Report by Zheng Wen, Edited by Zhou Changxian

On May 28th, Guoxuan High-tech announced their new product, a 360Wh/kg semi-solid-state battery at the 11th Science and Technology Conference.

This three-element semi-solid-state battery has a capacity of up to 160KWh, and an electric car utilizing this battery has a range of up to 1000km. According to reports, the product will be installed in cars this year. Guoxuan High-tech is currently constructing a larger semi-solid-state battery production line and plans to start formal production in the first half of next year.

As a cutting-edge product, the parameter of 360Wh/kg is enough to attract attention.

For reference, the energy density of most iron-lithium battery cells on the market is above 180Wh/kg, the energy density of lithium iron phosphate batteries is 210Wh/kg, and the energy density of ternary batteries is generally above 200Wh/kg, with mainstream products reaching 250Wh/kg. It is evident that the energy density of this Guoxuan High-tech product is significantly improved.

Zhang Hongli, Executive Vice President of Guoxuan High-tech Engineering Research Institute, revealed that besides the 360Wh/kg three-element semi-solid-state battery, a 400Wh/kg three-element semi-solid-state battery prototype is already in the company’s laboratory.

As a second-tier power battery supplier, Guoxuan High-tech’s counterattack seems imminent.

The Opportunity is now

In 2020, China’s share of the world’s pure electric vehicle market was 30.3%, which rose to 56.7% in 2021, and to 64% in the first quarter of 2022.

Under such a scenario, battery manufacturers in this market are inevitably ambitious. The battery industry is in a state of flux, and everything has not yet been fully determined.

Guoxuan High-tech is undoubtedly the most obvious beneficiary. In 2021, Guoxuan High-tech had the largest year-over-year increase in installed capacity of power batteries globally, with an increase of 194.12%. This is recognition of Guoxuan High-tech’s strategic perseverance over the years.

Since 2016, the national battery system energy density has been included in the assessment standards, with high energy density and long battery life becoming the subsidy focus, and ternary materials have been given priority development. By 2018, ternary lithium batteries had become mainstream. The prevailing view is that lithium iron phosphate batteries will gradually withdraw from the main stage of history.

Data shows that from 2016 to 2018, the proportion of installed ternary batteries soared from 20.66% to 53.92%, while the proportion of installed lithium iron phosphate batteries fell from 66.56% to 37.8%.# Guoxuan High-Tech adheres to its own judgment rather than following the trend on the strategic level. Despite the skepticism surrounding the lithium iron phosphate route, Guoxuan High-Tech still insists on increasing R&D funding and talent investment in the iron lithium field. Through technical improvements and continuously breaking through the energy density ceiling of the lithium iron phosphate battery, Guoxuan High-Tech has created more market space.

In 2018, the energy density of Guoxuan High-Tech’s lithium iron phosphate material battery reached 190 Wh/kg, and the system energy density reached 140 Wh/kg.

Guoxuan High-Tech, which is committed to lithium iron phosphate, has encountered considerable skepticism, even being seen as a regression.

In 2021, Guoxuan High-Tech’s opportunity came.

This year was a year of comprehensive attack for the lithium iron phosphate market, which began to shift from policy support to market-driven. With the decline of subsidies, the advantages of lithium iron phosphate in terms of cost, stability, and service life are highlighted. Companies such as Tesla, XPeng, and NETA have successively applied for new cars with lithium iron phosphate batteries, and automakers such as Daimler, Mercedes-Benz, and Volkswagen have also clearly indicated the lithium iron phosphate route.

Data show that in 2021, in terms of output, sales, and installed capacity, lithium iron phosphate surpassed ternary lithium batteries, with an installed capacity ratio of 51.7%, and output and sales ratios of around 57%.

During this period, Guoxuan High-Tech’s iron lithium technology has continuously broken through the industry’s ceiling, and in 2021, a lithium iron phosphate with an energy density of 210 Wh/kg was introduced. Currently, products based on this technology by Guoxuan High-Tech have received batch orders and will soon enter the new car announcement catalog of the Ministry of Industry and Information Technology.

In March of this year, the installed capacity of domestic power batteries reached 13.2 GWh for lithium iron phosphate, a year-on-year increase of 238.8%, accounting for 61.6%. The installed capacity of ternary lithium batteries was 8.2GWh, a year-on-year increase of 61.2%, accounting for 38.3%. The advantage of lithium iron phosphate batteries continues to expand.

Guoxuan High-Tech, which seized the opportunity of the iron lithium market, has an 80-20 ratio in its current business with a focus on lithium iron phosphate.

