Text | Karakush

The presale price of NETA S Yao Shi version is announced to be 338,800 yuan.

It’s a bit expensive.

Just like suddenly a plate of Sha County snack costs 33.88 yuan.

It’s not feasible to simply criticize their efforts, as many people question them, just like those who praise “Li Na Xiao” (a famous tennis player in China) being an expert. The conclusion on the surface is always the easiest because it is usually a correct cliché, but this may not be true for NETA.

For example, the absurd praise of “Li Na Xiao.” Going from temporary third-class to permanent third-class, of course, deserves applause, but CEO Zhang Yong also pointed out that “NETA’s sales volume multiple compared to Weixiao Ling exceeds, and we should exceed Weixiao Ling’s price multiple.”

The clarity among leaders is necessary, at least as a necessary and sufficient condition for success.

As for how to correctly evaluate the upward trend of NETA, it is necessary to first understand its situation.

Misunderstandings of NETA

The older generation of domestically produced car companies, after reaching a certain stage of development, all want to move up. This is the emotional attachment of Chinese automobile people, as well as the inevitable direction of expansion to improve profitability.

However, there are not many independent vehicle companies that have successfully completed the transition from less than 100,000 yuan to over 200,000 yuan and have been recognized by the market. Those that can maintain market share, such as Geely (Lynk & Co) and BYD, have three necessary preparations:

- A broad mass base that provides a guarantee of manufacturing quality;

- Independent research and development technology accumulation, which can provide certain product advantages;

- Stable main business, complemented by strong capital support.

If these three indicators are used to evaluate, it is clear that NETA’s upward trend is somewhat premature.

Its foundation is not large, and although the growth momentum among new forces in the market is good, the monthly sales are only intermittent and occasionally exceed 10,000.

The research and development level is somewhat ambiguous, with few core technology demonstrations in previous models. As for the brand new Shanhai platform that NETA S relies on, it appears outstanding on paper, but has yet to be confirmed in practice; it will be revealed when the product is delivered in the fourth quarter.

Capital has been relatively ample in recent years, completing the D-series financing last year, and initiating Pre-IPO rounds this year, with a target valuation of approximately 45 billion yuan, and plans to launch its Hong Kong IPO within the year.

Summing up in the words of investment specialist Zhou Hongyi, NETA has “accumulated core seed users, and laid the foundation for further expansion.”

At this time, moving up is different from standing firmly and then moving up. It is more like a strategic adjustment.

Early on, NIO’s core strategy was grounded in practical, low-cost operating abilities, with a focus on lower-tier markets. Zhang Yong once said, “Unlike other automakers, who aim to go upmarket with their brand, NIO only builds cars priced at less than 200,000 RMB and focuses on making the most of this limited space.” This is why NIO has been able to survive over the past five years.

In the long run, NIO faces two challenges.

First, the “low-end income trap.” NIO has two models currently on the market: the NIO V, priced around 70,000 RMB, and the NIO U, priced around 150,000 RMB, with a sales ratio of roughly 7:3, respectively. Its cost competitiveness for the value is weak, and with the implementation of improved regulations, increased consumption upgrades, and intensifying competition from other low-cost rivals, the cost of their product will rise, and the business will fall deeper into the “low-end income trap.”

As this year’s sub-100,000 RMB market becomes increasingly crowded, NIO faces intense competition from traditional automakers like SAIC General Motors Wuling, Chery, BYD, Ora, as well as new entrants like Yida Group, Sihao, and PenPen, among others. In comparison to the machine-like economies of scale of these companies, the cost advantage of a new entrant is not as feasible, and its low margins make it nearly impossible to enter the high value-added market. This means that gains will be short-term.

Second, there is a bottleneck in the “trade industry technology” route. NIO’s sales layout is wide-ranging, with 333 service networks, including 70 direct stores, built by the end of 2021, covering 193 cities. This breadth has supported NIO in reaching the milestone of 100k units sold this year. In comparison, at its 100k unit mark, Li Auto has built 234, 271, and 220 sales and service networks, covering 123, 95, and 204 cities, respectively.

Considering the channels and prices, NIO’s sales efficiency is relatively low, indicating that the marginal benefits brought by market inputs are relatively limited, and even gradually flattening. Further expansion requires comprehensive capabilities, such as brand and product upgrades, rather than relying solely on the trading industry.

