Writing by: Lu Weijia

Are 4S stores also “vulnerable groups” under the epidemic?

“Expected purchase tax reduction policy will bring about 2 million units of incremental growth.”

In response to the notice of the Ministry of Finance and the State Taxation Administration on the reduction of vehicle purchase tax on May 31st, Cui Dongshu, the Secretary-General of the China Passenger Car Association, believes that the reduction in purchase tax can greatly stimulate the growth of the car market, as well as improve the survival status and development confidence of dealers.

Because the notice of the reduction of vehicle purchase tax clearly states that “for passenger cars with a single vehicle price (excluding value-added tax) not exceeding 300,000 yuan and a displacement of 2.0 liters or less purchased from June 1, 2022 to December 31, 2022, half of the vehicle purchase tax shall be levied.”

If you purchase a passenger car with a single price of 3 million yuan or less, with less than 9 seats, and with an engine displacement of 2.0L or less, then you can be exempted from up to about 13,000 yuan of the purchase tax.

For consumers who have had a need to buy a car in recent times and for dealers who have been worried about orders, this is definitely good news.

However, the policy of reducing the 600 billion yuan purchase tax has been implemented for 8 days, and the number of new car orders in the terminal market has not exploded as expected. According to sales staff at dealerships, the enthusiasm of many consumers for buying a car is even gradually turning from positive to negative, and the number of consumers who decide to buy a car due to the policy of halving the purchase tax is few and far between.

Dealers Drink the “First Soup”

Buyers are less smart than sellers. When the policy of reducing the 600 billion yuan purchase tax was introduced, many consumers thought that they were the only direct beneficiaries of the policy, and the money saved on halving the purchase tax naturally went into their own pockets.

In fact, although many automakers have stated that they actively respond to the policy of reducing purchase tax and subsidize the other half of the purchase tax to consumers in the form of marketing gimmicks such as “full exemption of purchase tax” or gift of new car compulsory insurance.

But these are all tricks of dealers in marketing. Wool comes from sheep, whether it’s a so-called “full exemption of purchase tax” or a gift of new car compulsory insurance, most of them are tricks that dealers use to attract consumers to place orders because, at the same time as various preferential policies are being implemented, cash discounts originally given by the terminal market are quietly narrowing. We can understand that the dealer is “robbing Peter to pay Paul.”

