Editor’s Note: “New Energy Pitfall Guide” is a limited-time column launched by Garage 42, reviewing the development process of new energy vehicles with new power brand as the main focus from the perspective of marketing and operation. The series analyzes and discusses the underlying logic of various strategies and models, and hopes to present the profound changes that new power and new energy have brought to the automotive industry beyond products and technology. This column will be updated every Wednesday.

Special guest contributor Bluehyper, with more than ten years of experience in automotive marketing, has deeply participated in the construction of new power operation system.

If you were a user, which dealership would you choose for purchasing a car: one is a 100 square meters direct-sales storefront operated by the car company in a shopping center, and the other is a 2,000 square meters 4S franchise dealership located in the suburbs?

This is a question that many users are facing, and it is also a question that all car companies are facing. However, for car companies, whether to operate a direct-sales storefront or not not only concerns the user experience, but also the company’s resource capabilities and expansion needs. In addition to direct-selling, what is the authorized dealer system, which has recently been praised by many car companies? What is the difference between authorized dealership and direct-selling? Will it become an important choice for traditional car companies in the future transformation? This needs to start with the development of the channel.

Two minuses don’t make a plus, and the authorized dealer model has fallen into a vicious circle

“Direct-selling” and “direct-operation” have become important characteristics of new power, but these two concepts are often confused by many people. Direct-selling refers to a sales model that directly sells products to users, while direct-operation refers to car companies directly investing, operating and managing terminal stores (in low-end markets, many car trading stores are called “directly-operated stores”, which means that they are directly-operated by a certain dealer, not directly-operated by the car company itself). The reason why we need to discuss “direct-selling” and “direct-operation” in two separate articles is that direct-operation and direct-selling are not completely co-existing relations. Direct-operation is necessarily direct-selling, but direct-selling does not necessarily require direct-operation.

In the traditional model, dealers obtain brand authorization from car companies through franchising, and then sell vehicles to users through the dealer system. Therefore, as different business entities, there are inevitably many conflicts of interest between car companies and dealers, but these conflicts were concealed by China’s rapid growth over the past 20 years. Initially, in the rapidly growing market, franchised dealers who obtained authorization had many advantages:

- Dealers can afford the huge cost of storefront construction; different dealers can simultaneously build multiple storefronts, saving car companies a lot of capital, time and manpower costs.

- Early-stage dealers based on the local area are more aware of local user needs and policies.

- Through the dealer system, car companies obtain stable cash flow by wholesaling vehicles to dealers after the vehicles are produced.

However, as the market entered the stage of stock competition, the contradictions between dealers and automakers became increasingly prominent. Dealers began to become independent interest parties between automakers and users, and hoped to isolate the information between automakers and users.

-

The terminal prices of vehicles begin to be chaotic. Dealers often raise or lower prices arbitrarily due to competition and cash flow pressures. At the same time, they have created various kinds of charges, such as loan fees, licensing fees, decoration fees, outbound fees, and other mandatory bundled fees, without creating additional service value.

-

Due to the difficulty of automakers participating in direct management, dealers’ experience consistency is very poor, resulting in a large amount of marketing expenses of automakers being wasted.

-

Dealer groups are gradually rising, and dealer groups that join multiple brands hope to flow users among their multiple brands rather than handing them over to automakers. Dealer groups that own multiple single-brand stores are also more likely to hijack automakers.

The Mercedes-Benz female car owner sitting on the engine hood to seek justice event in April 2019 exposed many contradictions between automakers and dealers. Dealers cannot handle vehicle quality problems in a timely manner; being punished by market regulatory departments for illegally charging financial service fees has greatly damaged the brand image of Mercedes-Benz. At the same time, Xi’an Liuzhixing, the punished party, is also powerful. Its parent company, Lixinghang, has had many years of disputes with Mercedes-Benz. As the earliest exclusive agent of Mercedes-Benz passenger cars in China, it once held 49% of the equity of Mercedes-Benz China. Its dumping behavior of cutting the price of imported E-class by 8-10 million yuan before the launch of the new E-class by Mercedes-Benz in 2010, had a significant impact on the market and pricing strategy of domestically produced E-class. Mercedes-Benz China had to introduce more dealer groups, such as Pangda and Zhongsheng, to “disband the army with wine” and reclaim some management rights.

