Author: Zhu Yulong

A few days ago, a friend of mine talked to me about the story that a familiar dealer started cutting orders for automotive chips (a rather exaggerated description), which scared me. I just wrote an article a few days ago describing the current shortage of chips in the automotive industry becoming a new norm. But why did things suddenly turn around like consumer electronics? Based on some research and information summary, a logical path can be deduced.

-

Early June: The chip supply in Europe is improving, according to Bloomberg, subsequently reported by media such as Europe Autonews, describing mainly Daimler Trucks (named Karin Radstrom), Mercedes-Benz (Joerg Burzer), BMW, and Volkswagen.

-

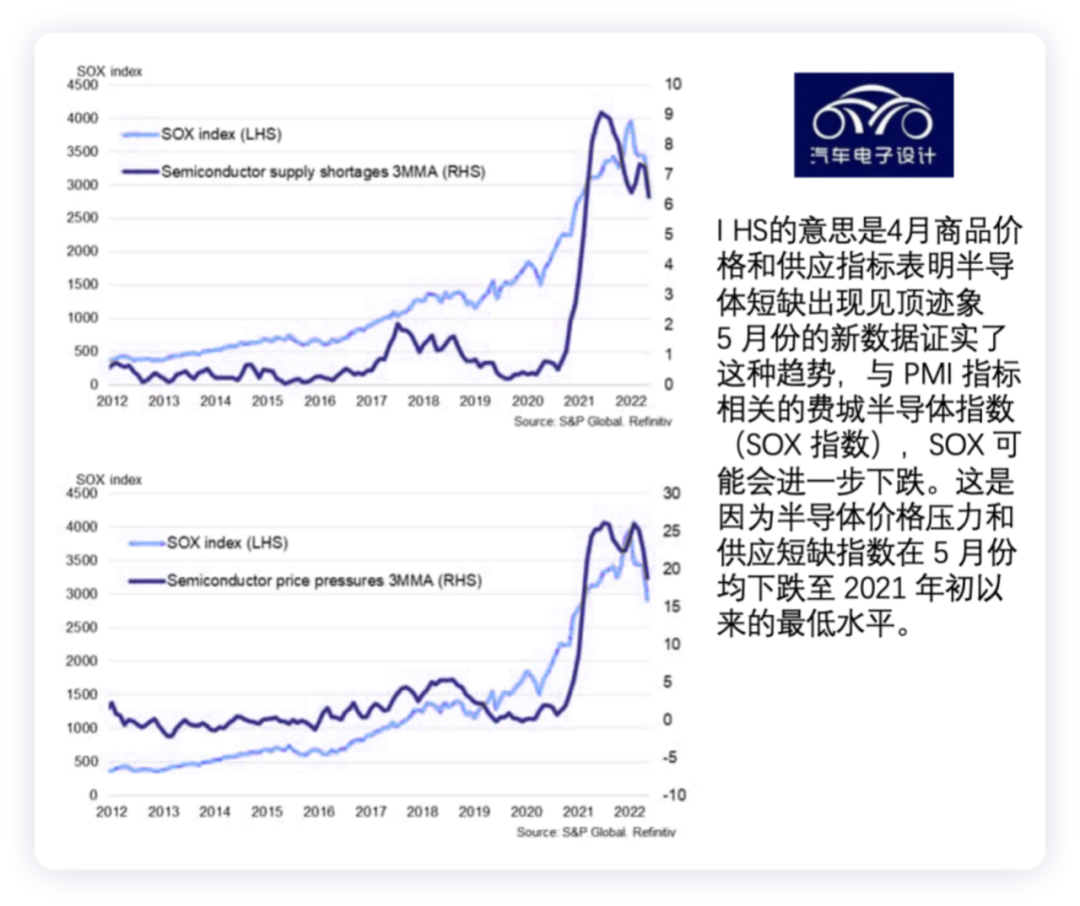

Mid-June: According to the S&P IHS index tracking situation, there are further signs of easing of semiconductor shortages globally, based on S&P Global PMI™, which derived from responses collected from over 20 projects in the S&P Global Manufacturing PMI survey regarding price pressures and supply shortages.

In reality, chips are still on the agenda for subsequent production arrangements for Chinese automotive companies. But judging from the information transmitted from the industry to the financial media, as well as the current prices and levels of difficulty in acquiring chips, the supply of automotive semiconductors is developing in a positive direction.

Some Logical Resumptions

There are quite a few consulting companies currently monitoring the chip situation. We use all the information to sort and synthesize it for a macro-level judgment, and then you, the reader, can make a rough judgment about the direction.

