Author: De Luo

On the internet, news about Tesla’s 4680 battery tends to periodically create a small hype, which always leads Tesla users to whisper to themselves: “Maybe I should wait a little longer before buying.”

On February 13th, Musk tweeted:

The development of the Model S Plaid battery pack has been a very difficult engineering process, and the next generation Model Y’s structural battery pack will be the next level of product.

This sentence has two meanings: firstly, the 4680 version of the CTC chassis will lead the next generation of chassis design; secondly, it may be difficult to produce and deliver CTC chassis based on the 4680 battery in the short term.

Why is “4680 battery + CTC chassis” one of the most influential innovations in the automotive industry?

Let’s discuss it more below.

92% Yield, Fast Enough

Before we talk about the 4680 battery, let’s introduce the concept: this is a cylindrical battery cell developed by Tesla named after its size of 46 mm in diameter and 80 mm in height.

In terms of positive and negative materials, there is little difference between domestic and foreign 4680 batteries. Mainly, high nickel + graphite, high nickel + silicon-carbon/silicon-oxygen are preferred strategies, which is also the strategy for other shaped batteries in the current industry.

So, you can still easily understand 4680 as a larger cylindrical ternary battery.

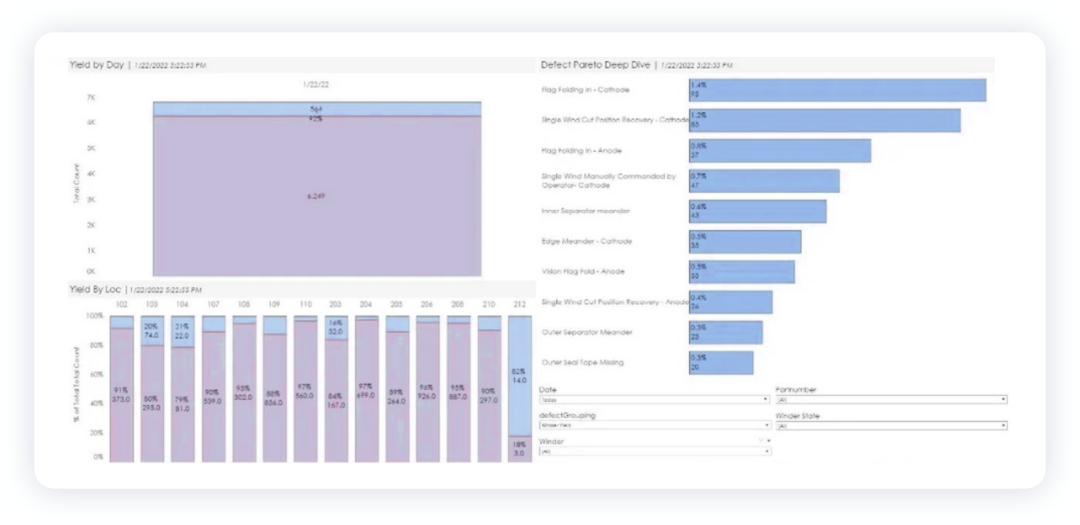

TMC’s website released a chart of 4680 battery yield statistics produced on January 22nd this year at Tesla’s Fremont factory in California.

The chart shows:

- The average yield rate of 4680 batteries reached 92% with a total of 6249 battery cells. Among the 14 machines surveyed, the highest yield rate was 97% and the lowest was 79%.

- Line 212 has a yield rate of 18%, used for testing or employee training.

This improvement speed is actually very fast. According to Tesla’s data, the initial yield rate of the 4680 trial production was only about 21%, and as of last November, the rate had reached 80% to 90%. Currently, the leaked data shows that it has already reached 92%.

According to relevant experts, the yield rate of 4680 batteries from various companies is as follows: Panasonic and LG: 80-90%; CATL: around 80%; others maintain around 70% or even lower, and by June, overall yield rates will exceed 90%.

From the perspective of the economy of scale production, an overall company yield rate exceeding 90%, with Tesla’s self-production and major suppliers reaching 95%, is the best time to ship.Based on the current pace, the first batch of Model Y overseas versions equipped with the 4680 battery will most likely be launched in Q2, and no later than Q3. As for the domestic market, it depends on the assembly rate of supporting enterprises. According to the current calculation of 80%, it is estimated that if it is delayed to Q4, it will be in 2023 Q1.

