Authors | Qiu Kaijun Wang Lingfang

Editor | Qiu Kaijun

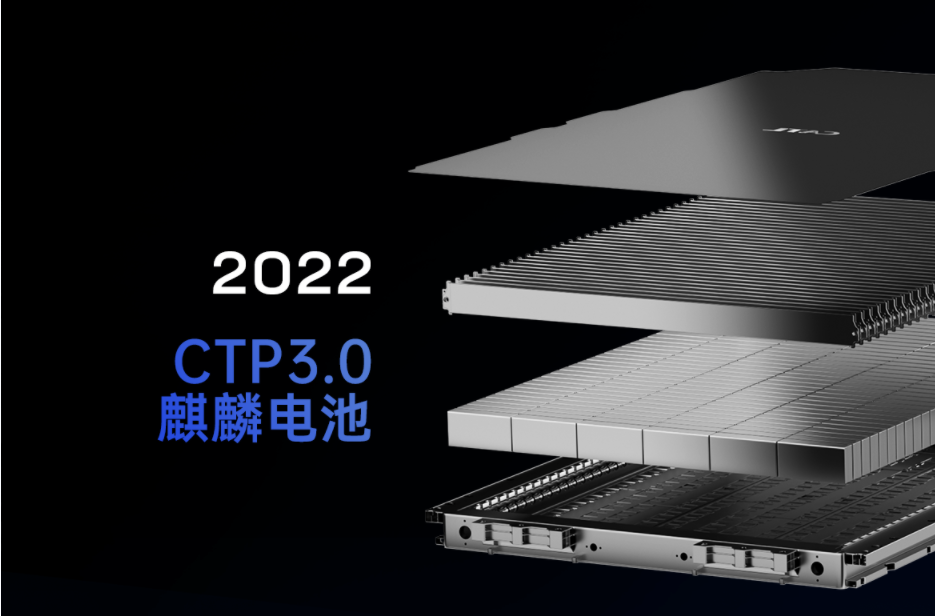

After two rounds of preheating, CATL announced the birth of the Kirin battery with a 3 minute and 57 second video and a public WeChat post.

CATL first introduced the Kirin battery at the 2022 Electric Vehicle 100 People’s Forum, and then mentioned it again in the “Clouds Over Yibin” high-end dialogue a week ago.

The Kirin battery is not a battery cell technology, but rather a battery system technology.

This is a battery system composed of square battery cells, with a volume utilization rate exceeding 72%, and the system integration degree reaching a new global high.

When using ternary material battery cells, the energy density of the Kirin battery system can reach 255Wh/kg, easily achieving a vehicle range of 1000 kilometers; when using lithium iron phosphate, the system energy density can also exceed 160Wh/kg.

Under the same battery cell chemistry and the same battery pack size, the energy density of the Kirin battery is 13% higher than that of the cylindrical 4680 battery system.

This is a product that competes with the cylindrical 4680 battery system.

Since Tesla released the 4680 battery cell on Battery Day, this battery cell has become a “hot commodity,” with some domestic and foreign battery companies stating their intention to follow suit. Some opinions even believe that the 4680 will gain overwhelming advantages in high-end power batteries.

However, it is not so easy for the 4680 battery cell and its system to completely outperform other high-specific-energy solutions.

Because there is no perfect battery in the world, any product or model is the result of balancing performance, cost, and safety.

In addition to the improvement of the performance of the battery cells themselves, the endowment and needs of the automakers, as well as the manufacturing capabilities of the battery companies, are important factors for automakers in choosing batteries.

Currently, the automakers’ ability to assemble cells into packs, the manufacturing difficulty of large cylindrical cells, and the difficulty of heat dissipation will all become constraints on the rapid development of the 4680 in the short term.

The emergence of the Kirin battery is proof that the 4680 model battery cell wants to rule the world, but it is not so easy. Currently, the development direction of power batteries is still based on multiple technological routes.

The founder of Ideal Automobile, Li Xiang, publicly endorsed CATL shortly after the release of the Kirin battery and commented “See you next year” on Weibo. Afterwards, Avita and NETA also interacted with CATL regarding the Kirin battery.

Let us first understand CATL’s Kirin battery. Then, let us see what kind of sparks will fly when the Kirin goes head-to-head with the 4680.

