Author: Zhu Yulong

Running with A00-level models is a basic link in the development of China’s new energy vehicles over the past few years.

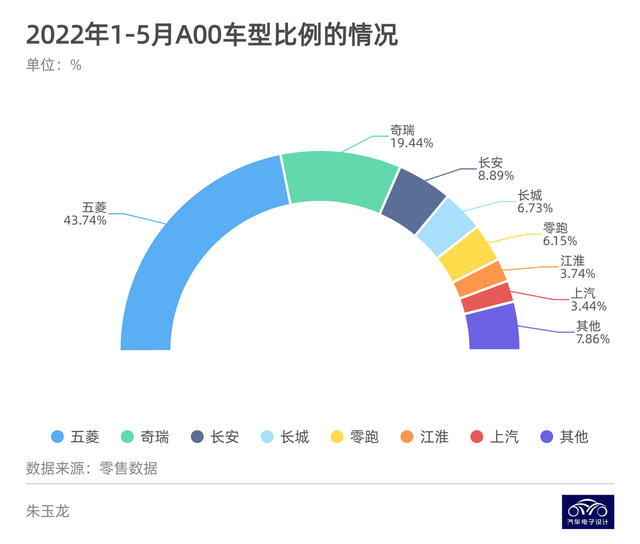

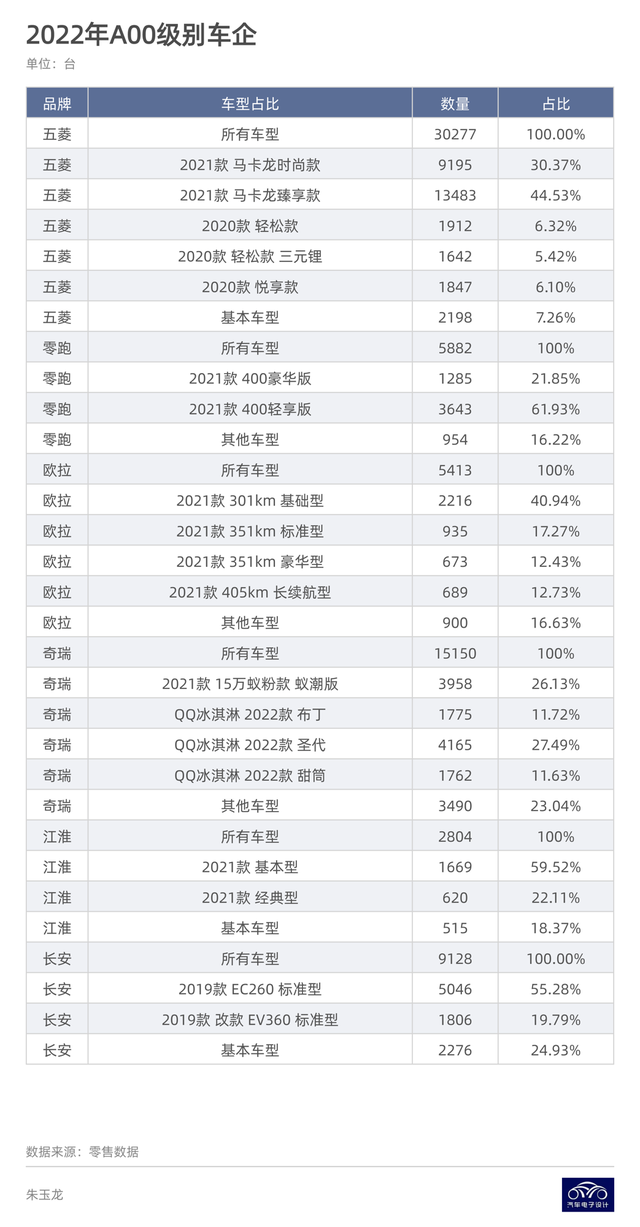

In the recent situation where battery costs have skyrocketed, from January to May 2022, a total of approximately 390,360 A00-level new energy vehicle models were sold, an increase of 53% year-on-year. However, in terms of market share, it only accounted for 25% of the total sales of new energy passenger cars, a drop of 8 percentage points. In terms of manufacturer layout, previously mainly dominated by five brands, namely Wuling, Great Wall, and Chery, the market has now evolved to revolve around these four companies, with additions of Ora and Leapmotor.

Today’s article is also in the form of a graphic to explore the A00 segment of the market.

Based on the current data, the growth rate of A00-level new energy vehicle models in 2022 will definitely slow down. It is expected that the total annual sales in 2022 will be maintained at around 1 million vehicles, mainly due to the following reasons:

- Battery and various component prices have risen due to the increase in primary materials (including metal and petroleum-derived industrial products), squeezing the living space of A00-level models. Those who are willing to persevere are only those with other demands. Not excluding that some companies will suddenly contract in September or October. In the case of willingness to supply-side impact, the main means of adjustment is through a significant adjustment in the vehicle sale price, which directly leads to a weakening of demand.

- With the increase of penetration rate, the demand of car companies for fuel consumption and new energy credits (double credits) has decreased. Due to the inability to offset the loss of profits in the transaction, most car companies are not highly motivated in production.

