DENZA: The Earliest “New Energy Luxury” Brand in China

In 2010, BYD and Mercedes-Benz established DENZA, the earliest “new energy luxury” brand in China, regardless of whether you believe it or not.

BYD’s revitalization of DENZA, in the narrow sense, began with the MPV D9. But broadly speaking, we have seen BYD make bold reforms on DENZA since last year, paving the way for revitalization.

At the beginning of last year, Zhao Changjiang, the former general manager of BYD’s sales department, was transferred to DENZA, taking overall responsibility for the rebuilding and marketing of the DENZA brand. Suddenly we saw a “big V” who communicates with users and netizens on Weibo appear.

At the end of last year, BYD and Mercedes-Benz reached a equity transfer agreement, increasing BYD’s stake in DENZA from 50% to 90%. This means that BYD now holds the absolute dominant position in DENZA, and has begun to tilt group resources to fully nourish this in-need brand.

In February of this year, DENZA Automobile Sales and Service Co., Ltd., wholly owned by BYD Auto Industry Co., Ltd., was officially established, and BYD prepared all the gifts for the birth of the D9.

On June 1st, after the release of the DENZA D9 for half a month, I was invited to participate in a group interview with DENZA’s senior management. The answer from Zhao Changjiang, General Manager of DENZA Sales Department, made me see not only DENZA’s ambition, but BYD’s entire group ambition.

Who are the buyers of DENZA D9?

In the 20,000+ orders held by DENZA, the DM-i model accounts for more than 75%, while EV accounts for 25%. Zhao Changjiang believes that the proportion of EV orders will gradually increase to around 30% in subsequent sales. This is because the DM-i version will start delivery in August, while the EV version will be delivered in November, lagging behind.

DENZA’s target audience for the D9 is very clear, divided into B-end and C-end markets. As for the B-end market, due to the fact that DENZA’s mini-program currently only supports private orders, the demand of B-end users is actually suppressed, and once it is opened up, it will usher in an outbreak.In these 20,000 orders, 20-30\% of users switched from SUVs to D9, and another 30\% were customers who exchanged their old BYD cars for the D9; while approximately 30\% of switchers came from BBA.

Focusing on the consumer (C) market, a report by iResearch from April this year clearly depicted the profile of Chinese MPV owners for family use. This profile is almost identical to that of the family-oriented users of DENZA D9: aged 25-45, middle class income, typically having a second or third child or traveling with three generations.

Zhao Changjiang believes that the C market will explode in the future, with a large 7-seater MPV + an SUV/sedan as their target. When taking a long family trip, an SUV is unable to guarantee the accessibility while satisfying the space requirements of all passengers, especially the third row and trunk space.

That’s why big 6/7-seater MPVs are in such high demand. Excluding independent aviation seats of the second row, the third row space of DENZA D9 was designed according to the “standard second row” of a typical car. With a full capacity of 7 adults and their luggage, the trunk can still accommodate 7 20-inch suitcases.

Why MPV?

I’m very curious why DENZA chose MPV as their first model for brand renewal instead of a large sedan or SUVs. The above product positioning and target audience can answer some of the questions, but not all.