At the same time, the ceiling of lithium iron phosphate batteries is still being broken. In March of this year, Li Zhen, chairman of Guoxuan High-Tech, pointed out that the 230Wh/kg lithium iron phosphate battery will gradually go into mass production by the end of this year. “Our next goal is 260Wh/kg, which has already been achieved in the laboratory’s prototype sample.” Guoxuan High-Tech, focusing on iron lithium, does not want to stop here and also plans to strengthen ternary lithium batteries. This is the latest 360Wh/kg ternary semi-solid state battery product.”Not wanting to be a general is not a good soldier.” In 2020, Xu Xingwu, senior vice president of SVOLT, ambitiously stated in an interview that SVOLT (rank) can still climb higher.

The facts will prove whether he was just talking big or not.

Can the success path of “Ning Wang” be replicated?

According to the latest data from the China Power Battery Industry Innovation Alliance, during the first four months of 2022, a total of 42 power battery companies in China achieved vehicle matching, but only 9 companies had a market share of over 1% in the domestic battery-powered vehicle market, which are CATL, BYD, CITIC Guoan MGL, SVOLT, Honeycomb Energy, EVE Energy, Xinwanda, FUNENG Technology, and the only foreign-funded enterprise, LG Energy Solution.

The head effect in the battery industry is very obvious. The leading “monopoly” led by CATL and the “multi-strong” of the second-tier enterprises have a clear but difficult to surpass boundary.

However, a new opportunity window seems to be opening up for second-tier enterprises. The growth rate of the new energy vehicle market in 2021 is higher than expected, and the supply gap of power batteries is obvious. SNE Research predicts that the global power battery gap will be about 18% by 2023, and the gap will expand to about 40% by 2025.

This means that during the expansion period, in addition to CATL, second-tier high-quality companies also have the opportunity to grab more market share. Although the development speed of the “Ning Wang” CATL is astonishing and its future development prospects are still promising, an obvious fact is that it cannot swallow such a large cake of development space alone.

From another perspective, whether in the global market or in the domestic market, the situation of a single dominant enterprise in any industry is not conducive to the benign development of the industry during a period of rapid growth. Conversely, it may not be a good thing for the healthy operation of this enterprise.

Today, the delay in new car deliveries caused by a shortage of upstream power battery supply is not a fresh topic. Volkswagen, Audi, and Mercedes-Benz have all been forced to delay or even halt production of some models due to a lack of batteries.

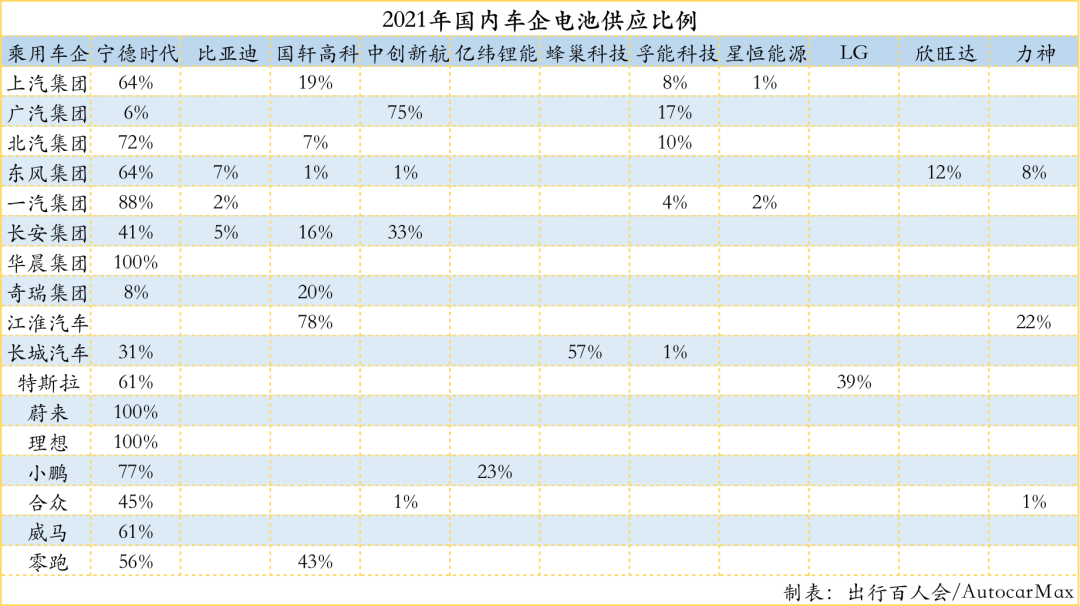

In fact, more and more automobile companies are seeking “secondary supply” and even “tertiary supply” to reduce risks in order to ensure a more stable supply chain. In 2021, in addition to new car-making forces such as NIO and Ideal using a single supplier, the vast majority of car companies have chosen a diversified supply system.