S&P IHS

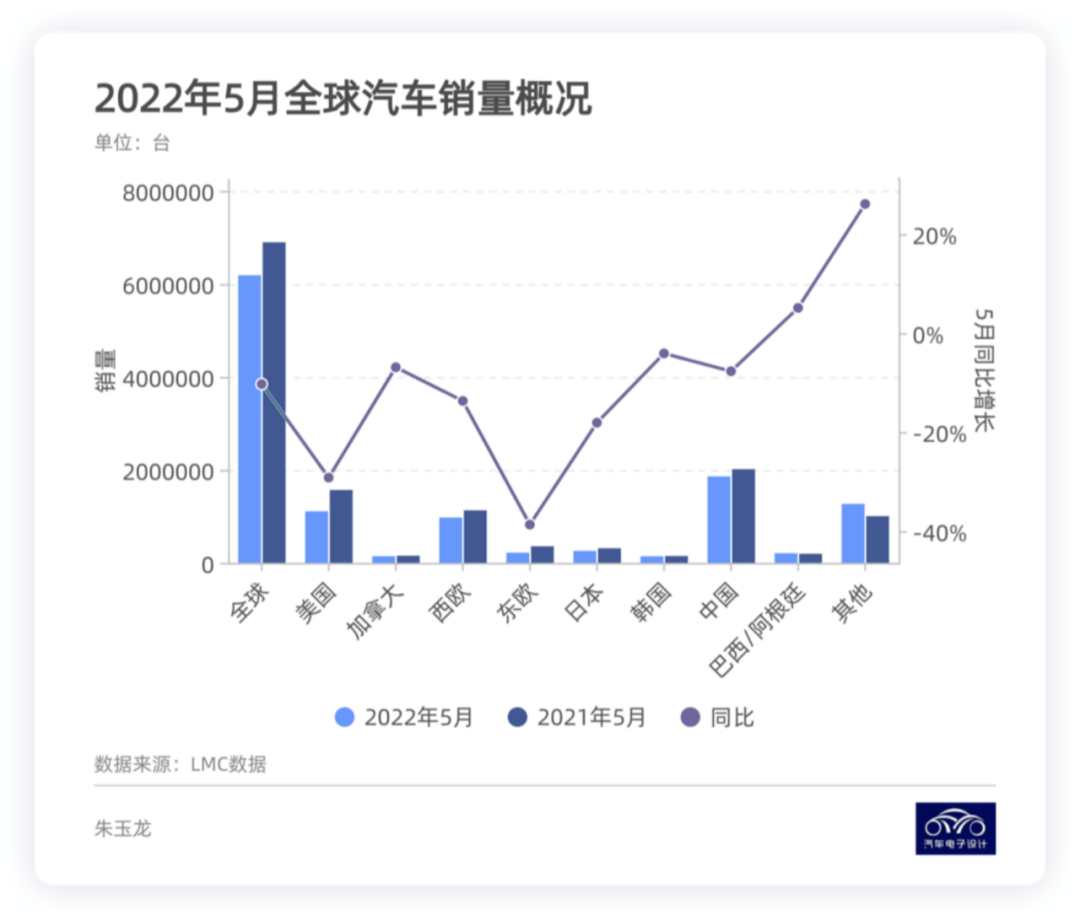

A lot of information is covered here, including the slowing down of the drop in European production and the acceleration of the decline in Asian automotive production. Based on the price index, the supply of chips is starting to continue to improve.

In terms of consumer chips (especially for smartphones and tablets), the hoarding logic was disrupted by the relatively low global demand, resulting in a decline in consumer chip production. While the global automotive supply and chip shortages are still at their peak, and the waiting time for car deliveries and supplies is still significant, the conclusion reached here is still relatively conservative.