Even powerful brands like Mercedes-Benz are prone to be bitten back by dealers, indicating the difficulty of the game between car companies and dealers. In addition to balancing conflicts by introducing more dealers, as car companies accumulate funds and begin to enter more industries, their subsidiaries also start to participate in the distribution link. Although these company-owned doors financially depend on car companies, they also adopt a “dealer system” and are independently accounted for. Therefore, these stores are not genuine direct sales, but more like a self-operated method.## The Choice of Direct Sales: Both Proactive and Compelled

When the dealership model encounters a multitude of issues, direct sales naturally becomes an option.

The development of the market has also created the foundation for direct sales:

-

A significant reduction in store opening costs. The reduced dependence on after-sales service for new energy vehicles, the popularization of shopping centers, and the development of the supermarket store model have made store construction low-cost, fast, and scalable. (See link to supermarket store content at the end of the article).

-

The development of the internet has made the way users obtain information more online-oriented, reducing dependence on physical stores.

-

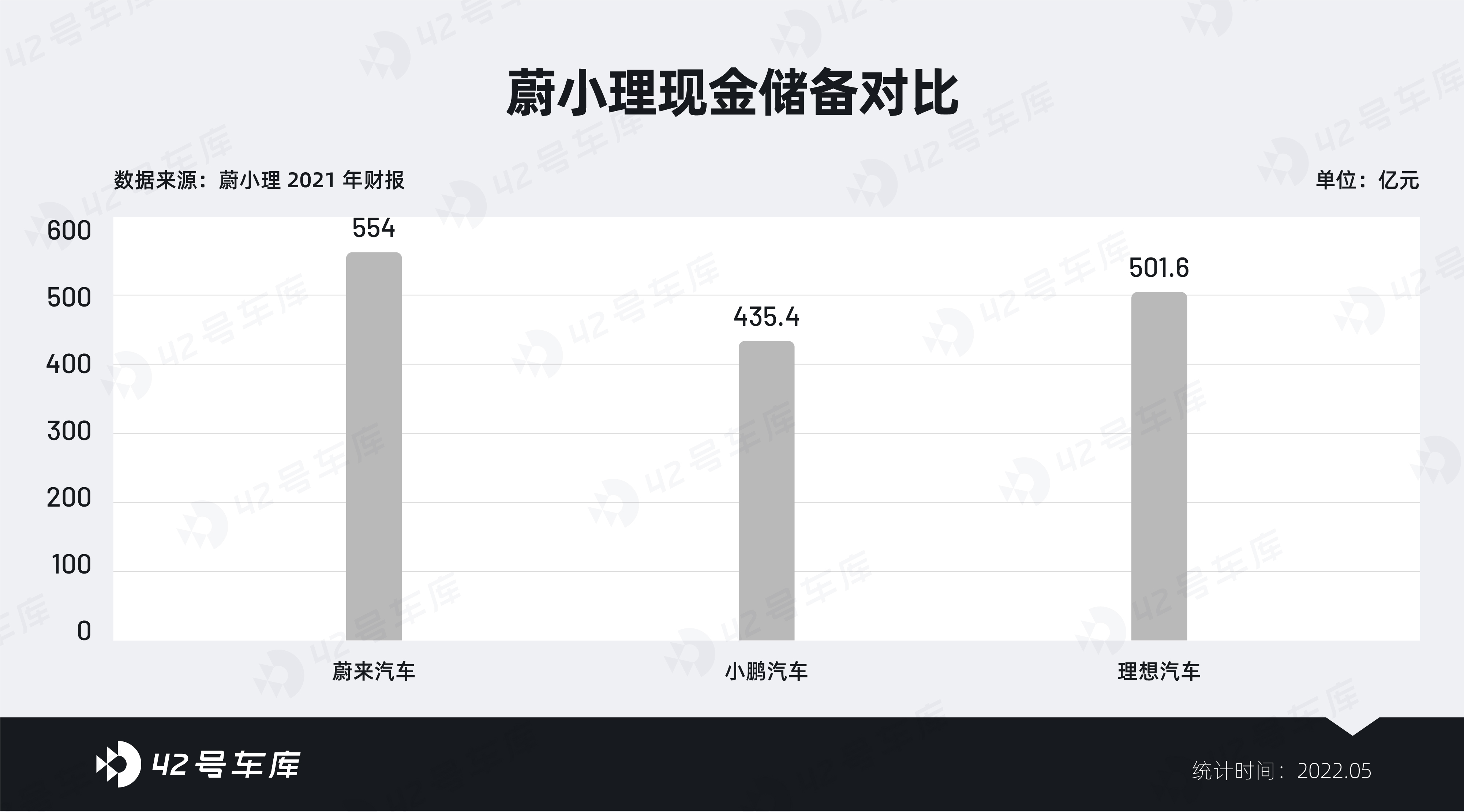

Contrary to many people’s expectations, new forces in the industry have stronger cash reserves compared to traditional manufacturers (taking only 2021 financial reports into account, Geely Automobile has a net cash reserve of 20.8 billion, Changan Automobile’s operating cash reserve is 22.9 billion, while XPeng Motors has a cash reserve of over 40 billion, NIO and Ideal both exceeding 50 billion).

At present, new energy vehicle manufacturers mainly use the method of supermarket store+delivery and service center + body spray center for direct sales. Among them, the supermarket store and delivery service center are directly operated while the body spray center is often outsourced due to environmental approval issues. Some brands also open flagship stores bearing the company’s image. Compared with the construction of traditional dealerships, it is not only more flexible but also has lower construction and operational costs. This is because having one or two delivery and service centers in each city can meet the low-frequency needs of new energy vehicle owners.

Apart from the above reasons, another important factor is that as a startup brand, if they want to recruit more dealers with low market recognition, they need to give high amounts of store-opening subsidies. Typically, a standard 4S dealership costs millions of dollars in subsidy. Although these subsidies can be paid in installments, it is still a considerable cost. In comparison, with abundant cash flow, the advantages of direct sales become more prominent.

For automotive companies, the most important benefit of direct sales is creating consistency in experience and services through flatter and more direct management. It also creates transparency and uniformity in retail prices and more professional and long-term services. Simply put, the main source of profit from traditional dealerships comes from decoration fees, loan fees, and compulsory insurance. However, on the whole, profits generally depend on after-sales service, with important income other than accident repairs relying on recommended projects