Author: Zhu Yulong

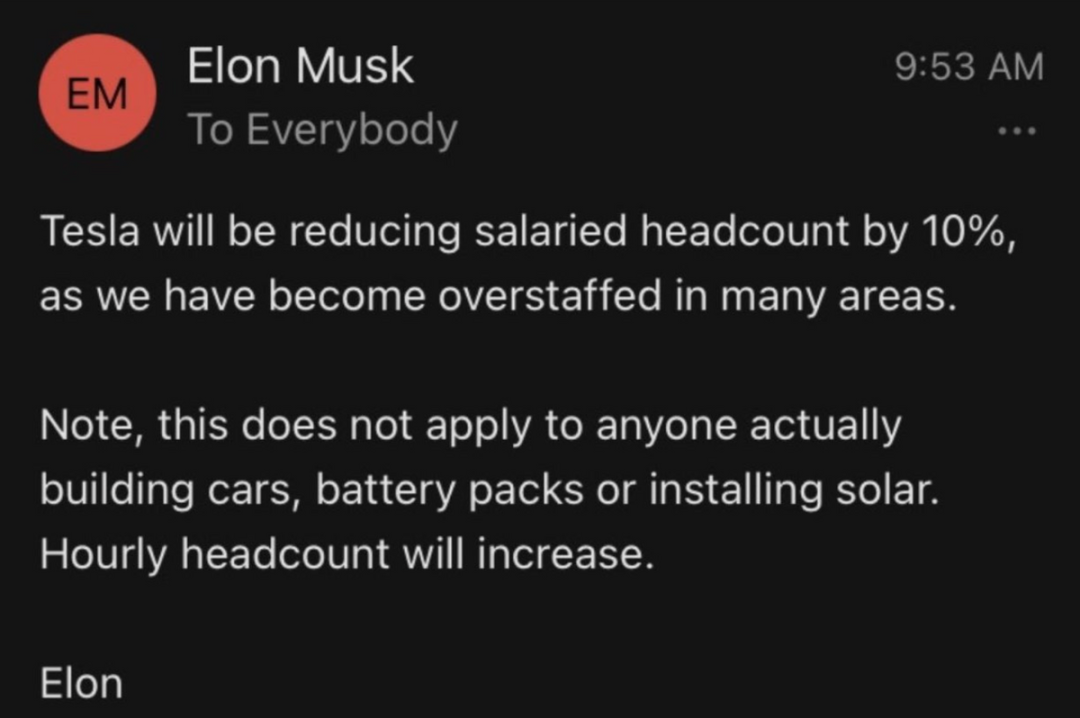

Recently, the news of Elon Musk’s plan to lay off 10% of the workforce has caused a stir. Actually, it is closely related to the entire automotive industry. At least in the European and American markets, the car sales face significant challenges, especially with the high inflation and oil prices, which directly affect the cost of car use.

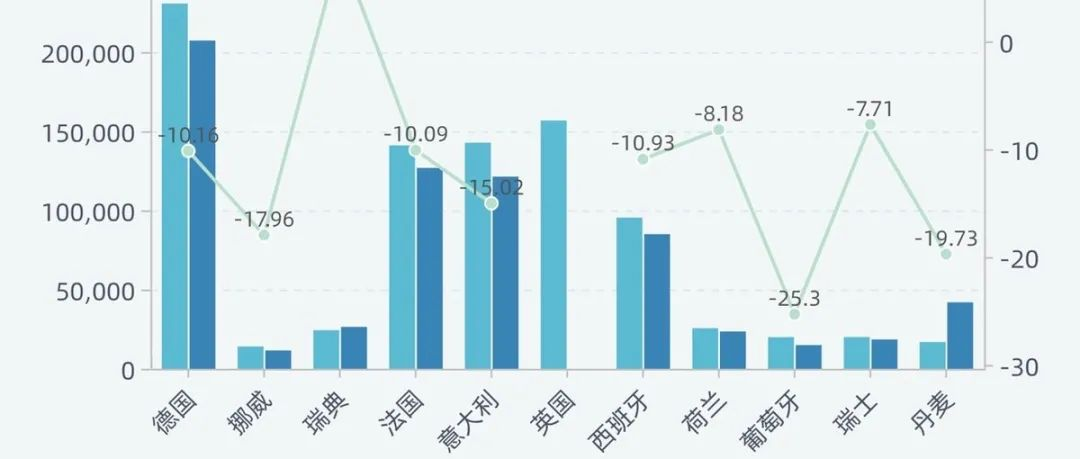

In May, the major automotive markets in Europe experienced a negative growth rate of around 10%, and the sales of new energy vehicles also showed a lack of growth momentum.