Zhang Yong’s goal for NIO is to achieve annual sales of 500,000 units by 2025 in the 100,000 to 300,000 RMB mainstream market. He believes that this mainstream market will account for 60% or more of the overall market in the future. However, because foreign brands are moving downward, market competition is on the rise.

NIO’s driving force is “technology equality,” bringing a 1 million class user experience to products priced at 100,000 to 300,000 RMB. In other words, it is still cost-effective, but with advanced cost-effectiveness or disruptive innovation. This cannot be done solely through supply chain management, as it requires a technological breakthrough to overcome pricing barriers.

These two challenges are interrelated and form a self-consistent cycle. Without profit margins, NIO cannot realize its transformation from “trade, industry, technology” to “technology, industry, trade”; without advancement, there are no profit margins.

Therefore, for NETA, it is not only a matter of making money, but also a matter of survival.

NETA recognized his own limitations early on. The NETA S was first proposed in 2019, the industry’s worst year. NETA suffered silently and had no place to go. “NETA has never had a shining moment like WmAuto Li,” said Zhang Yong.

In the winter of 2019, while quietly trying to survive, NETA gathered the company’s full strength and invested heavily in the development of a new platform, the Shanhaitong platform.

Does the Stairway Up Exist?

Zhou Hongyi once made a short video product called “Naitang”. You may not have heard of it because it failed.

Around the same time as Naitang, there was a competing product called Douyin.

Zhou Hongyi was deeply impressed that just because you see and understand many opportunities doesn’t mean they are your opportunities.

I don’t know if he shared this experience with Zhang Yong. The automotive field is similar. For example, in the early years, Zhang Hailiang worked on a Denka electric car, which became Skyline Auto after breaking through, but the transformation effect was not very optimistic.

In the early stages of mature conditions, there is only one successful brand that has moved up, the XPeng P7. XPeng has gone from being a brand for young people in small towns with a price tag of tens of thousands of yuan to a technology brand with a price tag of two to three hundred thousand yuan. In retrospect, there are two factors that cannot be ignored:

First, the outstanding intelligent spearhead. It completely broke through the original “clumsy” image. He XPeng recruited worldwide and spent a lot of money to establish the first fully self-developed automatic driving capability. In fact, when the P7 was first released, it focused on the music cockpit, and advanced assisted driving functions were gradually opened up later, but it firmly established the domestic intelligent first brand.

Second is the design sense, which pleases young people with an aesthetic that requires no education.

From the NETA S, you can see the same way of thinking as the XPeng P7.

In terms of intelligence, NETA proposes saturation investment. Zhang Yong said last year that “planning to invest a team of 1,000 people, spend 10 billion yuan to fight this battle.”

At the same time, practical choices are still retained.

NETA does not want to distribute limited resources to areas where it is not good at, so it does not do hardware, chip, or sensor work. For example, it uses Huawei’s laser radar, and the MDC and heat pump integrated control module hardware. Make the user experience, product technology, algorithm, and core platform good, keep the technology that users perceive strongly, and control the technology involving intelligent automotive safety.

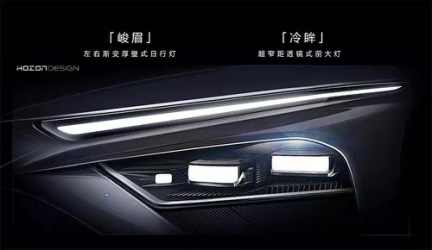

In terms of design, the NETA S, priced at 338,800 yuan, features many highlights: wing doors, a 0.216Cd drag coefficient, a diving battle-style appearance, and “Lotus” wheels.

NETA has a higher precision requirement for the styling. After completing the 1:1 model, it was found that the entire vehicle’s posture did not achieve the expected sense of motion. After in-depth discussions with the engineering team, the root cause was found, and the front suspension was adjusted to a double wishbone. After the adjustment, the entire front of the car was lowered.

This led to consequential changes, including the position lights, high and low beam lights, ultrasonic radar, lidar, millimeter wave radar, and so on, all being placed in the lowered front bumper area.