for normal maintenance.Due to the fact that automotive companies rely on profits generated from manufacturing rather than sales and operations, they no longer need to bundle a series of service fees and value-added services such as decoration to create profits. Similarly, in terms of after-sales service, because of the huge costs of construction and operation, directly operated after-sales service centers no longer pursue the gross profit of a single vehicle, but instead pursue operational efficiency, and will not recommend non-essential maintenance items such as cleaning and maintenance to users. Similarly, the reduced management levels and directly managed employees greatly improve the efficiency of information transmission between enterprises and users. User needs can be quickly fed back to the automotive company, and car companies can directly communicate with users.

Currently, due to competitive pressure in the industry, the turnover rate of traditional dealership employees is very high, and mobility often shows a trend from independent brands to joint venture brands, and from joint venture brands to luxury brands. The direct employment of car companies can provide more guarantees for front-line employees, which is also the reason why new forces often recruit many front-line employees from luxury brands.

However, direct sales are not all advantages. On the one hand, although the construction cost of channels for new forces and new energy is low, it is still a considerable investment, which is not a small burden for enterprises with insufficient cash flow. If calculated based on an average investment of 5 million yuan in a single city, the expenditure for building a channel network covering 200 cities nationwide is as high as 1 billion yuan, and the operating expenses of at least several million yuan per month in a single city exceeds 100 million yuan per month. This puts tremendous pressure on new forces with few products, and it becomes even more difficult if sales performance is poor.

On the other hand, dealers are also an important buffer between users and enterprises. The price reduction and product upgrades of new forces will basically trigger old car owners’ rights protection, actually, traditional car companies will also reduce prices and upgrade products, but dealers will adjust the pace according to the rhythm, gradually release the discount, and coupled with opaque terminal prices, old car owners cannot even understand the changes in price and products, let alone rights protection. Of course, whether it is sales or after-sales, the front-line employees of directly operated stores also directly represent the corporate image. Automotive companies can no longer let dealers “take the blame,” so the complaints they receive will be even more severe.

Difficulties abound in the prevailing model of direct sales.So, is there a model that can make the best use of strengths and avoid weaknesses? The agent + direct sales model has become a choice. Compared with the traditional distribution model, because there is no inventory pressure, the sales subject is the car enterprise, and the agent earns service commissions. There is no huge cash flow pressure, so it can focus more on improving the user experience. Compared with the direct sales model, the agency system can improve the speed of store expansion and reduce the funding requirements for car companies to build and operate stores.

