Author: Dayan

As various car companies successively released their sales data for May, Ideal Auto once again topped the domestic new force car companies’ list after months of waiting. Winning this championship was not easy.

In May, although several cities including Changchun and Shanghai had gradually resumed work and production despite being heavily affected by the pandemic, the epidemic control measures still posed significant challenges to the normal production of many parts suppliers as well as the continuous operation of the logistics system.

In addition, the pandemic had also undermined a part of consumer confidence in the economy and suppressed a part of the terminal demand. Therefore, the gold content of Ideal Auto’s sales champion in May was still relatively high.

The competition among new force car companies is becoming increasingly fierce

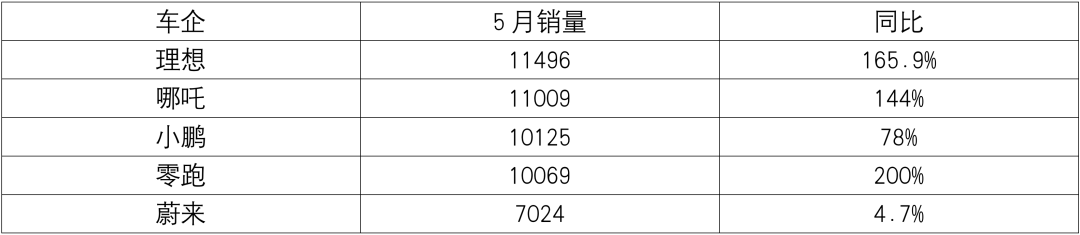

In terms of delivery volume in May, NIO’s sales did not exceed 10,000 due to being harder hit by the epidemic. The other four new force car companies all exceeded 10,000 in sales, with gratifying momentum in same-period growth rate.

Different from the other several new force car companies with many entry-level models, Ideal Auto currently only has the one model Ideal ONE on sale, with a price as high as 3.498 million yuan. Therefore, the difficulty of winning the sales champion among new force car companies has increased significantly.

Moreover, in terms of same-period growth rate, Ideal ranked second among new force car companies except for LI Auto with lower car positioning.

What’s particularly noteworthy is that on May 30th, China’s finished oil price was raised again, and the price of 92 gasoline has approached 9 yuan in some areas. If the oil price cannot decrease significantly in the future, the future sales prospects of new energy vehicles are still promising.

If we also take into consideration the fact that the constraints on pure electric vehicles in terms of cruising range and charging have not been fundamentally solved, in this situation, Ideal’s range extender technology will not only not be eliminated, but is likely to continue to be favored by consumers for a long time to come.

A peak in sales is expected in the second half of the year.The great success of the Ideal ONE has made Ideal confident in its extended range technology.

In the second half of this year, Ideal will begin delivery of its new flagship L9 that also utilizes extended range technology. The L9 will change the situation where Ideal has been a lone player in the market. Positioned at 400,000 to 500,000 yuan, the full-size SUV L9 will help Ideal further improve its brand positioning and continuously improve its gross profit margin.