Battery Pack with Inverted Cells

One of the biggest features of the Kirin battery is the inversion of the battery cells.Ningde Times is not the first company to focus on the placement of battery cells. Recently, SAIC released a battery pack with horizontal battery cells. The battery pack with inverted battery cells adopted by Ningde Times obviously has a higher space utilization rate than the one with horizontal battery cells. They both have the same adjustment idea for cooling components, which move from the bottom to the middle of the battery cells.

Ningde Times also integrated water cooling, insulation, and horizontal and vertical beams to further improve the integration of the battery pack.

(1) The space utilization rate of the battery cells reaches 72%

From the information provided by Ningde Times, it can be seen that its battery cells are inverted. When the top cover was facing upward, the battery pack needed to leave space both above and below the battery cells. The top cover needs to leave space for exhaust in case of overheating, while the bottom needs to leave space to prevent bottom ball impact.

Now with the inverted battery cells, the space for exhaust and bottom ball impact is shared, leaving an additional 6% space for the battery cells. Compared with the Rubik’s cube battery with horizontal battery cells, the space utilization rate of the battery cells is higher.

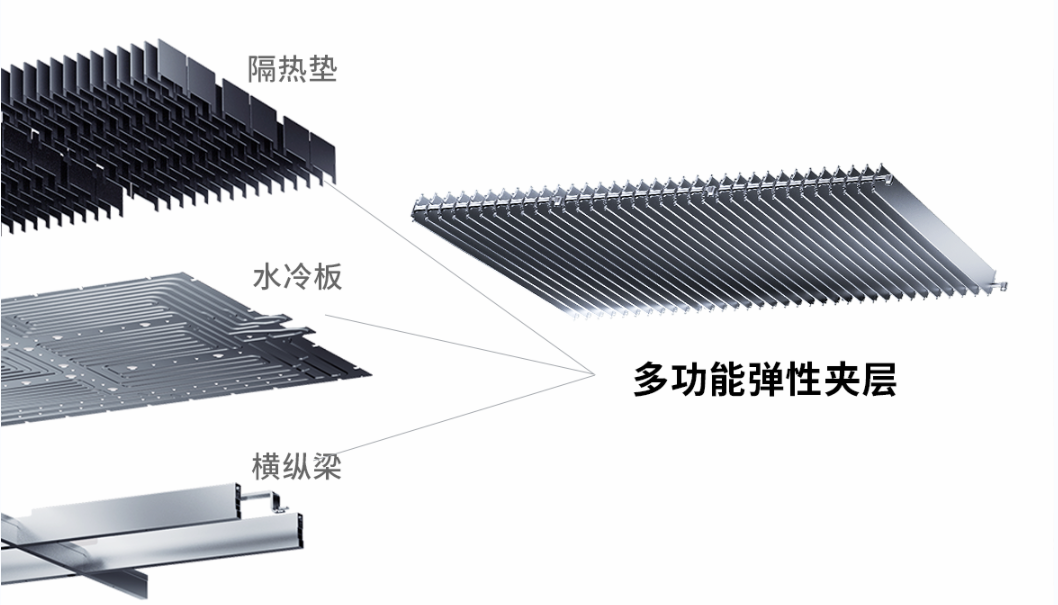

(2) Integrated into a multifunctional elastic sandwich

Ningde Times also eliminated the originally independent design of horizontal and vertical beams, water cooling plates, and insulation pads, integrating them into a multifunctional elastic sandwich. The built-in micrometer bridge connecting device helps free stretching and contraction with the breathing of the battery cells, enhancing the reliability of the battery cells throughout their lifespan.

This sandwich has more advantages than this. It also acts as a force-dispersed structure. The battery cells and multifunctional elastic sandwich form an integrated energy unit and become a force-dispersed structure in the driving direction, improving the structural strength and impact resistance of the battery.