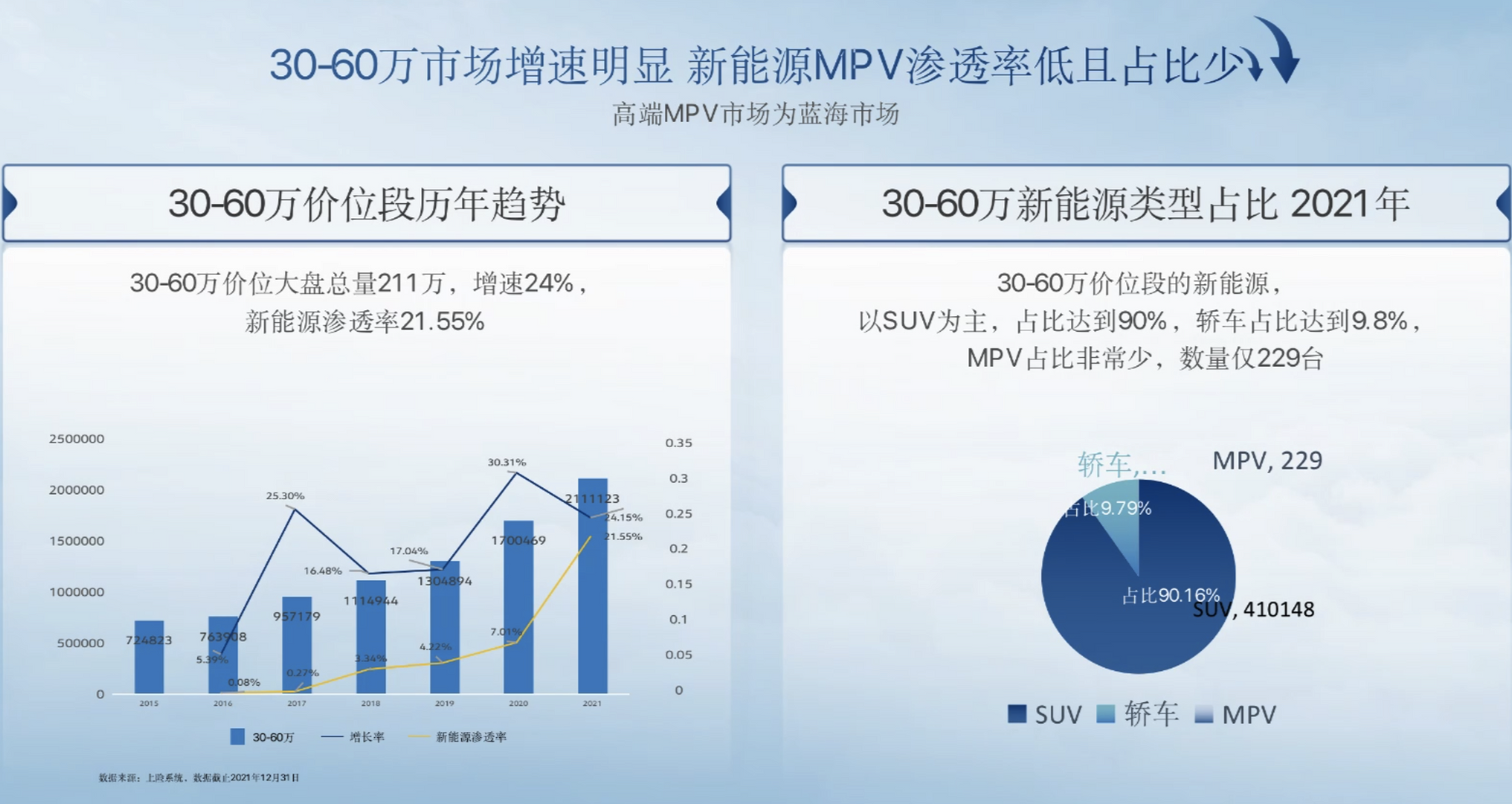

In 2018, China’s car market experienced negative growth for the first time and officially entered a stock market. The high-end MPV sector, especially high-end new energy MPVs, became a blue sea market for domestic brands to advance.