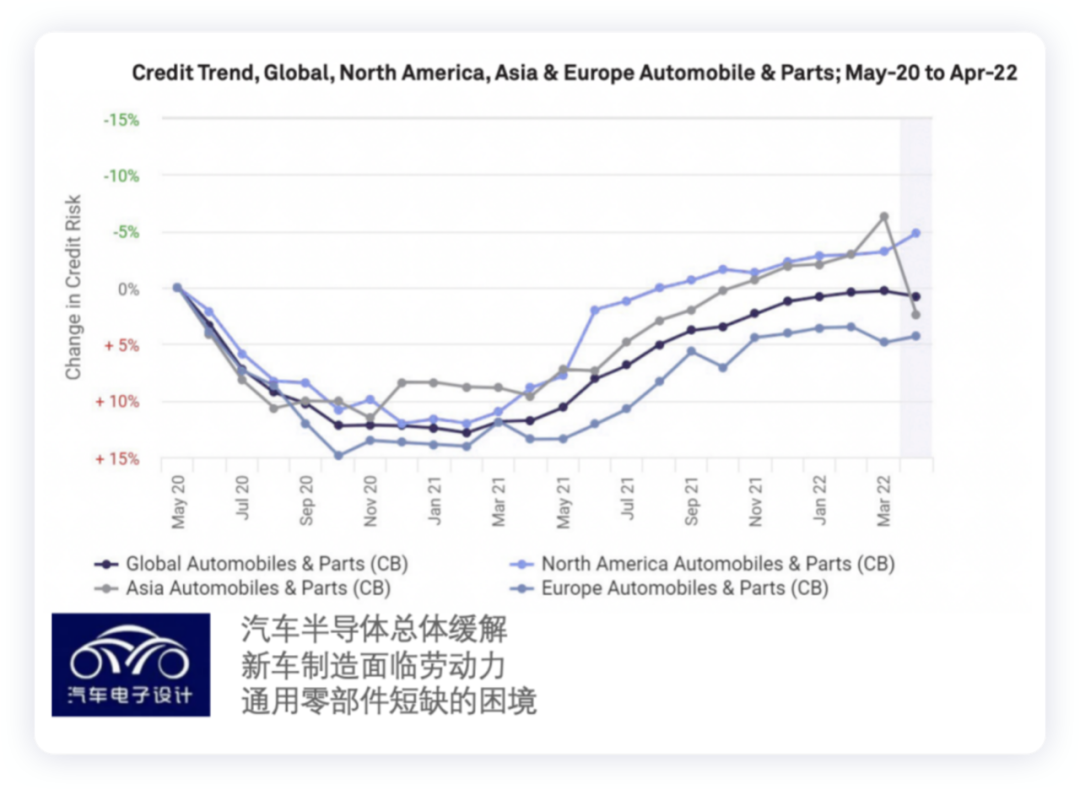

### Credit Benchmark

### Credit Benchmark

The issue discussed here is no longer the only one that global automakers need to face when it comes to automotive chips. Labor shortages in Europe and America and the general parts shortage have also begun to surface.