Due to the high price of oil, and the promotion of new energy vehicle policies in rural areas, this model still has rigid demand due to its low price. However, this year’s promotion strategy for vehicle models by car companies does not revolve around running mileage. Therefore, compared with last year, this market has not been effectively improved. This year’s incremental increases are mainly driven by A and DHT PHEV.

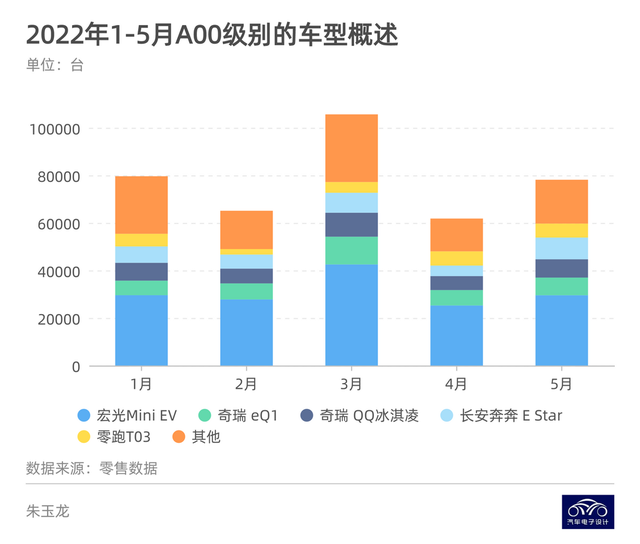

The main market brands for A00 cars in 2022 are also based on popular models, including Wuling Mini EV, Chery eQ, QQ Ice Cream, and Benben Four.

Segmentation of A00 car models

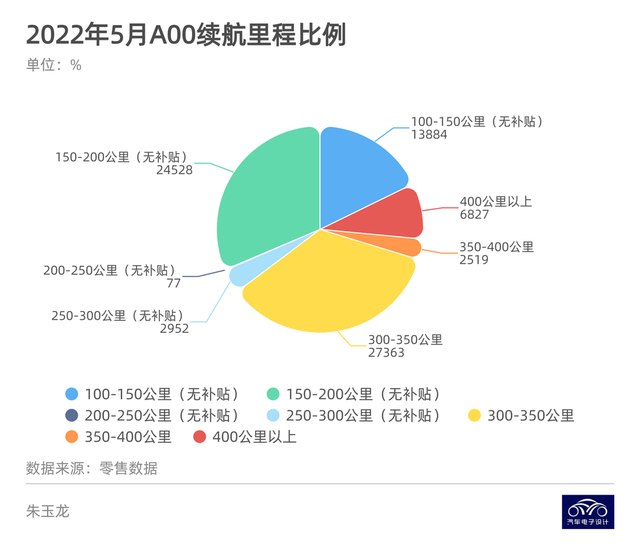

According to the cruising range, A00 cars can also be subdivided into two types: models with a cruising range of less than 300 kilometers without subsidies, and models with a cruising range of over 300 kilometers with subsidies, as shown in Figure 3 below:

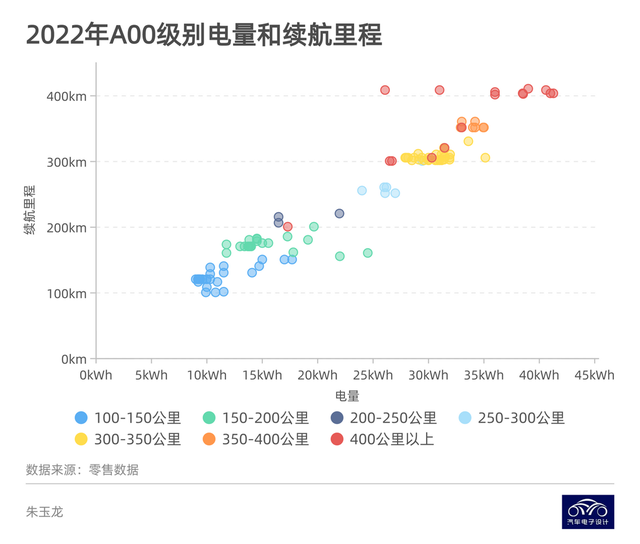

As for the battery configuration, for models without subsidies with a range of 300 kilometers, the main configuration is batteries less than 25-26kWh, with a focus on the 9-15kWh range, while in higher range configurations – the highest configuration being 45kWh – this belongs to the strategy of selling super small steel cannon cars.