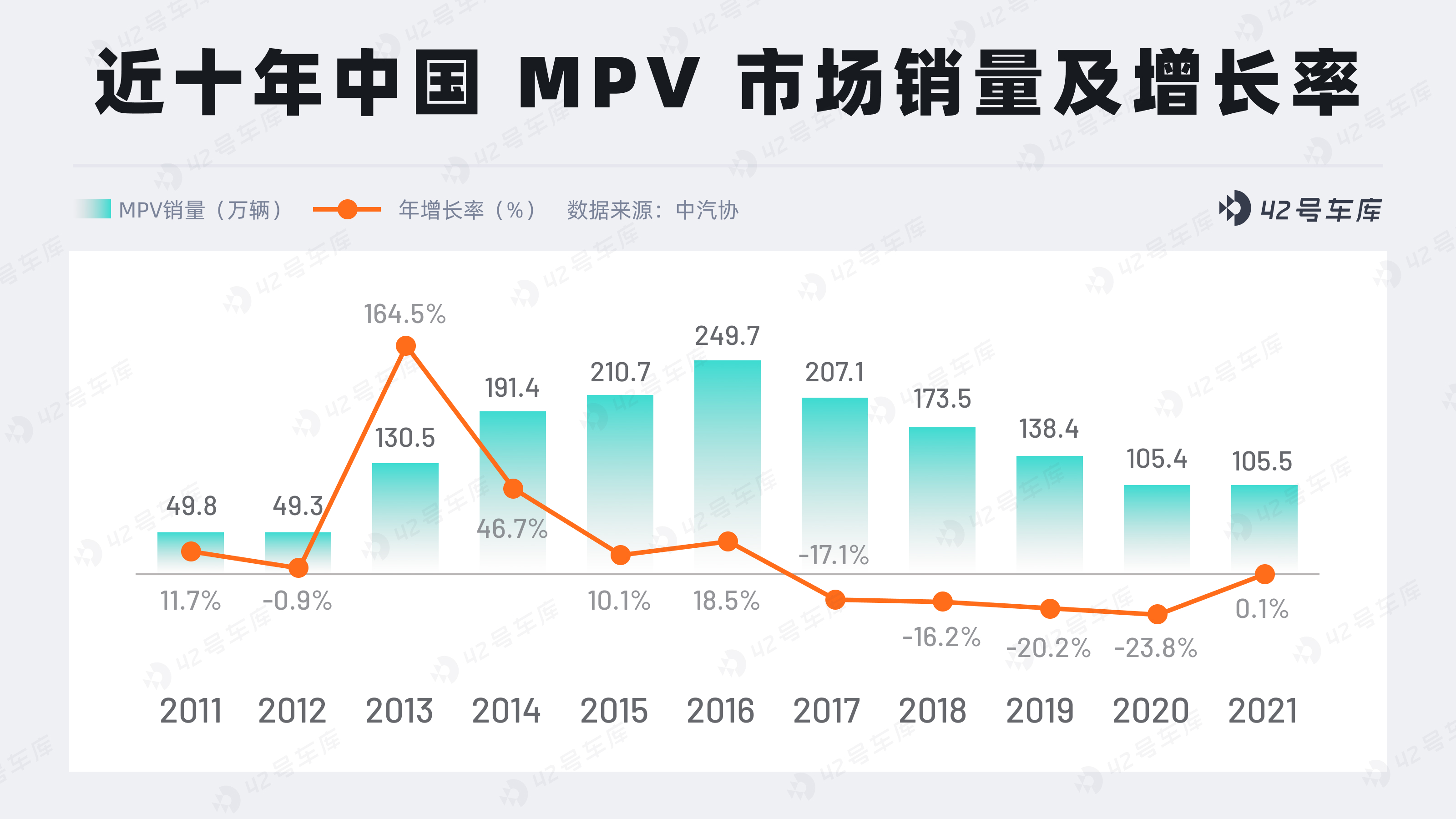

Pulling up the sales data of MPVs, it is strange that this is not a fluctuating upward curve. Instead, after the total sales volume of the domestic MPV market reached its peak in 2016, it experienced four consecutive years of negative growth and continued to decline. Only in the recent two years has this downward trend just been suppressed.

From 2011 to 2016, the development of small and medium-sized businesses in China was rapid, and the dual-use property of MPVs made the domestic MPV market explode in the early stage. The well-known models such as Wuling Hongguang and Baojun 730 are representative. Until 2021, the sales of the domestic MPV market have returned to positive growth, which is regarded as the end of the adjustment period for the domestic MPV market.

On the basis of last year’s MPV market, according to retail data from the China Passenger Car Association, the sales volume of MPVs priced above 200,000 yuan reached 391,029 units, a year-on-year increase of 23.8\%, far ahead of the overall increase of 6.5\% in the passenger car market. This indicates that the growth rate of middle and high-end MPV market demand is very optimistic. DENZA predicts that the market for MPVs priced above 300,000 yuan will reach 450,000 units this year.

If we look at the more mature market of the United States, the sales of MPVs account for 1.45\% of the total car sales. Although domestic MPVs account for 5\% of the total car sales, it includes a large number of entry-level MPV models, such as Wuling Hongguang. If the sales of middle and high-end MPVs in China are also converted to 1.45\%, then the market size of middle and high-end MPVs will be approximately 120 billion yuan!

Zhao Changjiang believes that the high-end MPV market has been dominated by Japanese joint venture brands for a long time, and the market variables are very small. DENZA D9 is here to disrupt this market.

Through this graph, we can clearly see that the passenger car market in the 300,000-600,000 yuan price range is rapidly expanding. In the new energy market under this price range, SUVs account for 90\% of the market, and sedans can also grab 9\% of the market, but the sales of new energy (plug-in hybrid + pure electric) MPVs is less than 300 units, which is in the nascent stage. With the further popularization of electrification and the further penetration of new energy, the future incremental of this market can be said to be huge.From May 17th, when the pre-sale of the Techrules D9 started, to May 23rd, there were already over 20,000 orders, indicating its popularity. During the communication session, I specifically asked Zhao Changjiang about the sales forecast of the Techrules D9: “By the end of this year, the monthly delivery volume of Techrules D9 will exceed 10,000 and the cumulative delivery volume will reach 40,000. According to their forecast, the domestic MPV market will reach approximately 1 million in 2024 and 1.5 million in 2025, and Techrules will gain a 40% market share, which is a sales volume of 600,000!”

In summary, the ambition is great.

What supports the ambition?

With a clear product type and user group, Techrules has set ambitious sales targets for themselves. Behind this is the strong support provided by BYD, who allocated their group resources.