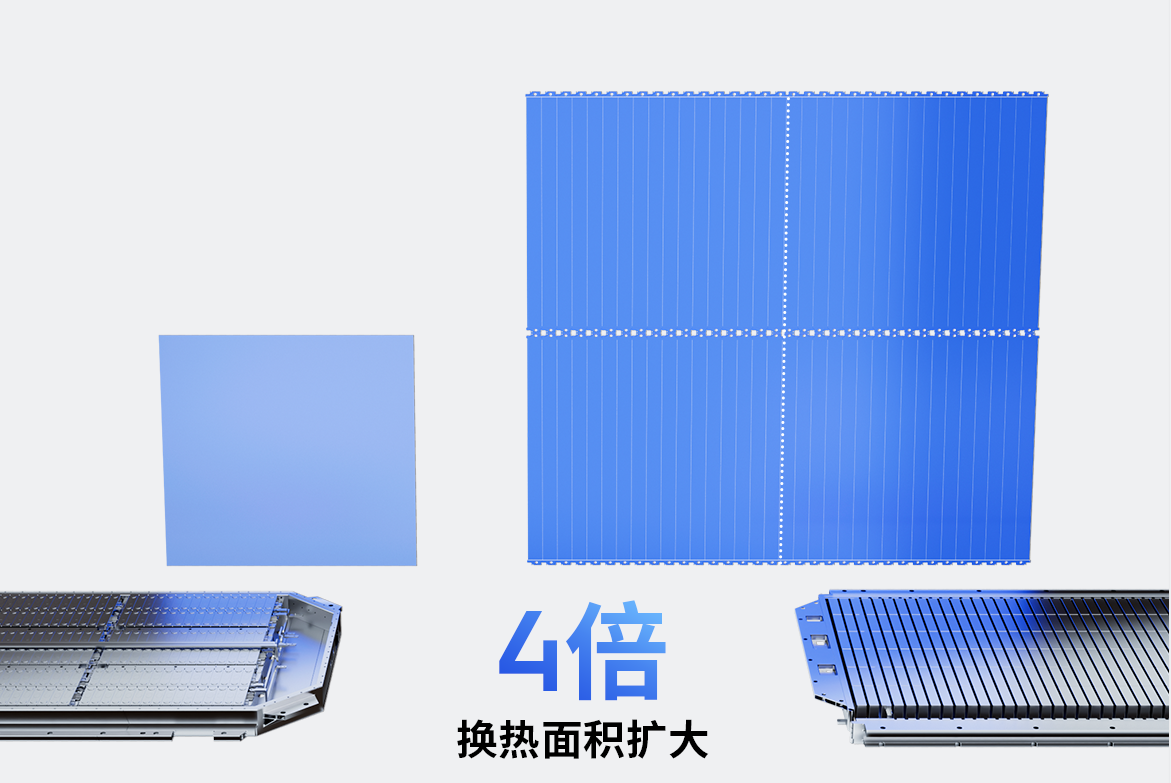

(3) Four-fold increase in heat exchange area

Ningde Times has placed the bottom water cooling component between the battery cells, which increases the heat exchange area by four times. This battery celI large surface cooling technology reduces the temperature control time of the battery cells to half that of before, thus adapting to faster and higher voltage charging. Currently, the Kirin battery can support 5-minute rapid heat-up and 80% fast charging in 10 minutes.

In extreme cases, the battery cells can cool down rapidly, effectively blocking abnormal heat transfer between battery cells, avoiding irreversible damage caused by the battery working at abnormal temperatures, and improving the life span and safety of the battery.

Therefore, the Kirin battery can achieve thermal stability and safety for the entire chemical system, thus adapting to material upgrades with higher energy density.

Significantly increasing the cooling area effectively adapts to the launch of car models on 800V voltage platforms by automotive manufacturers.It can be said that CATL has squeezed every inch of space inside the battery pack to the maximum extent through large amounts of real vehicle data and AI simulation.

Currently, for high-end 800V platform models, only the cylindrical 4680 battery system and the Kirin batteries can compete head-on. But which one is superior?

Cylindrical batteries

Globally, there are probably only a handful of major companies that insist on offering cylindrical cells as an option, and Tesla is one of them.

1. 4680 – Tesla’s Choice

The confidence behind Tesla’s self-developed and manufactured battery cells comes from its sales and technology. According to CleanTechnica data, in 2021, Tesla sold 936,200 vehicles globally, ranking first with a market share of 14.4%. With global high sales and market share, Tesla’s choices often have scale effects and cost advantages, making it the main reference for automakers and battery companies.

Although Tesla has now applied a large number of square cells, which are increasingly dominant, the impression that Tesla is a supporter of cylindrical cells is still deeply ingrained.

Indeed, Tesla has extensive experience in cylindrical cells. In the early days of Tesla’s establishment, there was no concept of power batteries in the market. Tesla chose the mature cylindrical 18650 cells as the power battery, which was an inevitable choice.

Since then, following the cylindrical path of 18650, Tesla worked with Panasonic to develop the 21700 cells and used them extensively, replacing the 18650 cells.

