Author: Zhu Yulong

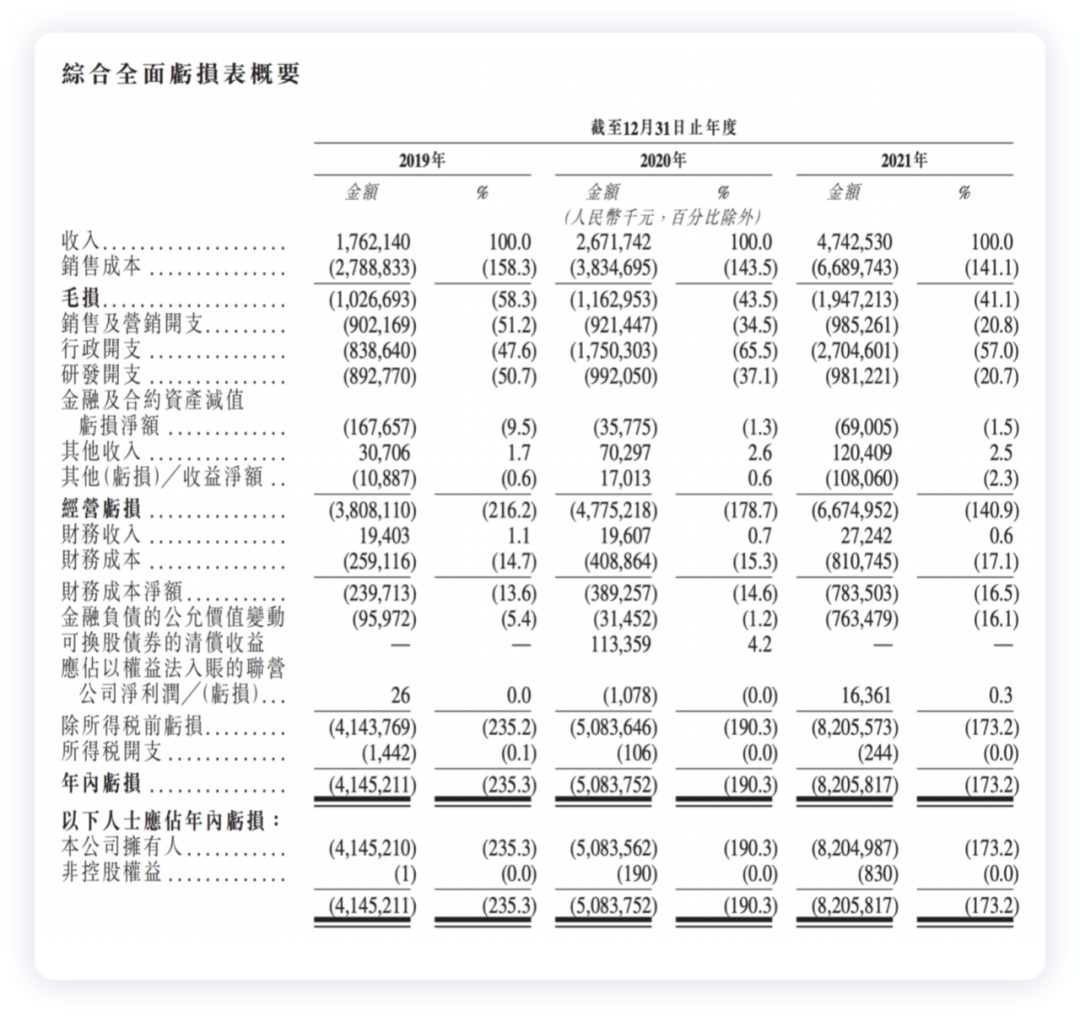

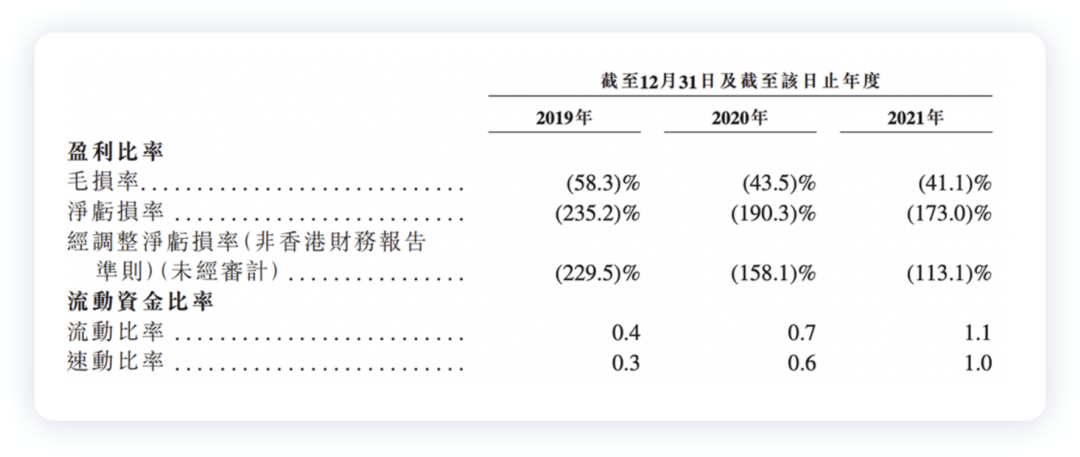

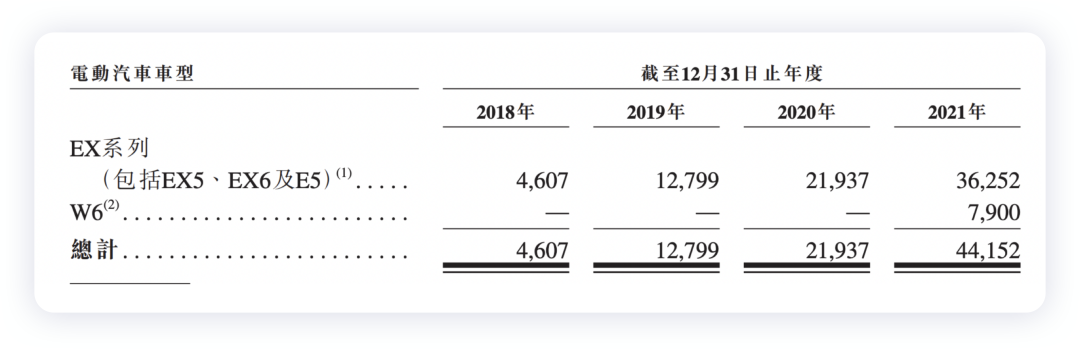

WM Motor has submitted a prospectus for listing on the Hong Kong stock exchange. What interesting facts are there about this company, which has been running in the new energy field for a long time? Some data: WM Motor sold 44,152 cars in 2021; revenue was RMB 4.743 billion, average car price was RMB 107,000, gross profit margin was -41.1%, and net loss was RMB 8.205 billion, an increase of 61%.

The accumulated revenue for the three years from 2019 to 2021 was RMB 9.175 billion (RMB 1.76 billion, RMB 2.67 billion, and RMB 4.74 billion), but during this period, the cumulative net loss was RMB 17.431 billion (RMB -4.145 billion, RMB -5.083 billion, and RMB -8.2 billion). The pre-listing valuation was about USD 4.1 billion, equivalent to RMB 27.5 billion, and the IPO is expected to raise USD 1 billion.

Note: WM Motor has 1,141 R&D personnel, accounting for 28.9%, with R&D centers in Chengdu, Shanghai, and Wenzhou. The R&D expenditure for three years was RMB 893 million, RMB 992 million, and RMB 981 million.