The market’s applause for the 4680 battery mainly focuses on “improving endurance and reducing costs.” Consumers seem to be even more excited than enterprises.

Tesla has achieved comprehensive innovation in multiple aspects such as unique cell design, self-developed cells, production processes, silicon negative electrode materials, high-nickel positive electrode materials, and integrated chassis design, by which the energy density has significantly increased, the endurance has significantly improved, and the unit cost and investment have significantly decreased.

The following are the data released on Tesla Battery Day:

-

Tesla is confident that the comprehensive endurance can be increased by 54% through 4680, among which cell design accounts for 16%, negative electrode materials 20%, positive electrode materials 4%, and cell chassis integration accounts for 14%.

-

The unit cost has decreased by 56%, with cell design accounting for 14%, cell factory accounting for 18%, negative electrode materials 5%, positive electrode materials accounting for 12%, and cell chassis integration accounting for 7%.

If Tesla can achieve the designed goals in mass production, the achievement is indeed significant and can directly promote Tesla to make vehicles priced below 30,000 USD.

Currently, Panasonic, LG, Samsung SDI, SKI, CATL, and other companies are pushing forward with the 4680 program, and these enterprises are all coincidentally researching the technology of cylindrical cells systematically. As Tesla’s 4680 cell production time moves forward, we can obviously feel that in the global power battery cell market, cylindrical battery solutions are becoming prosperous.

The Chaotic Era of Battery Standard

Compared to the concern of users about “improving energy density and reducing costs,” another angle is worth considering, which is the significance of cell standardization brought about by the 4680 cylindrical cell solution.

Here are a few concepts:

- The common goal in the industry: The three-element battery material end moves towards high-nickel and low-cobalt/cobalt-free; the structural end moves towards a non-module solution;

- Including the 4680 battery and CTC solution, the power battery field has been focusing on structural innovation rather than material innovation (topping up materials at most);

- Currently, Tesla’s battery scheme is mainly cylindrical, and other automakers use pouch cell and square-shell cell solutions.

The automobile industry is a complex field that involves hundreds of upstream and downstream suppliers. Therefore, terminal manufacturers are willing to promote the standardization of some components. In the era of electric vehicles, promoting cell standardization can directly reduce costs.In the early days, the main contradiction regarding battery cell standardization among various automakers was the inability to unify their battery plans:

- Nissan offered large rectangular soft pack battery cells with the same end terminal and polar ear;

- Tesla offered 1865 and 2170 battery cells;

- GM and Ford used large rectangular soft pack batteries with the same end terminal and polar ear;

- Kia and Hyundai provided two types of soft pack battery cells, with the same end and polar ear on both sides;

- Daimler used customized soft pack battery cells;

- Volkswagen gave its own definition of the battery cell’s specifications.

This is also the reason why the standardization of battery cells failed. Each automaker had its own standard, and ultimately, there was no standard at all. Moreover, different car models have different demands, making battery cell standardization even more difficult.

Automakers wanted to achieve mass production and cost reduction by standardizing battery cells, but this road was impassable. If battery cell standardization didn’t work, they turned to the module.

On the issue of promoting standardization, Volkswagen did have foresight and strength, and this is where the 355, 390, and 590 standard modules came from.

Evolution of Standard Modules

Module standardization is equivalent to automakers providing a pack box, and how to put the battery cells inside is up to the battery companies.

The so-called 355 refers to the length of the battery module, which is 355 mm, and the same goes for the 390 and 590.