This brought about a challenge in the selection requirements. For example, the eyebrow lights with a sharp appearance required a thickness of only 5mm at the corners, which was a challenge in mold production, while also ensuring that the light was still uniform when illuminated.

At the same time, integrating lidar into the design process was also very painful since it is a component that is not very friendly to conventional styling because of its appearance, which is a rectangular, flat surface. The flat surface is rarely visible on a car. The NETA eventually became a concealed treatment, integrating this incongruous and unharmonious component into the entire styling.

This is NETA’s judgment on technology. They believe that there is still room for variation in the future appearance of lidar, so the design language does not need to be fixed now. At the same time, the lowered position does not have a significant impact on actual use.

Chang Bing, the chief design officer of NETA Motors, told us that every brand hopes to have good designs, but often behind them lies the cost and technical costs. Not every brand has enough support to achieve aesthetic heights.

NETA has three internal advantages.

The first is a very flat team structure. In the NETA design center, there is an unwritten rule that any designer, even a newly hired assistant designer, can directly engage with Chang Bing. Even if a creative director does not agree, they can find him directly to discuss it. It avoids any suppression of creativity from the so-called structure and hierarchy from the system and reporting relationships.

The relationship between senior designers and young designers is not a traditional superior-subordinate management but rather a protection and guidance concept. The master helps avoid pitfalls but doesn’t give directions, and does the best to protect creativity that comes from the youngest people, allowing young people who understand young people the best to do the most suitable creativity.The second is the decision-making system. In Chang Bing’s view, this is the key factor determining the design differences between brands. The differences between designers themselves are relatively small, and every enterprise has excellent designers. However, whether excellent creativity can be turned into products to a greater extent depends on the decision-making system.

The NETA Design Center can maintain a very independent and equal relationship with traditional engineering research and development, and the decision-making efficiency of each department is extremely high. In some large enterprises, it may take nearly a week to make a choice and evaluation for styling. People of different levels evaluate and make decisions separately, which is very time-consuming.

At NETA, the design, marketing (user), engineering research and development (technology), plus the CEO, can take 15 minutes to decide on an issue. The higher the decision-making efficiency, the less interference and influence there is on the design.

Finally, it is the pursuit of designers themselves. For NETA S, they hope that when someone summarizes the history of Chinese automobile design in ten or twenty years, the NETA automobile can be included. For example, can NETA S still represent the aesthetics of the times if it is removed from commercial scrutiny? NETA hopes to have a place in this evaluation.

Of course, this still needs time to verify, but NETA itself is very confident. It not only looks different at first glance, but you can continue to look at it again and again and scrutinize it in detail.

The Real Challenge

A soul-searching question is whether having everything in place from products to technology to organizational quality means success is within reach.

You should remember that P7 did not become an instant success. It still encountered criticism such as “XPeng’s name is not good” and “marketing is too much like Pinduoduo.”

Li Bin once pointed out that the price range a brand can bear is limited, and if a brand wants to produce even more affordable models, it needs to start from scratch. This is also why NIO needs to start from scratch to build a mass-market brand.

Actually, the essence of the challenge of building a brand is not the brand itself, but because the vast majority of people in the world are very materialistic. We are too aware of this kind of disease in ourselves, and we always have a lot of understanding and pity for it. The so-called brand, in other words, is pleasing and managing the materialistic eyes of all levels of people.

We exaggerate the importance of certain features, and then belittle things that lack these features, thereby obtaining a sense of superiority, and the brand sets up a sense of superiority in these arbitrarily set norms. The so-called brand is more about humanity than a business.

In fact, NETA has the potential to grasp humanity. From a vertical perspective, it has already completed a wave in terms of B-end to C-end consumption, from sinking markets to semi-sinking ones.The main market of NETA has now upgraded to first- and second-tier cities, accounting for more than two-thirds of its sales, with the rest in third-to-fifth-tier cities. Of course, the proportion is slightly smaller in Beijing, Shanghai, Guangzhou, and Shenzhen. Next, in conjunction with the launch of NETA S, the focus will be on developing first-tier cities, which is NETA’s main task this year – “entering the cities”.

The price of NETA is between 200,000 and 300,000 yuan. Zhang Yong said that if they can achieve monthly sales of 10,000 units at this price range, then the goal of “entering the cities” will be fulfilled, which is not too unrealistic of an expectation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.