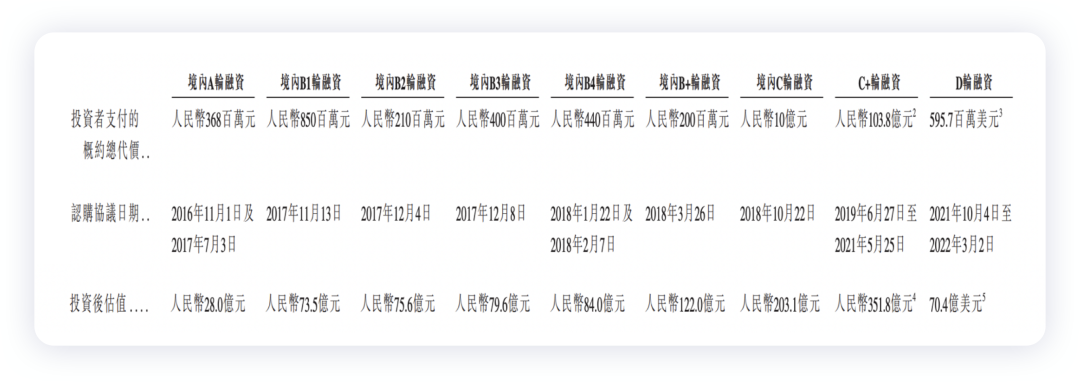

From February 2017 to September 2020, WM Motor conducted eight rounds of domestic equity financing. From October 2021 to March 2022, the company completed series D financing, raising USD 596 million. From series A to series D financing, the company raised a total of approximately RMB 31.5 billion, with a latest valuation of USD 7.04 billion, equivalent to RMB 47 billion.

Business Analysis

In 2021, WM Motor’s losses continued to expand, amounting to 8.205 billion yuan. To understand the gross profit margin, revenue/vehicle sales can be understood, and the vehicle prices are basically around 107,000 yuan. Sales expenses were 0.985 billion yuan, R&D expenses were 0.981 billion yuan, and administrative expenses were 2.704 billion yuan, mainly spent on 3,952 employees.