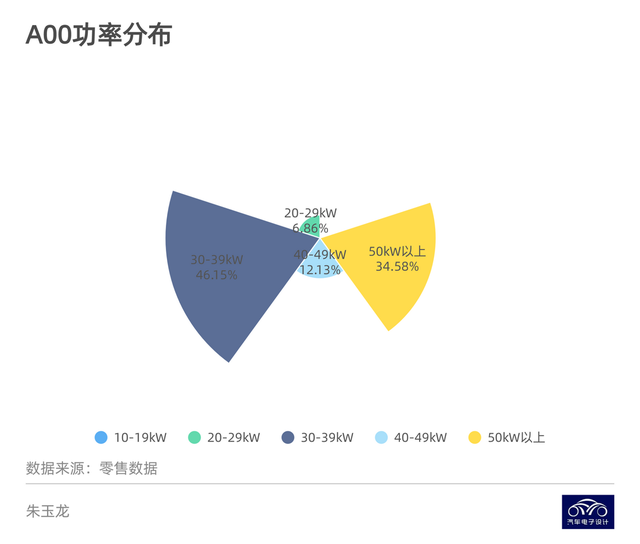

In terms of the electric drive system, A00-level models mainly have two power types: 30-39kW and 50kW, which are designed to meet the basic requirements of double 80.

In the A00-level cars, the distribution according to the market share of different companies is also interesting. If we further divide it into annual models, we can see that there were not many new A00-level models released in 2022, and carmakers clearly do not want to put too many resources into this field.

Battery selection for A00-level cars

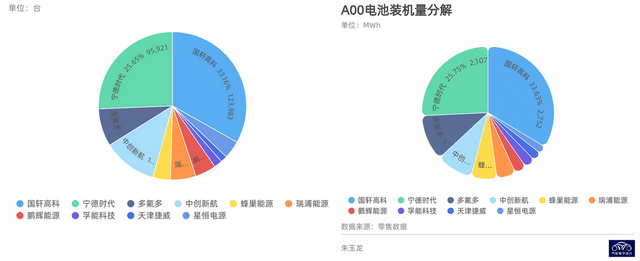

Looking at the number of batteries installed in A00 cars, the main manufacturers are Guoxuan High-tech, CATL, EVE and AVIC; followed by several popular manufacturers such as Rui Pro, and BAK Power.

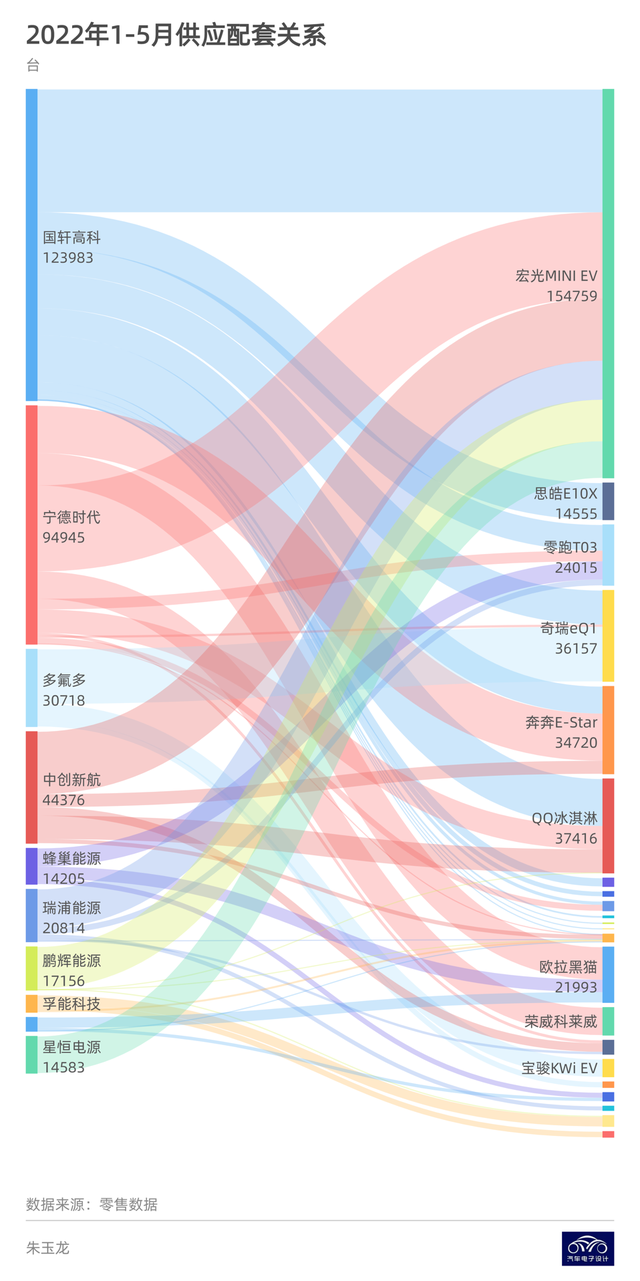

It is easy to see the pairing relationship in the shu data for the first five months of 2022, such as the battery allocation for the Hongguang Mini EV which focuses on Guoxuan High-tech, CATL, AVIC, Rui Pro, Penghui Energy, and Xingheng Power. The battery for Chery eQ1 is supplied by EVE and CATL, while Changan’s Benben mainly uses batteries from CATL and Guoxuan High-tech with AVIC being the secondary supplier. The FB Ice Cream QQ uses batteries from Guoxuan High-tech, CATL, and AVIC.

Conclusion: The A00-level car market has been relatively stable before 2021, but with the increasing prominence of cost issues, the proportion of this sector in the overall electric vehicle market will continue to decrease. This trend is positive, indicating that new energy vehicles are developing towards a healthier and more mature market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.