As shown in the following figure, we mainly focus on several major markets:

-

Germany’s passenger cars sold 207,199 units, a year-on-year decrease of -10.2%

-

France sold 126,813 units, a year-on-year decrease of -10.09%

-

Italy sold 121,299 units, a year-on-year decrease of -15.02%

-

Spain sold 84,977 units, a year-on-year decrease of -10.93%

(The data for the UK has not been released)

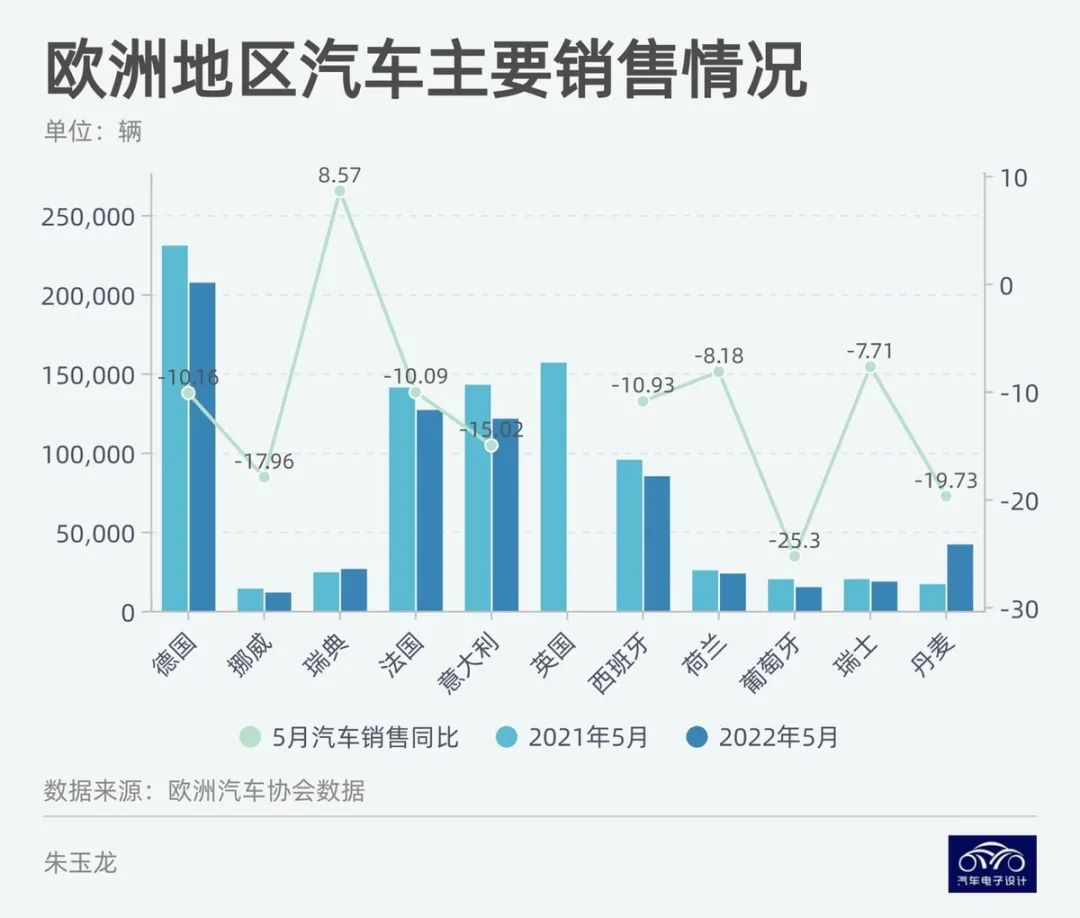

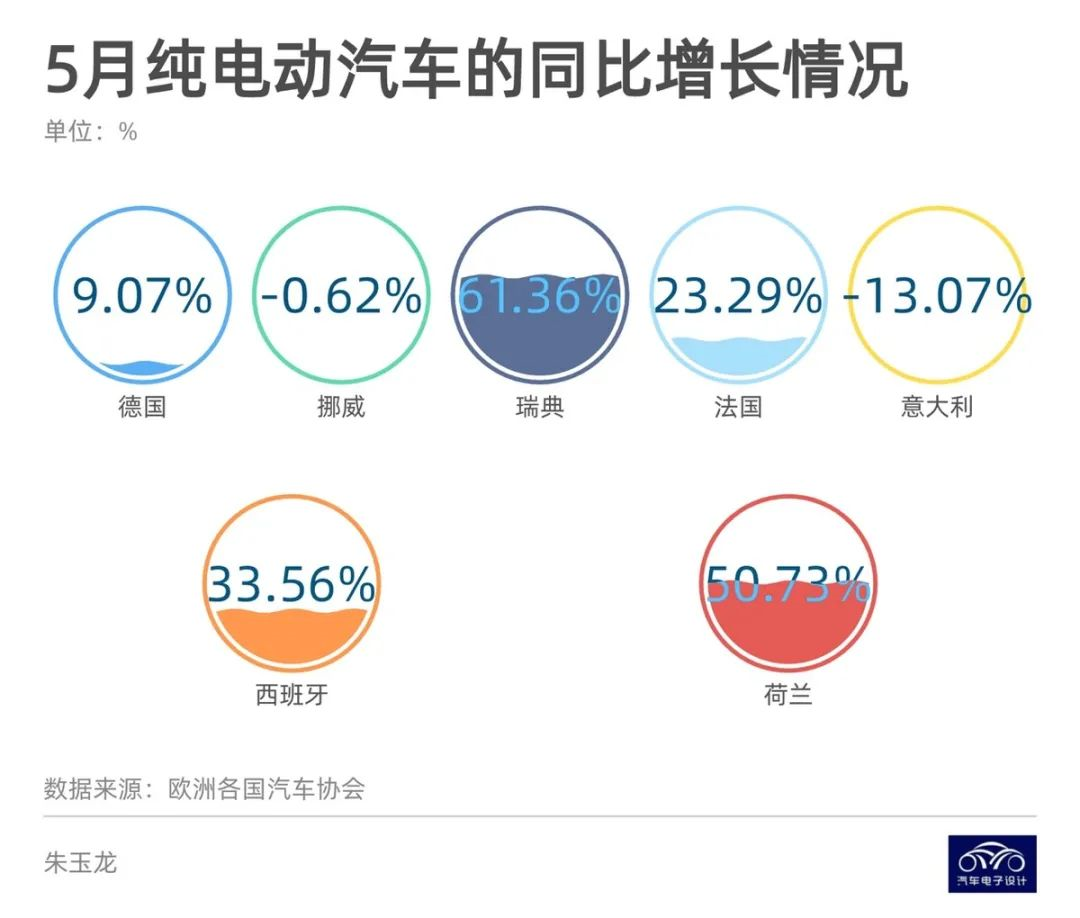

Sales of new energy vehicles

The sales of new energy vehicles in Europe are as follows:

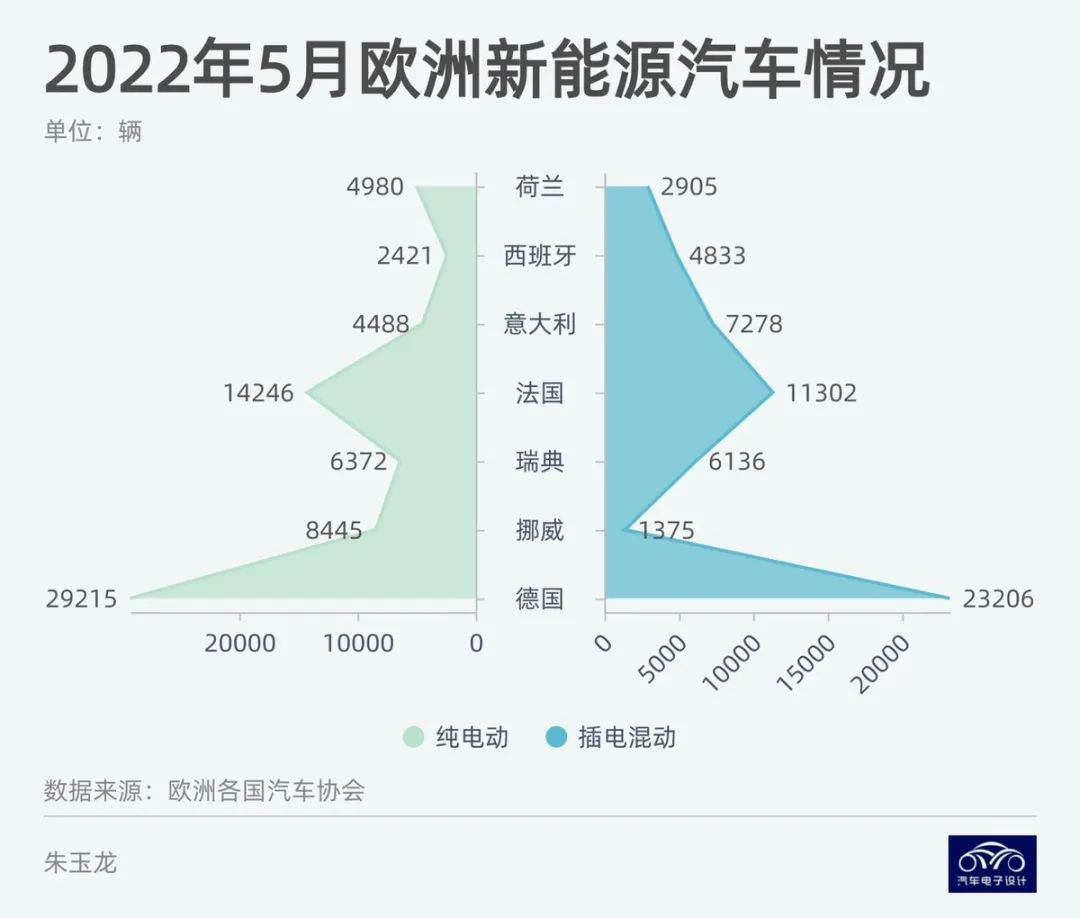

- Pure electric vehicles

In several major markets, the growth rate of pure electric vehicles in the segmented market has also begun to slow down. Compared with the growth rate of 50-100% in 2020-2021, it now presents a relatively smooth sales situation.