How to highlight luxury and convince consumers of the high-end attributes? In addition to having gorgeous configurations, the focus is on the difficult-to-quantify craftsmanship. The Techrules D9 production line is located in BYD’s Changsha Second Factory and is currently exclusive to Techrules. It is subject to the same craftsmanship and quality requirements as Mercedes-Benz, making Mercedes-Benz the main contributor to the Techrules brand, even after the reduction of their shareholding.

At the conference, Zhao Changjiang placed emphasis on three independent attributes of Techrules: independent brands, independent teams, and independent products. Independent brands mean that physical stores need to be self-constructed, and the density and coverage of stores will directly affect Techrules’ sales.

On the channel side, Techrules chose a direct sales model, which, in Zhao Changjiang’s words, means “we have spared no expense” and will invest 1 billion to build and layout channels. This year, Techrules will layout 200 stores, covering 69 cities nationwide, and will later cover 138 cities. The vast majority of provinces will be within 200 km, and 97% of the market will be covered within 100 km.

These physical stores are divided into:

- Techrules Center – which integrates sales, experience, charging, and other services. It is the most functional store located in the city center, with the first one in Guangming International Auto City in Shenzhen;

- Techrules flagship store – which focuses on sales and experience, with exclusive test drives and energy replenishing services. It is generally located near leisure and shopping scenes for customers;

- Techrules Home – which creates and shares experiences with users, forming new interactions between users and between users and the brand;

- Techrules MINI Center – which mainly provides paint and body services.Translate the following Chinese Markdown text to English Markdown text in a professional manner. Retain the HTML tags in Markdown and only output the results.

Similarly, DENZA has also comprehensively laid out online channels, such as official websites, mini-programs, and DENZA apps, etc., forming a good complementary relationship with offline stores.

In terms of marketing methods, DENZA’s core value is based on user satisfaction, not spending money on purchasing leads and flow, striving to achieve glory and positive reputation through media dissemination.

Issues with the D9 Product

- Non-rotating car screen

Initially, BYD’s cabin section relied heavily on an Android-based rotating car screen as a prominent selling point. However, on DENZA, the car screen no longer rotates. As for the purpose of this change, I also asked DENZA for verification. On the one hand, there are many screens on D9, and there are interactive features of multiple screen linkage as well, but rotation is not conducive to linkage, so to enhance unity, the screen will no longer rotate; on the other hand, without rotation, the design space in the field is much larger.

- Choice between 7325 and 8155

There are many screens on D9, including up to 7 screens such as headrests, armrests, and HUDs, with high resolution, software for multi-screen circulation, and real-time dynamic wallpaper. All of this requires high computing power from the car machine chip. However, the DENZA D9 uses the car high-end chip 7325 by Qualcomm (778G), instead of the flagship chip 8155 used in Qualcomm’s auto line, which is very confusing.

There are many reasons for using 7325. Firstly, it takes into account the problem of chip supply. 7325 has more stable delivery and is guaranteed for the delivery of the entire vehicle. In addition, DENZA stated that 8155 is not more advanced, but because these two products belong to different systems, they need to provide users with 5G and more comprehensive service support. 7325’s image recognition capability and full compatibility with the Android ecosystem are better.

To drive the rear screens on high-end models, DENZA added two more chips to support the two rear screens.

Conclusion

In fact, the boatman’s initial intention to make cars was for new energy. This goal was achieved in March of this year, marked by the official cessation of petroleum car production. I know that many people Diss this “cessation of petroleum,” which is not entirely pure petroleum, but even so, who else has done it, not even 100\% cessation of petroleum cars? BYD claims to be the first in traditional car companies, justifiably.BYD has upgraded its brand by getting rid of its traditional fuel-powered cars, and now its product line is directly confronting Joint Venture fuel-powered cars. Meanwhile, DENZA represents the top of BYD’s ambition, extending its reach further upward. Its D9 model has entered the luxury MPV field, however, DENZA’s ultimate goal is to compete with BBA, as we may say it.

As I mentioned before, the weakness of BYD is its intelligence, which includes intelligent cabins and auxiliary driving. However, DENZA has already delivered! Both the new UI design and the 8 million yuan pop-up camera are the highlights that distinguish DENZA from BYD. In terms of auxiliary driving, the surprises are actually hidden in DENZA’s two SUV models released this year.

Let me give you a sneak peek:

-

A five-seater EV version, with C-level space and B-level size, focuses on sports and technology.

-

Another “world-class” SUV, a six-seater medium-to-large SUV, is equipped with DM-i technology, which will apply advanced technologies such as lidar and higher-level auxiliary driving, with the main goal of competing with BBA in the marketplace.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.