AutoForecast Solutions

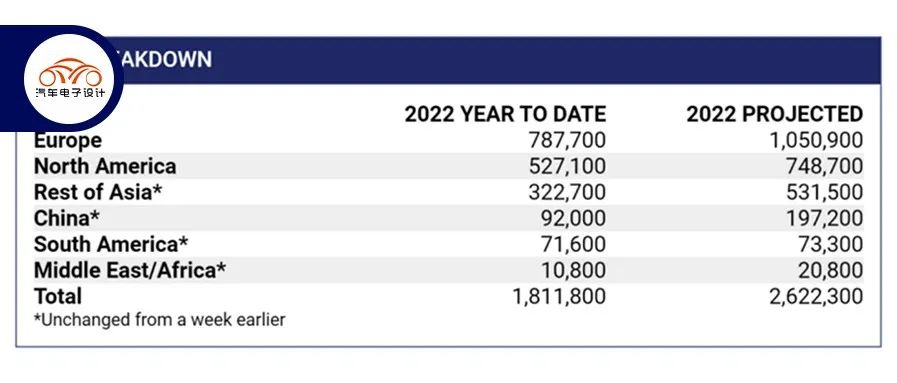

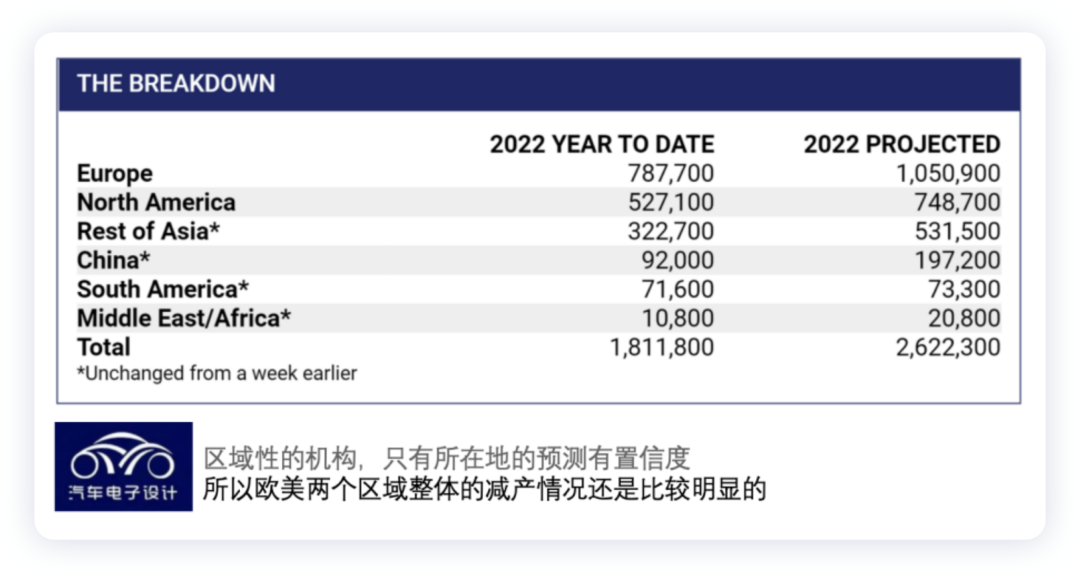

According to the global automotive forecasting VP Sam Fiorani of AFS, the shortage of automotive chips is far from over. In the short term, the automotive industry will continue to compete with higher-profit consumer chips for limited wafer fab space, with full recovery not expected until 2023. AFS specializes in forecasting in North America and also provides a table showing this year’s reduction in chip production.

In Asia, Toyota reduced production by 10% (75,000 units) in May and 100,000 units in June.

Cautiously Optimistic about Automotive Chips

After listing the above information, I think it is still difficult to judge the trend of chips. The management of automotive chips worldwide is now in a sensitive state. The incident with the aircraft carrier earlier caused the purchase of automotive chips to continue without stopping, so now car companies and Tier 1s are still firmly buying chips. The speculators who participated in it are starting to fade away, which objectively indicates that the risk of chip supply is beginning to decrease.

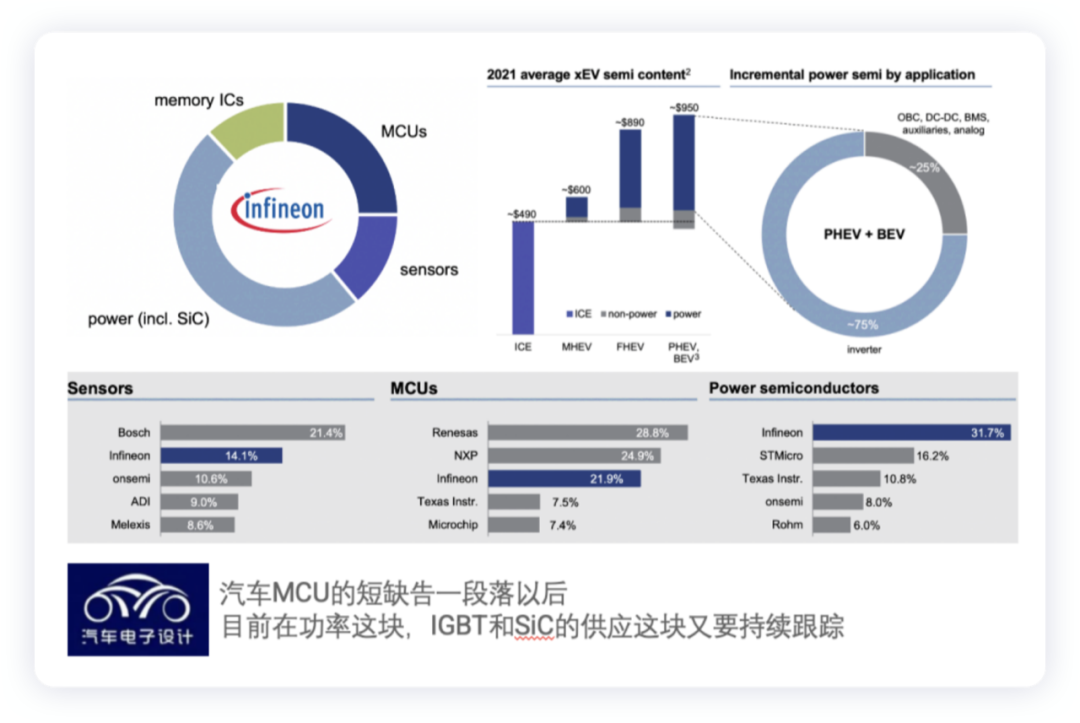

However, the procurement of automotive chips in the domestic market is still in a stage of many defects. The main reason for this is the original classification of automotive chips, from MCUs, power SPC chips, ASIC chips, low-voltage MOSFETs, and drivers, which makes it difficult to gather a considerable volume. Coupled with our attention to new energy vehicles, there are more chip giants such as BMS, Inverter, OBC, and DCDC, which are more than conventional fossil fuel cars.