This is a huge opportunity for second-tier battery manufacturers. With the expansion of the scale effect of second-tier battery manufacturers, the completion of cost-effectiveness, and the possibility of further penetration ratio expansion.On a technical level, there is still significant room for improvement in the energy density, safety, charging speed, and cycle life of current lithium-ion batteries. Innovative technologies in battery materials, battery form factors, and battery manufacturing processes have yet to fully mature. The market competition landscape is still in a state of technological evolution, providing ample opportunities for second-tier battery manufacturers with outstanding product performance and leading research and development capabilities.

Of course, expanding scale effects remains the most pressing issue for second-tier battery companies. Their survival is challenged by different circumstances compared to first-tier battery suppliers. Most second-tier enterprises’ profitability is not strong, and expanding production capacity and winning more battery projects from automakers is the most significant problem they face in the next development stage.

As an example, the latest financial report of Guoxuan High-Tech shows that it achieved revenue of 3.916 billion CNY in the first quarter, a year-on-year increase of 203.14%; however, net profit fell 32.79% year-on-year to 32.2 million CNY. This is already the third consecutive quarter of net profit decline for Guoxuan High-Tech, indicating the pressing need to increase production and revenue.

By the end of 2021, Guoxuan High-Tech had achieved a designed production capacity of 50 GWh. Its production capacity is expected to reach 100 GWh by the end of 2022.

On May 28, 2022, the Guoxuan New Energy Smart Manufacturing Project in Liuhe District, Nanjing, was officially put into operation. This is the third project to be built in Liuhe, with a total investment of 10 billion CNY, and plans to build a 20 GWh power battery production line project, as well as supporting projects such as new energy power battery PACKs, shells, enclosures, and wiring harnesses.

On May 30, Yichun Guoxuan Battery Project was officially put into operation. The project has an investment of 10 billion CNY and plans to build a 30 GWh power battery project in two phases, with the first phase constructing a 15 GWh power battery production line.

As part of its 2025 production capacity plan, Guoxuan High-Tech has raised its previous production capacity target of 100 GWh to 300 GWh.

As one of the leading domestic battery manufacturers, Guoxuan High-Tech has formed partnerships with many automakers, including Changan, Great Wall, SAIC-GM Wuling, BAIC, WM Motor, Zero Run, Geely, Chery, Hozon, and Chongqing Ruichi. Its supporting automaker count is second only to CATL, with a particularly close relationship with Volkswagen.

By the end of 2021, Volkswagen became the largest shareholder of Guoxuan High-Tech. Currently, Guoxuan High-Tech and Volkswagen Group have achieved dual mass production targeting the first-generation ternary lithium battery and ferro-phosphate standard battery cells. They are also jointly developing the next-generation standard battery cells for the European market.

On March 9, Guoxuan High-Tech announced on its website that “the company’s cooperation with Volkswagen has further deepened, and the company has officially obtained Volkswagen’s mass production targeting point. The related products will be used for Volkswagen’s largest new energy platform. Relevant departments of the company are making every effort to promote production in the shortest time possible.”In the future, Guoxuan High-tech has the potential to become Volkswagen’s largest battery supplier. According to analysis, just for VW’s Anhui standard battery core, the demand for ternary batteries is expected to be around 13.3-16.7 GWh, and the demand for lithium iron phosphate batteries can reach 15 GWh.

According to Volkswagen’s plan, starting in 2023, the Volkswagen Group will supply four standardized battery cores including lithium iron phosphate batteries, high manganese batteries, ternary lithium batteries, and all-solid-state batteries. By 2030, the proportion of supporting vehicle models is expected to reach 80%.

Another foreseeable opportunity is that, as the first manufacturer of “standard battery cores” for Volkswagen, Guoxuan High-tech has the opportunity to rapidly improve its ability to control mass production, lead standards, and manage supply chains.

By cooperating with Volkswagen as a stepping stone, Guoxuan High-tech has the opportunity to enter the supply chain of more international automotive companies and become a dark horse with an impact on the global power battery market.

This is a traceable road to success.

In 2012, CATL began supplying batteries for BMW i3. In the process of cooperation with BMW, CATL seized the opportunity to make rapid progress in volume product control and management. In 2017, CATL obtained a long-term purchase order for power batteries worth 4 billion euros from BMW, achieving deep binding with BMW. Since then, CATL has begun to develop rapidly and become a leading player in the industry.

Perhaps, Guoxuan High-tech can also replicate CATL’s development path during its cooperation with Volkswagen.

Opportunities are right in front of us, and the time has come for Guoxuan High-tech to counterattack.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.