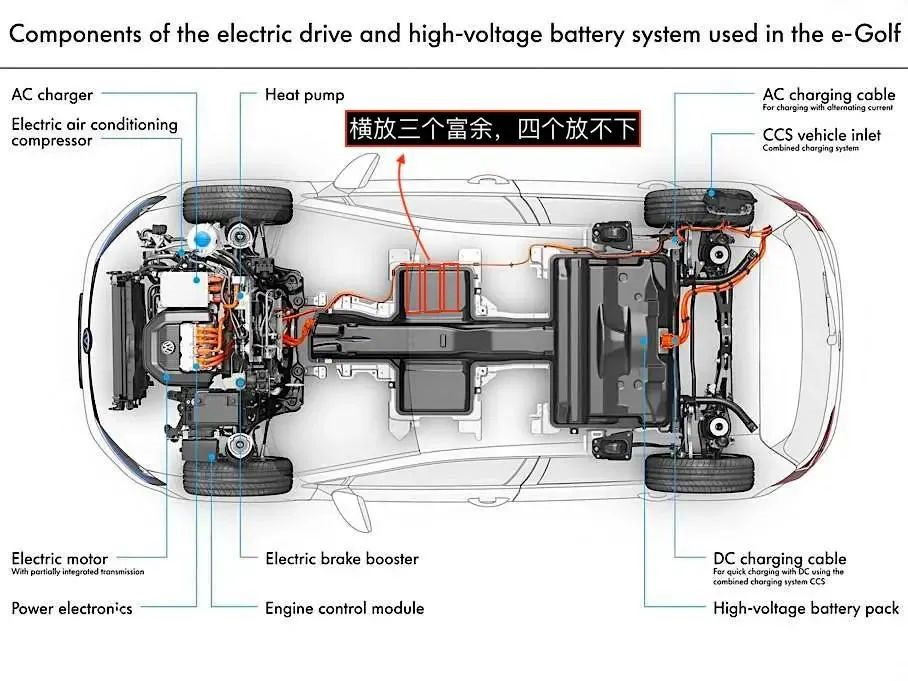

Volkswagen’s 355 module is also the most widely used standard module. It was used in early models such as the e-Golf and Audi Q7 e-tron. The latter had a greater impact in China because China followed the square route at the time, so this module was also most commonly used in China.

As product forms developed, issues with the 355 began to emerge. Because the 355 was compatible with both PHEV and EV requirements, the length and width restrictions were too many. This caused an excess of space when placing the modules horizontally in threes and not enough space when placing them in fours.

The 390 further extended the length, allowing for the placement of three modules horizontally, which increased the space utilization rate and ensured safety.

Through the evolution of the 355, the 390 gradually became the main module solution for the Volkswagen Group.

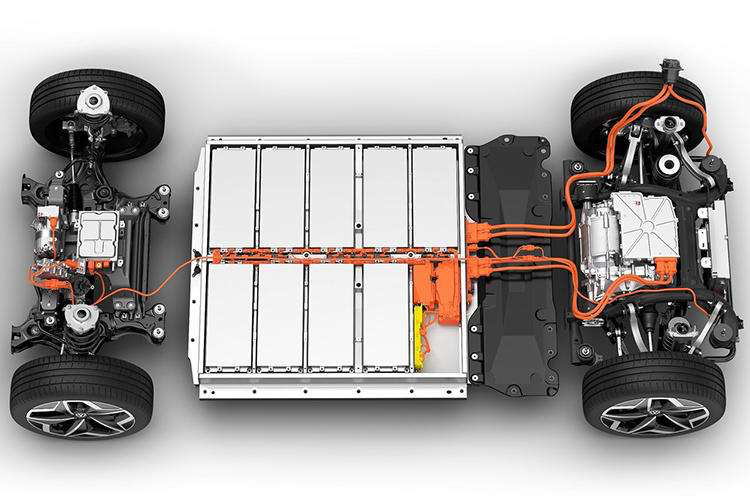

The 590 was a product of the MEB era for Volkswagen. On the one hand, the demand for larger modules was more substantive help for current designs. In the same width range, if one module is removed, the space utilization rate can be improved, structural components can be reduced, and costs can be lowered.

The 590 module has the same width as the 390, and energy is increased by squeezing the horizontal space of the battery pack.

Evolution Results of Battery Modules

So far, the evolutionary results of the 590 module have been obtained. In terms of the width direction of the battery pack, 355 and 390 represent three schemes of horizontal placement of modules, while 590 represents two schemes of horizontal placement with fewer structural components.

Whether it is 355, 390, 590, they are essentially iterative improvements in terms of battery module, aiming to reduce the structural components of modules to compress the space of the battery pack and achieve improved endurance and performance.

After the introduction of the 590 standard module, two other structural component optimization schemes appeared, which are CTP and blade batteries.

CATL has introduced the CTP scheme, and BYD has released the blade battery, which marks a major step forward in large module integrated solutions. At least the industry has noticed that even without mastering the materials, one can still solve the problem by tweaking the structural components.

During the same period, Tesla’s Model 3, based on 2170 batteries, had already adopted a large module scheme. From the current standpoint, the CTP breakthrough effect beyond the boundaries of standard modules 355, 390, and 590 is very good through structural innovation, at least balancing the relationship between cost and scalability.