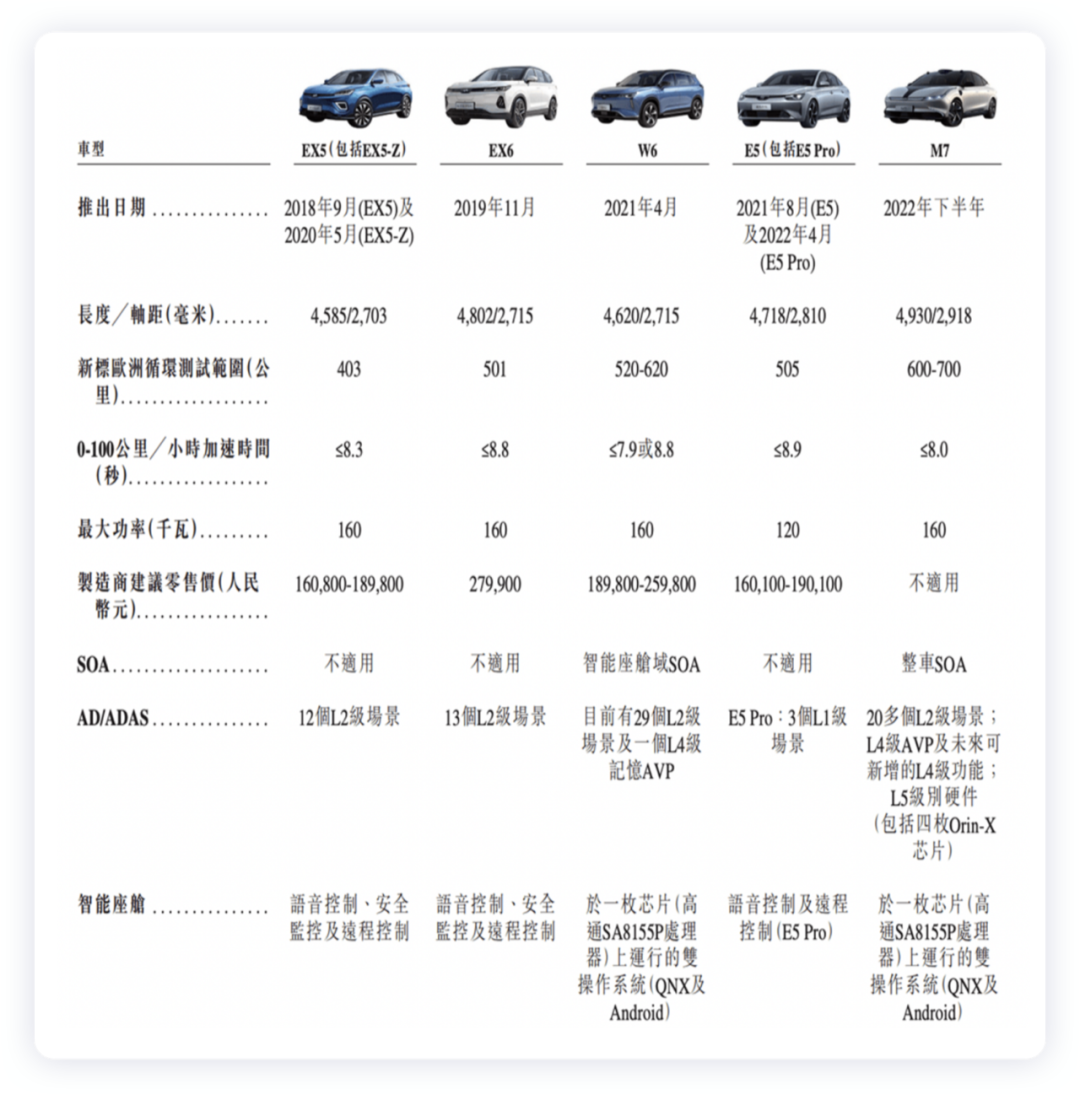

WM Motor’s models include four types: SUVs (EX5, EX6, W6), and a compact mid-sized car with a wheelbase of 2.7-2.8 meters. The main selling points of the previous E series were still electric and cost-effective, and the intelligent driving only supports basic L1, L2 functions and cannot be OTA, which led to a sales price of only a little over 100,000 yuan in 2021. Starting from W6, WM Motor debuted Apollo’s high-end intelligent parking function AVP, and the intelligent cabin also supports OTA upgrades. The M7 in the second half of 2022 will have Baidu ANP2.0 on board in terms of software, which can realize high-speed assistant driving. In terms of hardware configuration, WM Motor has stacked M7 to the highest level in the industry, with 3 lidars and 4 Nvidia Orin chips, and a computing power exceeding 1000T.

The price range of these products is completely disjointed and maintained in one showroom where the price can range from 100,000 yuan to 300,000 yuan. Besides, the sales channel is very characteristic, with prices jumping from around 160,000 yuan to just under 100,000 yuan. It is hard to understand how they manage to offer such low prices.

Intelligent Endorsement# Weima believes that China’s domestic electric vehicle market has entered the stage of smart vehicles, and three core capabilities are the most critical: ADAS, OTA, and EE architecture. Weima is raising funds in Hong Kong stocks for modular vehicle development platforms, including Living Pilot AD/ADAS platform, Living Engine and next-generation intelligent cockpit platform, Living Motion electric powertrain platform, and Ajax chassis platform and Caesar chassis platform research and upgrades, as well as OTA technology research and development.

This means that currently, no specific Ajax platform can be accepted by consumers, and the next round of betting comes with Caesar, mainly relying on 800V battery pack + SiC for electric drive, and developing smart chips to reach L4.

Note: It seems a bit thin for more than 1,000 engineers to do L4, and M7 is expected to provide AVP with independent research and development of L4 in 2023, and time is really tight.

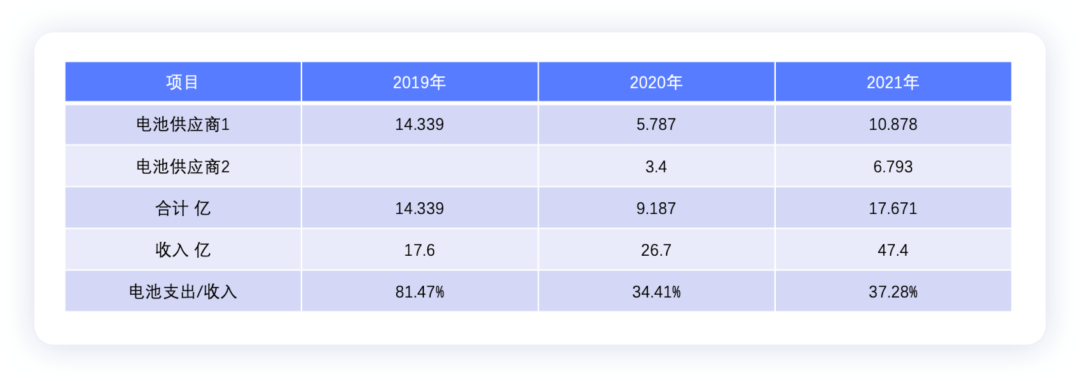

I think the biggest problem is the proportion of money paid to the two battery suppliers compared to their own income, from more than 80% in 2019 to still over 37% last year. Isn’t this just doing business for the battery suppliers?

Conclusion: With the rise in battery prices in 2022, what do you think the ratio of battery procurement to revenue will be in 2022? This business is not right.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.