My personal judgement is that as we’ve been tracking, new energy vehicles have been constantly gaining ground. Due to the fact that consumers of fuel cars are either parking their cars at home or purchasing a second electric vehicle, the sampling chips of power semiconductors and BMS have become the most scarce, while Infineon’s power class MCU (multi-core & functional safety) in the single-chip microcontroller became a tight supply project beginning in July. Starting from July, the chip shortage will turn from universal projects to components specifically for electric vehicles.

My personal judgement is that as we’ve been tracking, new energy vehicles have been constantly gaining ground. Due to the fact that consumers of fuel cars are either parking their cars at home or purchasing a second electric vehicle, the sampling chips of power semiconductors and BMS have become the most scarce, while Infineon’s power class MCU (multi-core & functional safety) in the single-chip microcontroller became a tight supply project beginning in July. Starting from July, the chip shortage will turn from universal projects to components specifically for electric vehicles.

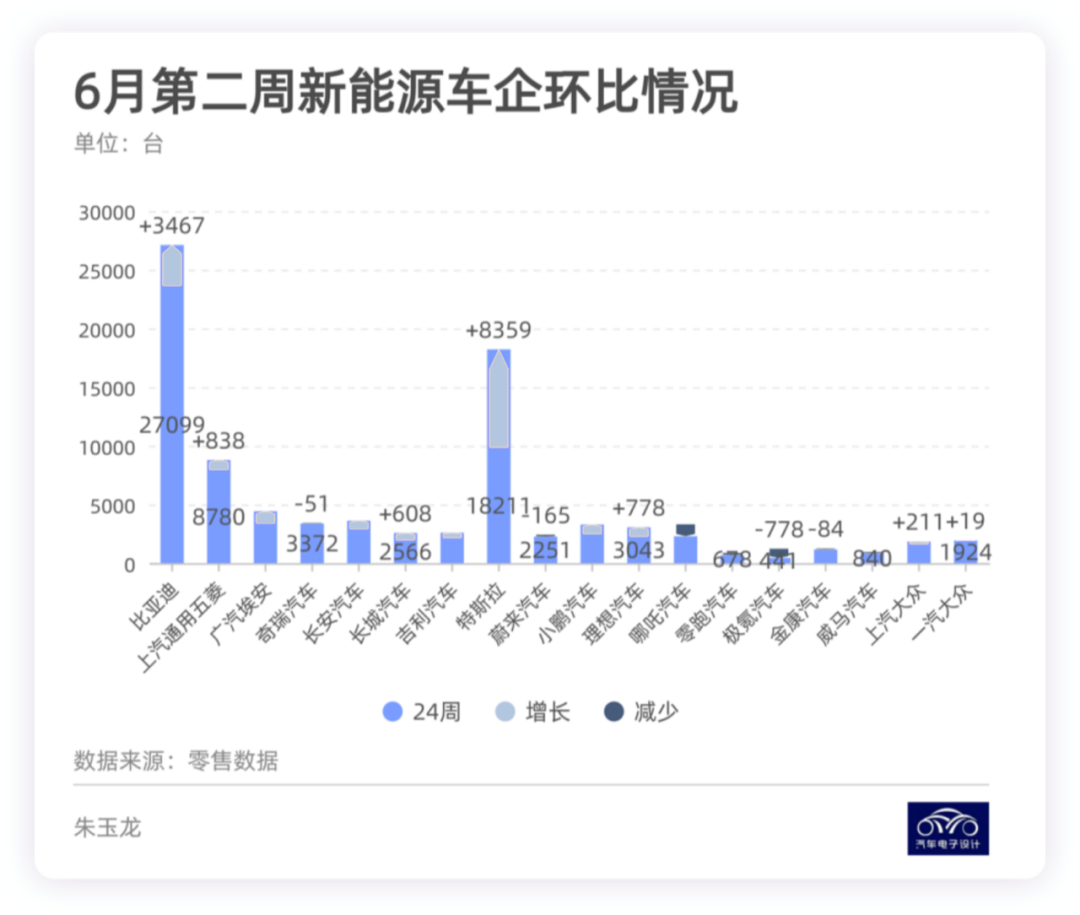

In summary: Whenever I talk to my comrades in the new energy industry, they always complain about a lack of chips. As traditional automobile brands begin to make efforts to sell new energy vehicles in the second half of the year, the chips everyone fights for may become more focused and categorized.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.