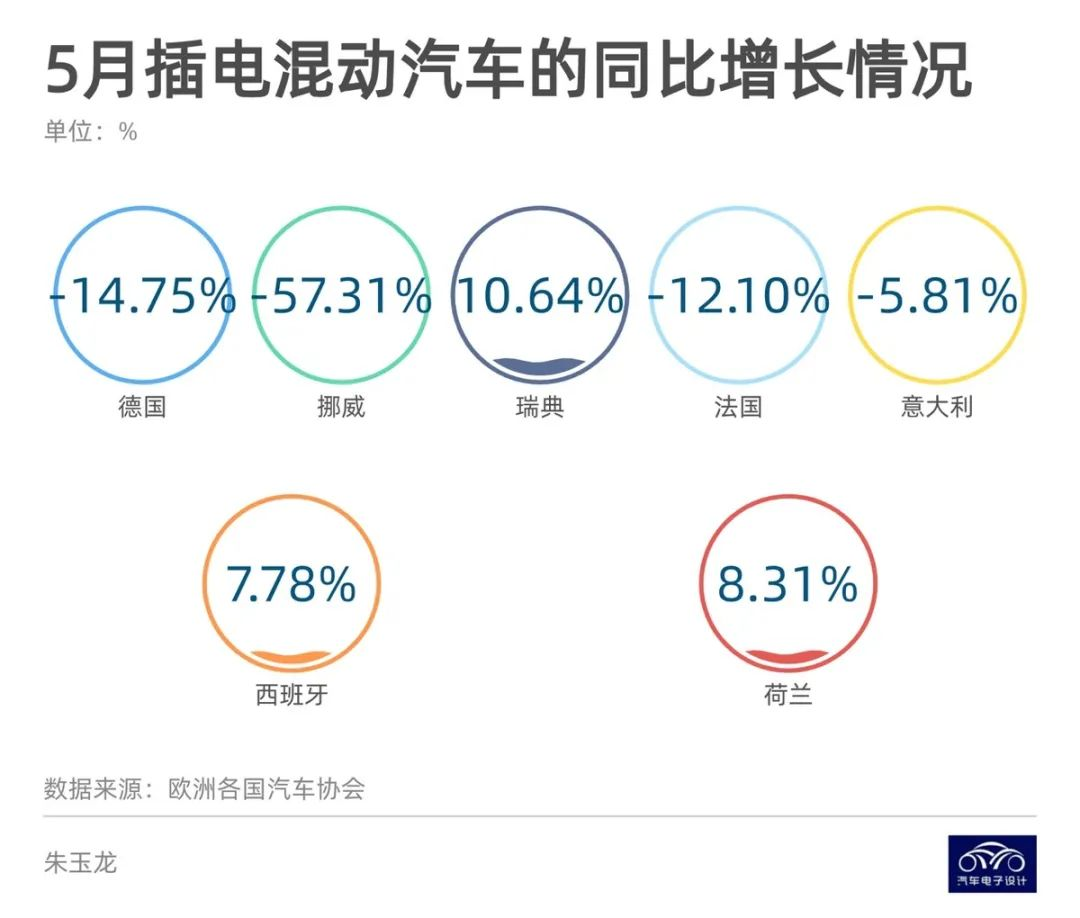

- Plug-in hybrid electric vehicles

Overall, the performance of plug-in hybrid electric vehicles in May was mediocre, and the decrease was relatively large:

-

Germany sold 23,206 units, a year-on-year decrease of -14.75%

-

Norway sold 1,375 units, a year-on-year decrease of -57.31%

-

Sweden sold 6,136 units, a year-on-year increase of 10.64%

-

France sold 11,302 units, a year-on-year decrease of -12.10%

-

Italy sold 7,278 units, a year-on-year decrease of -5.81%

-

Spain sold 4,833 units, a year-on-year increase of 7.78%

-

Netherlands sold 2,905 units, a year-on-year increase of 8.31%

Currently, the entire European automotive market is experiencing weak demand growth, and under the stimulus of subsidies, new energy vehicles in Europe have achieved significant growth in the past few years. However, at this point in time, the main obstacle is no longer the issue of purchasing subsidies. The main issues are the high energy prices, and the overall inflation impact on European consumption power.

Adjustment of New Energy Vehicle Strategy

The automotive industry is a very mature industry. As a commodity, cars are different from the rapidly iterating mobile phone industry, and consumers place more emphasis on stability, practicality, safety, and durability. In the current economic situation, most consumers buy cars as durable goods and as a significant purchase decision. At this point, with the support of purchase tax and local subsidies, rigid demand for car consumption can be squeezed out. But from the overall development of the industry, everyone has to adjust the pace globally.