Undoubtedly, Tesla has unique advantages in the management of 18650 and 21700 cells. But it remains uncertain whether Tesla can still effortlessly handle the 4680 cells, whose energy has multiplied several times.

Tesla’s choice of large cylindrical cells is a continuation of its technology, and is based on its strong bargaining power.

This only means that Tesla has advantages in group technology management. However, in the field of mass production of battery cells, Tesla is still a novice and must maintain a cautious attitude towards the cells it produces.

Moreover, we need to repeat that Tesla itself has also used a large number of CATL’s square cells, and their usage is increasing.

2. Other companies’ choices

Different from Tesla, other automakers have more diversified choices, but generally not towards cylindrical cells.

Worth mentioning is Toyota’s choice. The modularity of Tesla’s first mass-produced roadster was designed with the help of Toyota.

However, Toyota itself chose square cells. It is worth noting that Panasonic, Toyota’s cell cooperation partner, is Tesla’s main supplier of cylindrical cells. But the battery technology direction chosen by the joint venture battery company, Prime Planet Energy & Solutions, is square cells.

In addition, Nissan, Daimler, GM, Renault-Nissan and Volvo tend to choose soft pack cells, while Volkswagen has adopted a strategy of standard cells, using square cells.

Chinese car companies are particularly fond of square battery cells, as the top two battery companies – CATL and BYD – both specialize in square cells. In addition, the new leaders in the intelligent electric vehicle industry, including NIO’s William Li and domestic energy brand leaders such as Ora and Aiways, all use square cells. In 2020, square batteries accounted for 80% of China’s battery shipments.

From an international data perspective, square cells accounted for more than 49% in 2020, while pouch cells accounted for 27.8% of the global EV market.

In terms of market share in the real world, square cells have a leading advantage and all three types of packaging will coexist for a long time. However, in China, the market share of pouch cells is relatively low and it is unlikely to become mainstream in the short term.

4680: Shortcomings in Size

In China, only cylindrical and square cells compete head-to-head.

In theory, the technology maturity of cylindrical cells is the highest, but in practice, compared to 18650 and 21700, mass-producing 4680 is very difficult.

In the eyes of the industry, despite Tesla and Panasonic having extensive experience with small cylindrical batteries, the experience is basically not applicable to 4680 because 4680 requires the use of multiple innovative technologies together, and a single failure can be catastrophic.

In general, 4680 must choose the full ear (free ear) technology, and conventional single ear technology cannot solve the problem of hot spots and cannot adapt to high power needs.

First of all, mass production is difficult.

The first difficulty is that the accuracy requirements for the winding machine are higher. After all, the size of the battery cell has increased significantly, making it more difficult to align.

The second difficulty is the welding technology of the ear. At present, there are two types of production processes for full ear technology: the cut-stack method and the rolling method. The cut-stack method is the solution adopted by Tesla. Its main method is to cut and roll in slices, resulting in a large surface roughness, which can cause inconsistent contact between the ears and result in poor consistency of internal resistance. In addition, due to the two ends being sealed by the ears, continuous injection of electrolyte during production is impossible.

The rolling method is a commonly used full ear solution by Chinese companies, which rolls the ear into a flat end via ultrasound or mechanical means. The ear is prone to produce metal debris during the rolling process, resulting in excessive self-discharge of the battery and even internal short circuits. In addition, the compact end face after rolling makes it difficult for electrolyte to enter the interior of the battery cell.

All of these will be obstacles to improving battery cell yields.

Secondly, space utilization is low.Under the same chemical system, the space utilization rate of large cylindrical batteries is much lower than that of square batteries. The head of a certain battery company gave an example. With the same battery pack, the phosphate iron lithium large cylindrical battery can only be charged to 50%, while the square battery can be charged to 80%. With the same ternary material, the square battery can use ordinary 532 or 622 materials, but the 4680 battery must use high nickel to achieve nearly the same amount of electricity.

Although high-nickel ternary materials have high energy density, it also means higher risk of thermal runaway. In terms of system protection, more efforts are needed.

Thirdly, traditional heat dissipation methods are difficult. Currently, cylindrical batteries all use side cooling. The axial heat conduction of cylindrical batteries is generally the fastest, and the side heat dissipation is the slowest. This feature is even more obvious in 4680 large batteries. Under 800V high voltage charging, the battery will accumulate a large amount of heat in a short time, and the side heat dissipation speed is slow. This will greatly affect the life of the battery if continued.

