Jia Haonan, Chu Wanbo from Co-pilot Temple

Smart Car Reference | Official Account AI4Auto

Did you watch the wave of nostalgia from Luo Dayou last night?

When you were reminiscing about your youthful years, did you notice the logo that was omnipresent throughout the concert?

The Luo Dayou concert, including the recent online performance by Cui Jian, were exclusively sponsored by JiHu Automobile with real money and silver.

You might ask: who is JiHu Automobile? Many netizens couldn’t answer, because there were almost no interactions or messages mentioning this sponsor during the live broadcast or playback, which was a bit embarrassing…

This scene seems familiar, right? The JiHu Automobile did not create the same lively atmosphere during the previous Cui Jian concert.

In fact, JiHu Automobile is a high-end brand that is striving to turn around the poorly performing Beijing Automotive Group by betting on its transformation towards new energy and intelligent vehicles.

JiHu Automobile is also a deep partner for Huawei’s foray into the automotive business and the launch of its intelligent driving solution, as well as the production partner for the fifth-generation Robotaxi of Baidu Apollo.

However, despite the halo of the two tech giants, this brand that Beijing Automotive Group has placed high hopes on has been persistently plagued by poor sales.

Will JiHu Automobile’s self-rescue through the flow of Cui Jian and Luo Dayou be able to convert sentiment into sales?

What has JiHu Automobile done?

Luo Dayou’s online concert was exclusively sponsored by JiHu Automobile. Four days before the concert, JiHu’s official channels continuously released related promotional videos, which shows JiHu’s dedication to this marketing operation.

A series of classic masterpieces such as “Childhood” and “Story of Time” played “sentiment” to the extreme. Luo Dayou, who is dubbed the “father of music education”, also has a visible appeal.

In terms of live broadcast data during the concert, before the warm-up phase before the concert officially began, Luo Dayou’s video account had already reached 5.918 million views. By the end of the concert at 22:10, the number of viewers reached 35.662 million.

According to the data mechanism for “calculating heads” on the video account, with Luo Dayou as its flagship, JiHu Automobile garnered more than 30 million exposures for this online concert.This emotional marketing approach has been used by Polestar in Guo Degang’s online concert before, and in terms of exposure, the effect was remarkable.

Public data showed that Guo Degang’s online concert last month briefly boosted the ceiling of the video live concert viewing record on Douyin, and this time, Polestar harvested a total of 90 million user reach during the concert.

From the perspective of exposure, emotional marketing does seem attractive, but on the other hand, the interaction at the concert site seemed to have little to do with Polestar.

The keywords discussed by the audience were mostly “Grandpa Qinghui” or the celebrity himself.

Did the money spend effectively?

To determine whether the money spent was worth it, we need to look for answers from the data.