The earliest practitioner of the agent direct sales model was WmAuto, a head enterprise of new forces. Unlike NIO, which chose direct sales and set up flagship stores in landmark locations in first- and second-tier cities, WmAuto with weak financing capabilities, but deep background of traditional car companies, adopted the C2M customized production + city partners model and recruited a group of top dealer groups to represent the sales of products. At that time, when the development of new energy was not clear, dealers did not want to invest too much capital, so WmAuto also set up four self-operated stores in key cities to assist sales. XPeng Motors also adopted the same channel development method as WmAuto, which later became the choice of NETA Automobile and Leapmotor Automobile.

In 2019, which is the “worst” year for new forces, WmAuto, under the pressure of sales and cash flow, first gave up the direct sales + agency model and returned to the traditional distribution model to start wholesaling vehicles to press inventory. Although NIO also began recruiting franchisees, it still insisted on having NIO’s team directly operate the stores.

In 2020, after smoothly passing through the cold winter, XPeng Motors further increased the proportion of direct sales stores and continuously improved the requirements for franchisees. NIO stopped the franchise model and returned to the fully direct sales model. The latecomer, Ideal Automobile, has always been firmly on the road of direct sales and direct marketing.

Apart from WmAuto’s “turnaround” due to cash flow pressure, it was recently reported that Dongfeng’s LanTu brand will also abandon the direct sales route and instead start recruiting franchisees to act as sales agents. Beiqi’s polar fox has chosen a mixed route of direct sales + dealerships earlier.

For traditional car companies, in addition to the high threshold of funds and time resources required for direct sales, the interests of existing dealers are also an important consideration. Volkswagen seems to have initially believed that dealers’ willingness to sell ID series products was not strong enough, and forcibly pressing the inventory would only backfire. However, if new channels are opened, not only will more than 2,000 existing 4S stores be wasted, but it may also be resisted by dealers because of the development of new channels.After all, the experience with Volkswagen Group is still fresh in memory. In November 2016, SAIC and Audi signed a cooperation framework agreement, but soon thereafter 28 FAW-VW-Audi dealers initiated a rights protection negotiation with Audi, which ultimately expanded to 400 out of Audi’s 430 dealers in China. The dealers threatened to refuse to distribute new cars, withdraw from the network, and demand compensation, ultimately forcing Audi to suspend cooperation with SAIC until the launch of the first SAIC-Audi product, the A7L, in 2022. Meanwhile, SAIC-Audi continued to use Audi’s existing channels and sold products through an agency system.

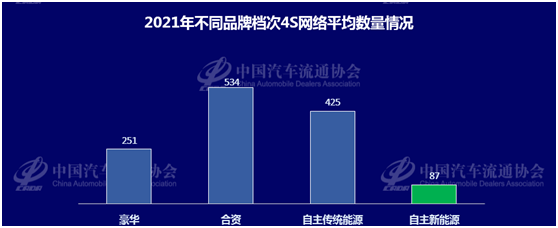

With the ID. series, both FAW-Volkswagen and SAIC-Volkswagen have adopted an agency model for sales and authorized a portion of existing dealers as agents.

So far, FAW-Volkswagen has developed 731 agents, while SAIC-Volkswagen has developed 757, which account for more than 80% of the original dealerships. However, the reality did not meet expectations, and ID. series sales did not reach the expected levels, with sales of only over 6,000 units in the first half of 2021. In order to achieve sales targets, Volkswagen began to put pressure on its agency dealers and started to reduce inventory.

As a result, dealers began to offer large discounts, with a Shanghai dealer offering a maximum discount of RMB 28,000 for the ID.4 and RMB 37,000 for the ID.6.

Subsequently, SAIC-Volkswagen imposed penalties on the dealers, including withholding all commissions for the month and issuing a warning letter. But penalties did not increase sales. SAIC-Volkswagen then launched an employee car purchase policy with high discounts and repurchase commitments, and store discounts gradually became the norm. In the end, the ID. series sold 70,625 units in the whole year of 2021, but still did not achieve the sales target of 80,000 to 100,000 units for the year.

As new energy penetration continues to increase, car companies are launching new energy product lines and high-end brands. Admiring the direct sales model of new forces, coupled with a deep understanding of the advantages and disadvantages of the dealership model, the direct sales + agency model has become the choice of many new brands.

This includes SAIC’s RisingAuto and ZhiJi brand, Geely’s JiKe and smart, and so on, all of which choose this model and prioritize dealers within the system. However, the reality is that many previous automotive companies did not achieve the expected results, with poor sales performance, and instead took on more marketing expenses and huge inventory pressure.

