Author: Zhang Yi

On June 1st, according to the HKEX filing disclosure, WM Motor Technology Co., Ltd. submitted the listing application document to HKEX, with Joint Sponsors being Haitong International Securities, China Renaissance Securities (Hong Kong) Limited and BOCOM International Securities Limited.

WM Motor stated in the prospectus that the net proceeds of the IPO will be mainly used for the development of vehicle development platforms and next-generation smart cars, expanding sales and service networks, promoting brand awareness, investing in production, and as operating capital and general corporate purposes.

In terms of financial data, from 2019 to 2021, the revenue of WM Motor (excluding dealer amounts) were RMB 1.762 billion, RMB 2.617 billion, and RMB 4.742 billion, respectively. Among them, the amounts given to dealers by WM Motor were RMB 345 million, RMB 775 million, and RMB 1.621 billion, respectively. This means that while the overall gross profit margin of WM Motor has been continuously narrowing, the gross profit margin per vehicle in 2021 has already increased to -5.1%.

It should be noted here that WM Motor has adopted a dealer sales model, which differs slightly from the direct sales model of “Weixiaoli”. According to accounting standards, under the dealer sales model, the recognized revenue in the financial statements needs to deduct dealer rebates, while under Weixiaoli’s direct sales model, the end sales price would be included in the accounting revenue. The different business models adopted will result in slightly different revenue amounts at the same sales price and sales volume.

From WM Motor’s strategic layout perspective, with the successive launches of models such as EX5, EX6, W6, and E.5, its product matrix has covered both the mainstream SUV and sedan segments.

According to the prospectus, as of December 31, 2021, WM Motor has delivered 83,485 electric vehicles, with a compound annual growth rate of over 100% over the past four years. Among them, 44,152 electric vehicles were delivered in 2021, 21,937 were delivered in 2020 and 12,799 were delivered in 2019, achieving a 96.3% year-on-year growth.

In addition, WM Motor has also launched an expansion plan for its offline business, with a sales and service network consisting of 621 partner storefronts, covering 397 WM Experience Centers, 180 WM User Centers and 44 WM Star Creation Centers in 211 cities.Weima Motors has a strong pursuit of technology for future development. It is expected to launch the M7 in the second half of this year with Weima’s self-developed L4 AVP, which can support L5 autonomous driving function. In 2023, it will launch new SUVs, sedans, and MPVs based on the Caesar platform, covering the entire range of products from class A to class B.

In terms of production capacity, due to the heavy asset prepositioning strategy, Weima has already built two intelligent manufacturing bases in Wenzhou and Huanggang, with a full production capacity of 250,000 vehicles per year, before officially submitting its IPO application to the Hong Kong Stock Exchange.

This submission to the Hong Kong Stock Exchange marks Weima as another “new force in car-making” to be listed after “WM Motors”. For Weima, the journey to going public has not been easy.

With the release of the “Sci-Tech Innovation Board Stock Issuance and Listing Examination Rules of the Shanghai Stock Exchange” on December 4, 2021, as well as the “Management Measures of the Sci-Tech Innovation Board Listing Committee of the Shanghai Stock Exchange”, the policy for Sci-Tech Innovation Board IPOs is tightening. As a result, Geely and Dongfeng have terminated their plans to go public on the Sci-Tech Innovation Board and the Growth Enterprise Market.

Looking back at Weima Motors, after completing two rounds of financing last year, with more and more Hong Kong companies joining, it has also hinted that it may turn to the Hong Kong Stock Exchange.

In addition to Weima Motors, several other new car-making forces such as Leapmotor and CHJ Automotive have plans to go public in Hong Kong, with some already having submitted their IPO applications.

Some investors believe that in terms of A shares, the timing of going public is unpredictable. Although the certainty of the US market is high, the recession in society also makes consumers concerned about data security, resulting in more uncertainty. In addition, the trading volume on the Hong Kong stock market is much different from the US stock market, which has a great impact on investments. Although there are some preconditions for listing on the Hong Kong Stock Exchange, it can still be a good choice after balancing the pros and cons.

In terms of data, Weima Motors has the qualifications for going public, backed by Baidu and Agile Group, with only one step away from an IPO.

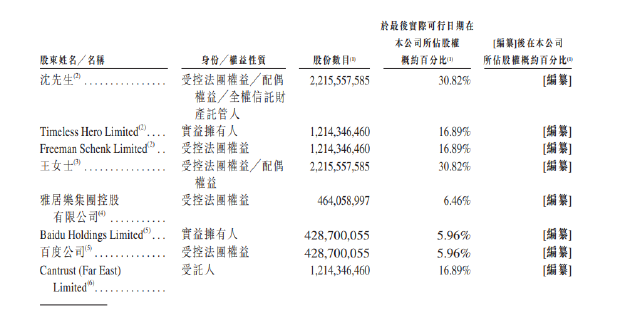

In October 2021, Weima Motors received a financing of USD 300 million in Series D1, and then obtained USD 152 million in Series D2 in December of the same year. According to the prospectus, Weima Motors has just completed nearly USD 600 million in pre-IPO financing, with a total financing amount of CNY 35 billion. Baidu holds 5.96% of the shares, Shen Hui and Wang Lei collectively hold 30.82%, and Agile Group holds 6.46%.

最后,上市并非是威马汽车的终点,而是起点。面对当前 “拥挤的 IPO 赛道”,获得外部融资实现自我 “价值” 来增加自身的竞争优势是当前势在必行的举措。

最后,上市并非是威马汽车的终点,而是起点。面对当前 “拥挤的 IPO 赛道”,获得外部融资实现自我 “价值” 来增加自身的竞争优势是当前势在必行的举措。

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.