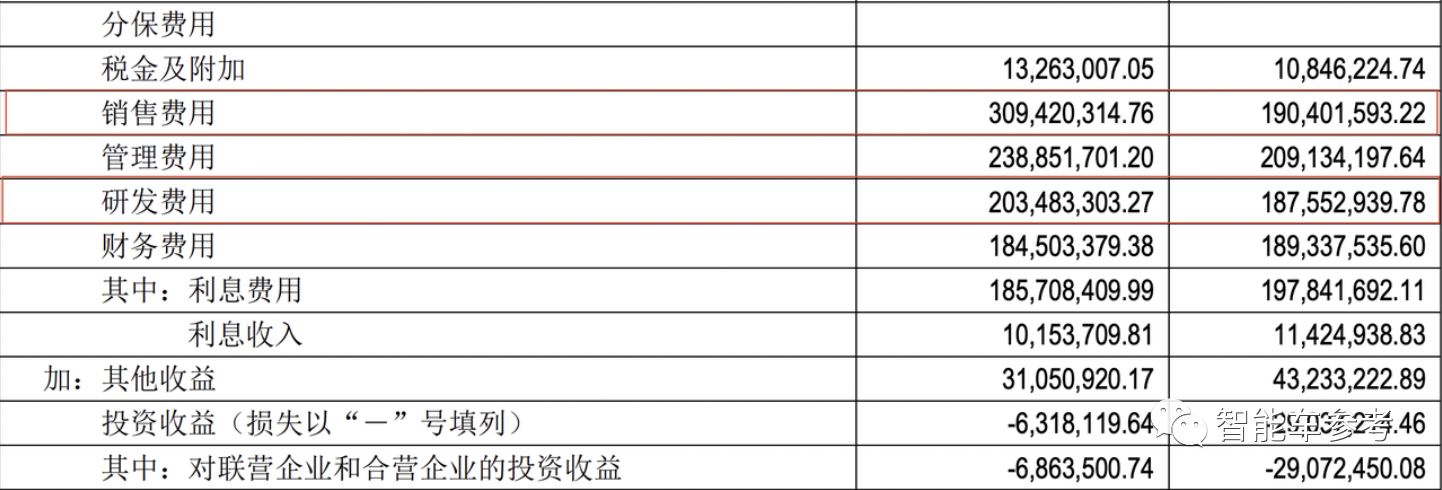

Official information showed that since the beginning of this year, Polestar has started to exert its efforts in marketing, which is reflected in the financial report as a significant increase in sales expenses spent on marketing and promotion.

In the first quarter of this year, the sales expenses of Polestar’s parent company, BAIC Blue Valley, were 309 million yuan, an increase of 63% from the same period last year. Comparing with the R&D costs of 203 million yuan, which increased by less than 20 million yuan from the same period last year.

If we calculate according to the time period of commercial sponsorship, the recent two online concerts should have completed planning and fund settlement in the first quarter. The increase in BAIC Blue Valley’s marketing expenses is largely used for this series of advertising and sponsorship activities.

Did the money spent have an effect?

In the short term, the effect was obvious.

