Today, a simple interview program caused a sensation. In an interview with Liang Yubo, the Executive Vice President of BYD, Kuiying Chun accidentally revealed that BYD is also preparing to supply batteries to Tesla.

In fact, there was news before that the 56th customer of VD is Tesla, which has been developing various size cells for large-scale projects with “tens of GWh”.

As the saying goes, ten years in the East and ten years in the West. This reminds me of 2011, ten years ago when Ma Yilong replied “Hahaha” and “Have you seen their car” to the host’s repeated questions during Bloomberg’s interview. Unexpectedly, ten years later, BYD and Tesla joined hands.

In fact, the combination of Tesla and BYD is due to their respective needs.

Why does Tesla choose BYD?

For Tesla, the problem that restricts large-scale shipments is not the factory capacity or chip shortage, but battery supply shortage.

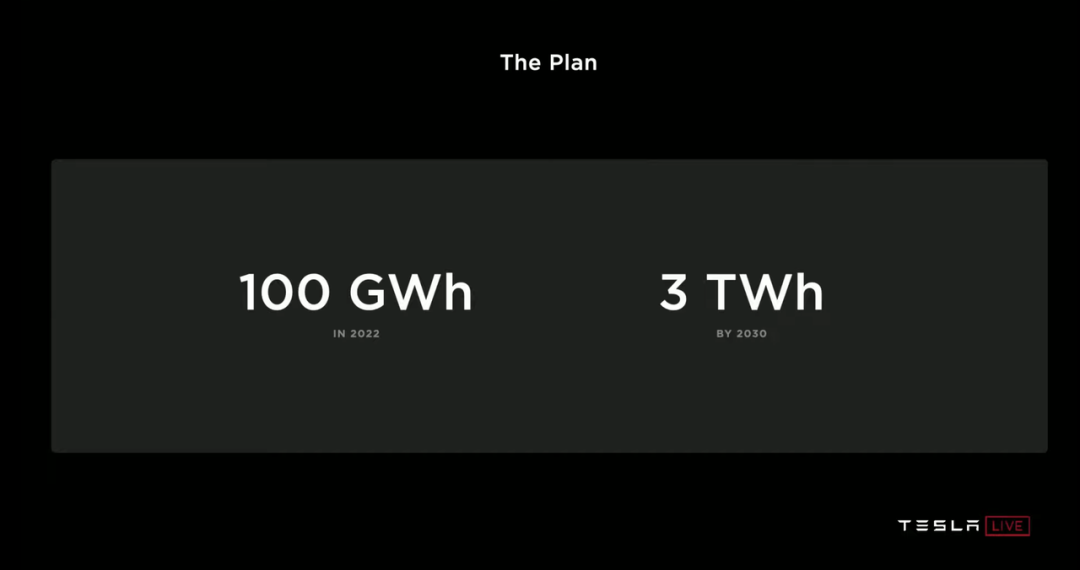

Ma Yilong also emphasized this point during the Battery Day in 2020. Tesla has a huge demand for batteries, with a total demand of 100 GWh in 2022 and 3 TWh in 2030. However, Panasonic, LG, and CATL, the current suppliers of Tesla, do not have enough capacity to meet Tesla’s needs. Therefore, Tesla is also preparing to build its own battery production line and even investing in battery upstream mining.

The most intuitive solution is to directly include BYD, a veteran of the battery industry, as its battery supplier.

BYD’s thirst for big customers

BYD started with batteries and used to produce and sell batteries on its own. Seeing the explosive growth of the domestic new energy market and the rise of CATL, BYD took the initiative to support Freepower independently at the group level and contacted car manufacturers that compete with BYD on the market.

Here are some Freepower known passenger car customers:

FAW Hongqi, Bestune

Ford (Mach-E, Ruiji PHEV)# Toyota

PSA

Changan

Dongfeng Lantian

Ceres

Hyundai

Dongfeng Honda

Although Fudi has had many customers, the total volume of these customers is probably not as large as the “10 GWh” of a Tesla. This is why Fudi is busy with things like battery size. Can such a big client bring more inspiration?

Will BYD take off this year?

Today, I looked at BYD’s stock price, around 320, which is very close to last year’s peak of around 330!

Looking at other aspects, DM-i is selling well, DENZA has been renewed, and higher-end brands will also be launched this year. On the other hand, Fudi has also confirmed customers like Tesla. This is the best BYD in history. Ma Yilong should regret mocking BYD in the past.

Will it take off this year? My answer is positive. What about you?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.