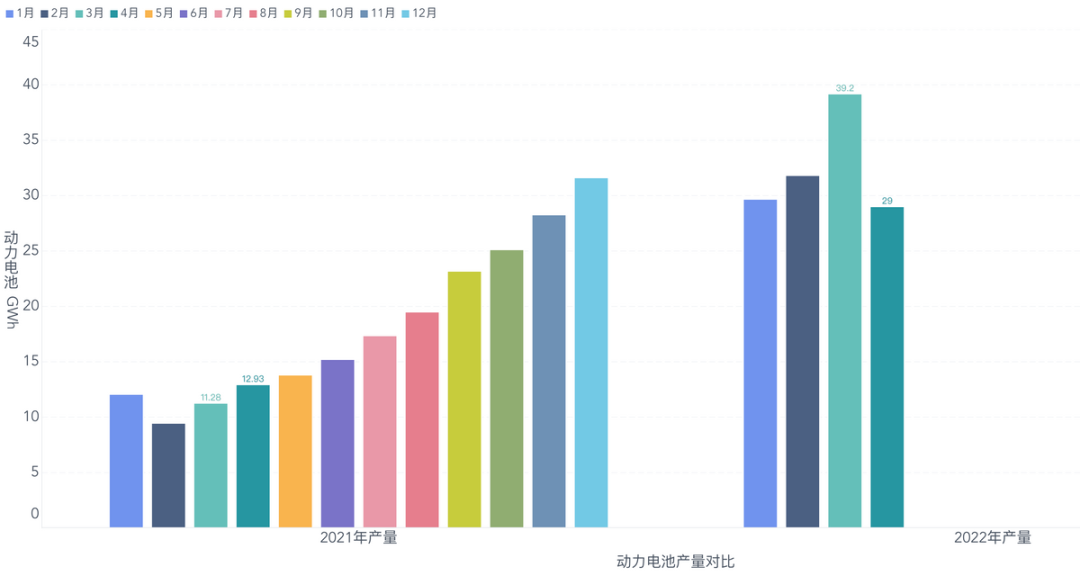

My understanding is that this wave in China can be regarded as a manufacturer’s rush to respond to the cancellation of subsidies in the future, although the residents are in the objective state of current income expectations. With the high demand for new energy vehicles starting from June 2022, under the conditions of high battery costs, we see that the production volume of batteries continues to remain high, which means this is a hot sale before subsidies are cancelled. Some companies are responding to their listing by performing well in the second half of 2022, but for most car companies, under the current macroeconomic constraints, demand growth in 2023-2024 should be planned with a rational pace.

For cars that are high in battery production volume and selling at high prices, they are more about hyping up sales. Raising the price of cars has a significant risk for long-term growth.

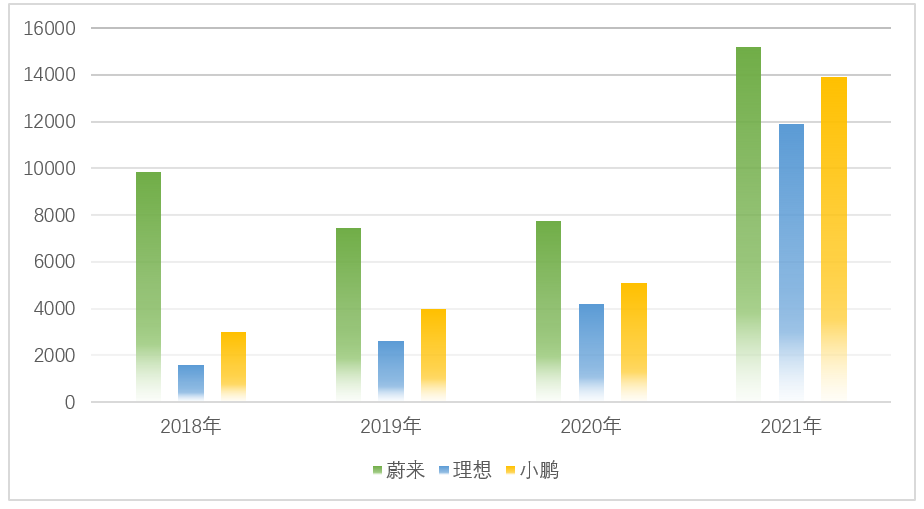

In 2021, the number of employees in new car-making forces such as Li Auto, NIO, and Xpeng surged. Data from the 2021 report shows that:

-

The total number of Ideal Automobile employees increased to 11,900, an increase of 7,720 from the same period last year, a year-on-year increase of nearly 185%;

-

The total number of NIO’s employees increased to 15,200, an increase of 7,441 from the same period last year, a year-on-year increase of 96%.- The total number of employees at XPeng Motors has increased to 13,900, an increase of 8,816 from the same period last year, a year-on-year increase of 173%.

In 2021, the total number of employees in three car companies has increased by nearly 18,000. In terms of employee function classification, the number of R&D personnel and sales personnel has increased the most. In order to meet the growing demand, personnel in all aspects need to keep up.

In summary: Most of the new forces in the industry have frozen their total number of employees, but they did recruit a significant amount in 2021. Following Tesla to make some optimizations is inevitable.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.