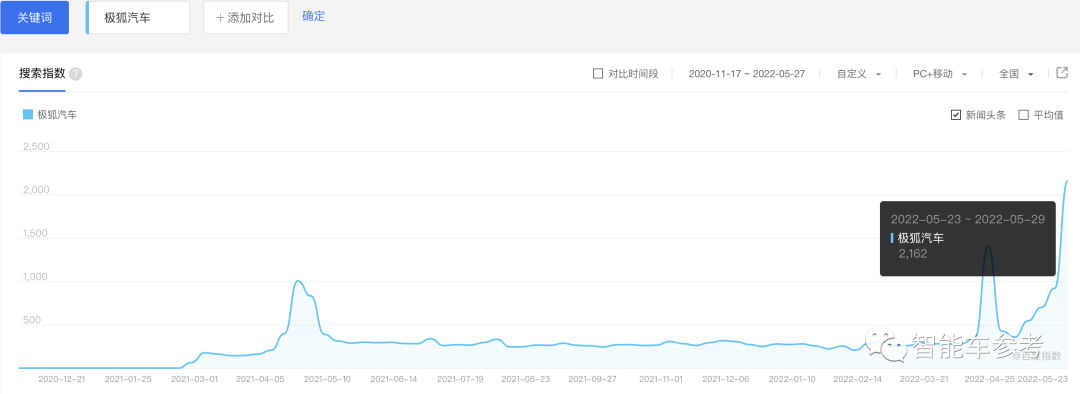

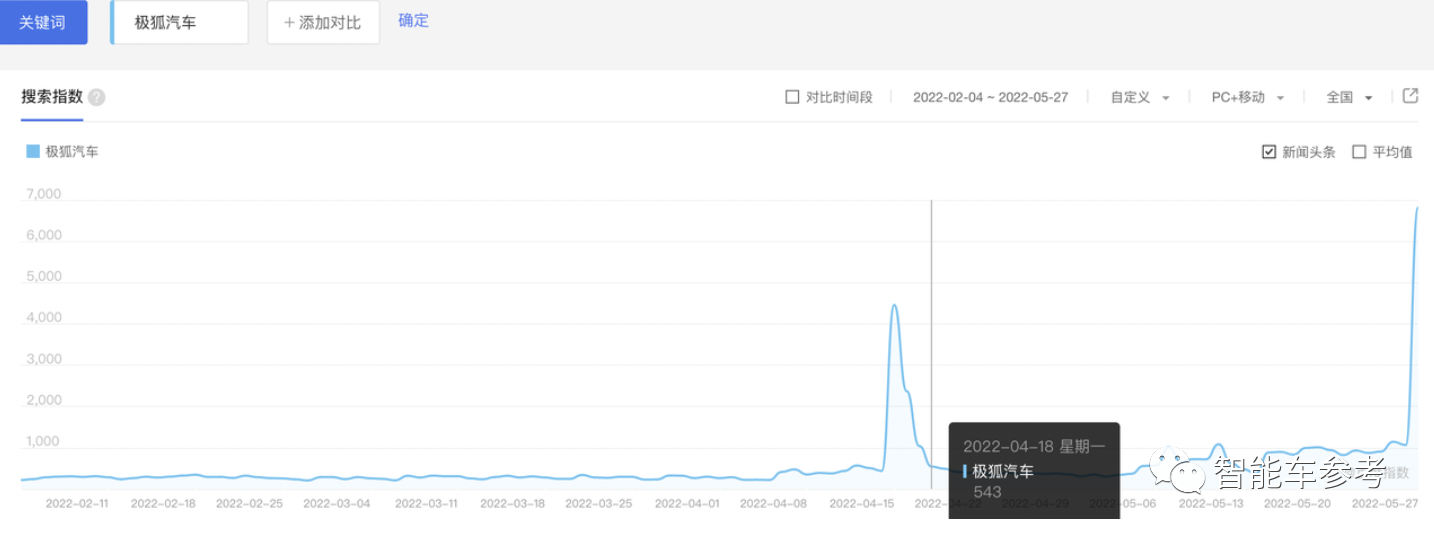

Baidu search showed that “Polestar Automobile” has two peaks of search index on the Baidu platform when it entered this year:

The first peak occurred from April 11 to April 17, with a search index of 1404, corresponding to the preheating and later exposure time of the Guo Degang concert. The other was during the preheating and exposure period of Luo Dayou’s concert in the past week, with a search index of 2162.

Compared with this, the last time Polestar Automobile’s search index exploded was at last year’s Shanghai Auto Show in April when it collaborated with Huawei to launch the Polestar Alpha Hi edition, but even then, the search index was only 1005.

In terms of user search density, it’s true that Cui Jian and Luo Dayou are more appealing than hugging tech giants.

However, in the long run, fast-coming traffic also fades quickly.

Data shows that the online concert of Cui Jian only stayed popular for about three days, and its Baidu search index drastically dropped on April 18th, then went back to the previous low level.

Search index is only one aspect. To measure the effectiveness of marketing strategies, the ultimate criterion is to see whether the cars sell well or not.

According to the data from a website of passenger car sales volume, the number of insured cars of Jihoo brand in April this year was 889, and the cumulative number from January to April this year was 2871.

This sales level has indeed increased compared with the state of the previous year when the monthly sales of Jihoo were less than 500, but the growth is also limited. Jihoo did not get rid of the lackluster performance of selling less than one thousand cars per month.

In other words, the money was spent, two concerts were also performed, but the final sales growth was far from matching the exposure on paper.

What is the significance of Jihoo’s new marketing attempt?

According to the Beijing News, quoting the official statement of Jihoo:

In 2021, Jihoo has authorized more than 120 construction outlets, authorized 73 authorized service centers, and covered 54 cities nationwide, in order to realize the transformation of products to high-end. BAIC has increased its brand promotion, advertising and operation, and other sales costs, which affect the company’s performance by about 1.7 billion yuan. Specifically, Jihoo’s marketing costs are 400 million yuan.

In fact, Jihoo’s efforts in both channels and marketing are still there.

However, in auto circles, “good-looking but not salable” is commonly used to express regret for a certain car. But Jihoo car seems to have not even achieved the influence of being “good-looking or salable”.

It’s been a long time since its listing, and its marketing expenses are higher than its R&D expenses. Why is Jihoo’s brand building and promotion not ideal?

BAIC knows that its user reputation is not good enough, so it never mentions the word “BAIC” in any promotion of Jihoo, so as not to add a historical burden to the new brand.

So, what did Jihoo do?