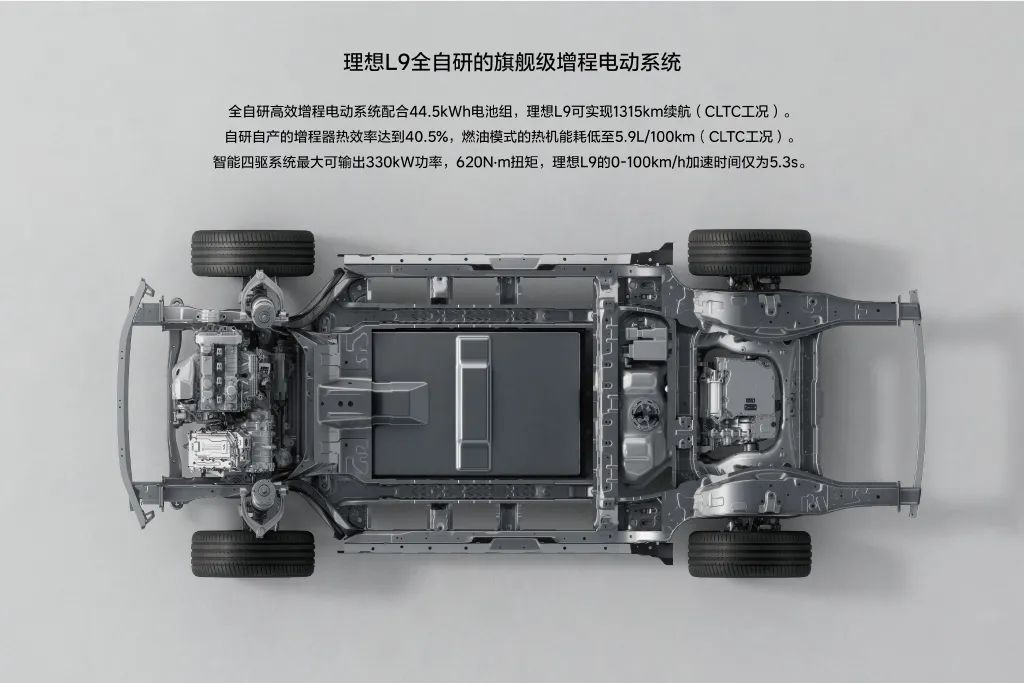

From a product performance perspective, the L9 with its all-new generation of extended range system will have significant performance improvements compared to the Ideal ONE, achieving perfect balance in power, fuel consumption and pure electric range.

With product strength that is not inferior to models such as the Mercedes-Benz GLS, BMW X7, and Land Rover Range Rover, as well as its high cost performance, the Ideal L9 also has the potential to become a popular model.

The biggest advantage of Ideal now is having a large number of new cars that can be introduced to the market. Whether it is the L9 that will be launched this year in the third quarter, a pure electric BEV with a brand-new body shape next year, or an entry-level model positioned at 200,000 to 300,000 yuan, all of them will help Ideal expand into new niche markets.

With clearer product positioning, Ideal can avoid squeezing between various models and form the greatest strength.

Overcoming the supply chain crisis

For Ideal, the supply chain will be its biggest challenge.

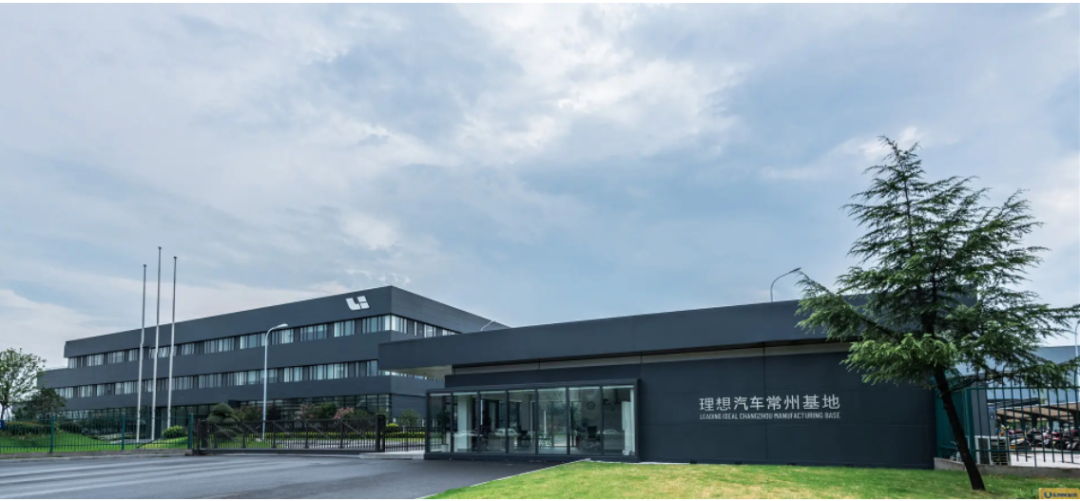

In terms of production capacity, according to Ideal co-founder and president Chen Yinan, the parts supply chain system of Ideal’s factories in the Yangtze River Delta region has gradually begun to recover. However, Ideal’s Changzhou plant still suffers from tight parts supply, resulting in delayed delivery of some new cars.