Tesla’s method is to add a water-cooled plate on the top to achieve the effect of double-side cooling on the side and top.

If car manufacturers do not have the cylindrical battery grouping technology and have to rely on battery companies to manufacture battery systems, it will be difficult to achieve economies of scale.

The negative electrode of 4680 batteries must use silicon-carbon negative electrodes to reflect the significance of energy density improvement. However, silicon-carbon negative electrodes also have disadvantages. First, the cost is high. Second, there are many side reactions, high expansion, and low first charge-discharge efficiency, which affect the battery quality. Third, under the influence of silicon volume changes, the SEI film of the silicon-carbon negative electrode repeatedly breaks and reforms, and a large amount of lithium ions are consumed, which may cause the cycling performance and battery capacity to decrease.

Although 4680 batteries have outstanding advantages in energy density and fast charging performance, their safety challenges are great, and the difficulty of production has increased geometrically. Moreover, for car manufacturers, the difficulty of grouping cylindrical batteries is high. If they do not have the cylindrical battery grouping technology, their cost advantages are difficult to play out.

A single-item champion is inferior to a comprehensive champion.

4680 batteries, which perform well individually, seem to be inferior to Kirin batteries after they are grouped. According to data provided by CATL, in terms of energy density, fast charging performance, integration, and thermal conductivity, the round 4680 system is slightly inferior to Kirin batteries.

The development of electric vehicles has gained the trust of consumers and entered a phase of popularization.

The demand for power batteries has also undergone new changes.- The driving range has met consumer expectations, and energy density is no longer the core pain point.

- Although charging is still difficult for some, high-end models highlight fast charging capabilities for power batteries.

- As the ownership increases, fire accidents have raised concerns, and safety has gradually become more important.

- As demand grows too fast, material supply safety and supply prices are becoming increasingly important.

Based on this, there are several trends in power battery selection by automakers for different markets:

First, low- and mid-end models are beginning to use lithium iron phosphate batteries, and even consider sodium-ion and manganese-based material batteries, but adopt a large module or no module format to achieve good system energy density, cost, and safety.

Second, a few high-end models (BYD, and possibly some other companies follow suit) are also using lithium iron phosphate batteries, emphasizing safety.

Third, most high-end models still use ternary batteries, but are not eager to adopt high-nickel technologies, instead taking the middle to high-nickel material route. Some even mix ternary and lithium iron phosphate structures to achieve a balance between energy density, safety, and cost.

Fourth, a few high-end models still pursue high energy density to achieve long driving range or lightweight. There are solutions for pouch, cylindrical, and ternary batteries, but higher costs are required for system design and protection.

Fifth, the electrochemical system that can be mass-produced is still the mainstream, and structural innovation and material micro-innovation are the focus.

All of this is thanks to the innovative path opened by CATL’s battery system structure innovation.

Before CATL announced its CTP technology, battery companies only explored ways to increase energy density through the size of the battery core, material systems, and other aspects. However, the replacement of material systems is a very slow process that requires continuous improvements in formulas to balance the various performance aspects of the battery core, and it often takes several years or even more than a decade of research and development to mature.

But CATL’s simplified battery pack structure has opened up an innovative path: First, achieving higher energy density. By simplifying the structure without changing the battery core material, the energy density of the battery pack can be greatly improved, which is relatively easier to accomplish, and the iteration speed of battery energy density is faster.

Second, it is relatively safe. Compared with increasing the nickel content to increase the energy density of the battery core itself, the stability of the battery core is guaranteed, and the safety of the battery system is also improved to a certain extent.

Following CATL’s footsteps, BYD, Guoxuan High-tech, Zhongtai New Energy, and many other companies have successively launched their structural simplified battery pack products, leading the industry’s innovation. Chinese battery companies quickly pushed the energy density of the entire vehicle’s battery pack to 200Wh/kg, greatly improving the driving range of pure electric vehicles, undoubtedly playing a role in accelerating the popularization of electric vehicles.# 2022, CATL Introduces CTP3.0 Battery Pack Breaking the Record Again

In 2022, CATL introduced CTP3.0 battery pack, once again breaking the record for the longest range of Chinese electric vehicles, easily reaching 1000 kilometers. This effectively solves the problem of short driving range and range anxiety in winter, and is beneficial to extending the battery cycle life.

It seems that the effects that CATL’s CTC technology can achieve are worth looking forward to.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.