At the beginning of its listing, Jihoo tried hard to bind its OEM factory Magna (Jihoo is not independently produced by BAIC but produced, calibrated, and debugged by Magna, a North American OEM factory of Mercedes-Benz and BMW).

The emphasis of publicity naturally falls on “German tuning” and “the same chassis as luxury cars”.This was before the αS was unveiled in cooperation with Huawei. After the announcement of the partnership with Huawei, Lynk & Co closely associated itself with Huawei’s traffic halo. In fact, the αS is indeed the mass-produced car with the highest “Huawei content,” enough to attract attention.

However, the Huawei version of the αS has not yet been launched, slowly exhausting everyone’s patience and expectations. Lynk & Co’s marketing strategy of “hugging the thigh” of partners is not the original sin. Indirectly demonstrating its strength through the status of a partner during the start-up period is a strategy used by most brands. However, partners can only determine the lower limit of a brand, and as for the upper limit, it ultimately depends on their own strength and product positioning. This may be one of the reasons why Lynk & Co is always overshadowed by Huawei, Cui Jian, and Luo Dayou.

Before sponsoring the concert by Cui Jian and Luo Dayou, Lynk & Co preferred to place advertisements on traditional portal websites and official media. Only this year did they gradually move towards new media such as live streaming, Douyin, and WeChat.

In the process of exploring new media to face users, Lynk & Co occasionally comes up with stunning marketing “interludes,” such as the former president Yu Liguo being accused of “intimidating and threatening” users in the official app community, causing a lot of controversy. The incident ended with Lynk & Co apologizing and Yu Liguo resigning.

At the beginning of the year, a Douyin certified blue V official account, “Lynk & Co World Expo Center,” posted a public diss against Tesla’s brake failure, using this to promote a video entitled “Lynk & Co’s brake industry ceiling,” which caused controversy.

But even with such outrageous measures, Lynk & Co’s popularity still did not rise. Therefore, changing the marketing strategy has become a path that Lynk & Co must take.

Sponsoring concerts by popular stars can help generate more traffic, but not necessarily for young idols. Instead, Lin & Co chose to sponsor concerts of nostalgic rock giants, indicating that the official position of Lynk & Co on their model positioning should aim at urban white-collar workers aged 40 and above with a certain economic foundation.

From the user distribution that Lynk & Co attracted after sponsoring the concert, it is indeed mainly within the 40-year-old age group as indicated by the TGI index.However, for the middle-aged rock fans who entered the concert live, is their love for Cui Jian and Luo Dayou or for Lynk & Co?

Currently, it seems that the success of Lynk & Co’s sponsored concert marketing campaign relies on them releasing sales and delivery figures.

However, under the influence of the pandemic, all automotive businesses look bleak, and even if Lynk & Co’s efforts are effective, it is uncertain when the results will be seen.

Nevertheless, Lynk & Co’s new marketing approach is also of irreplaceable significance. Firstly, it is the first time that WeChat’s video channel has attempted to exclusively sponsor a concert (Cui Jian’s concert), which is a landmark event in the creation of new race categories and new species.

At the level of advertising and marketing, it also sparked industry debate and thought. Some people believe that Lynk & Co’s marketing approach this time is successful, as seen by the overall data of social media platforms such as Weibo, video channels, and Douyin being very excellent.

For car companies like Lynk & Co, using high-quality IP that has national-level and phenomenon-level appeal to form a connection between product traffic and sales is an excellent exploration and attempt.

However, there are opposing views that merely having traffic alone is not enough to say that this is a successful marketing campaign. Cars are not fast-moving consumer goods, and traffic is difficult to convert quickly. Consumers need to have a profound understanding and recognition of the brand and product before they will buy.

As for Lynk & Co’s sponsorship, the secondary spread of marketing activities has limited scalability for user self-propagation, and there are some deviations in the matching degree between brand audiences. There have also been no effective measures taken to convert concert audiences into brand audiences and potential customers.

As for the automotive industry level, Lynk & Co’s move is a pioneering one, and whether it is effective or not is doomed to be included in the industry’s teaching materials.

However, among all these discussions focusing on new media, marketing skills, and even behavioral psychology, no one has come out to say whether Lynk & Co’s vehicles are worth buying or not.“`html

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.