Module standardization has brought many advantages. On the one hand, it can accelerate the standardization of battery manufacturers and achieve scalable supply. On the other hand, it enables automakers to quickly achieve mass production delivery.

“Cell” in the Module Evolution Process

There are many types of battery cells based on different packaging methods, and the mainstream ones are soft pack, square shell, and cylinder. It should be pointed out that theoretically, battery manufacturers can make all three types of cells, but we can simply understand that Tesla mainly uses a cylindrical scheme, supplied by Panasonic and LG; LG mainly supplies soft packs to overseas American brands, while domestically it is still square shells; CATL mainly supplies square shells to Volkswagen, GM, and BMW.

Soft packs have not developed well in China, mainly because the energy density of soft packs is not as high as that of square shells; the packaging of soft packs has always been a challenge and is prone to accidents. After Volkswagen and BMW chose CATL as their supplier, it accelerated the industrialization of square shells in China.

Therefore, square shells have always been a hot item in China. Cylinder batteries are also considered top-notch because of Tesla’s exclusive use. After the promotion of the large module plan, especially the soft pack solution, the phase decay of soft packages has accelerated.

Positive Development

To explain why we need to discuss the changes in the module and the battery cells. The standardization of modules or solutions with modules such as CATL has actually buried a minefield between automakers and battery companies, that is, whether to pursue the integration of the battery pack or the integration of the whole vehicle?

Here, we have to mention Tesla again as a representative of vertical integration, which has undergone three iterations of battery pack technology since the first-generation Roadster.

- Before 2015: E-platform based on a modified Lotus vehicle, the product is Roadster.

- 2015-2017: Tesla’s 2nd generation battery pack technology S-platform, the product is Model S/X.- After 2017: Tesla’s third-generation battery pack technology 3 platform, with the product being the Model 3.

It should be noted that starting from the second-generation battery pack technology, Tesla has been developing the battery pack based on the needs of the whole vehicle forward.

What is developing based on the needs of the whole vehicle forward?

Simply put, develop a battery pack that meets the product’s needs through the engineering needs of the whole vehicle.

Note that the core of this sentence is “engineering needs of the whole vehicle.” Previously, “ZHICAR” interpreted Tesla’s battery pack design and mentioned:

Starting from the second-generation battery pack, Tesla has been doing integrated design, and it is highly integrated in the third generation.

This integration is not the battery pack itself, but based on the integration of the whole vehicle, like the OBC, DCDC, and PDU integrated into the battery’s Penthouse. The longitudinal beam of the battery pack is integrated into the longitudinal beam of the whole vehicle, etc.

Based on this higher-dimensional integrated design, many new solutions for the whole vehicle must be based on this integration in the future. For example, removing the pre-charge circuit, Model 3 does not have a pre-charge resistor or a pre-charge relay, and all of these functions are implemented by DCDC.

If DCDC is not integrated into the battery pack, it is impossible to complete this functional integration.

This is the aforementioned development of battery pack integration based on the engineering needs of the whole vehicle. This requires Tesla to plan at least five years of future functions and potential needs.

Based on this, we can see that Tesla’s expertise is very strong.

In contrast, the domestic battery pack development plan at the same time is CTP, which is currently being implemented. From the perspective of the single-cell battery pack, CTP has high integration, low cost, and increased capacity. This reduces costs for battery companies, but it may have the opposite effect on the whole vehicle.

The biggest difference between CTP and Tesla is that the development of integrated battery packs in China is led by the battery company, and the drawback is that the battery company is developing based on the most efficient cost of achieving the cell and pack. This inevitably leads to discrepancies when matching with the whole vehicle, even if the automaker optimizes it, it is still not developed from top to bottom based on the whole vehicle.

From this perspective:

- Tesla is probably ahead of the world by about 2-3 years.

- Battery pack integration must serve the whole vehicle, not the cell.

- With integration at the whole vehicle level, redundant functions and expensive components can be removed.

This is why the 4680 + CTC solution will have a huge impact on the industry.

4680 + CTC optimized solution

As we mentioned above, from the standard module to the CTP large module, this battery manufacturer-led development model is not conducive to the automaker in the long run. In this case, the automaker’s power to define the entire vehicle chassis will be reduced, and this is also evident to the automaker.This has led to companies like Volkswagen and Volvo taking the lead in releasing battery strategies that involve not only producing their own batteries but also researching and producing standardized battery cells.

