end positioning, the current growth is facing a more complex problem: how to compete directly with established players in their territory; how to turn “high-end” management into a quantifiable and sustainable business capability; and how to become a stable and normal profit-making organization.

ET7 and the second-generation platform embody this introspective change.

If four years ago (or even four years before that), NIO’s success relied on innovation in the business model plus the effect of “fans”, jointly promoting a middle-class social and humanistic care legend full of extreme cases; then four years later, NIO is perfecting the system, first investing in the product itself, heavily focusing on technology to empower high-end, broadening the defensive moat of the main business, and leveraging a wider and more universal consumer enthusiasm.

This cultivation process is plain and unremarkable.

On the one hand, it is a continuous increase in investment in deepwater R&D. NIO has already built a relatively complete technological map, with independent R&D systems for electric motors, electronic control, battery packs and intelligent systems. As of the end of May, NIO had applied for and been granted a total of about 5,000 patents.## Abstract Numbering Complementing Product

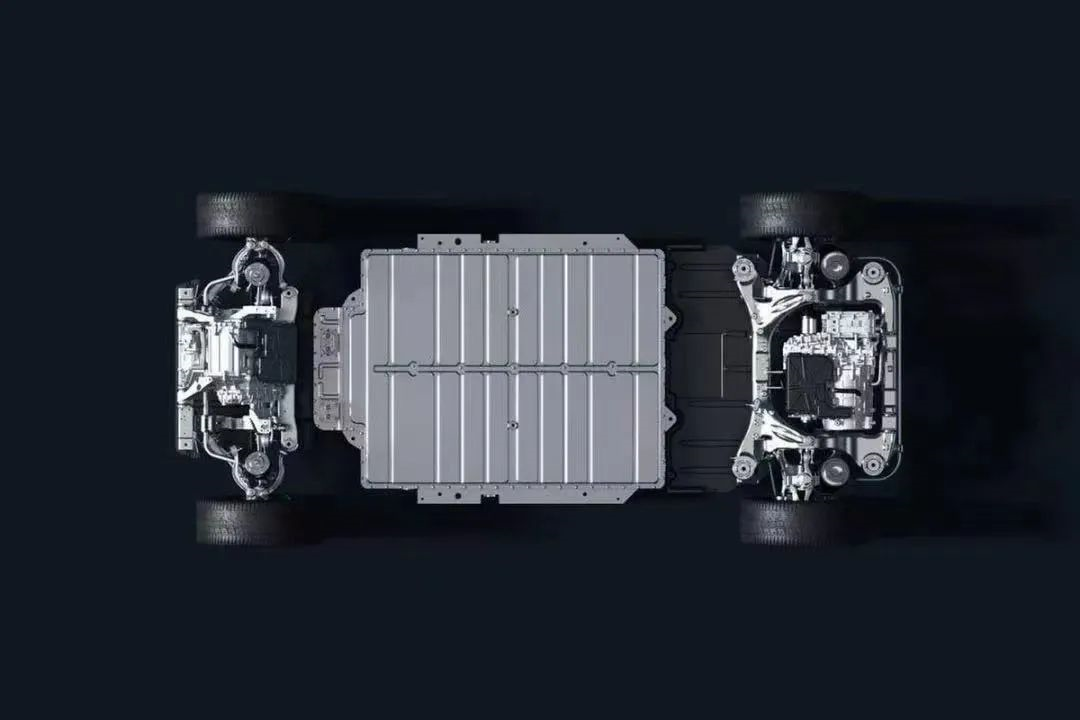

The esoteric skills of the 2nd-gen platform reflect in the concrete product: novel EE architecture; self-developed smart ICC for chassis domain control; 2nd-gen motor featuring silicon carbide; NIO Pilot, an ADAS system crafted with NIO’s proprietary tech from perception, algorithm to the whole command and control.

In addition, battery is the field with relentless investment by NIO. The battery department was established from the very beginning of the startup, now having a team of over 400 people, engaging deeply in materials, cell and pack design, battery management and production, with batteries of 75 and 100 degrees being the fruits of involvement that bring cost advantage and mileage boon. Currently, the team is developing an 800-volt battery pack that supports battery swap and ultra-fast charging, slated for release in 2024.

Full-throttle R&D has become a marathon. Q1 financial report this year shows that NIO’s R&D expenses soared by 156.6% YoY to CNY 1.76 billion, with R&D expense ratio at 17.76%.

This is a result of experience correction. Forced to abandon half of its R&D plans due to the crisis in 2019, NIO suffered passive new car launch in 2021 despite the release of the ET7 and ET5, with the 866 taking on much of the workload, which partly explains the brief stumble.

With technological backing, this year NIO has been able to enter an intensive period of new product releases. In June, it just unveiled the third model ES7 based on the 2nd-gen platform, which will be delivered in August, with a time gap of just two months, compared to the accelerated pace of the ET7 and ET5.

On the other hand, there is continuous reinforcement to the commercial model, including treating batteries as an asset to manage.

Ironically, nothing can prove the long-term value of BaaS more convincingly than the short-seller report that questions its worth: there has not been any significant impact on either the capital market or public reputation.

Many international giants, including JPMorgan, Morgan Stanley, and Daiwa Capital, continue to maintain their buy ratings on NIO in their reports, citing similar reasons. As Deutsche Bank pointed out, there is no new significant information, some figures are incorrect, and some elements of the business model are misunderstood. Concerns are expected to soon fade away.

If there are any concerns left.

On the financial front, there is still room for a hard line of explanation. At the user level, there is no perceptible difference, with choosing BaaS still being a service offered by NIO that lowers entry barriers and offloads battery depreciation, broadening boundaries and benefiting NIO’s core business from a consumer psychology safety perspective.The main business can withstand any criticism, whether it is slander or criticism. With over 200,000 deliveries in the past four years, NIO’s solid foundation in the industry cannot be faked or tarnished.

Base sales growth will naturally drive revenue from NIO’s business model. Especially with the launch of NIO’s Volkswagen brand business in 2024, battery swapping will still be supported, allowing for economies of scale in research and development and services.

Starting with the ET7, the story is largely unsexy, mainly filling gaps while maintaining strengths.

Business is an extremely difficult journey, and the second half is clearly not as good as the first.

Of course, since we are spectators, we care about the scenery; those who actually walk the journey care about the distance, and as long as they walk far enough, all detours are just the preface.

Hedging One’s Bets

Over the past period of time, external criticism of NIO has to some extent been due to expectations of its sudden brilliance, which has not yet been fully realized as it has been building strength in secret.

The comeback is not too far off. Multiple growth engines will be ramped up in the second half of the year.

ES7 deliveries begin in August, while ET5 deliveries begin in September, the latter being another richly-imagined selling point, potentially propelling NIO’s revenue to the next level. For this reason, NIO has made early preparations for production capacity, and put it in NeoPark’s new manufacturing facility in Hefei. At the same time, ES8/ES6/EC6 are also about to upgrade their intelligent platform and launch a new one.

The product strength is stronger than ever before, and the product portfolio is richer than ever before, with precise positioning for each small segment of the high-end market from 300,000 to 500,000 RMB.

In addition, NIO’s NAD autonomous driving system will be launched in the second half of the year, bringing the full capability of luxury hardware to the second-generation models, which will be available on a service subscription model for RMB 680 per month. In the innovative and changing market, such an intelligent spear has the opportunity to penetrate traditional luxury barriers and appeal to high-end consumers.

NIO is about to embark on its strongest super cycle in history.

Gloomy stagnation in the first half of the year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.