It should be noted that in addition to its Changzhou plant, Ideal is also refurbishing a plant of Beijing Hyundai, and earlier this year, it bought a piece of land in Chongqing to be used as a third plant. The Chongqing factory will cover 113 hectares, with an investment of RMB 5.667 billion, and is expected to be completed and put into operation in 2025.In the field of intelligent electric vehicles, which are bottlenecked by batteries and chips, Ideal Automotive is making continual moves.

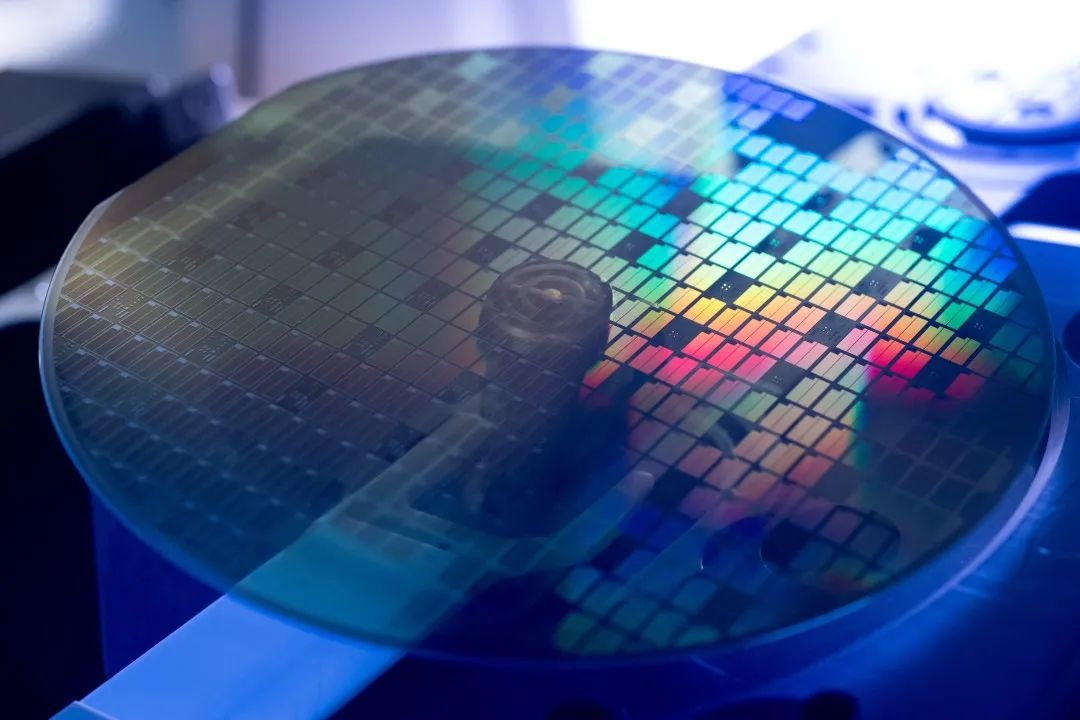

Previously, Ideal Automotive invested in battery company Xinwanda together with NIO and XPeng. Recently, Ideal Automotive has jointly established Suzhou SK Semiconductor Co., Ltd. with domestic semiconductor leading enterprise Sanan Optoelectronics, focusing on the research and development and production of the third-generation semiconductor silicon carbide vehicle power chip modules, which are currently the hottest in the automotive power chip field.

The plant is expected to start sample production in May 2023, and after being officially put into production in 2024, it will gradually form an annual production capacity of 2.4 million half-bridge products.

As the next-generation product of IGBT, the current silicon (Si) substrate material has basically approached its physical limit, while silicon carbide (SiC) material is recognized as the main direction of progress and development in the power semiconductor industry, and it can improve the range of electric vehicles and reduce costs with lower power consumption.

By firmly grasping the technology of silicon carbide chips, not only can it pioneer in creating more leading performance silicon carbide chips, but it can also help improve the performance of electric vehicles, while avoiding the problem of chip shortages in power chips.

Starting from the third quarter, with the continuous launch of new models, Ideal Automotive’s scale and volume will reach a new level.

The supporting capacity expansion of Ideal Automotive, which is launched with its new models, will be gradually realized. Through the coordination of factories in Changzhou, Beijing, and Chongqing, Ideal is making its way toward its goal of becoming “the first in China, with a market share of over 20%, and the world’s top intelligent electric vehicle enterprise in 2030”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.