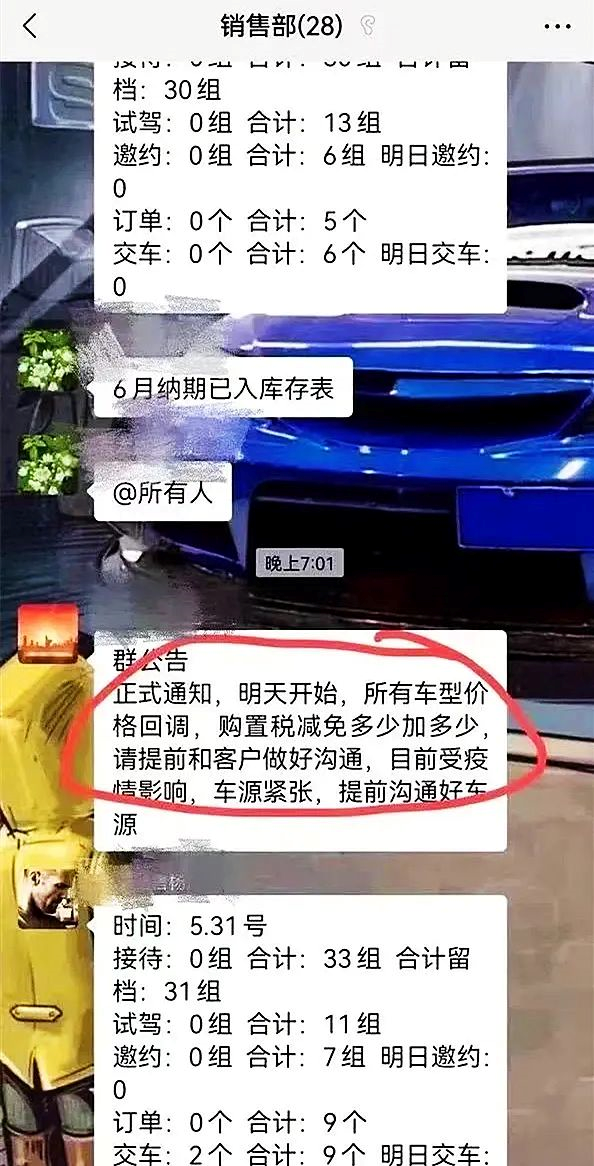

What’s even more unacceptable is that some dealerships held emergency meetings on the day the purchase tax reduction policy was announced to notify salespeople to rollback the terminal selling prices of all car models in the dealership along with the implementation of the purchase tax reduction policy. The amount of tax reduction is directly proportional to the amount of rollback. Furthermore, due to the impact of the pandemic, vehicle supply is currently limited, so salespeople need to communicate with the dealership in advance about vehicle supply.

It is not difficult to see that these dealerships are trying to gain an advantage in the information asymmetry between buyers and sellers by cheating. They even want to take the subsidy in the half-price purchase tax reduction.

Fortunately, consumers these days are no longer “stupid”. The small actions of these dealerships have been exposed as information is now extremely transparent. Especially for consumers who have been paying close attention to the terminal market recently, they only need to compare the landed price of the new cars before and after the policy to realize what tricks the dealerships have played behind the scenes.

As a result of this, the number of new car orders in the terminal market has not increased explosively. A salesperson from a FAW-Volkswagen 4S dealership said that, except for a significant increase in customer traffic on the day of the Dragon Boat Festival, the other times had remained fairly flat since the purchase tax reduction policy was implemented.

It can be seen that the small price adjustments made by dealerships behind the scenes have hindered the explosion of the car market to a certain extent.

However, considering that the policy is in a phased form, the explosive point of the car market may occur within the traditional car buying season of “Golden September and Silver October”. Therefore, if we reach a conclusion on the eighth day of the policy’s implementation, it may be one-sided.

At the same time, if the number of new car orders in the terminal market fails to achieve a significant increase, then I believe that dealerships will readjust the terminal prices accordingly. If some dealerships have to raise their selling prices due to a shortage of vehicles, we may “be kind” and not buy their cars, thus helping them overcome the difficulties of a vehicle shortage.

Are dealerships also forced to do so?

Regarding the dealerships’ narrowing of terminal discounts, Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that this phenomenon is normal because before the policy was implemented, dealerships were considering survival issues. After the policy was implemented, dealerships are thinking about livelihood issues, which reflects the change in the dealership’s survival status. Supply and demand determine the price promotion. If demand is weak, the price will be very low to ensure a certain level of sales, but when demand increases significantly, promotions will be withdrawn, giving the dealership a certain margin.

Objectively speaking, although the sneaky price hikes by dealers are hard to accept, from a certain perspective, we can also understand why they are taking such risks.

Behind the inflated prices set by dealers lies the fact that they have been struggling over the past couple of years under the influence of the pandemic. According to relevant data, nearly 1,400 domestic dealerships withdrew from the market in 2021, forcing the industry to accelerate its reshuffle pace.

For those dealerships that are still operating normally, they not only face the pressure from the general lack of enthusiasm among consumers for buying cars, but also have to engage in a battle of wits with automakers. Under various epidemic prevention and control policies, even those rich and powerful dealerships seem to be a vulnerable group that requires support.

In the future, if the pandemic continues to break out persistently, I believe that the automotive dealership industry will once again go through a major reshuffle. As new forces endorse the direct sales model, traditional 4S stores may even be replaced. This may ultimately create a more transparent pricing structure for the automotive market.

The fate of traditional 4S stores remains uncertain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.