All of this has cast a shadow on the direct sales + agency model.

Stepping out of the Comfort Zone, Win-Win is the Only Way Out for the Agency SystemSo what are the problems with the agent-direct sales model? The core problem is that automobile manufacturers and agents are two different business entities and both have their own interests. Achieving mutual benefit is key, and the following points are also crucial:

-

Not holding inventory is the basic guarantee. “Inventory is the root of all evil.” As long as agents are forced to allocate more inventory than their sales capacity, they will become dealers, and the significance of the agent-direct sales system will disappear. A progressive commission and rebate system with high thresholds and large price differences is also a disguised way of holding inventory because agents will choose to lower prices or take inventory to earn higher commissions. Of course, considering that customers still have a demand for vehicles in stock, it is not impossible to match inventory with agent sales capacity under conditions of abundant production capacity. However, the owners of these stocks should be the automobile manufacturers themselves, and the manufacturers should also provide financial inventory financing solutions for inventory and even display vehicles.

-

The main responsibility of automobile manufacturers should be clear. The essence of the agent-direct sales model is still direct sales, and automobile manufacturers become the main body of sales. Automotive manufacturers’ sales teams should bear the pressure of sales volume, rather than passing the sales pressure to dealers through inventory pressure, as in the past. Both in terms of marketing and sales, they should face users, and on the one hand, they should have a deep understanding of the needs of different regions and different types of users. On the other hand, the product positioning and pricing must be accurate and there should be no room for secondary adjustments through dealers.

-

Ability to fully connect with users. Users should be able to be reached both online and offline. The app we often use or the physical store are just one of the many touchpoints. Currently, all platforms manage user information with the user’s mobile phone number as the key ID, which enables user information to be fully integrated from online to physical stores and to vehicles. Seamless full-time service and complete data recording and analysis are equally important because data never lies when it comes to the professionalism required of frontline personnel. In 2021, XPeng Motors was fined RMB 100,000 by the market supervision and management department for violating regulations by collecting 430,000 facial photographs of users from its Shanghai store. The purpose was to associate users’ faces with their IDs to track all their behaviors, but such behavior is not advisable without the user’s permission to collect photos.

-

Change the zero-sum game. For large, low-frequency items such as real estate and automobiles, the sales side often encounters zero-sum games. A single game occurs because users often buy a vehicle only every few years and are very unlikely to buy from the same store, resulting in the occurrence of passenger-carrying behavior. A zero-sum game implies that regardless of how much preliminary reception and test driving work sales staff have done, all profits go to those who ultimately complete the transaction, so vicious price cuts are common.In the real estate field, Ke.com created the ACN (Agent Cooperation Network) model to share profits with brokers. Based on the complete user data mentioned above, auto companies can also adopt the same method to split the profits of customer acquisition, test drive display, and vehicle delivery. The agents can share the commission based on their workload, and since these profits are highly related to customer satisfaction, this approach can enable auto companies to reach real customers.

In terms of management, the decoupling of hardware and software in the traditional dealership model, in which a dealership’s storefront, employees, and inventory assets are treated as a whole, makes it difficult for auto companies to intervene in their management. In the agency model, if we consider the agents’ storefronts as hardware and their frontline employees as software, the decoupling of hardware and software can be achieved. Auto companies can use tools such as WeChat Work and Feishu to connect themselves, agents’ frontline employees, and customers remotely. Through direct management, not only can the professionalism of front-line staff be enhanced through training and supervision, but their performance and salary can also be intervened in for more effective management.

To sum up, every pro has its con. Although the agency direct sales model has the advantages of capital cost and expansion speed, the actual operational difficulties far exceed those of direct sales, and it is not a shortcut at all. For new energy followers with limited funds and tight time constraints, these are unavoidable problems.

For car companies, the biggest trap of the agency direct sales model is not about capability and technology but the ability to retreat easily, i.e., to turn agents back into dealers, returning to the traditional mode of wholesale distribution. In times of market and sales setbacks, the new models constructed by traditional automakers and dealerships with all the necessary elements tend to easily return to the comfort zone of the traditional dealership system. It is often those who persist in direct sales that achieve unexpected success in the face of incredible odds. In the past few years, the current leading new energy companies have proven that strategic determination and adherence are the most precious assets in this era of constant change in the automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.