Seeing this, there is a feeling of going back to basics – Volkswagen initially failed with standard battery cells and had to circle back to them, which also reflects the urgency of automakers to regain control over the integrated development of the chassis and the batteries.

Why is 4680 the best solution?

Because both the large module solution and the next-generation CTC solution require higher performance from the battery cells themselves, from a packaging perspective, pouch cells will not make big progress in the development of power batteries at this stage, leaving only large cylindrical cells and large prismatic cells with more robust housings.

Volkswagen and Volvo are both using prismatic cells for their next-generation standardized cells, while Tesla remains a firm supporter of cylindrical cells. When it comes to choosing between these larger cells, there are a few factors to consider:

First, Ningde Times dominates the prismatic cell market, leaving little room for other battery manufacturers.

Among the top five power battery companies globally, Panasonic and LG are actually quite unique. With the advantage of Tesla’s shipments and their own technology, these two companies have been able to switch seamlessly between standard modules, large modules, and large cylindrical batteries.

Ningde Times prismatic cells are very well positioned in the 590 to CTP transition phase, relying on partnerships with Volkswagen, BMW, and domestic firms like NIO, to capture shipments in this phase, including shipments of 590 modules and CTP battery packs. In the future, Volkswagen’s own research and development of standardized cells will follow both “self-production” and “outsourcing” paths, of which Ningde Times will take the majority of the outsourced portion.

By this phase, Samsung SDI and SKI have fallen behind, and large cylindrical batteries are currently one of the best cell types to be paired with the next-generation CTC technology. As a result, large cylindrical batteries are re-leveling various battery companies in the standardization aspect.

Second, is a large cylindrical cell better than a prismatic cell in a high-nickel system?

From my discussions with several battery experts, if both battery cell types have the same high-nickel ratio, prismatic cells will have increased contact area, and in the CTC structure, prismatic cells will have more difficulty with thermal management and a higher probability of thermal runaway.

Third, the 4680 cell can be made into a lithium iron phosphate version.

This is an opportunity for all battery manufacturers. As mentioned earlier, up to now, both battery cells and packs are structurally innovative, and material advancement can only be known as upgrading and optimization. Therefore, automakers may widely use high- and low-end combinations of products to optimize costs and ensure driving range, using high-end ternary large cylindrical cells and low-end lithium iron phosphate large cylindrical cells.

In combination with the CTC solution, this can optimize costs while ensuring driving range, but it is still unknown how economically beneficial lithium iron phosphate large cylindrical cells will be.

From these three points, it can be seen that the 4680 cell is different from the previous 1865 and 2170 cells, and the most important thing about it, in addition to its form, is that it is more like the “590” of the standard module era.It mainly defines the standards of the cylindrical battery cell for the CTC era.

Final Words

Tesla’s role is to tell consumers, the industry, and battery companies that I have provided the reference answer. You can check it out and decide for yourselves.

From the standard battery cells of Volkswagen and Volvo’s self-developed standard battery cells, it is likely that these products will be mainly used for self-use instead of penetrating into the outside market. And based on the fact that LG, Panasonic, CATL, SDI, and SKI are all testing the 4680 battery cell, it can be seen that the 4680 battery cell is a recognized industry standard.

This lays the foundation for the large-scale application of the 4680 battery cell. According to the Korea Technology Daily, BMW has collaborated with Samsung SDI to begin researching and developing large cylindrical battery cells similar to the 4680, with a size possibly between 2170 and 4680.

Currently, more manufacturers are evaluating the production process of the large cylindrical battery cells. Once Tesla and other companies such as LG and Panasonic begin delivering their mass-produced versions, these companies can switch to 4680 at any time.

The impact of “4680 + CTC” on the industry mainly includes two points:

- At this stage, the design of the battery cell and module is integrated without a module, and the structural innovation realized may need to be used at the level of solid-state batteries or other material-level innovations;

- “4680 + CTC” reclaims the dominant power of defining battery cells and packs in the hands of the main factory;

- Automotive manufacturers are starting to move towards Tesla in terms of vehicle integration;

- The deployment of shell-type battery cells is likely to be affected by the 4680 battery cell.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.